Answered step by step

Verified Expert Solution

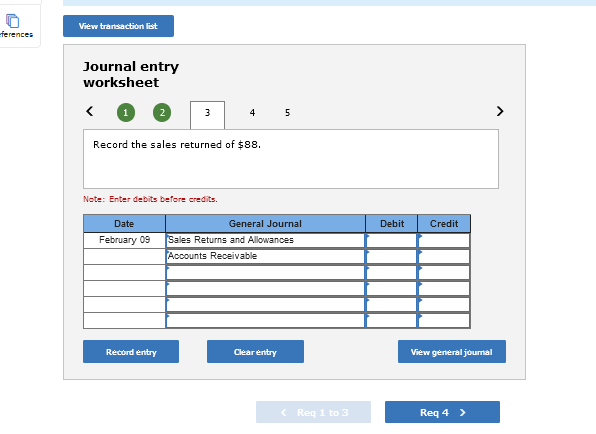

Question

1 Approved Answer

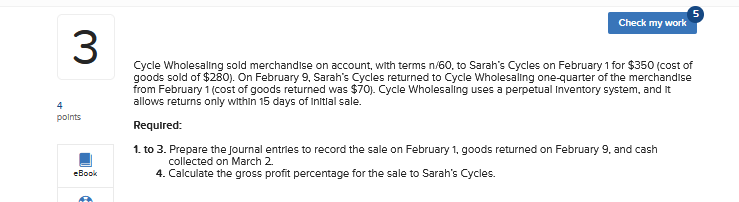

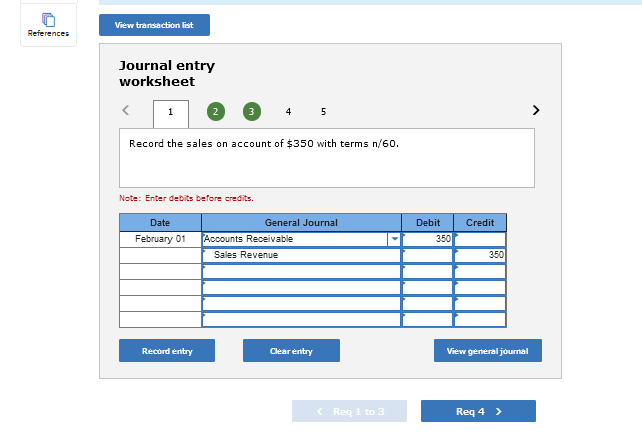

Journal entry worksheet (2) 3 ( 3 Record the sales on account of $350 with terms n/60. Note: Enter debits before credits. Journal entry worksheet

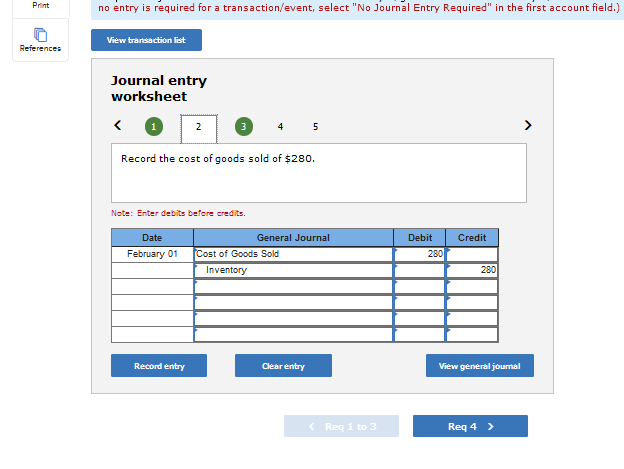

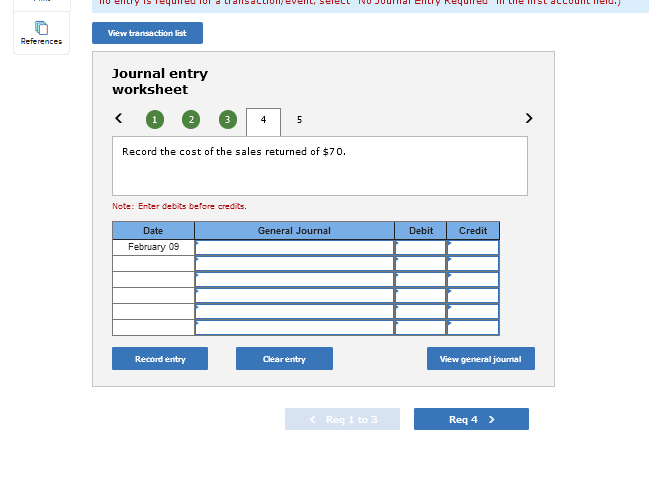

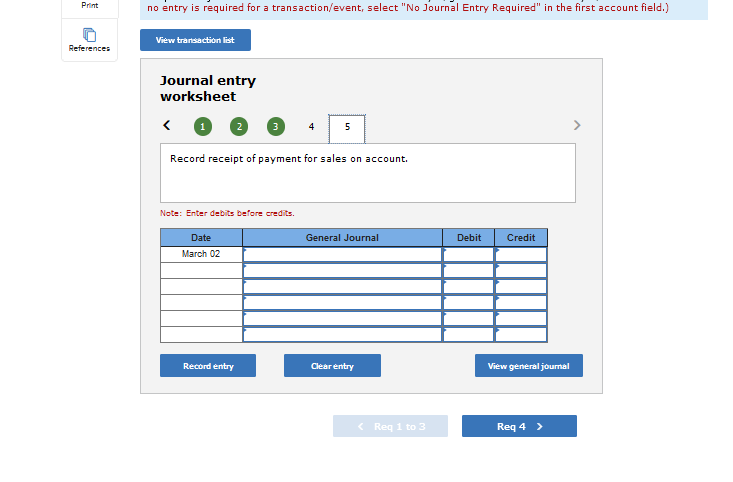

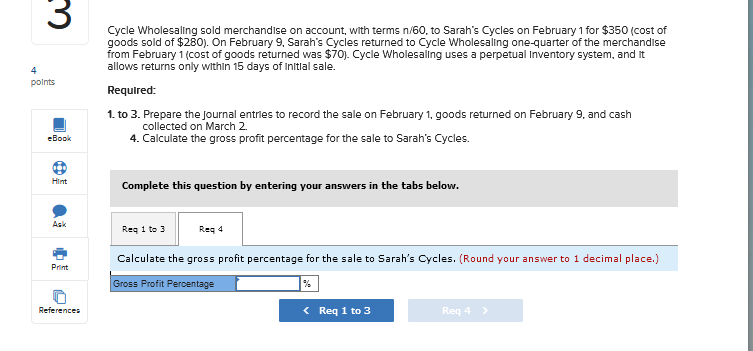

Journal entry worksheet (2) 3 ( 3 Record the sales on account of $350 with terms n/60. Note: Enter debits before credits. Journal entry worksheet (1) 3 5 Record the cost of the sales returned of $70. Note: Enter debits before credits. Cycle Wholesaling sold merchandise on account, with terms n/60, to Sarah's Cycles on February 1 for $350 (cost of goods sold of $280 ). On February 9 . Sarah's Cycles returned to Cycle Wholesaling one-quarter of the merchandise from February 1 (cost of goods returned was $70 ). Cycle Wholesaling uses a perpetual Inventory system, and it allows returns only within 15 days of Initlal sale. Required: 1. to 3. Prepare the journal entrles to record the sale on February 1, goods returned on February 9, and cash collected on March 2. 4. Calculate the gross profit percentage for the sale to Sarah's Cycles. Complete this question by entering your answers in the tabs below. Calculate the gross profit percentage for the sale to Sarah's Cycles. (Round your answer to 1 decimal place.) Cycle Wholesaling sold merchandise on account, with terms n/60, to Sarah's Cycles on February 1 for $350 (cost of goods sold of $280 ). On February 9, Sarah's Cycles returned to Cycle Wholesaling one-quarter of the merchandise from February 1 (cost of goods returned was $70 ). Cycle Wholesaling uses a perpetual Inventory system, and it allows returns only within 15 days of Initlal sale. Required: 1. to 3. Prepare the Journal entrles to record the sale on February 1, goods returned on February 9 , and cash collected on March 2. 4. Calculate the gross profit percentage for the sale to Sarah's Cycles. Journal entry worksheet 1 2 4 Note: Enter debits before credits. Journal entry worksheet Record receipt of payment for sales on account. Note: Enter debits before credits. Journal entry worksheet Record the cost of goods sold of $280. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started