Answered step by step

Verified Expert Solution

Question

1 Approved Answer

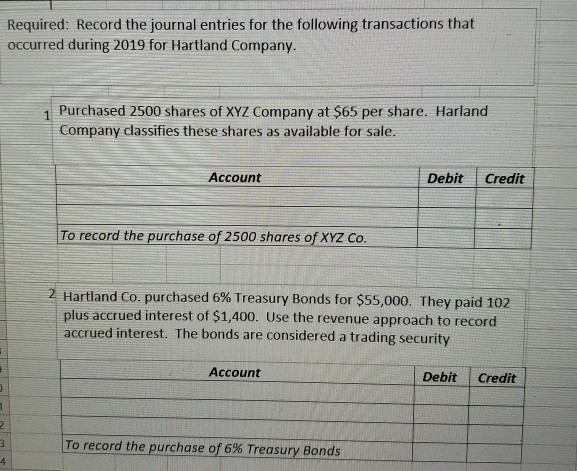

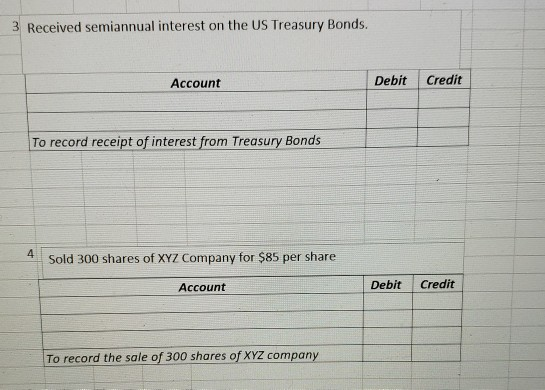

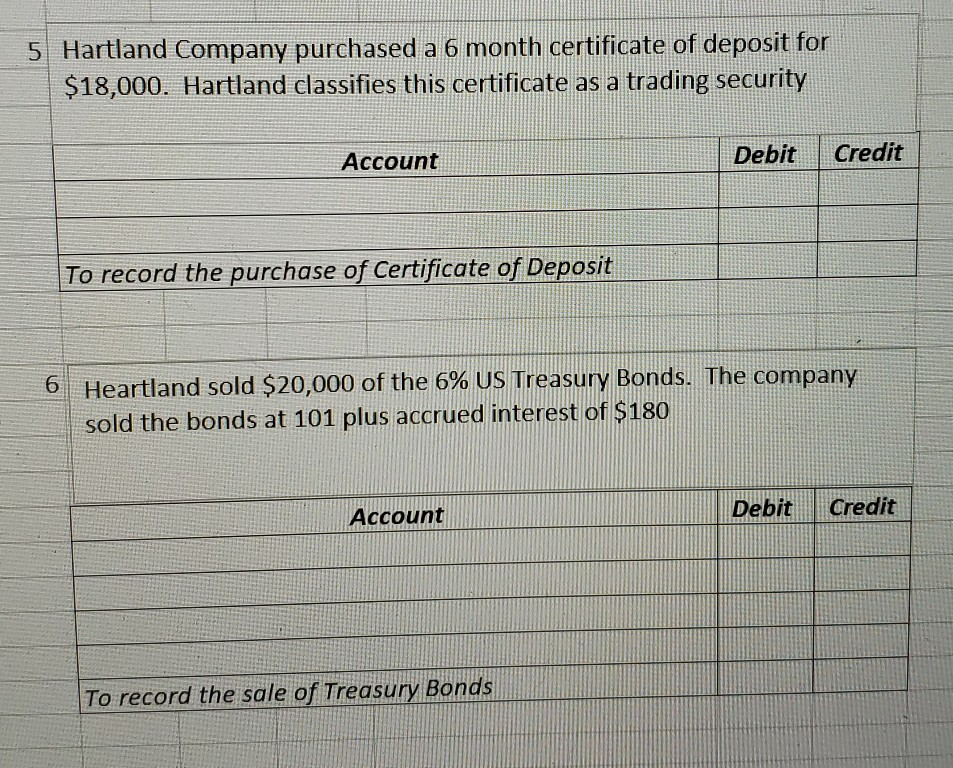

Journal Entries Required: Record the journal entries for the following transactions that occurred during 2019 for Hartland Company. 1 Purchased 2500 shares of XYZ Company

Journal Entries

Required: Record the journal entries for the following transactions that occurred during 2019 for Hartland Company. 1 Purchased 2500 shares of XYZ Company at $65 per share. Harland Company classifies these shares as available for sale. Account Debit Credit To record the purchase of 2500 shares of XYZ Co. 2 Hartland Co. purchased 6% Treasury Bonds for $55,000. They paid 102 plus accrued interest of $1,400. Use the revenue approach to record accrued interest. The bonds are considered a trading security Account Debit Credit 2 3 To record the purchase of 6% Treasury Bonds 4 3 Received semiannual interest on the US Treasury Bonds. Account Debit Credit To record receipt of interest from Treasury Bonds 4 Sold 300 shares of XYZ Company for $85 per share Account Debit Credit To record the sale of 300 shares of XYZ company 5 Hartland Company purchased a 6 month certificate of deposit for $18,000. Hartland classifies this certificate as a trading security Account Debit Credit To record the purchase of Certificate of Deposit 6 Heartland sold $20,000 of the 6% US Treasury Bonds. The company sold the bonds at 101 plus accrued interest of $180 Account Debit Credit To record the sale of Treasury Bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started