Answered step by step

Verified Expert Solution

Question

1 Approved Answer

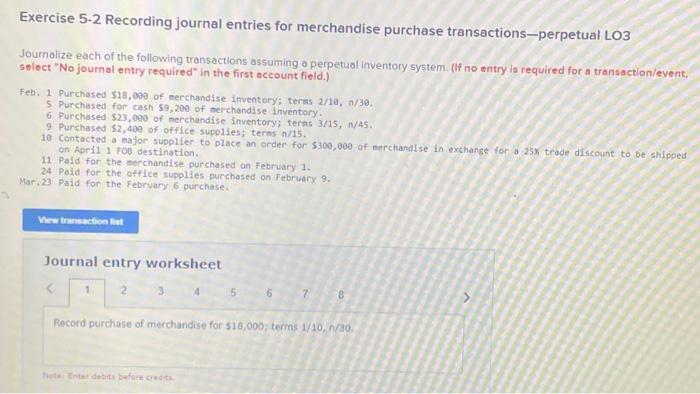

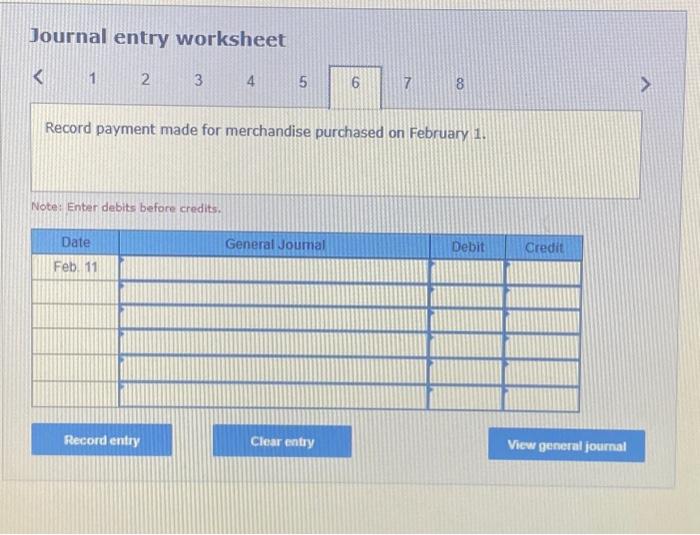

Journal entry worksheet begin{tabular}{|l|l|} hline 1 Record payment made for merchandise purchased on February 1. end{tabular} Note: Enter debits before credits. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started