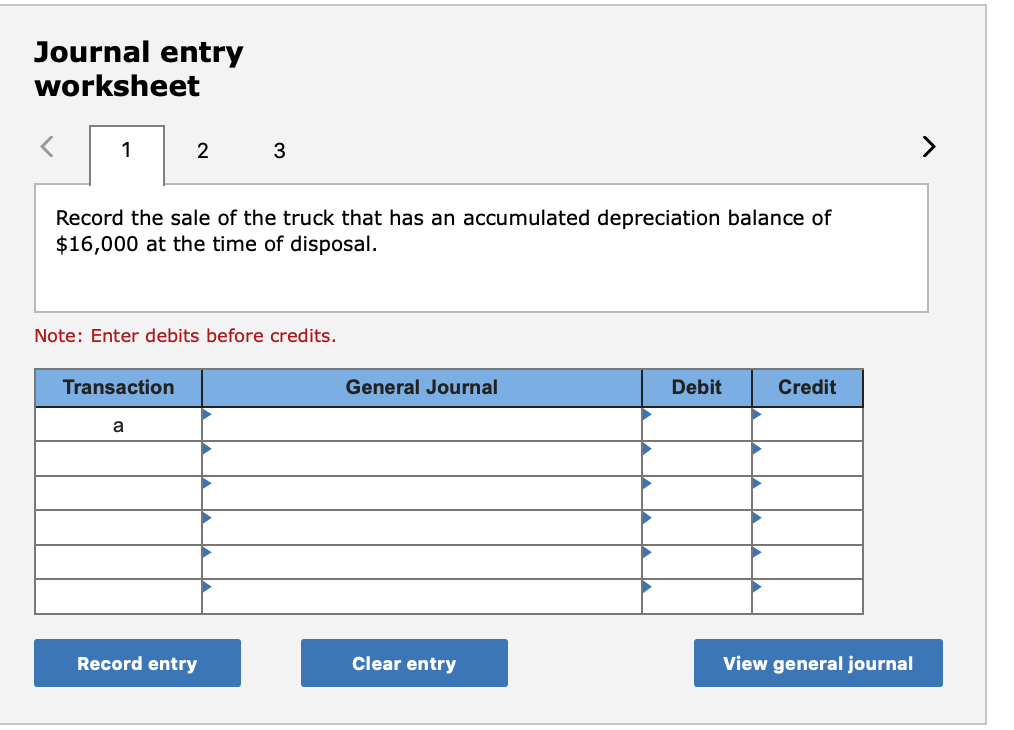

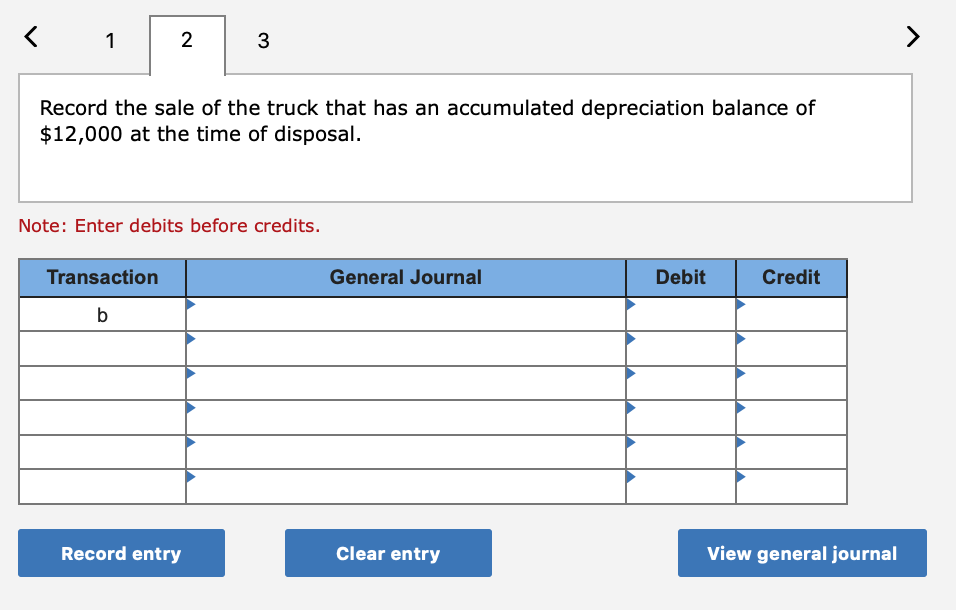

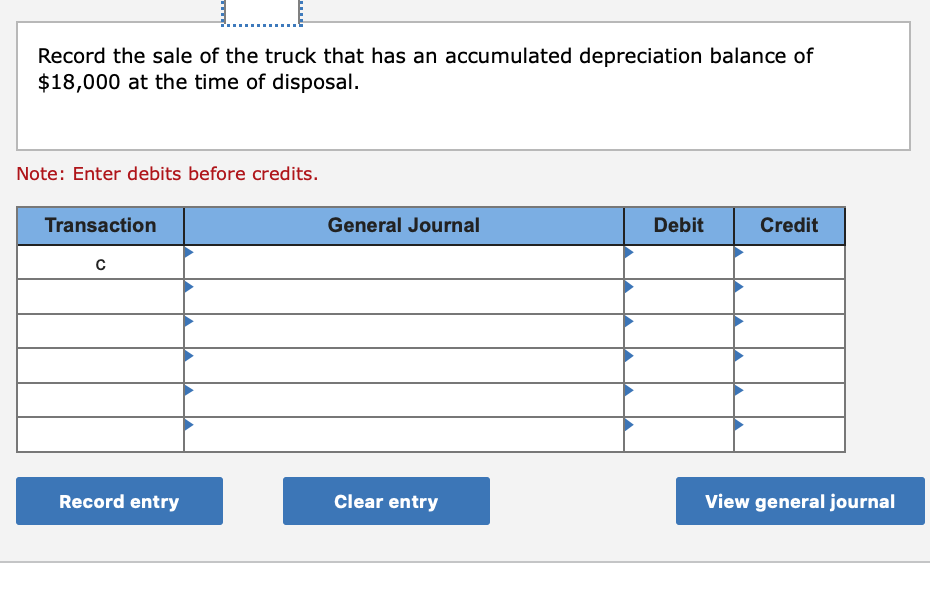

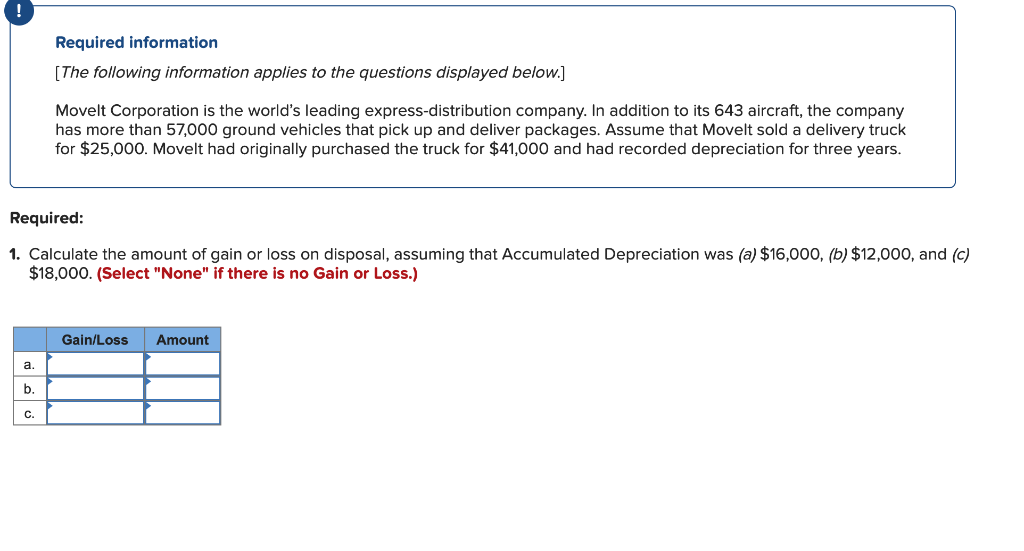

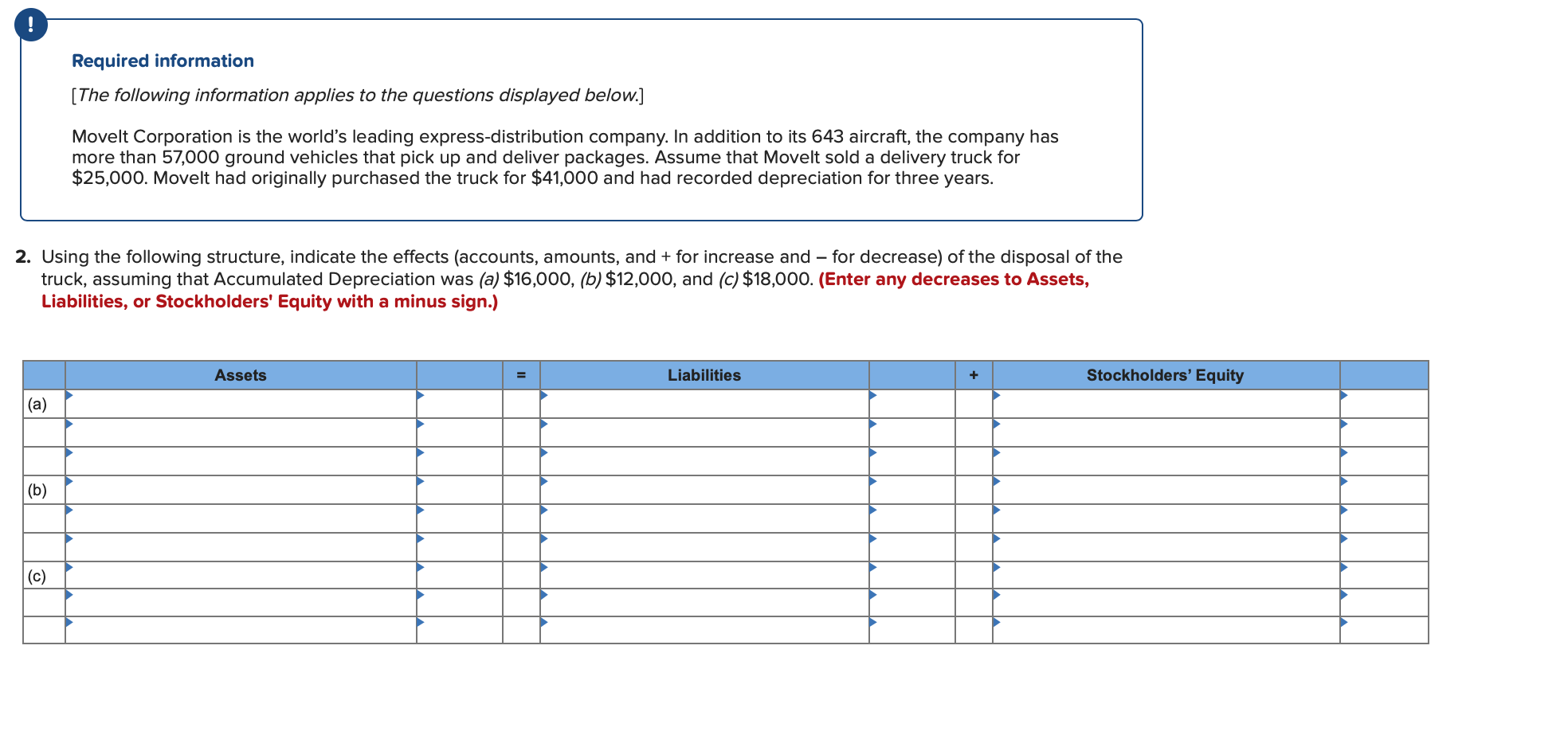

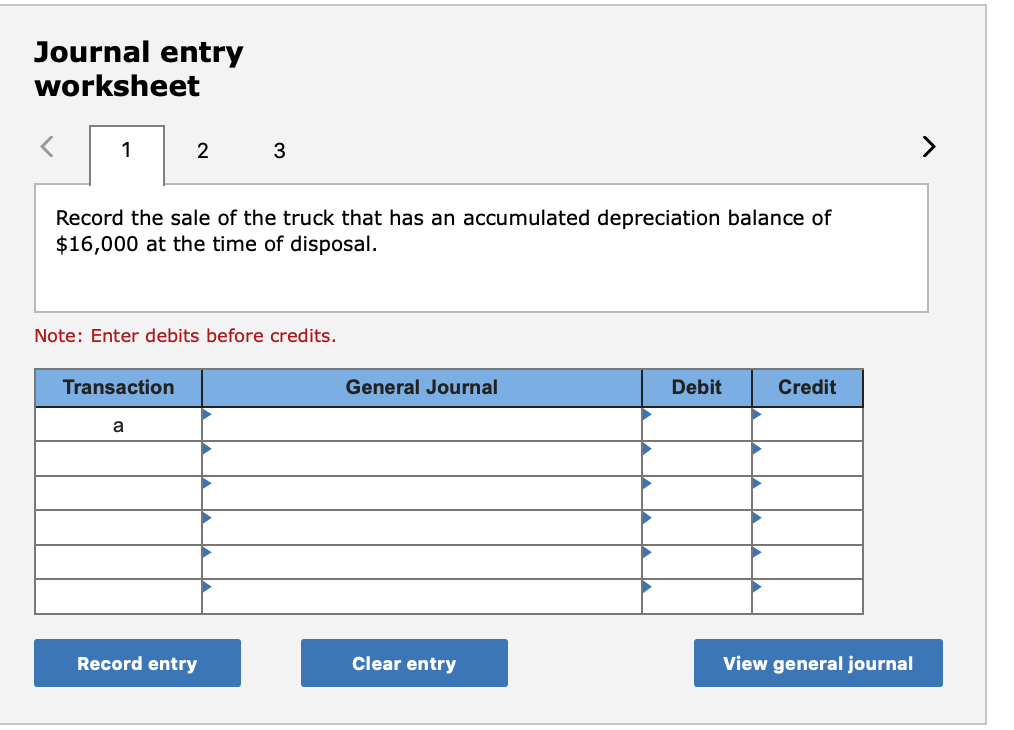

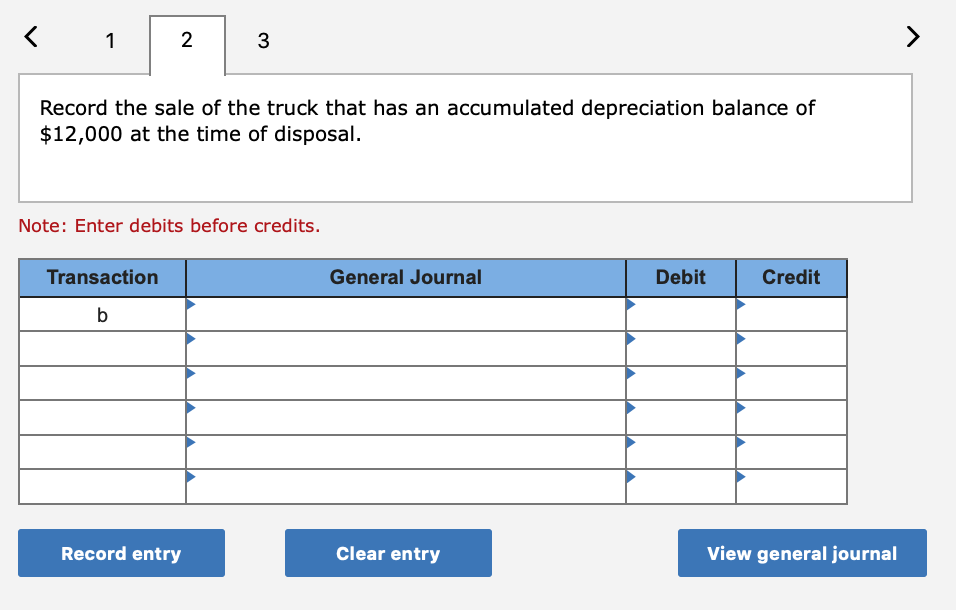

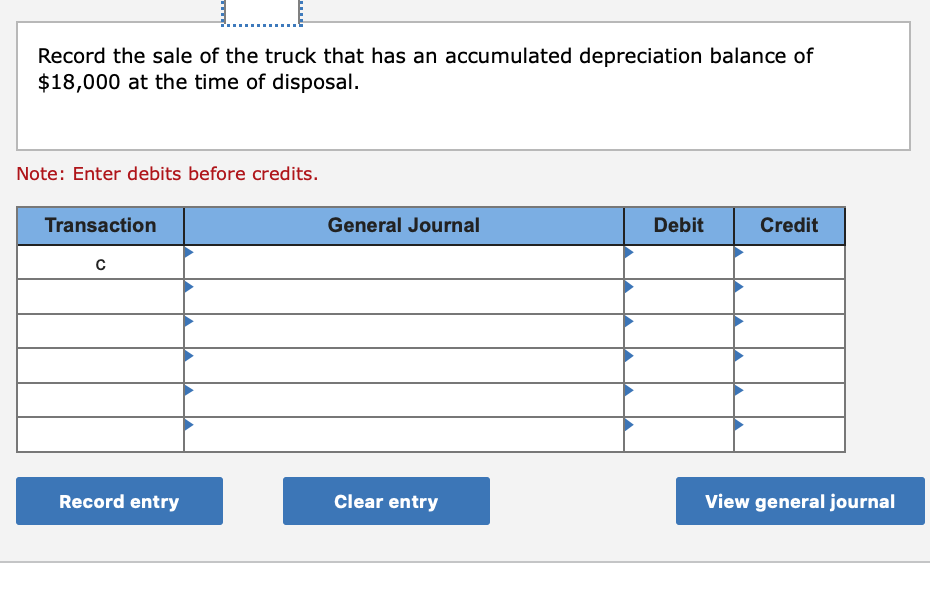

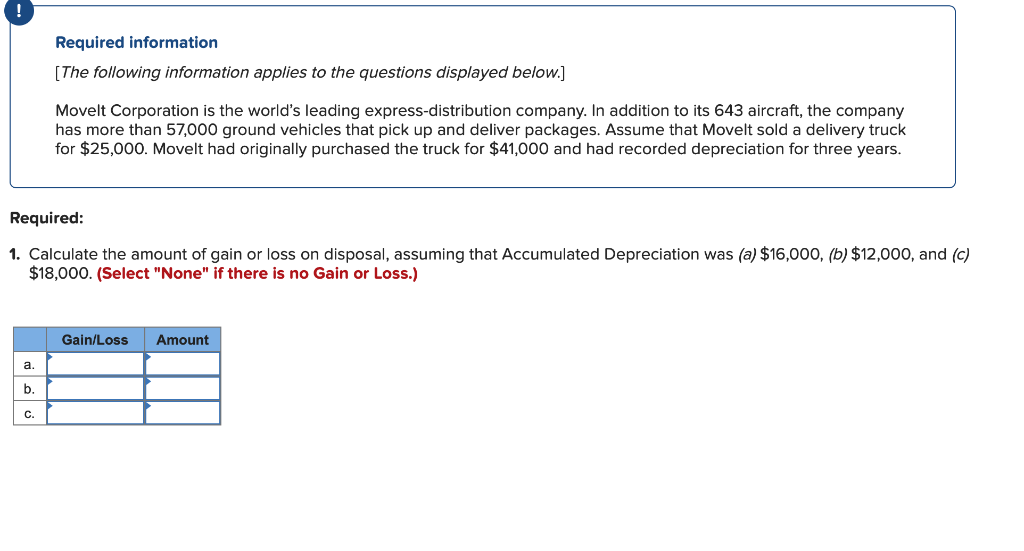

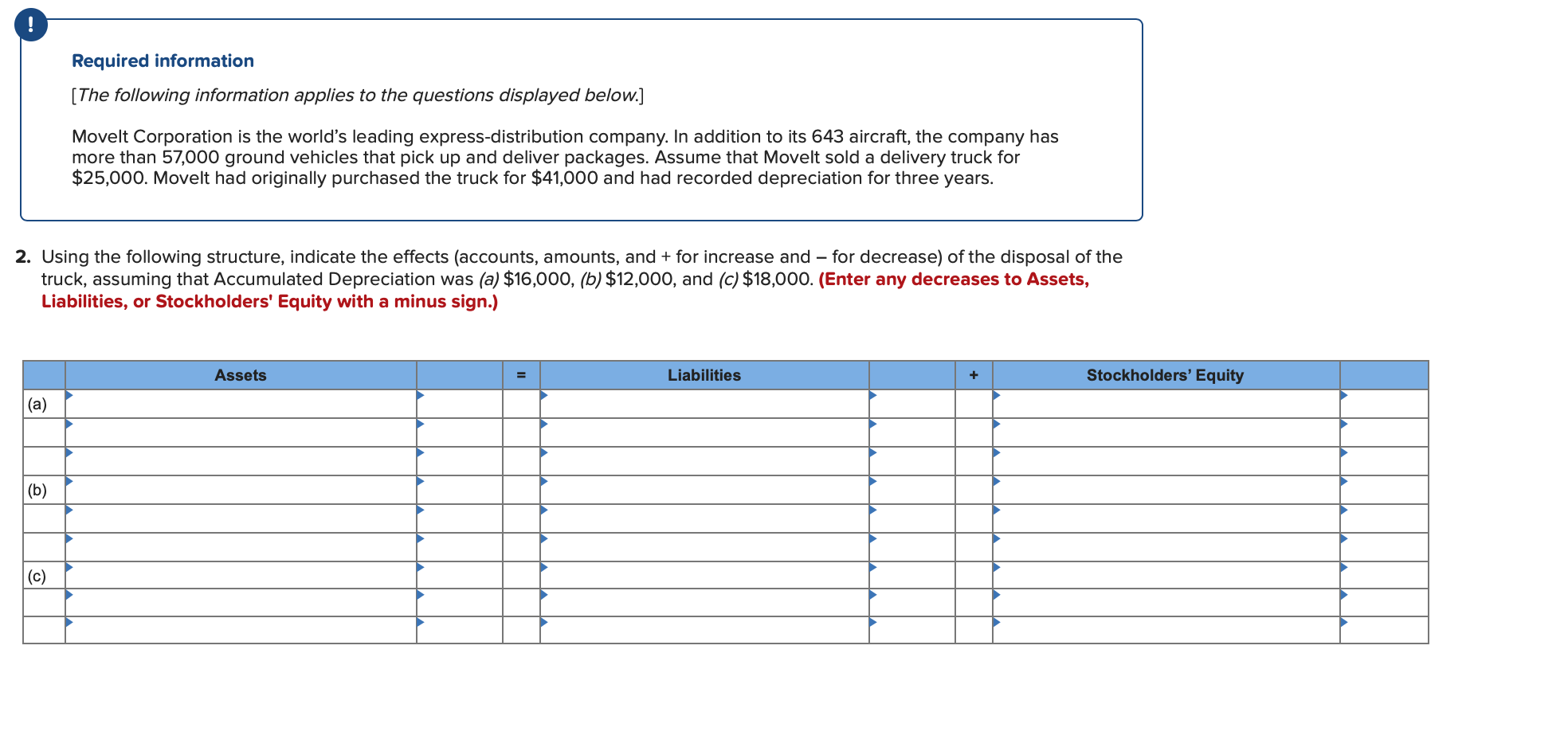

Journal entry worksheet 2 3 Record the sale of the truck that has an accumulated depreciation balance of $16,000 at the time of disposal. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal 2 Record the sale of the truck that has an accumulated depreciation balance of $12,000 at the time of disposal. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Record the sale of the truck that has an accumulated depreciation balance of $18,000 at the time of disposal. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Required information [The following information applies to the questions displayed below.] Movelt Corporation is the world's leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a delivery truck for $25,000. Movelt had originally purchased the truck for $41,000 and had recorded depreciation for three years. Required: 1. Calculate the amount of gain or loss on disposal, assuming that Accumulated Depreciation was (a) $16,000, (b) $12,000, and (c) $18,000. (Select "None" if there is no Gain or Loss.) Gain/Loss Amount Required information [The following information applies to the questions displayed below.] Movelt Corporation is the world's leading express-distribution company. In addition to its 643 aircraft, the company has more than 57,000 ground vehicles that pick up and deliver packages. Assume that Movelt sold a delivery truck for $25,000. Movelt had originally purchased the truck for $41,000 and had recorded depreciation for three years. 2. Using the following structure, indicate the effects (accounts, amounts, and + for increase and for decrease) of the disposal of the truck, assuming that Accumulated Depreciation was (a) $16,000, (b) $12,000, and (c) $18,000. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.) Assets Liabilities Stockholders' Equity