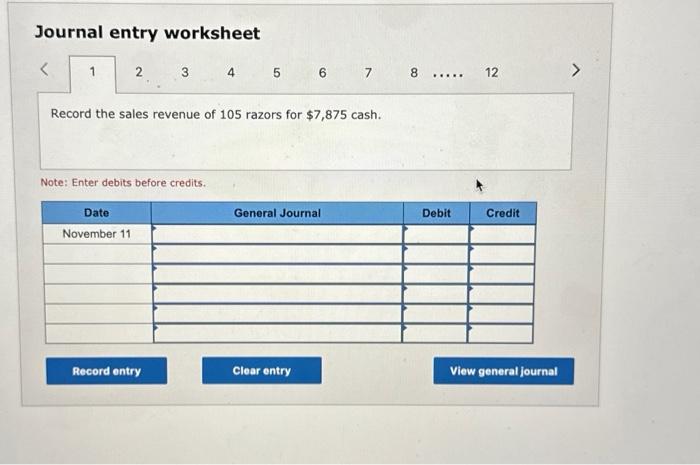

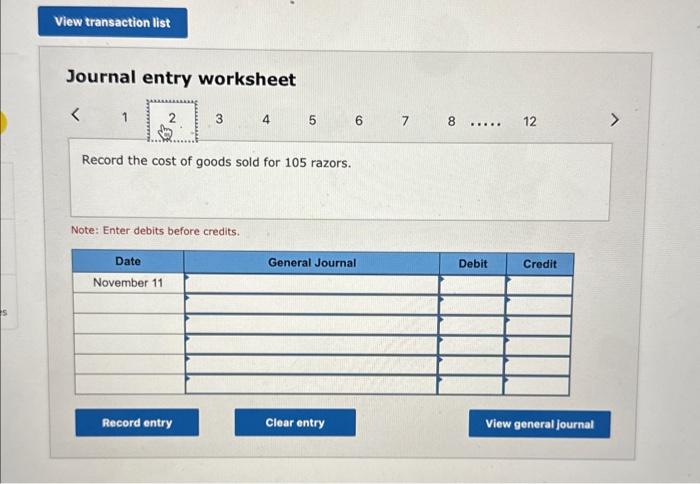

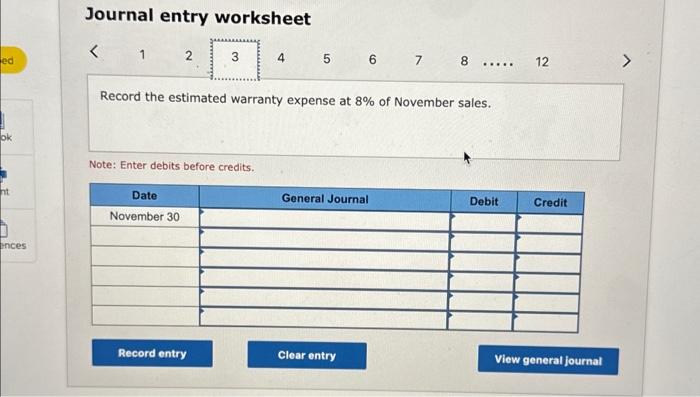

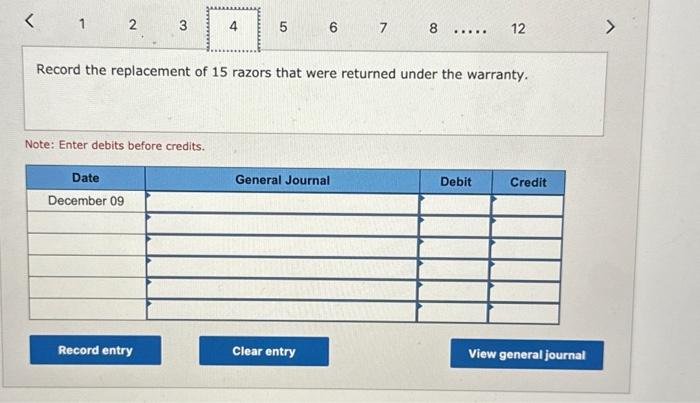

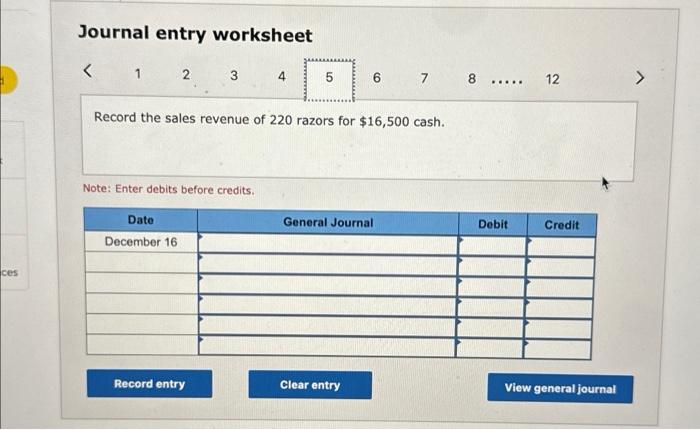

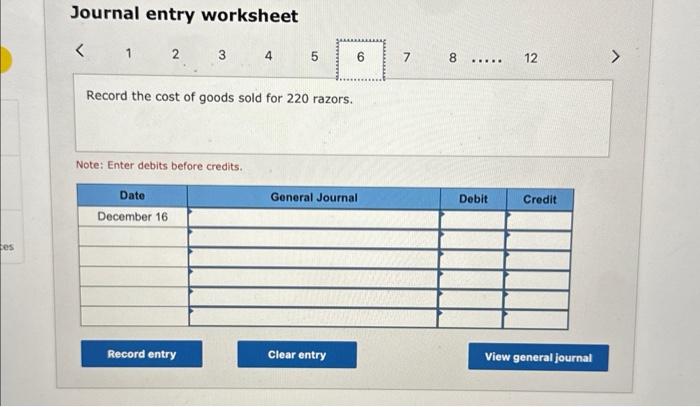

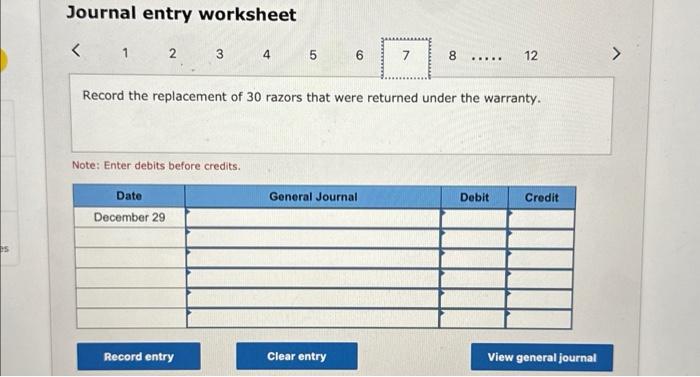

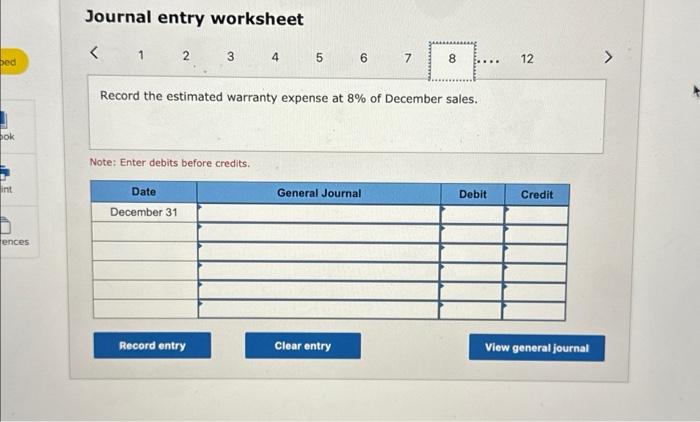

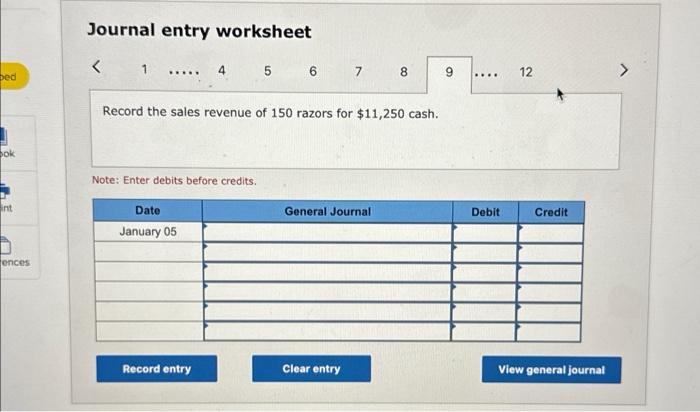

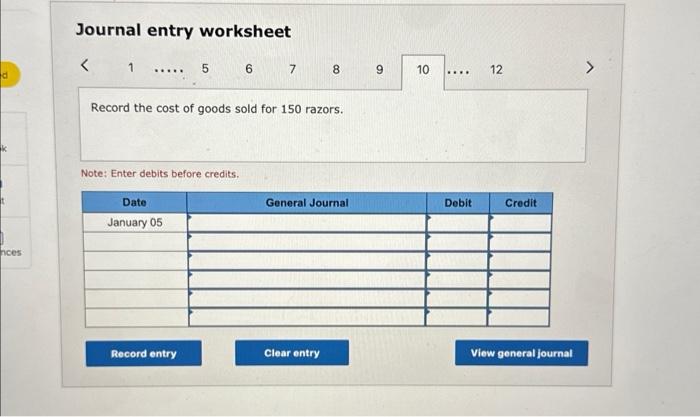

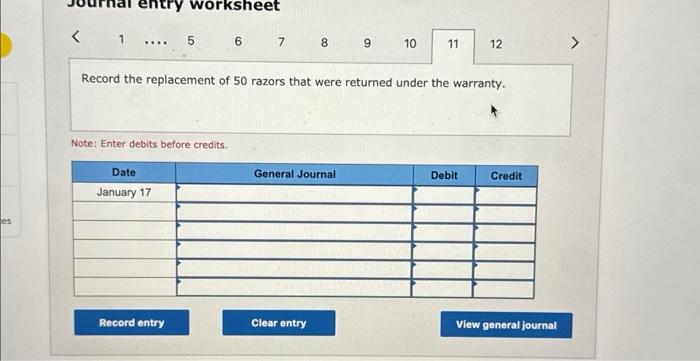

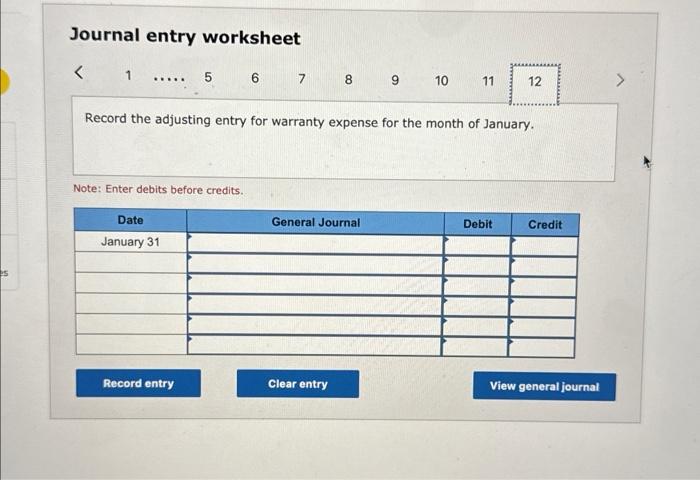

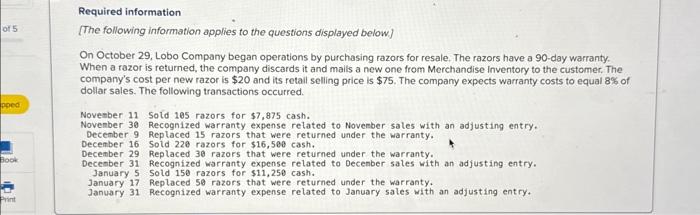

Journal entry worksheet 1 2 5 Record the replacement of 30 razors that were returned under the warranty. Note: Enter debits before credits. Journal entry worksheet Journal entry worksheet Record the adjusting entry for warranty expense for the month of January. Note: Enter debits before credits. Journal entry worksheet Record the estimated warranty expense at 8% of November sales. Note: Enter debits before credits. Journal entry worksheet Record the cost of goods sold for 220 razors. Note: Enter debits before credits. Record the replacement of 15 razors that were returned under the warranty. Note: Enter debits before credits. Journal entry worksheet Record the sales revenue of 150 razors for $11,250 cash. Note: Enter debits before credits. Journal entry worksheet 1 2 3 5 6 Record the estimated warranty expense at 8% of December sales. Note: Enter debits before credits. Journal entry worksheet 3 5 6 7 Record the sales revenue of 105 razors for $7,875 cash. Note: Enter debits before credits. worksheet 15 8 9 12 Record the replacement of 50 razors that were returned under the warranty. Note: Enter debits before credits. Journal entry worksheet Record the sales revenue of 220 razors for $16,500 cash. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below] On October 29 , Lobo Company began operations by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and mails a now one from Merchandise Inventory to the customer. The company's cost per new razor is $20 and its retail selling price is $75. The company expects warranty costs to equal 8% of dollar sales. The following transactions occurred. Novenber 11 Sold 105 razors for $37,875 cash. November 30 Recognized warranty expense related to November sales with an adjusting entry. December 9 Replaced 15 razors that were returned under the warranty. Decenber 16 Sold 226 razors for $16,500 cash. December 29 Replaced 30 razors that were returned under the warranty. Decenber 31 Recognized warranty expense related to Decenber sales with an adjusting entry. January 5 sold 150 razors for $11,250 cash. January 17 Replaced 50 razors that were returned under the warranty. January 31 Recognized warranty expense related to January sales with an adjusting entry