Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Journal entries to record the receipt and use of contributions by a nonprofit hospital Ellen Falk Hospital, a nonprofit hospital, had the following transactions during

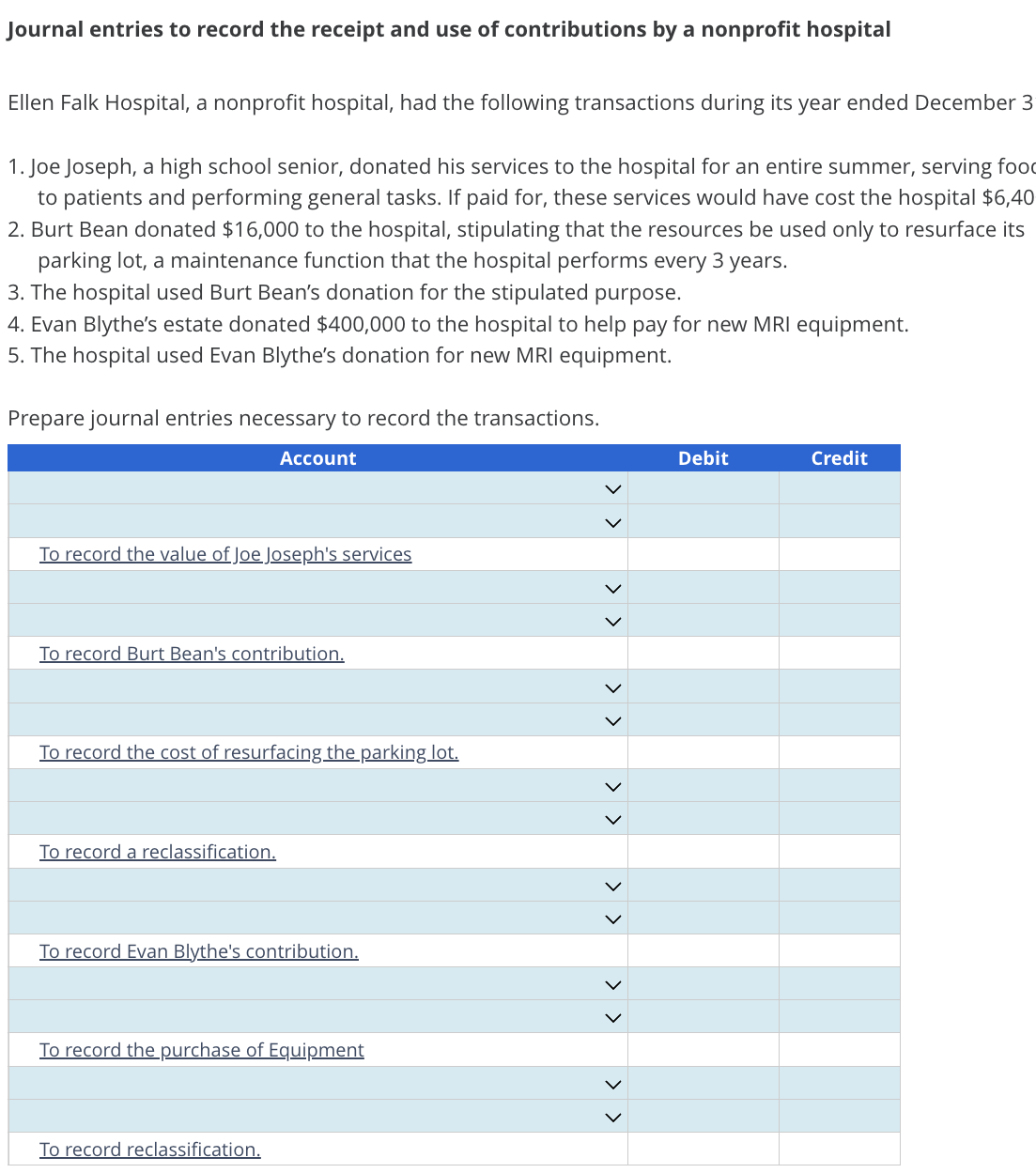

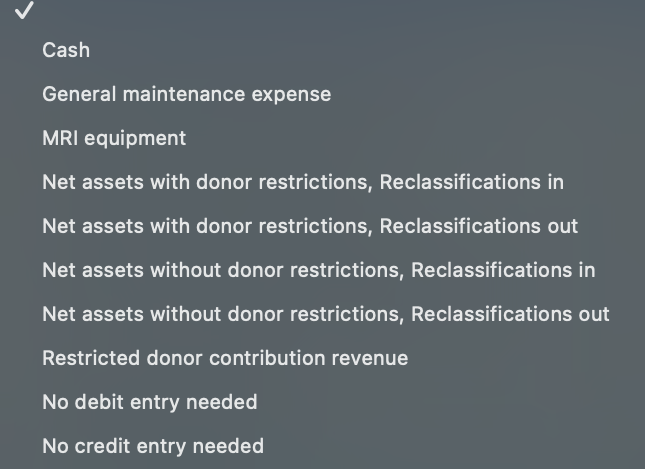

Journal entries to record the receipt and use of contributions by a nonprofit hospital Ellen Falk Hospital, a nonprofit hospital, had the following transactions during its year ended December 1. Joe Joseph, a high school senior, donated his services to the hospital for an entire summer, serving fo to patients and performing general tasks. If paid for, these services would have cost the hospital $6,4 2. Burt Bean donated $16,000 to the hospital, stipulating that the resources be used only to resurface its parking lot, a maintenance function that the hospital performs every 3 years. 3. The hospital used Burt Bean's donation for the stipulated purpose. 4. Evan Blythe's estate donated $400,000 to the hospital to help pay for new MRI equipment. 5. The hospital used Evan Blythe's donation for new MRI equipment. Prepare journal entries necessary to record the transactions. Cash General maintenance expense MRI equipment Net assets with donor restrictions, Reclassifications in Net assets with donor restrictions, Reclassifications out Net assets without donor restrictions, Reclassifications in Net assets without donor restrictions, Reclassifications out Restricted donor contribution revenue No debit entry needed No credit entry needed

Journal entries to record the receipt and use of contributions by a nonprofit hospital Ellen Falk Hospital, a nonprofit hospital, had the following transactions during its year ended December 1. Joe Joseph, a high school senior, donated his services to the hospital for an entire summer, serving fo to patients and performing general tasks. If paid for, these services would have cost the hospital $6,4 2. Burt Bean donated $16,000 to the hospital, stipulating that the resources be used only to resurface its parking lot, a maintenance function that the hospital performs every 3 years. 3. The hospital used Burt Bean's donation for the stipulated purpose. 4. Evan Blythe's estate donated $400,000 to the hospital to help pay for new MRI equipment. 5. The hospital used Evan Blythe's donation for new MRI equipment. Prepare journal entries necessary to record the transactions. Cash General maintenance expense MRI equipment Net assets with donor restrictions, Reclassifications in Net assets with donor restrictions, Reclassifications out Net assets without donor restrictions, Reclassifications in Net assets without donor restrictions, Reclassifications out Restricted donor contribution revenue No debit entry needed No credit entry needed Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started