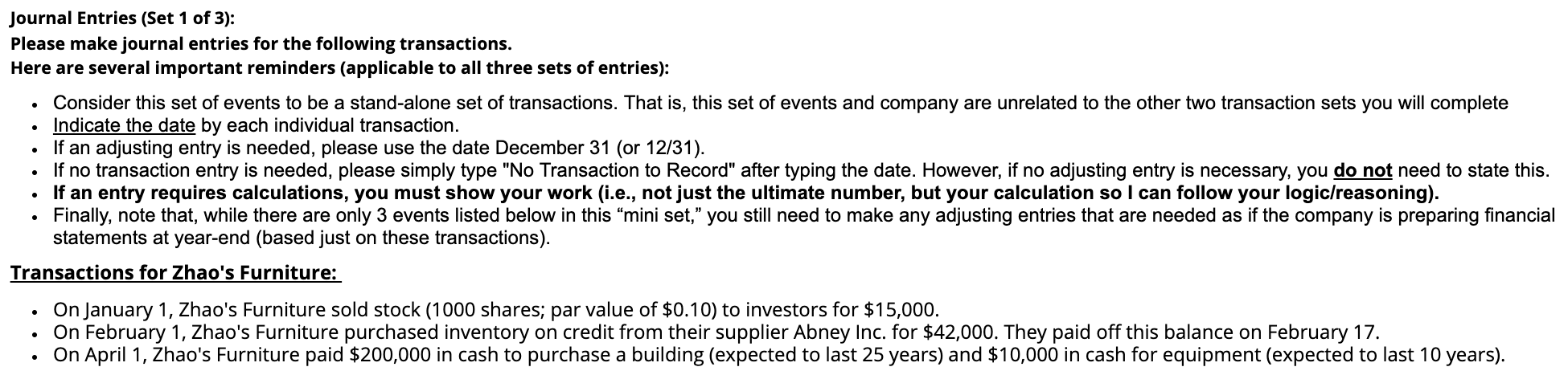

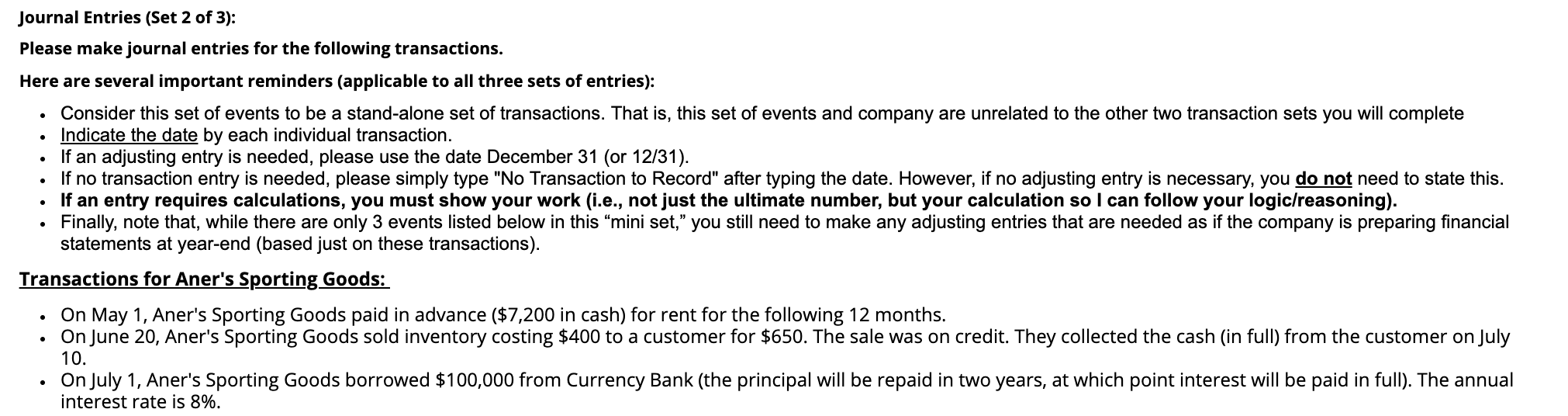

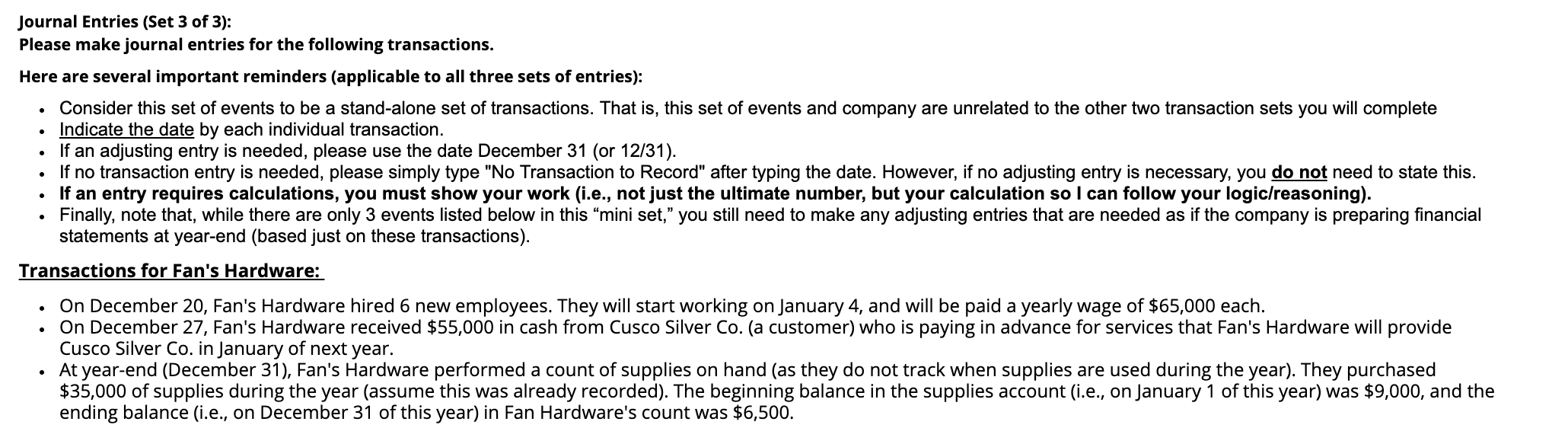

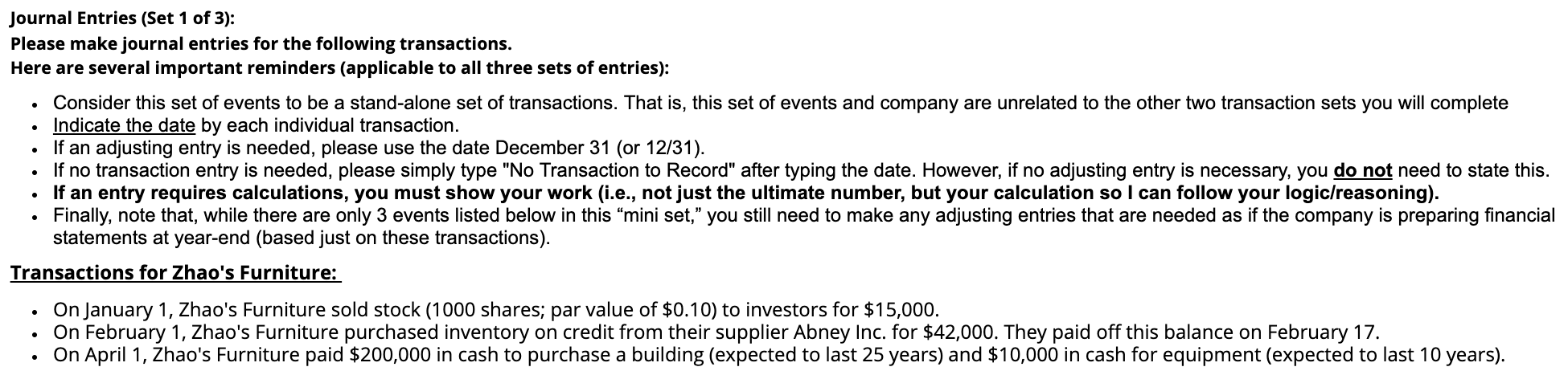

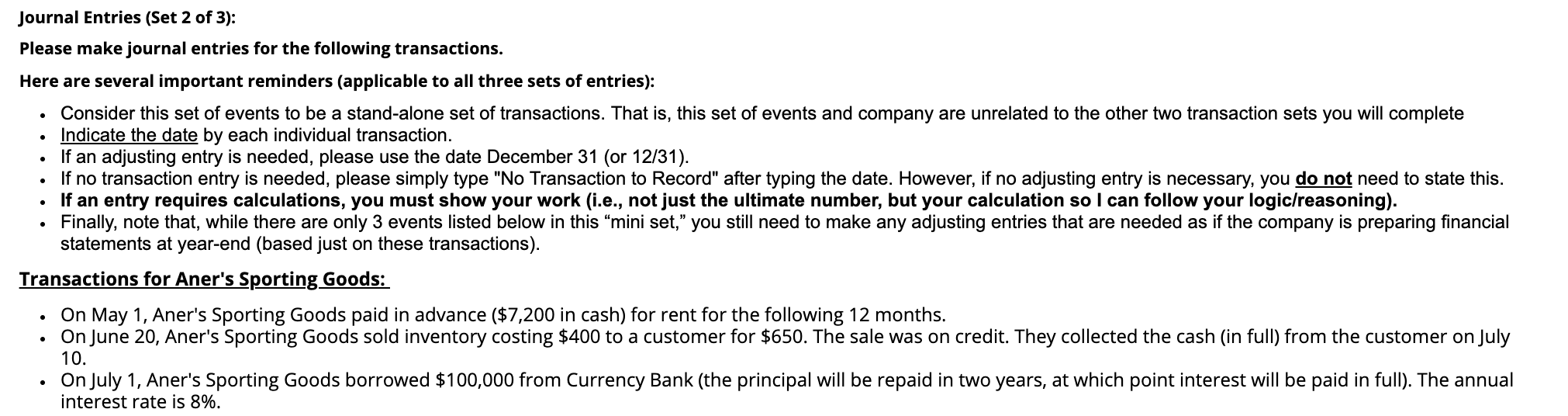

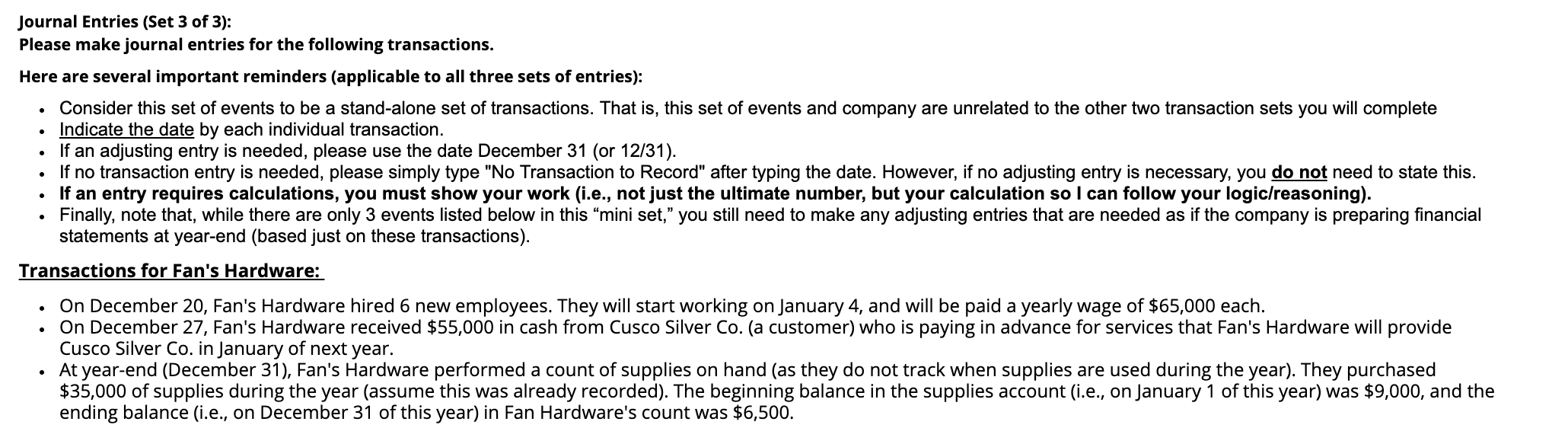

. . Journal Entries (Set 1 of 3): Please make journal entries for the following transactions. Here are several important reminders (applicable to all three sets of entries): Consider this set of events to be a stand-alone set of transactions. That is, this set of events and company are unrelated to the other two transaction sets you will complete Indicate the date by each individual transaction. If an adjusting entry is needed, please use the date December 31 (or 12/31). If no transaction entry is needed, please simply type "No Transaction to Record" after typing the date. However, if no adjusting entry is necessary, you do not need to state this. If an entry requires calculations, you must show your work (i.e., not just the ultimate number, but your calculation so I can follow your logic/reasoning). Finally, note that, while there are only 3 events listed below in this mini set," you still need to make any adjusting entries that are needed as if the company is preparing financial statements at year-end (based just on these transactions). Transactions for Zhao's Furniture: . . On January 1, Zhao's Furniture sold stock (1000 shares; par value of $0.10) to investors for $15,000. On February 1, Zhao's Furniture purchased inventory on credit from their supplier Abney Inc. for $42,000. They paid off this balance on February 17. On April 1, Zhao's Furniture paid $200,000 in cash to purchase a building (expected to last 25 years) and $10,000 in cash for equipment (expected to last 10 years). . Journal Entries (Set 2 of 3): Please make journal entries for the following transactions. Here are several important reminders (applicable to all three sets of entries): Consider this set of events to be a stand-alone set of transactions. That is, this set of events and company are unrelated to the other two transaction sets you will complete Indicate the date by each individual transaction. If an adjusting entry is needed, please use the date December 31 (or 12/31). If no transaction entry is needed, please simply type "No Transaction to Record" after typing the date. However, if no adjusting entry is necessary, you do not need to state this. If an entry requires calculations, you must show your work (i.e., not just the ultimate number, but your calculation so I can follow your logic/reasoning). Finally, note that, while there are only 3 events listed below in this mini set," you still need to make any adjusting entries that are needed as if the company is preparing financial statements at year-end (based just on these transactions). Transactions for Aner's Sporting Goods: On May 1, Aner's Sporting Goods paid in advance ($7,200 in cash) for rent for the following 12 months. On June 20, Aner's Sporting Goods sold inventory costing $400 to a customer for $650. The sale was on credit. They collected the cash (in full) from the customer on July 10. On July 1, Aner's Sporting Goods borrowed $100,000 from Currency Bank (the principal will be repaid in two years, at which point interest will be paid in full). The annual interest rate is 8%. Journal Entries (Set 3 of 3): Please make journal entries for the following transactions. Here are several important reminders (applicable to all three sets of entries): Consider this set of events to be a stand-alone set of transactions. That is, this set of events and company are unrelated to the other two transaction sets you will complete Indicate the date by each individual transaction. If an adjusting entry is needed, please use the date December 31 (or 12/31). If no transaction entry is needed, please simply type "No Transaction to Record" after typing the date. However, if no adjusting entry is necessary, you do not need to state this. If an entry requires calculations, you must show your work (i.e., not just the ultimate number, but your calculation so I can follow your logic/reasoning). Finally, note that, while there are only 3 events listed below in this mini set, you still need to make any adjusting entries that are needed as if the company is preparing financial statements at year-end (based just on these transactions). Transactions for Fan's Hardware: On December 20, Fan's Hardware hired 6 new employees. They will start working on January 4, and will be paid a yearly wage of $65,000 each. On December 27, Fan's Hardware received $55,000 in cash from Cusco Silver Co. (a customer) who is paying in advance for services that Fan's Hardware will provide Cusco Silver Co. in January of next year. At year-end (December 31), Fan's Hardware performed a count of supplies on hand (as they do not track when supplies are used during the year). They purchased $35,000 of supplies during the year (assume this was already recorded). The beginning balance in the supplies account (i.e., on January 1 of this year) was $9,000, and the ending balance (i.e., on December 31 of this year) in Fan Hardware's count was $6,500