Answered step by step

Verified Expert Solution

Question

1 Approved Answer

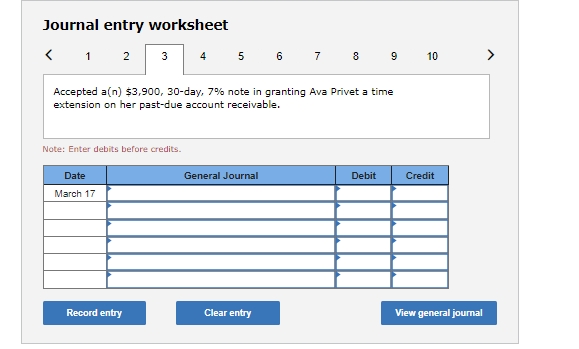

Journal entry worksheet Journal entry worksheet 1245 Accepted a(n)$2,080,60day,9% note in granting Noah Carson a time extension on his past-due account receivable. Note: Enter debits

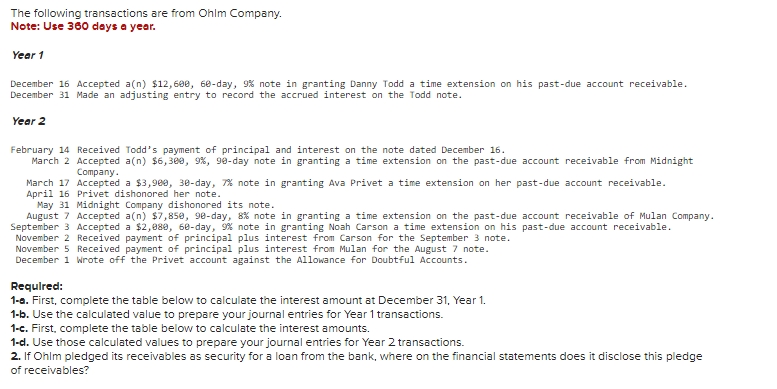

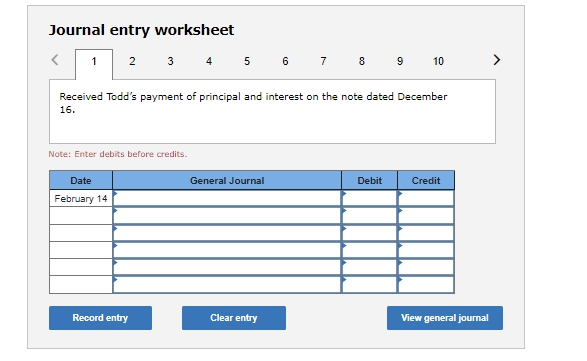

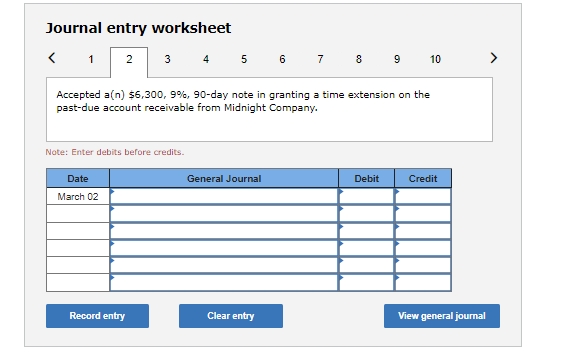

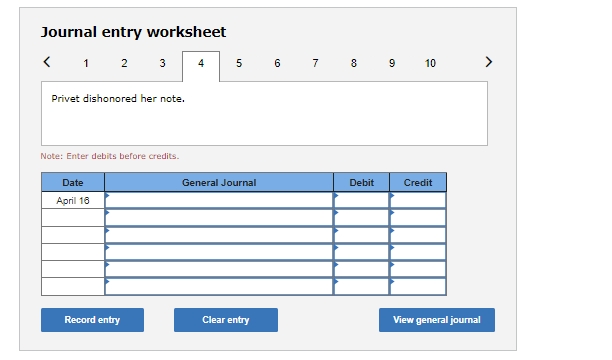

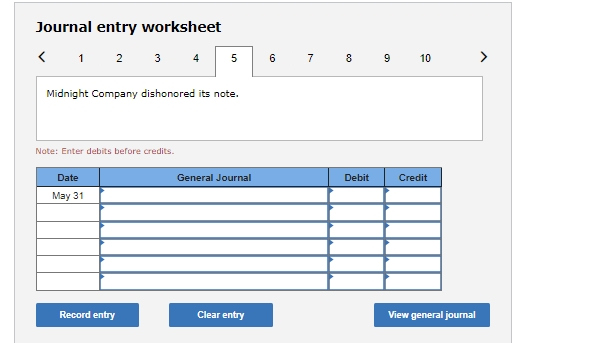

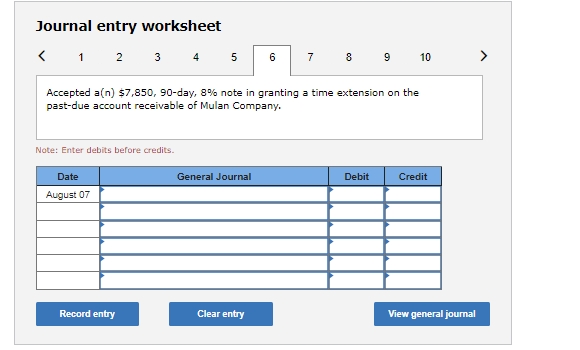

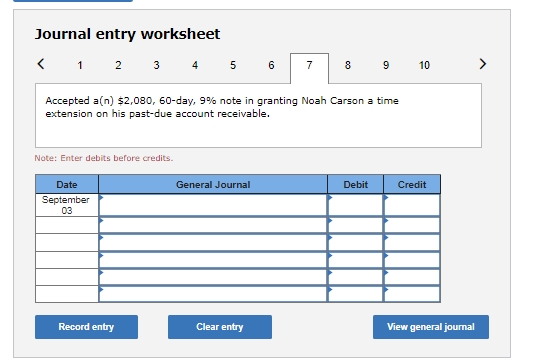

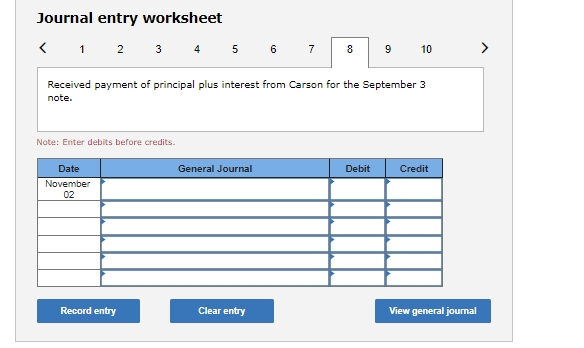

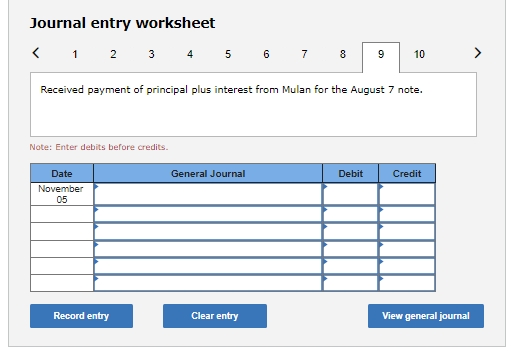

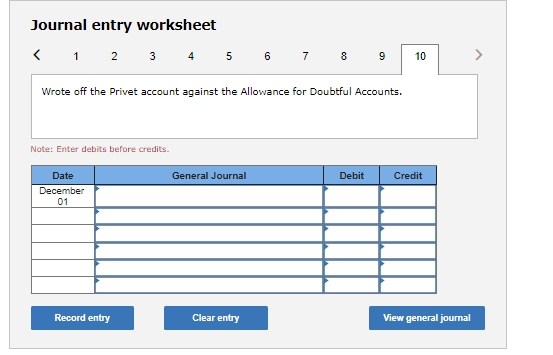

Journal entry worksheet Journal entry worksheet 1245 Accepted a(n)$2,080,60day,9% note in granting Noah Carson a time extension on his past-due account receivable. Note: Enter debits before credits. Journal entry worksheet 12345 789 Accepted a(n)$7,850,90day,8% note in granting a time extension on the past-due account receivable of Mulan Company. Note: Enter debits before credits. Journal entry worksheet 567891 Accepted a(n)$6,300,9%,90-day note in granting a time extension on the past-due account receivable from Midnight Company. Note: Enter debits before credits. Journal entry worksheet 123456 9 Received payment of principal plus interest from Carson for the September 3 note. Note: Enter debits before credits. Journal entry worksheet 1 4 5 7 Received payment of principal plus interest from Mulan for the August 7 note. Note: Enter debits before credits. Journal entry worksheet Received Todd's payment of principal and interest on the note dated December 16. Note: Enter debits before credits. The following transactions are from Ohlm Company. Note: Use 360 days a year. Year 1 December 16 Accepted a(n)$12,690,60-day, 9% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n)$6,309, 9\%, 99-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,960, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. April 16 Privet dishonored her note. May 31 Midnight Company dishonored its note. August 7 Accepted a(n)$7,859, 90-day, 8% note in granting a time extension on the past-due account receivable of Mulan Company. September 3 Accepted a $2,089, 60-day, 9\% note in granting Noah Carson a time extension on his past-due account receivable. November 2 Received payment of principal plus interest from Carson for the September 3 note. November 5 Received payment of principal plus interest from Mulan for the August 7 note. December 1 Wrote off the Privet account against the Allowance for Doubtful Accounts. Required: 1-a. First, complete the table below to calculate the interest amount at December 31, Year 1. 1-b. Use the calculated value to prepare your journal entries for Year 1 transactions. 1-c. First, complete the table below to calculate the interest amounts. 1-d. Use those calculated values to prepare your journal entries for Year 2 transactions. 2. If Ohlm pledged its receivables as security for a loan from the bank, where on the financial statements does it disclose this pledge of receivables? Journal entry worksheet 4 5 6 8 9 Accepted a(n)$3,900,30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. Note: Enter debits before credits. Journal entry worksheet 12345678 Wrote off the Privet account against the Allowance for Doubtful Accounts. Note: Enter debits before credits. Journal entry worksheet

Journal entry worksheet Journal entry worksheet 1245 Accepted a(n)$2,080,60day,9% note in granting Noah Carson a time extension on his past-due account receivable. Note: Enter debits before credits. Journal entry worksheet 12345 789 Accepted a(n)$7,850,90day,8% note in granting a time extension on the past-due account receivable of Mulan Company. Note: Enter debits before credits. Journal entry worksheet 567891 Accepted a(n)$6,300,9%,90-day note in granting a time extension on the past-due account receivable from Midnight Company. Note: Enter debits before credits. Journal entry worksheet 123456 9 Received payment of principal plus interest from Carson for the September 3 note. Note: Enter debits before credits. Journal entry worksheet 1 4 5 7 Received payment of principal plus interest from Mulan for the August 7 note. Note: Enter debits before credits. Journal entry worksheet Received Todd's payment of principal and interest on the note dated December 16. Note: Enter debits before credits. The following transactions are from Ohlm Company. Note: Use 360 days a year. Year 1 December 16 Accepted a(n)$12,690,60-day, 9% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n)$6,309, 9\%, 99-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,960, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. April 16 Privet dishonored her note. May 31 Midnight Company dishonored its note. August 7 Accepted a(n)$7,859, 90-day, 8% note in granting a time extension on the past-due account receivable of Mulan Company. September 3 Accepted a $2,089, 60-day, 9\% note in granting Noah Carson a time extension on his past-due account receivable. November 2 Received payment of principal plus interest from Carson for the September 3 note. November 5 Received payment of principal plus interest from Mulan for the August 7 note. December 1 Wrote off the Privet account against the Allowance for Doubtful Accounts. Required: 1-a. First, complete the table below to calculate the interest amount at December 31, Year 1. 1-b. Use the calculated value to prepare your journal entries for Year 1 transactions. 1-c. First, complete the table below to calculate the interest amounts. 1-d. Use those calculated values to prepare your journal entries for Year 2 transactions. 2. If Ohlm pledged its receivables as security for a loan from the bank, where on the financial statements does it disclose this pledge of receivables? Journal entry worksheet 4 5 6 8 9 Accepted a(n)$3,900,30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. Note: Enter debits before credits. Journal entry worksheet 12345678 Wrote off the Privet account against the Allowance for Doubtful Accounts. Note: Enter debits before credits. Journal entry worksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started