Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Journal Entries Amortization Schedule Straight-Line Amortization Effective Interest Option #1: Investments in Debt Securities Complete the following questions. In addition to answering the items below,

Journal Entries

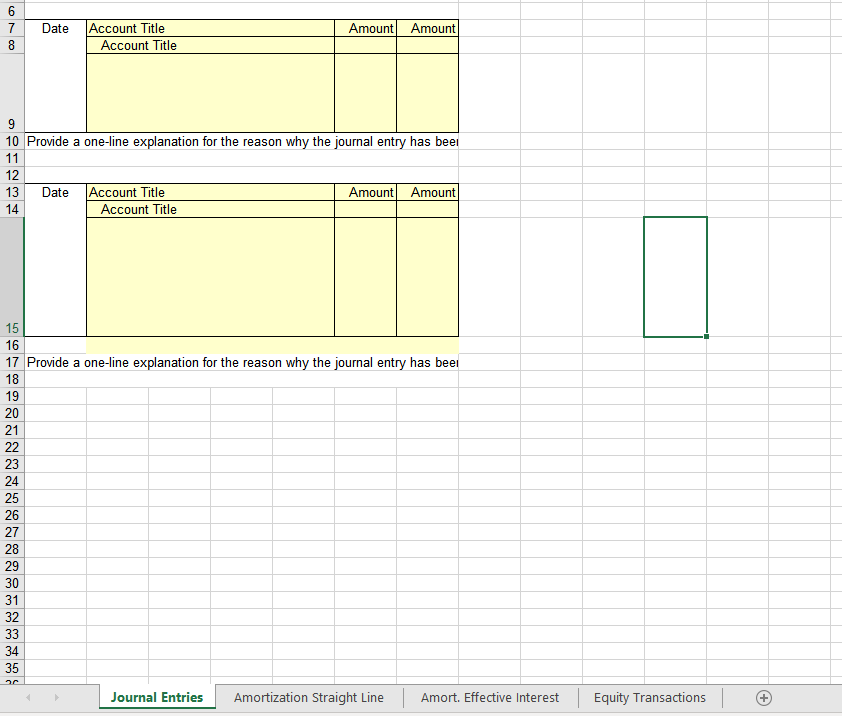

Amortization Schedule Straight-Line

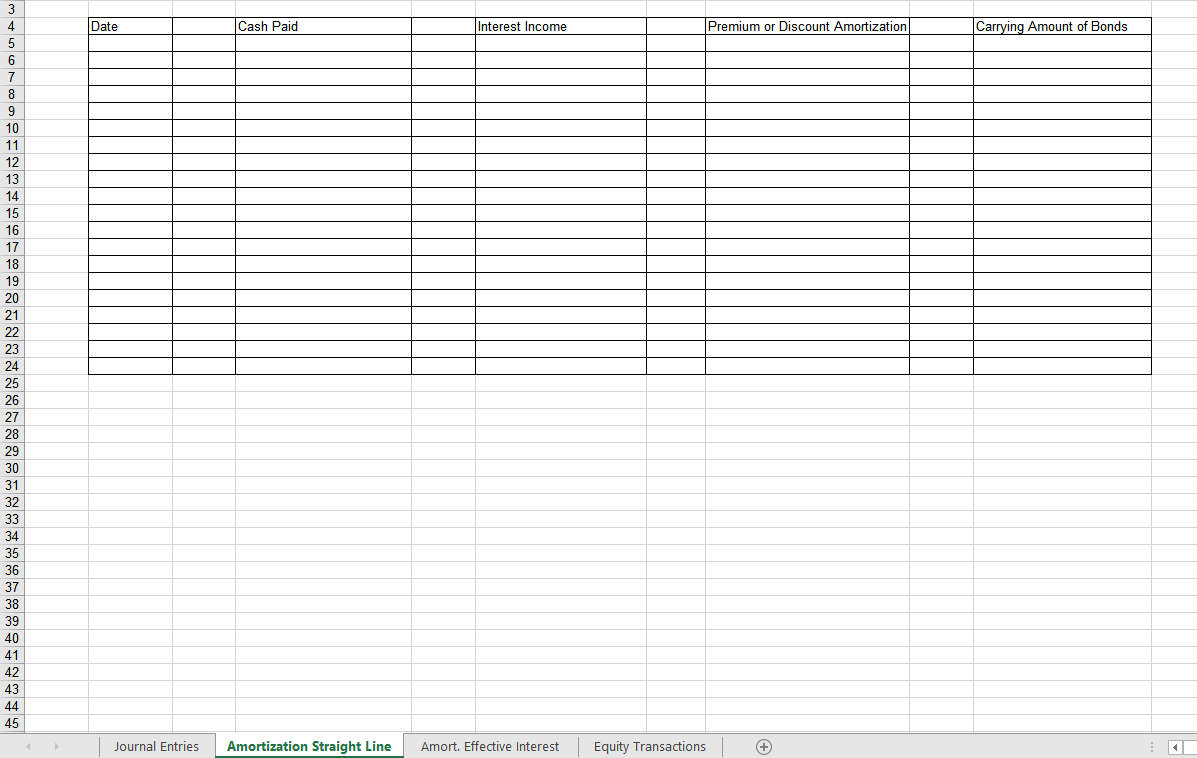

Amortization Effective Interest

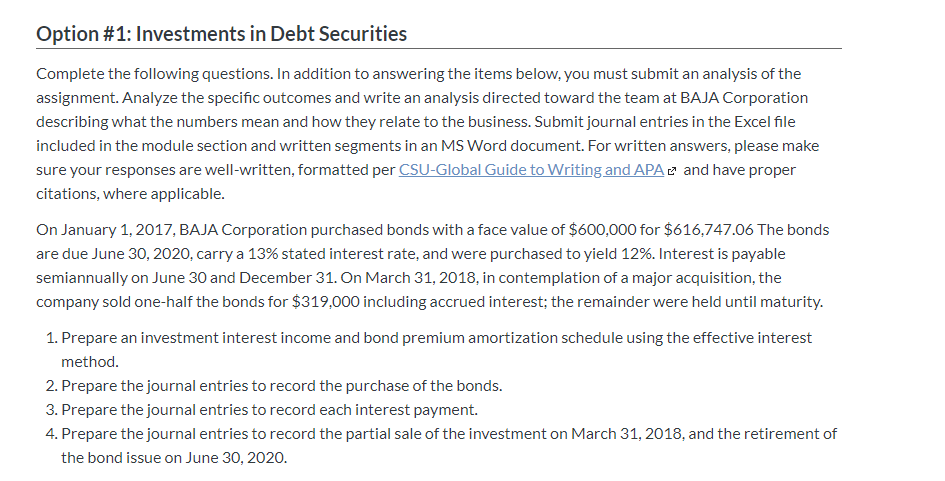

Option #1: Investments in Debt Securities Complete the following questions. In addition to answering the items below, you must submit an analysis of the assignment. Analyze the specific outcomes and write an analysis directed toward the team at BAJA Corporation describing what the numbers mean and how they relate to the business. Submit journal entries in the Excel file included in the module section and written segments in an MS Word document. For written answers, please make sure your responses are well-written, formatted per CSU-Global Guide to Writing and APA2 and have proper citations, where applicable. On January 1, 2017, BAJA Corporation purchased bonds with a face value of $600,000 for $616,747.06 The bonds are due June 30.2020. carry a 13% stated interest rate, and were purchased to yield 12%. Interest is payable semiannually on June 30 and December 31. On March 31, 2018, in contemplation of a major acquisition, the company sold one-half the bonds for $319,000 including accrued interest; the remainder were held until maturity. 1. Prepare an investment interest income and bond premium amortization schedule using the effective interest method. 2. Prepare the journal entries to record the purchase of the bonds. 3. Prepare the journal entries to record each interest payment. 4. Prepare the journal entries to record the partial sale of the investment on March 31, 2018, and the retirement of the bond issue on June 30, 2020. 6 7 Date Account Title | Account Title Amount Amount 8 10 Provide a one-line explanation for the reason why the journal entry has been 11 12 13 Date Amount Amount Account Title Account Title 15 16 17 Provide a one-line explanation for the reason why the journal entry has been Journal Entries Amortization Straight Line Amort. Effective Interest Equity Transactions Date Cash Paid Interest Income Premium or Discount Amortization Carrying Amount of Bonds Journal Entries Amortization Straight Line Amort. Effective Interest Equity Transactions Date Cash Paid Interest Income Premiumor Discount Amortization Carrying Amount of Bonds - Journal Entries Amortization Straight Line Amort. Effective Interest Equity Transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started