Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Journal entries to record both employee and employer payroll compensation and deductions. I strongly recommend that you print out these facts for easy reference in

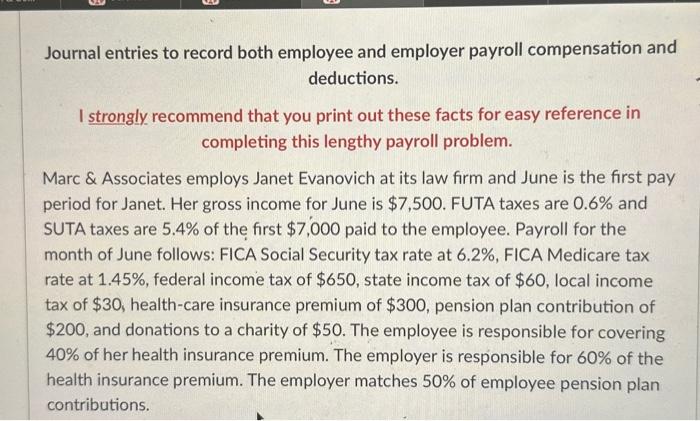

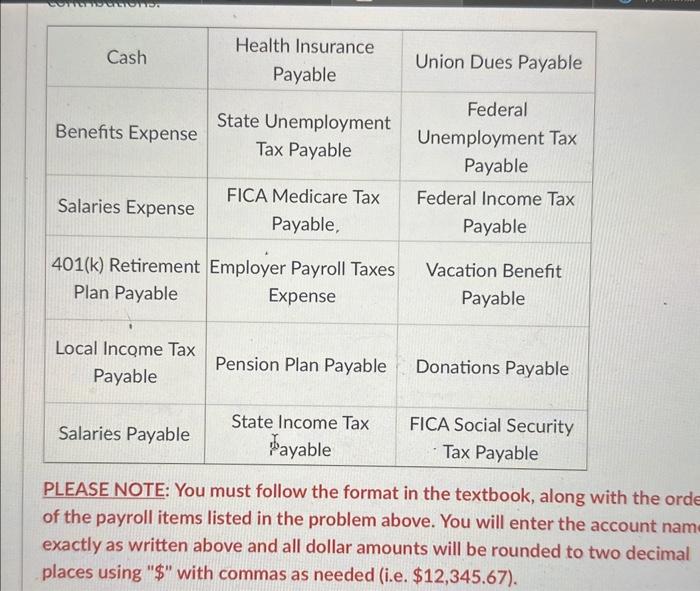

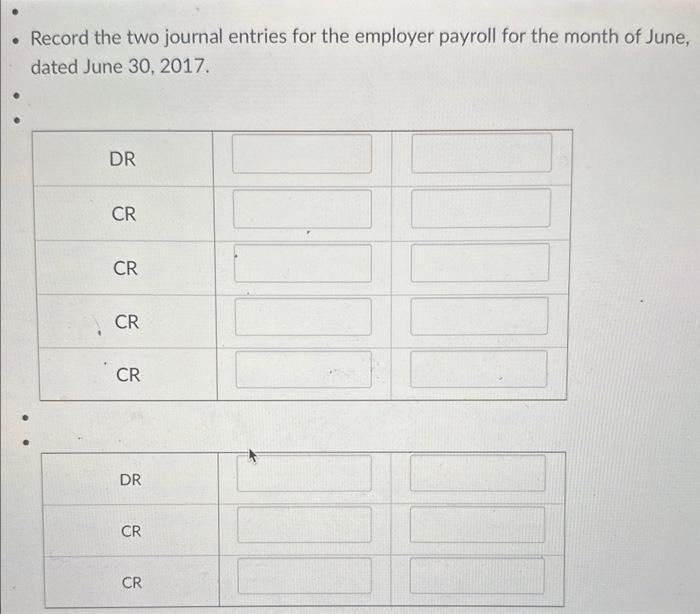

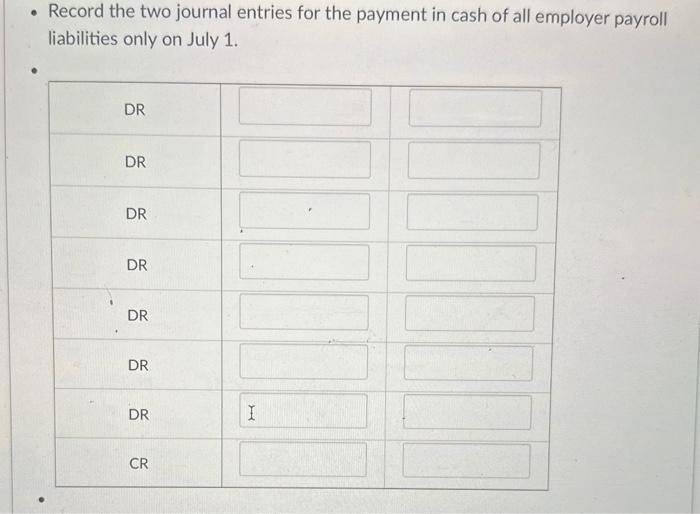

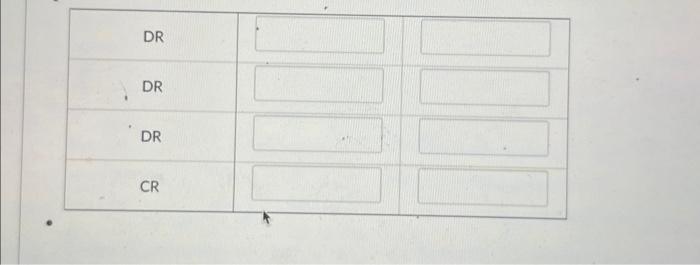

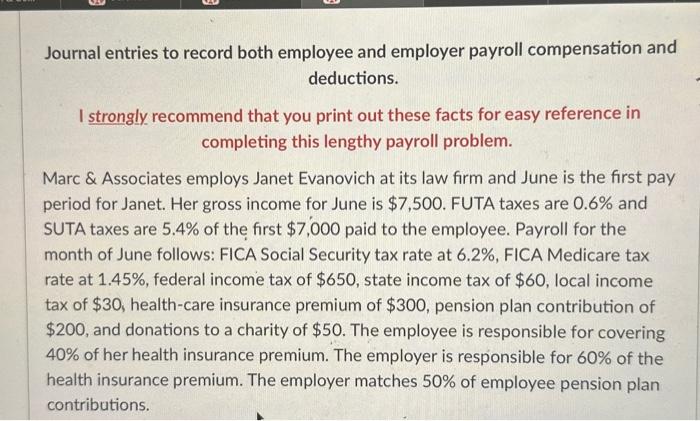

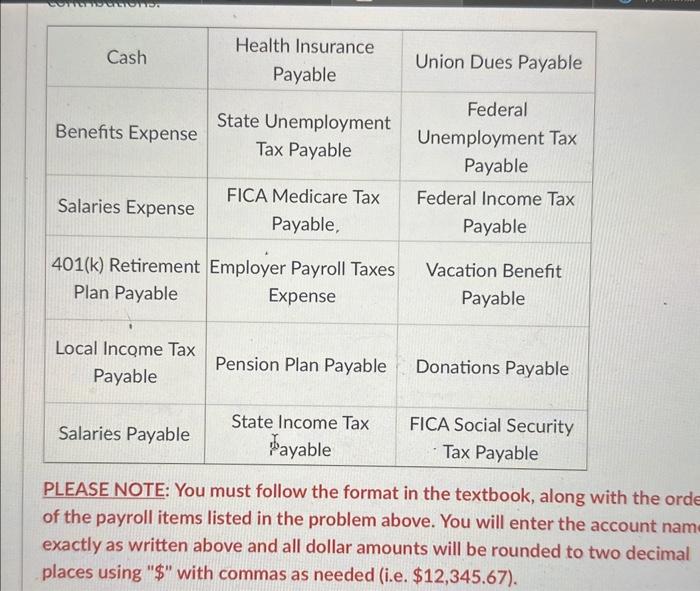

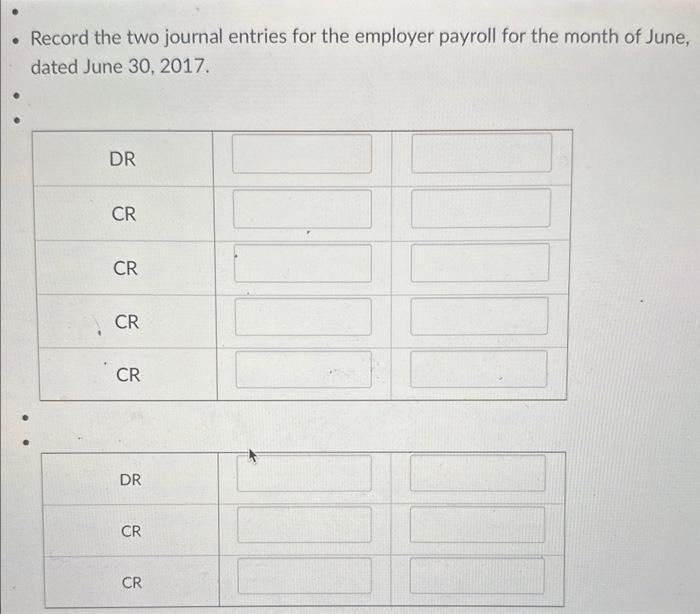

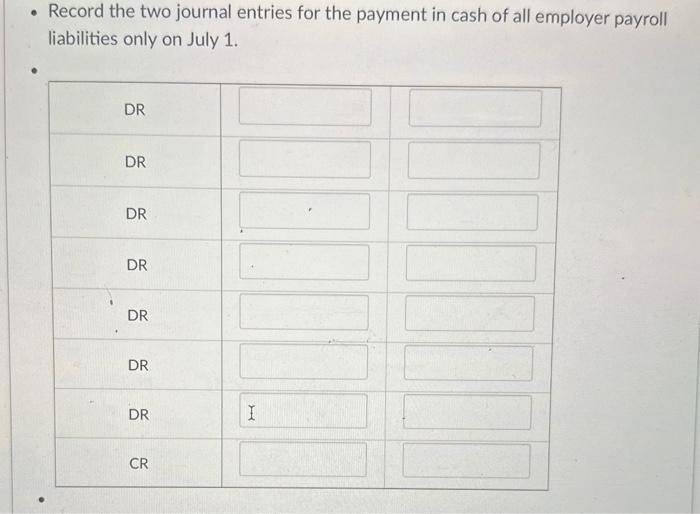

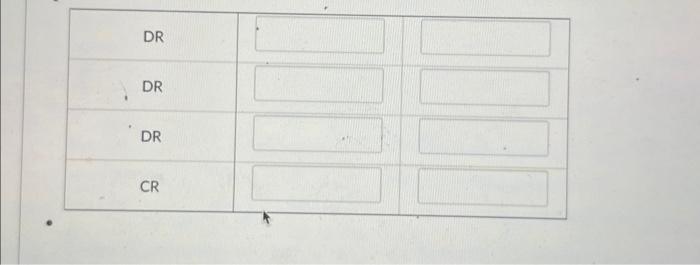

Journal entries to record both employee and employer payroll compensation and deductions. I strongly recommend that you print out these facts for easy reference in completing this lengthy payroll problem. Marc \& Associates employs Janet Evanovich at its law firm and June is the first pay period for Janet. Her gross income for June is $7,500. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to the employee. Payroll for the month of June follows: FICA Social Security tax rate at 6.2\%, FICA Medicare tax rate at 1.45%, federal income tax of $650, state income tax of $60, local income tax of $30, health-care insurance premium of $300, pension plan contribution of $200, and donations to a charity of $50. The employee is responsible for covering 40% of her health insurance premium. The employer is responsible for 60% of the health insurance premium. The employer matches 50% of employee pension plan contributions. exactly as written above and all dollem amounts exactly as written above and all dollar amounts will be rounded to two decimal places using "\$" with commas as needed (i.e. $12,345.67). - Record the two journal entries for the employer payroll for the month of June, dated June 30, 2017. - Record the two journal entries for the payment in cash of all employer payroll liabilities only on July 1

Journal entries to record both employee and employer payroll compensation and deductions. I strongly recommend that you print out these facts for easy reference in completing this lengthy payroll problem. Marc \& Associates employs Janet Evanovich at its law firm and June is the first pay period for Janet. Her gross income for June is $7,500. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to the employee. Payroll for the month of June follows: FICA Social Security tax rate at 6.2\%, FICA Medicare tax rate at 1.45%, federal income tax of $650, state income tax of $60, local income tax of $30, health-care insurance premium of $300, pension plan contribution of $200, and donations to a charity of $50. The employee is responsible for covering 40% of her health insurance premium. The employer is responsible for 60% of the health insurance premium. The employer matches 50% of employee pension plan contributions. exactly as written above and all dollem amounts exactly as written above and all dollar amounts will be rounded to two decimal places using "\$" with commas as needed (i.e. $12,345.67). - Record the two journal entries for the employer payroll for the month of June, dated June 30, 2017. - Record the two journal entries for the payment in cash of all employer payroll liabilities only on July 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started