Question

Journal entries and trial balance Instructions Chart of Accounts Journal Ledger Unadjusted Trial Balance Final Questions Instructions Elite Realty acts as an agent in buying,

Journal entries and trial balance

Instructions

Chart of Accounts

Journal

Ledger

Unadjusted Trial Balance

Final Questions

Instructions

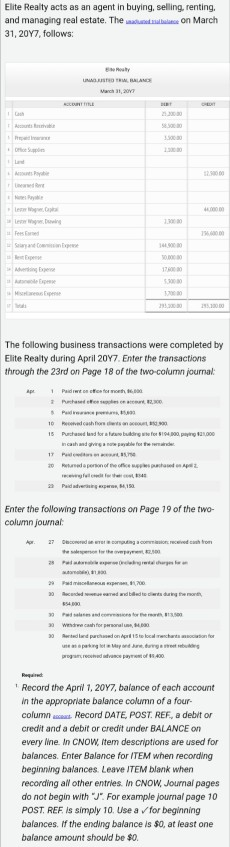

Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 20Y7, follows:

Elite Realty

UNADJUSTED TRIAL BALANCE

March 31, 20Y7

ACCOUNT TITLEDEBITCREDIT

1

Cash

25,200.00

2

Accounts Receivable

58,500.00

3

Prepaid Insurance

3,500.00

4

Office Supplies

2,100.00

5

Land

6

Accounts Payable

12,500.00

7

Unearned Rent

8

Notes Payable

9

Lester Wagner, Capital

44,000.00

10

Lester Wagner, Drawing

2,300.00

11

Fees Earned

236,600.00

12

Salary and Commission Expense

144,900.00

13

Rent Expense

30,000.00

14

Advertising Expense

17,600.00

15

Automobile Expense

5,300.00

16

Miscellaneous Expense

3,700.00

17

Totals

293,100.00

293,100.00

The following business transactions were completed by Elite Realty during April 20Y7. Enter the transactions through the 23rd on Page 18 of the two-column journal:

Apr.1Paid rent on office for month, $6,000.2Purchased office supplies on account, $2,300.5Paid insurance premiums, $5,600.10Received cash from clients on account, $52,900.15Purchased land for a future building site for $194,000, paying $21,000 in cash and giving a note payable for the remainder.17Paid creditors on account, $5,750.20Returned a portion of the office supplies purchased on April 2, receiving full credit for their cost, $340.23Paid advertising expense, $4,150.

Enter the following transactions on Page 19 of the two-column journal:

Apr.27Discovered an error in computing a commission; received cash from the salesperson for the overpayment, $2,500.28Paid automobile expense (including rental charges for an automobile), $1,800.29Paid miscellaneous expenses, $1,700.30Recorded revenue earned and billed to clients during the month, $54,000.30Paid salaries and commissions for the month, $13,500.30Withdrew cash for personal use, $4,000.30Rented land purchased on April 15 to local merchants association for use as a parking lot in May and June, during a street rebuilding program; received advance payment of $9,400.

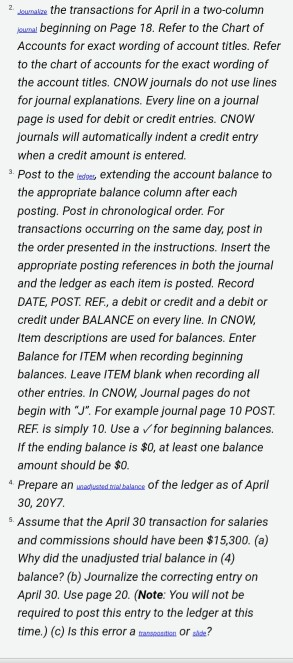

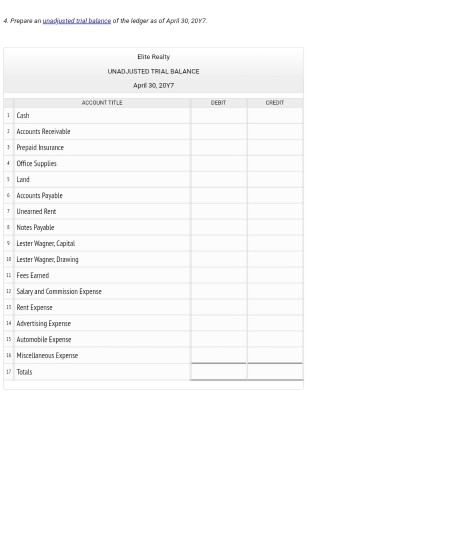

Required:1.Record the April 1, 20Y7, balance of each account in the appropriate balance column of a four-column account. Record DATE, POST. REF., a debit or credit and a debit or credit under BALANCE on every line. In CNOW, Item descriptions are used for balances. Enter Balance for ITEM when recording beginning balances. Leave ITEM blank when recording all other entries. In CNOW, Journal pages do not begin with J. For example journal page 10 POST. REF. is simply 10. Use a for beginning balances. If the ending balance is $0, at least one balance amount should be $0.2.Journalize the transactions for April in a two-column journal beginning on Page 18. Refer to the Chart of Accounts for exact wording of account titles. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.3.Post to the ledger, extending the account balance to the appropriate balance column after each posting. Post in chronological order. For transactions occurring on the same day, post in the order presented in the instructions. Insert the appropriate posting references in both the journal and the ledger as each item is posted. Record DATE, POST. REF., a debit or credit and a debit or credit under BALANCE on every line. In CNOW, Item descriptions are used for balances. Enter Balance for ITEM when recording beginning balances. Leave ITEM blank when recording all other entries. In CNOW, Journal pages do not begin with J. For example journal page 10 POST. REF. is simply 10. Use a for beginning balances. If the ending balance is $0, at least one balance amount should be $0.4.Prepare an unadjusted trial balance of the ledger as of April 30, 20Y7.5.Assume that the April 30 transaction for salaries and commissions should have been $15,300. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry on April 30. Use page 20. (Note: You will not be required to post this entry to the ledger at this time.) (c) Is this error a transposition or slide?

Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The aim oblace on March 31, 2017, follows: March 31, 2017 CH . 17000 The following business transactions were completed by Elite Realty during April 2017. Enter the transactions through the 23rd on Page 18 of the two-colurn journal: 1 Paidos to 12.30 Padrowe, 10 chiesa 15 Pulad for at blive for 8164200, 3.000 cash and see the 17 de 20 and person of cewe shared2 effe Enter the following transactions on Page 19 of the two- column Journal 27 Decond computing.com Cred ca trom these ter the past 2,00 Pad.700 Podmiotherwis. Window cash for personale, 14.000 >> Rected and purchased onderste local chartacciation for penge, der urs program of 1400 Required Record the April 1, 2017, balance of each account In the appropriate balance column of a four- columns. Record DATE, POST. REF, a debitor credit and a debitor credit under BALANCE on every line. In CNOW, Item descriptions are used for balances. Enter Balance for ITEM when recording beginning balances. Leave ITEM blank when recording all other entries. In CNOW, Journal pages do not begin with For example journal page 10 POST REF is simply 10. Use a for beginning balances. If the ending balance is $0, at least one balance amount should be $0. 2 kumalize the transactions for April in a two-column koumal beginning on Page 18. Refer to the Chart of Accounts for exact wording of account titles. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. 3. Post to the media extending the account balance to the appropriate balance column after each posting. Post in chronological order. For transactions occurring on the same day, post in the order presented in the instructions. Insert the appropriate posting references in both the journal and the ledger as each item is posted. Record DATE, POST. REF., a debitor credit and a debitor credit under BALANCE on every line. In CNOW, Item descriptions are used for balances. Enter Balance for ITEM when recording beginning balances. Leave ITEM blank when recording all other entries. In CNOW, Journal pages do not begin with "U". For example journal page 10 POST REF. is simply 10. Use a v for beginning balances. If the ending balance is $0, at least one balance amount should be $0. Prepare an unaclued wbalance of the ledger as of April 30, 2017 5. Assume that the April 30 transaction for salaries and commissions should have been $15,300. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry on April 30. Use page 20. (Note: You will not be required to post this entry to the ledger at this time.) (c) Is this error a transantan or side? 4 4. Prepare and bece of the edgar as of April 30, 2017 Elite Realty UNADJUSTED TRIAL BALANCE April 20, 2017 ACCOUNT TITLE DEBIT CREDIT 1 Cash 1 Accounts Receivable ? Prepaid Insurance + Office Supplies 1 Land Accounts Payable Unearried Rent Notes Payable Lester Wagner, Capital 1 Lester Wagner, Drawing 11 Fees Eamed 12 Salary and Commission Expense Is Rent Expense 14 Advertising Expense 15 Automobile Experise 1 Miscellaneous Excense 12 Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started