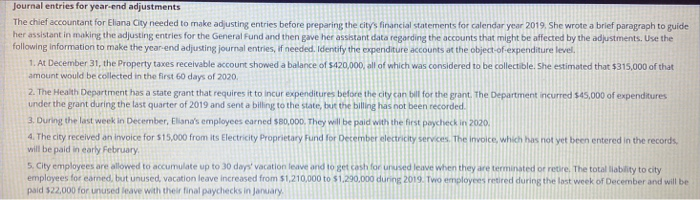

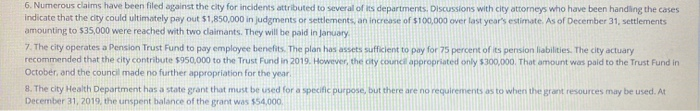

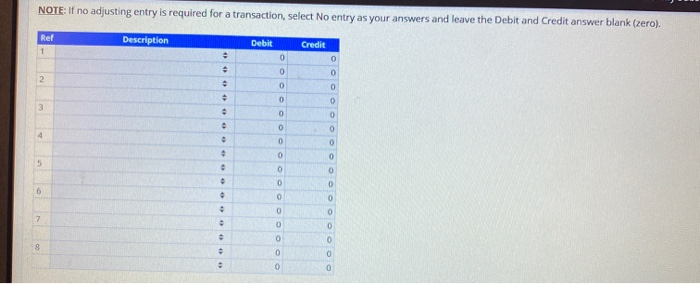

Journal entries for year-end adjustments The chief accountant for Eliana City needed to make adjusting entries before preparing the city's financial statements for calendar year 2019. She wrote a brief paragraph to guide her assistant in making the adjusting entries for the General Fund and then gave her assistant data regarding the accounts that might be affected by the adjustments. Use the following information to make the year-end adjusting journal entries, if needed. Identify the expenditure accounts at the object-of-expenditure level. 1. At December 31, the Property taxes receivable account showed a balance of 5420,000, all of which was considered to be collectible. She estimated that $315,000 of that amount would be collected in the first 60 days of 2020, 2. The Health Department has a state grant that requires it to incur expenditures before the city can bill for the grant The Department incurred 545,000 of expenditures under the grant during the last quarter of 2019 and sent a billing to the state, but the billing has not been recorded. 3. During the last week in December, Eliana's employees earned $80,000. They will be paid with the first paycheck in 2020, 4. The city received an invoice for $15,000 from its Electricity Proprietary Fund for December electricity services. The invoice, which has not yet been entered in the records, will be paid in early February 5. City employees are allowed to accumulate up to 30 days Vacation leave and to get cash for unused leave when they are terminated or retire. The total liability to city employees for earned, but unused, vacation leave increased from $1,210,000 to $1.290,000 during 2019. Two employees retired during the last week of December and will be paid $22,000 for unused leave with their final paychecks in January 6. Numerous claims have been filed against the city for incidents attributed to several of its departments. Discussions with city attorneys who have been handling the cases indicate that the city could ultimately pay out $1,850,000 in judgments or settlements, an increase of $100,000 over last year's estimate. As of December 31, settlements amounting to $35,000 were reached with two claimants. They will be paid in January 7. The city operates a Pension Trust Fund to pay employee benefits. The plan has assets sufficient to pay for 75 percent of its pension liabilities. The city actuary recommended that the city contribute $950,000 to the Trust Fund in 2019. However, the city council appropriated only $300,000. That amount was paid to the Trust Fund in October, and the council made no further appropriation for the year 8. The city Health Department has a state grant that must be used for a specific purpose, but there are no requirements as to when the grant resources may be used. At December 31, 2019, the unspent balance of the grant was $54,000 NOTE: If no adjusting entry is required for a transaction, select No entry as your answers and leave the Debit and credit answer blank (zero). Ref 1 Description Debit Credit 0 0 0 0 2 0 0 0 0 3 0 0 0 0 4 0 0 0 0 5 e 0 0 0 6 0 0 0 0 0 7 0 0 0 8 - 0 . 0 0 Journal entries for year-end adjustments The chief accountant for Eliana City needed to make adjusting entries before preparing the city's financial statements for calendar year 2019. She wrote a brief paragraph to guide her assistant in making the adjusting entries for the General Fund and then gave her assistant data regarding the accounts that might be affected by the adjustments. Use the following information to make the year-end adjusting journal entries, if needed. Identify the expenditure accounts at the object-of-expenditure level. 1. At December 31, the Property taxes receivable account showed a balance of 5420,000, all of which was considered to be collectible. She estimated that $315,000 of that amount would be collected in the first 60 days of 2020, 2. The Health Department has a state grant that requires it to incur expenditures before the city can bill for the grant The Department incurred 545,000 of expenditures under the grant during the last quarter of 2019 and sent a billing to the state, but the billing has not been recorded. 3. During the last week in December, Eliana's employees earned $80,000. They will be paid with the first paycheck in 2020, 4. The city received an invoice for $15,000 from its Electricity Proprietary Fund for December electricity services. The invoice, which has not yet been entered in the records, will be paid in early February 5. City employees are allowed to accumulate up to 30 days Vacation leave and to get cash for unused leave when they are terminated or retire. The total liability to city employees for earned, but unused, vacation leave increased from $1,210,000 to $1.290,000 during 2019. Two employees retired during the last week of December and will be paid $22,000 for unused leave with their final paychecks in January 6. Numerous claims have been filed against the city for incidents attributed to several of its departments. Discussions with city attorneys who have been handling the cases indicate that the city could ultimately pay out $1,850,000 in judgments or settlements, an increase of $100,000 over last year's estimate. As of December 31, settlements amounting to $35,000 were reached with two claimants. They will be paid in January 7. The city operates a Pension Trust Fund to pay employee benefits. The plan has assets sufficient to pay for 75 percent of its pension liabilities. The city actuary recommended that the city contribute $950,000 to the Trust Fund in 2019. However, the city council appropriated only $300,000. That amount was paid to the Trust Fund in October, and the council made no further appropriation for the year 8. The city Health Department has a state grant that must be used for a specific purpose, but there are no requirements as to when the grant resources may be used. At December 31, 2019, the unspent balance of the grant was $54,000 NOTE: If no adjusting entry is required for a transaction, select No entry as your answers and leave the Debit and credit answer blank (zero). Ref 1 Description Debit Credit 0 0 0 0 2 0 0 0 0 3 0 0 0 0 4 0 0 0 0 5 e 0 0 0 6 0 0 0 0 0 7 0 0 0 8 - 0 . 0 0