Answered step by step

Verified Expert Solution

Question

1 Approved Answer

journal entries Rayya Company purchases a machine for $159,600 on January 1, 2021. Straight-line depreciation is taken each year for four years assuming a eight-year

journal entries

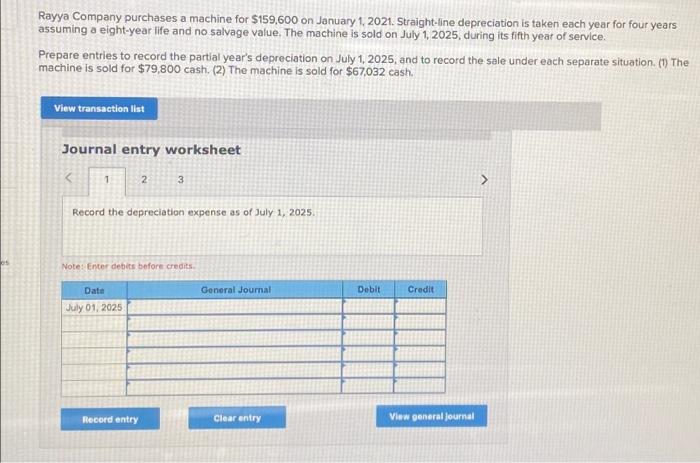

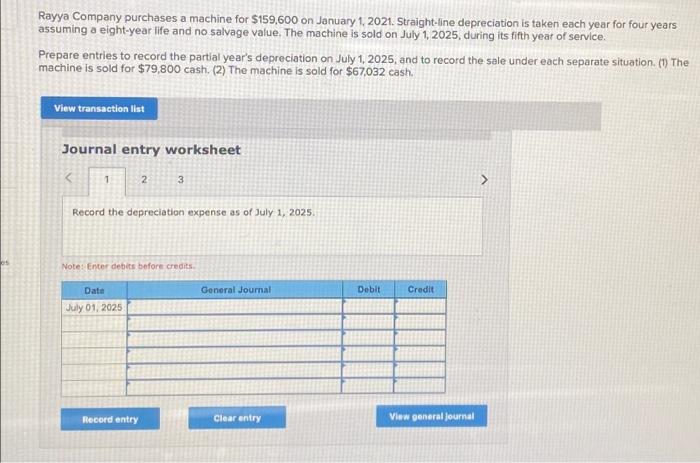

Rayya Company purchases a machine for $159,600 on January 1, 2021. Straight-line depreciation is taken each year for four years assuming a eight-year life and no salvage value. The machine is sold on July 1, 2025, during its fifth year of service. Prepare entries to record the partial year's depreciation on July 1, 2025, and to record the sale under each separate situation (1) The machine is sold for $79,800 cash. (2) The machine is sold for $67.032 cash. View transaction list Journal entry worksheet Record the depreciation expense as of July 1, 2025. Note: Enter debits before credits Date General Journal Debit Credit July 01, 2025 Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started