Journal entries to record investment transactions

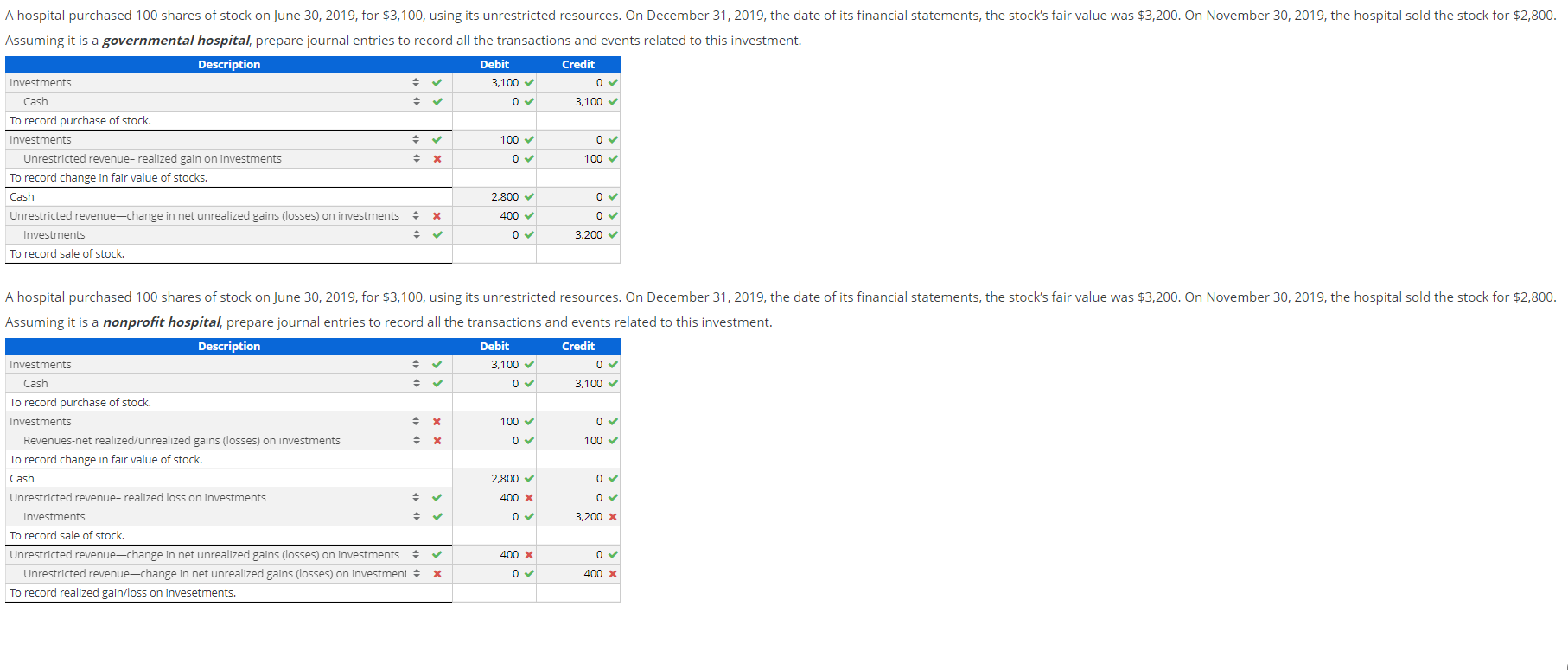

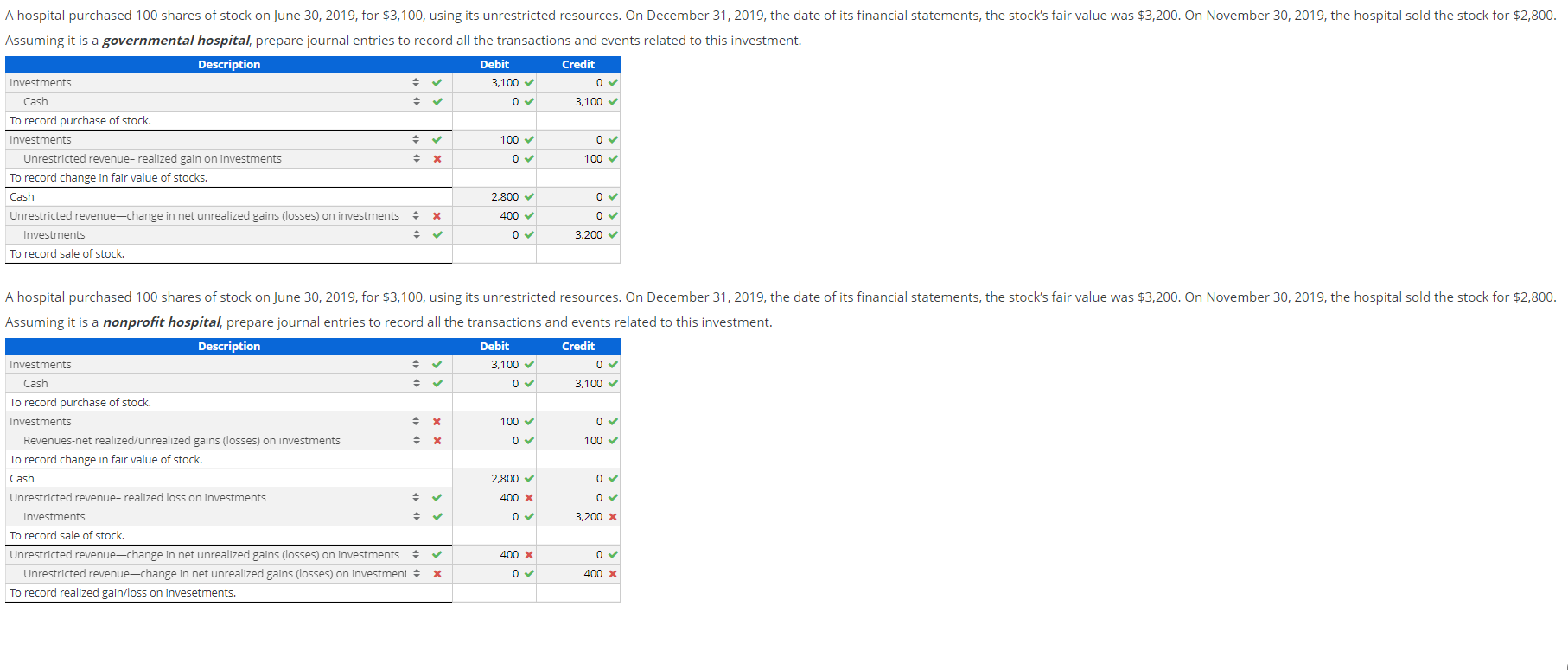

A hospital purchased 100 shares of stock on June 30, 2019, for $3,100, using its unrestricted resources. On December 31, 2019, the date of its financial statements, the stocks fair value was $3,200. On November 30, 2019, the hospital sold the stock for $2,800.

Assuming it is a governmental hospital, prepare journal entries to record all the transactions and events related to this investment.

A hospital purchased 100 shares of stock on June 30, 2019, for $3,100, using its unrestricted resources. On December 31, 2019, the date of its financial statements, the stock's fair value was $3,200. On November 30, 2019, the hospital sold the stock for $2,800. Assuming it is a governmental hospital, prepare journal entries to record all the transactions and events related to this investment. Description Investments 3,100 o Debit Credit Cash 0 3,100 To record purchase of stock. Investments 100 X 0 100 0 Unrestricted revenue- realized gain on investments To record change in fair value of stocks. Cash Unrestricted revenue-change in net unrealized gains (losses) on investments Investments To record sale of stock. X 2,800 400 0 0 3,200 0 x A hospital purchased 100 shares of stock on June 30, 2019, for $3,100, using its unrestricted resources. On December 31, 2019, the date of its financial statements, the stock's fair value was $3,200. On November 30, 2019, the hospital sold the stock for $2,800. Assuming it is a nonprofit hospital, prepare journal entries to record all the transactions and events related to this investment. Description Debit Credit Investments 3,100 o Cash 0 3,100 To record purchase of stock. Investments 100 Revenues-net realized/unrealized gains (losses) on investments 0 100 To record change in fair value of stock. Cash 2,800 Unrestricted revenue- realized loss on investments 0 Investments 3,200 x To record sale of stock. Unrestricted revenue-change in net unrealized gains (losses) on investments Unrestricted revenue-change in net unrealized gains (losses) on investment 0 400 x To record realized gain/loss on invesetments. 0 400 X 400 X 0 X A hospital purchased 100 shares of stock on June 30, 2019, for $3,100, using its unrestricted resources. On December 31, 2019, the date of its financial statements, the stock's fair value was $3,200. On November 30, 2019, the hospital sold the stock for $2,800. Assuming it is a governmental hospital, prepare journal entries to record all the transactions and events related to this investment. Description Investments 3,100 o Debit Credit Cash 0 3,100 To record purchase of stock. Investments 100 X 0 100 0 Unrestricted revenue- realized gain on investments To record change in fair value of stocks. Cash Unrestricted revenue-change in net unrealized gains (losses) on investments Investments To record sale of stock. X 2,800 400 0 0 3,200 0 x A hospital purchased 100 shares of stock on June 30, 2019, for $3,100, using its unrestricted resources. On December 31, 2019, the date of its financial statements, the stock's fair value was $3,200. On November 30, 2019, the hospital sold the stock for $2,800. Assuming it is a nonprofit hospital, prepare journal entries to record all the transactions and events related to this investment. Description Debit Credit Investments 3,100 o Cash 0 3,100 To record purchase of stock. Investments 100 Revenues-net realized/unrealized gains (losses) on investments 0 100 To record change in fair value of stock. Cash 2,800 Unrestricted revenue- realized loss on investments 0 Investments 3,200 x To record sale of stock. Unrestricted revenue-change in net unrealized gains (losses) on investments Unrestricted revenue-change in net unrealized gains (losses) on investment 0 400 x To record realized gain/loss on invesetments. 0 400 X 400 X 0 X