Journal entries

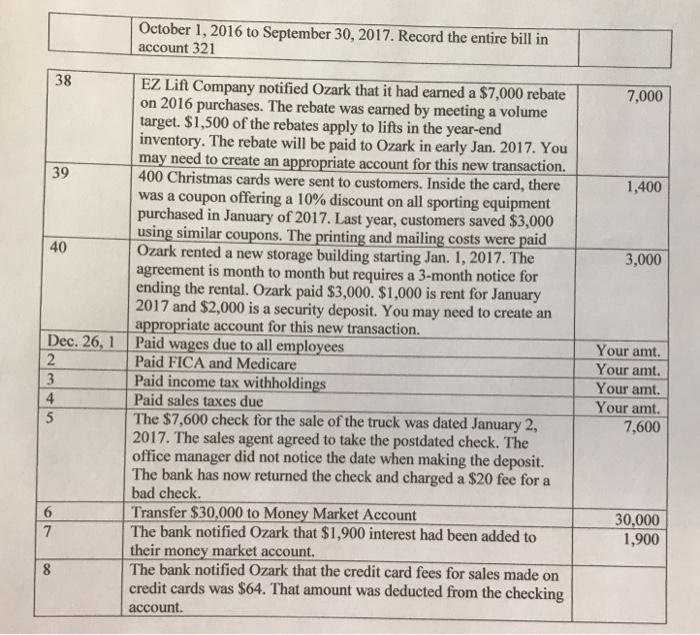

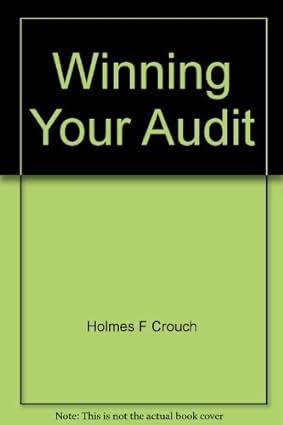

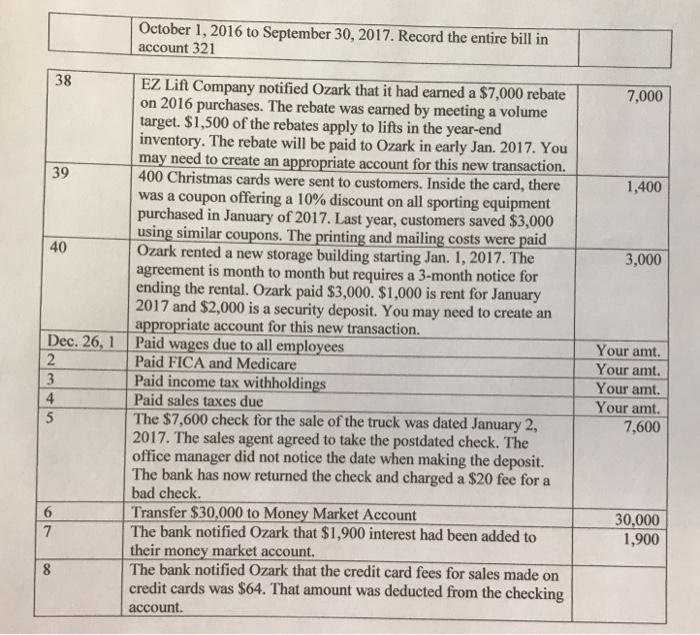

October 1, 2016 to September 30, 2017. Record the entire bill in account 321 38 EZ Lift Company notified Ozark that it had earned a $7,000 rebate 7,000 on 2016 purchases. The rebate was earned by meeting a volume target. $1,500 of the rebates apply to lifts in the year-end inventory. The rebate will be paid to Ozark in early Jan. 2017. You may need to create an appropriate account for this new transaction. 400 Christmas cards were sent to customers. Inside the card, there was a coupon offering a 10% discount on all sporting equipment purchased in January of 2017. Last year, customers saved $3,000 using sim Ozark rented a new storage building starting Jan. 1, 2017. The agreement is month to month but requires a 3-month notice for ending the rental. Ozark paid $3,000. $1,000 is rent for January 2017 and $2,000 is a security deposit. You may need to create an appropriate account for this new transaction 39 1,400 ilar coupons. The printing and mailing costs were paid 40 3,000 Dec. 26,1 Paid wages due to all employees Your amt Your amt Your amt Your amt 7,600 Paid FICA and Medicare Paid income tax withholdings Paid sales taxes due The $7,600 check for the sale of the truck was dated January 2, 2017. The sales agent agreed to take the postdated check. The office manager did not notice the date when making the deposit. The bank has now returned the check and charged a $20 fee for a bad check. Transfer $30,000 to Money Market Account The bank notified Ozark that $1,900 interest had been added to their money market account. The bank notified Ozark that the credit card fees for sales made on credit cards was $64. That amount was deducted from the checking account. 4 30,000 1,900 October 1, 2016 to September 30, 2017. Record the entire bill in account 321 38 EZ Lift Company notified Ozark that it had earned a $7,000 rebate 7,000 on 2016 purchases. The rebate was earned by meeting a volume target. $1,500 of the rebates apply to lifts in the year-end inventory. The rebate will be paid to Ozark in early Jan. 2017. You may need to create an appropriate account for this new transaction. 400 Christmas cards were sent to customers. Inside the card, there was a coupon offering a 10% discount on all sporting equipment purchased in January of 2017. Last year, customers saved $3,000 using sim Ozark rented a new storage building starting Jan. 1, 2017. The agreement is month to month but requires a 3-month notice for ending the rental. Ozark paid $3,000. $1,000 is rent for January 2017 and $2,000 is a security deposit. You may need to create an appropriate account for this new transaction 39 1,400 ilar coupons. The printing and mailing costs were paid 40 3,000 Dec. 26,1 Paid wages due to all employees Your amt Your amt Your amt Your amt 7,600 Paid FICA and Medicare Paid income tax withholdings Paid sales taxes due The $7,600 check for the sale of the truck was dated January 2, 2017. The sales agent agreed to take the postdated check. The office manager did not notice the date when making the deposit. The bank has now returned the check and charged a $20 fee for a bad check. Transfer $30,000 to Money Market Account The bank notified Ozark that $1,900 interest had been added to their money market account. The bank notified Ozark that the credit card fees for sales made on credit cards was $64. That amount was deducted from the checking account. 4 30,000 1,900