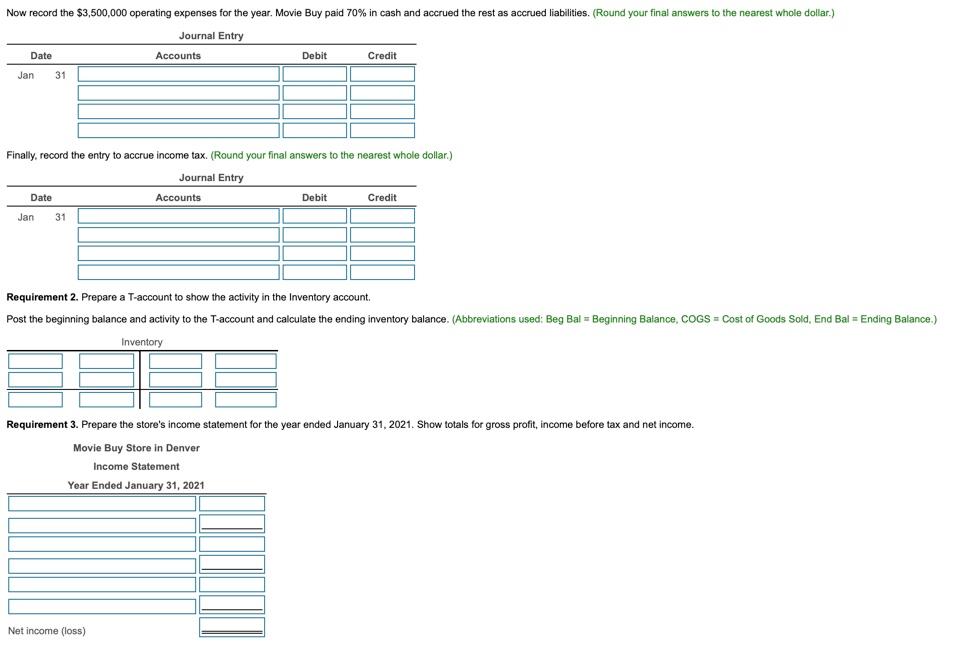

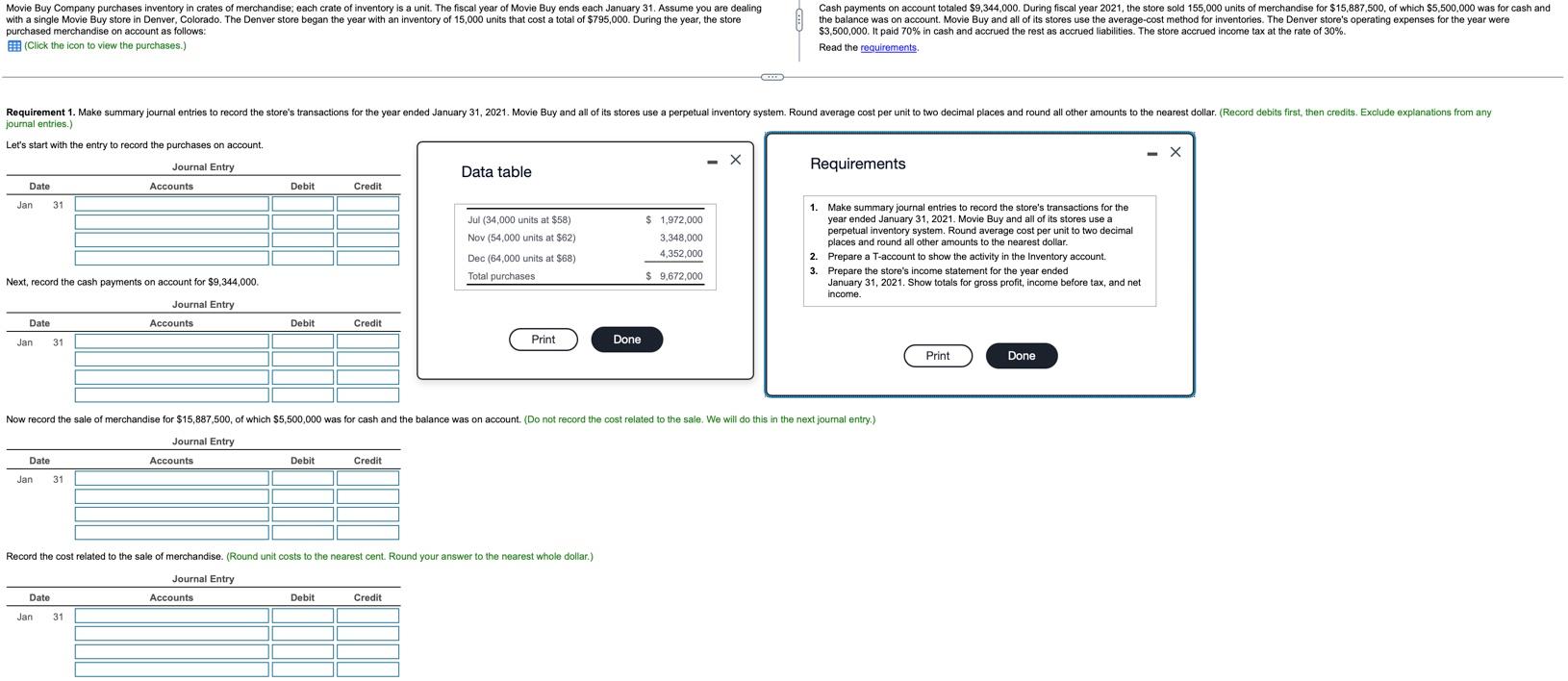

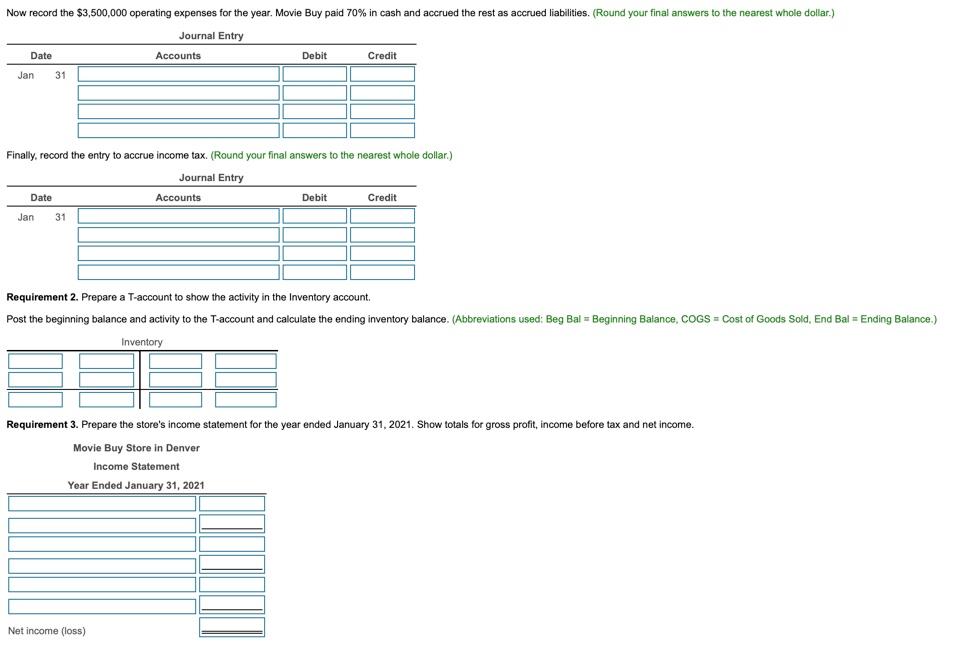

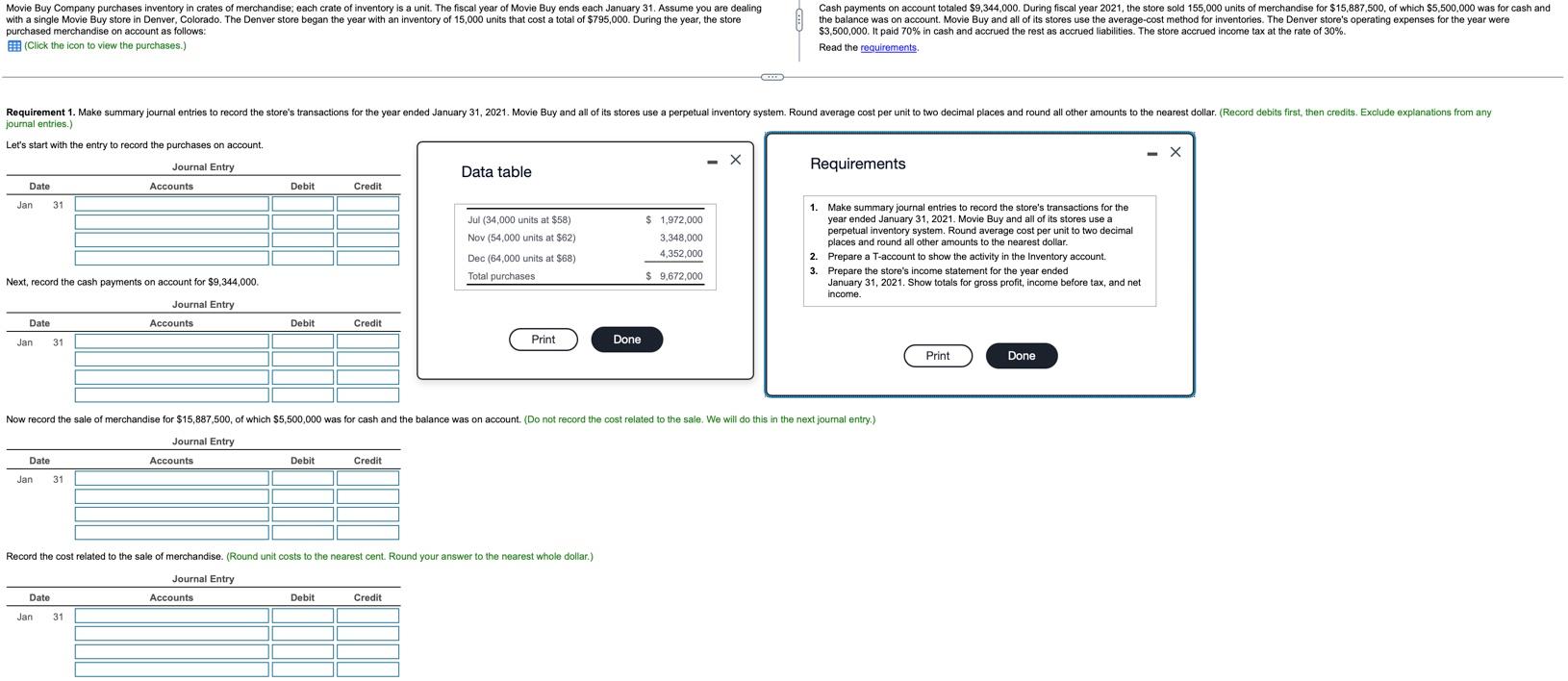

Journal Entry \begin{tabular}{cccc} \hline Date & Accounts & Debit \\ \hline Jan 31 & & Credit \\ \hline \end{tabular} Finally, record the entry to accrue income tax. (Round your final answers to the nearest whole dollar.) Journal Entry \begin{tabular}{ccc} \hline Date & Accounts & Debit \\ \hline Jan31 & & Credit \\ \hline \end{tabular} Requirement 2. Prepare a T-account to show the activity in the Inventory account. Inventory Requirement 3. Prepare the store's income statement for the year ended January 31,2021 . Show totals for gross profit, income before tax and net income. Movie Buy Store in Denver Income Statement Year Ended January 31, 2021 Net income (loss) Movie Buy Company purchases inventory in crates of merchandise; each crate of inventory is a unit. The fiscal year of Movie Buy ends each January 31 . Assume you are dealing Cash payments on account totaled $9,344,000. During fiscal year 2021 , the store sold 155,000 units of merchandise for $15,887,500, of which $5,500,000 was for cash and with a single Movie Buy store in Denver, Colorado. The Denver store began the year with an inventory of 15,000 units that cost a total of $795,000. During the year, the store purchased merchandise on account as follows Cash payments on account totaled $9,344,000. During fiscal year 2021 , the store sold 155,000 units of merchandise for $15,887,500, of which $5,500,000 was for cas was on account. Movie Buy and all of its stores use the average-cost method for inventories. The Denver store's operating expenses for the year were $3,500,000. It paid 70% in cash and accrued the rest as accrued liabilities. The store accrued income tax at the rate of 30% E.3 (Click the icon to view the purchases.) Read the ! Journal Entry \begin{tabular}{cccc} \hline Date & Accounts & Debit \\ \hline Jan 31 & & Credit \\ \hline \end{tabular} Finally, record the entry to accrue income tax. (Round your final answers to the nearest whole dollar.) Journal Entry \begin{tabular}{ccc} \hline Date & Accounts & Debit \\ \hline Jan31 & & Credit \\ \hline \end{tabular} Requirement 2. Prepare a T-account to show the activity in the Inventory account. Inventory Requirement 3. Prepare the store's income statement for the year ended January 31,2021 . Show totals for gross profit, income before tax and net income. Movie Buy Store in Denver Income Statement Year Ended January 31, 2021 Net income (loss) Movie Buy Company purchases inventory in crates of merchandise; each crate of inventory is a unit. The fiscal year of Movie Buy ends each January 31 . Assume you are dealing Cash payments on account totaled $9,344,000. During fiscal year 2021 , the store sold 155,000 units of merchandise for $15,887,500, of which $5,500,000 was for cash and with a single Movie Buy store in Denver, Colorado. The Denver store began the year with an inventory of 15,000 units that cost a total of $795,000. During the year, the store purchased merchandise on account as follows Cash payments on account totaled $9,344,000. During fiscal year 2021 , the store sold 155,000 units of merchandise for $15,887,500, of which $5,500,000 was for cas was on account. Movie Buy and all of its stores use the average-cost method for inventories. The Denver store's operating expenses for the year were $3,500,000. It paid 70% in cash and accrued the rest as accrued liabilities. The store accrued income tax at the rate of 30% E.3 (Click the icon to view the purchases.) Read the