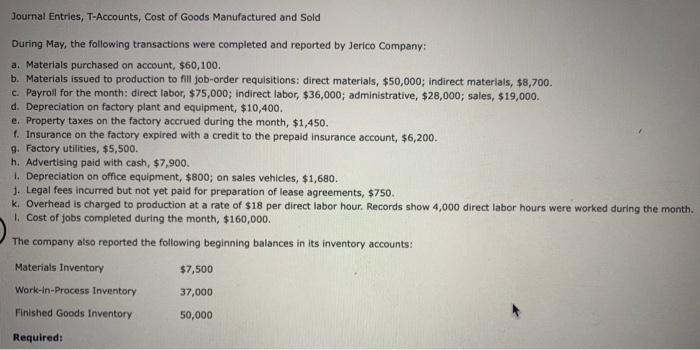

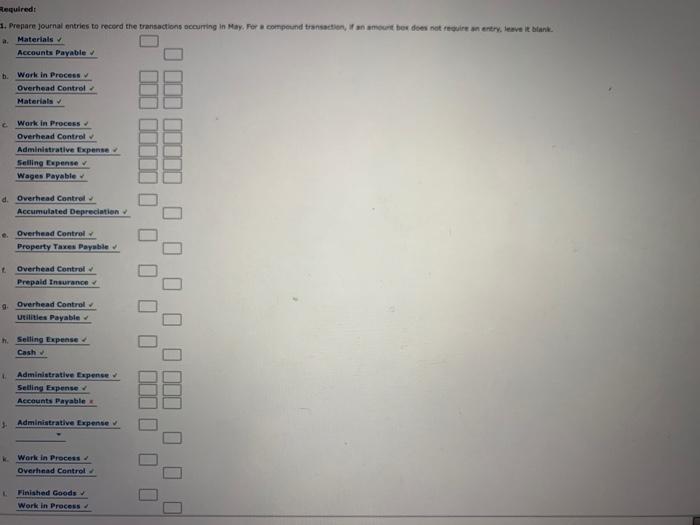

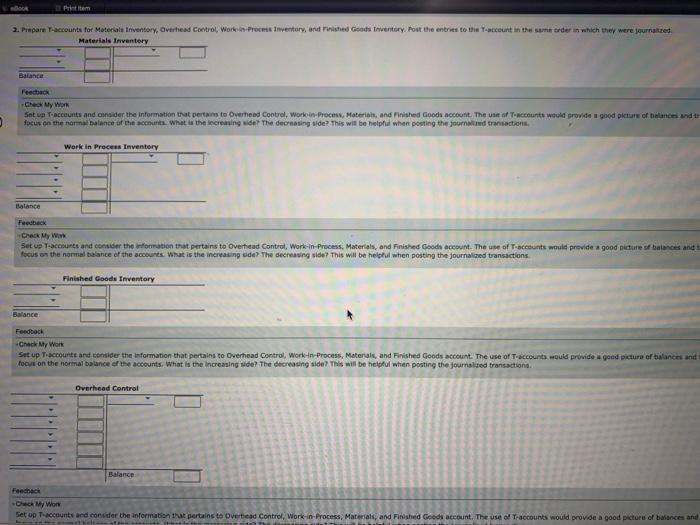

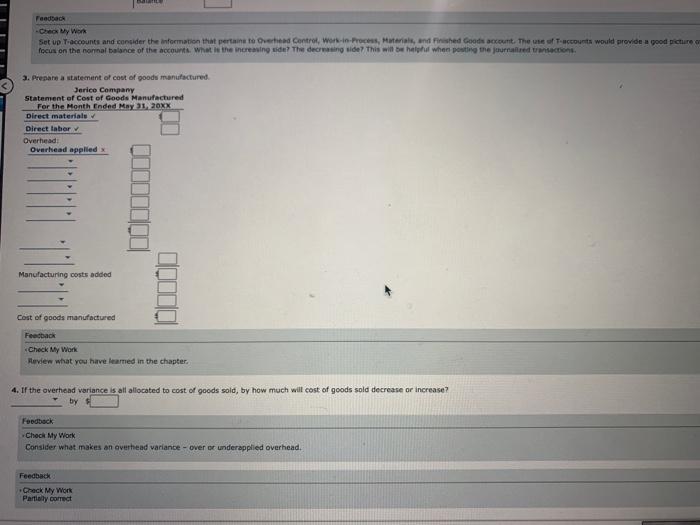

Journal Entries, T-Accounts, Cost of Goods Manufactured and Sold During May, the following transactions were completed and reported by Jerico Company: a. Materials purchased on account, $60,100. b. Materials issued to production to fill job-order requisitions: direct materials, $50,000; indirect materials, $8,700. c. Payroll for the month: direct labor, $75,000; indirect labor, $36,000; administrative, $28,000; sales, $19,000. d. Depreciation on factory plant and equipment, $10,400. e. Property taxes on the factory accrued during the month, $1,450. 1. Insurance on the factory expired with a credit to the prepaid Insurance account, $6,200. 9. Factory utilities, $5,500. h. Advertising paid with cash, $7,900. 1. Depreciation on office equipment, $800; on sales vehicles, $1,680. 1. Legal fees incurred but not yet paid for preparation of lease agreements, $750. k Overhead is charged to production at a rate of $18 per direct labor hour. Records show 4,000 direct labor hours were worked during the month. 1. Cost of jobs completed during the month, $160,000. The company also reported the following beginning balances in its inventory accounts: Materials Inventory $7,500 Work-in-Process Inventory 37,000 Finished Goods Inventory 50,000 Required: Required: Prepare Journal entries to record the transactions occurring in May. Per compound transaction in our box does not require an enery, leave it bank a. Materials Accounts Payable h. Work in Process Overhead Control Materials c Work in Process Overhead Control Administrative Expense Selling Expense Wages Payable d. Overhead Control Accumulated Depreciation e Overhead Control Property Taxes Payable t Overhead Control Prepaid Insurance 9. Overhead Control Utilities Payable Selling Expense Cash Administrative Expense Selling Expense Accounts Payable 0 0 0 0000 0 Administrative Expense Work in Process Overhead Control Finished Goods Work in Process 2. Prepare T-accounts for Materials inventory, Overhead Control, Worte de Process Inventory, and Fished Goods Thventory. Pout the entries to the Taccount in the same order in which they were journalised Materials Inventory Balance Check My Won Setup Taccounts and consider the information that pertama to Overhead Control, Work in Process Materiah, and finished Goods account. The use of accounts would provide good picture of balances and to focus on the normal balance of the count. What is the creating wide? The decreasing side? This will be helpful where posting the journed transaction Work in Process Inventory Balance Feedback Check My W Set Up T-accounts and consider the formation that pertains to Overhead Control, Work in Process, Materials, and Finished Goods account. The use of accounts would provide a good picture sf balances and focus on the normal balance of the accounts. What is the increasing de? The decreasing side? This will be helpful when posting the journalized transactions Finished Goods Inventory Balance Feedback Check My Work Set up accounts and consider the information that pertains to Overhead Control, Work in Process, Materials, and finished Goods account. The use of T-accounts would provide good picture of balances and focus on the normal balance of the accounts. What is the increasing side? The decreasing side? This will be helpful when posting the journaled transactions Overhead Control Balance Feedback Check Won Set op T-accounts and consider the information that pertains to Overhead Control, Work-in-Process, Materials, and finished Goods account. The use of accounts would provide a good picture of balances and Feedback Check My Won Set up T-accounts and consider the information that pertama to Overhead Control, wort-in-Process Materials, and finished Goods account. The use of accounts would provide a good picture focus on the normal balance of the accounts. What is the increasing de? The decreasing side? This will be helpful when put the journalized transactions 3. Prepare a statement of cost of good manufactured Jerice Company Statement of Cost of Goods Manufactured For the Month Ended May 31, 20XX Direct materials Direct laber Overhead Overhead applied Manufacturing costs added Cost of goods manufactured Feedback Check My Work Review what you have leared in the chapter. 4. If the overhead variance is all allocated to cost of goods sold, by how much will cost of goods sold decrease or increase? by Feedback Check My Work Consider what makes an overhead variance-over or underapplied overhead Feedback Check My Work Partially correct