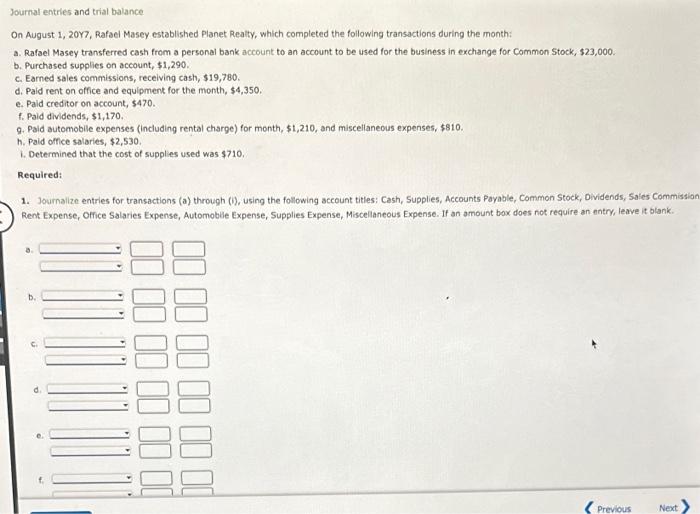

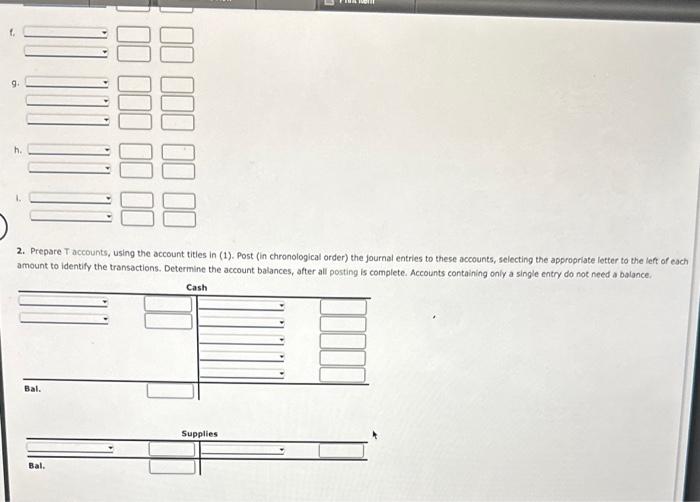

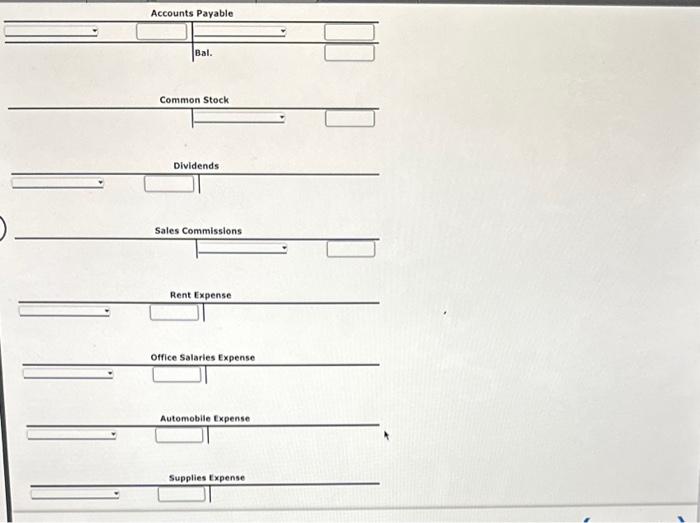

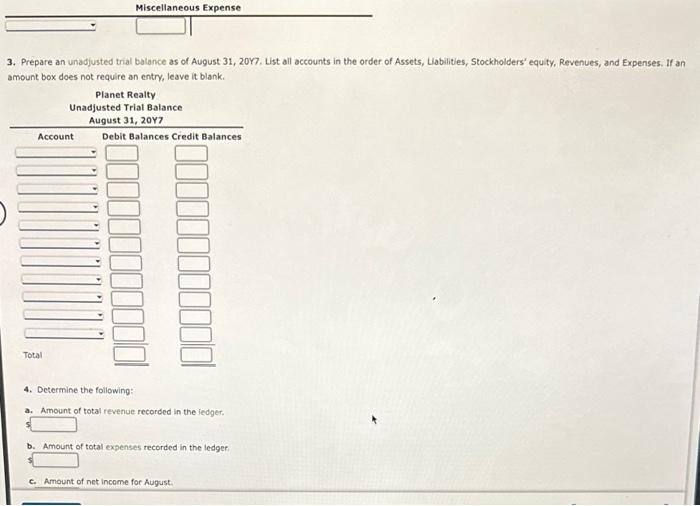

Journal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for Common 5 tock, $23,000. b. Purchased supplies on account, $1,290. c. Earned sales commissions, receiving cash, $19,780. d. Paid rent on office and equipment for the month, $4,350. e. Paid creditor on account, $470. f. Paid dividends, $1,170. 9. Paid automobile expenses (including rental charge) for month, $1,210, and miscellaneous expenses, $810. h. Paid office salaries, $2,530. 1. Determined that the cost of supplies used was $710. Required: 1. Journalize entries for transactions (a) through (1), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commission Rent Expense, Office Salaries Expense, Automoblie Expense, Supplies Expense, Miscelianeous Expense. If an amount box does not require an entry, leave it blank. 2. Prepare T accounts, using the account tities in (1). Post (in chronological order) the journal entries to these accounts, selecting the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. Accounts Payable Common Stock Dividends Sales Commissions Rent Expense Office Salaries Expense Automobile Expense Supplies Ixpense 3. Prepare an unadjusted trial balance as of August 31, 20Y7. List all accounts in the order of Assets, Llabilities, Stockholders' equity, Revenues, and Expenses. If an amount box does not require an entry, leave it blank. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. C. Amount of net income for August. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August