Answered step by step

Verified Expert Solution

Question

1 Approved Answer

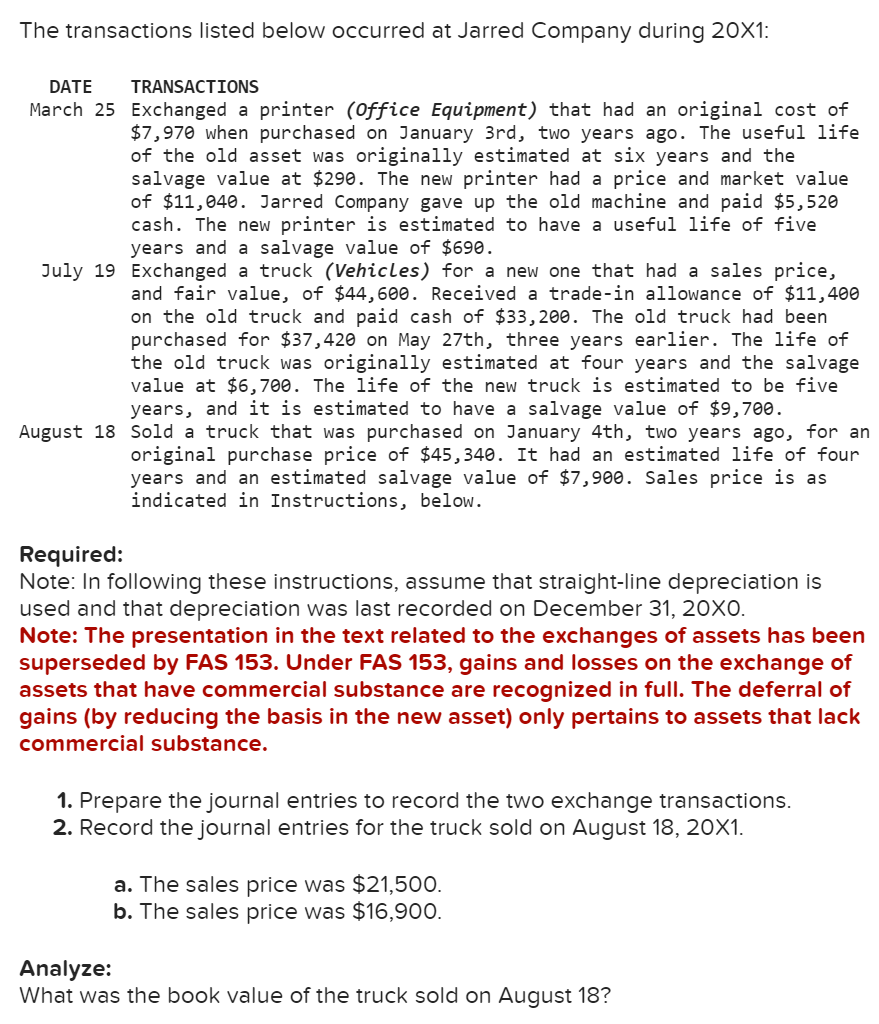

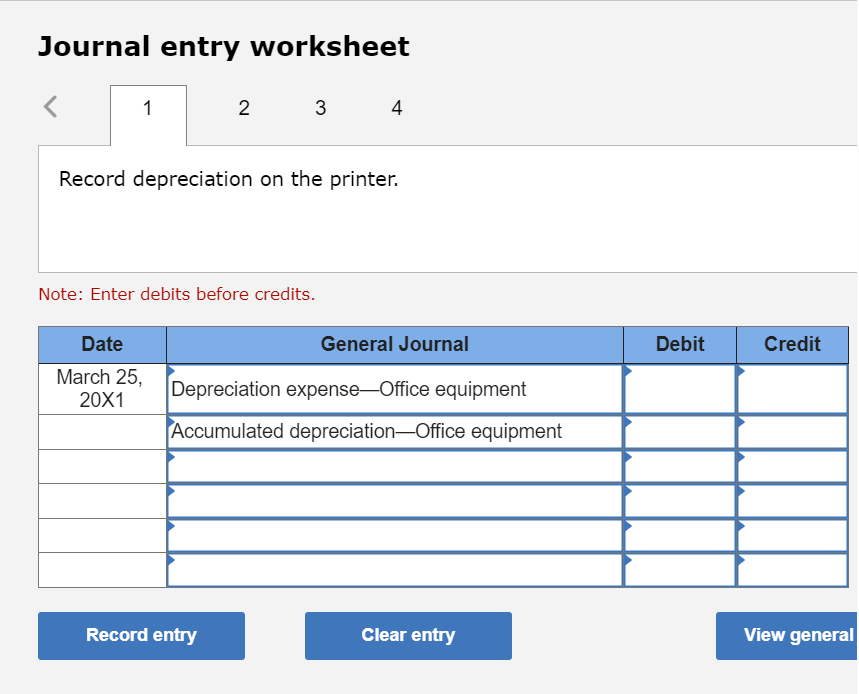

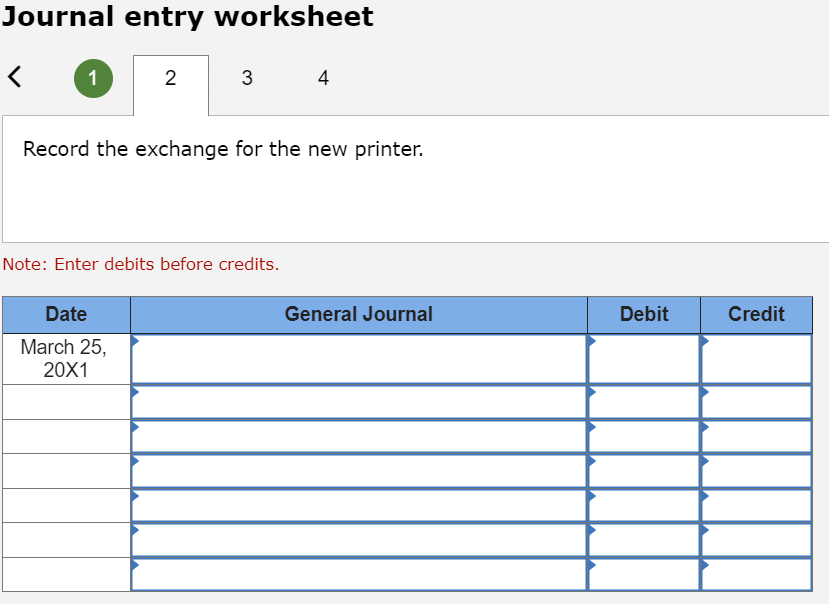

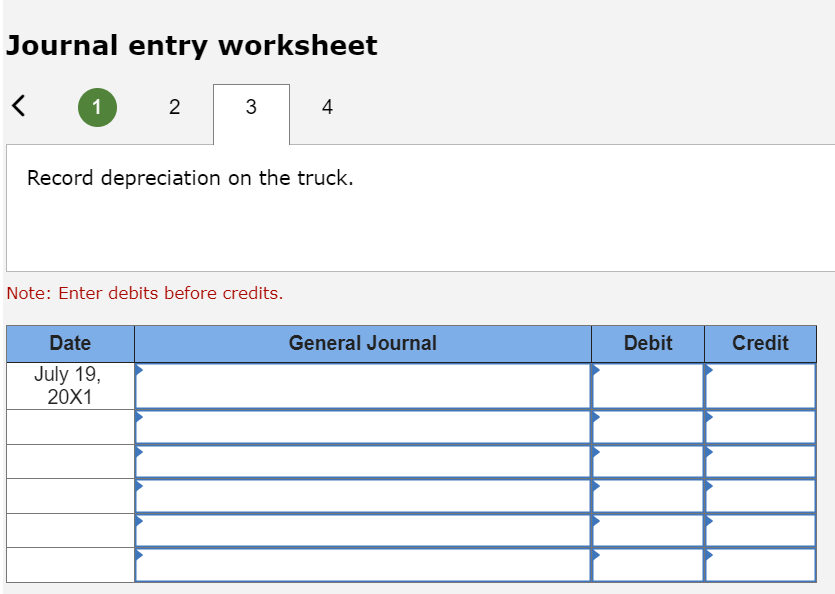

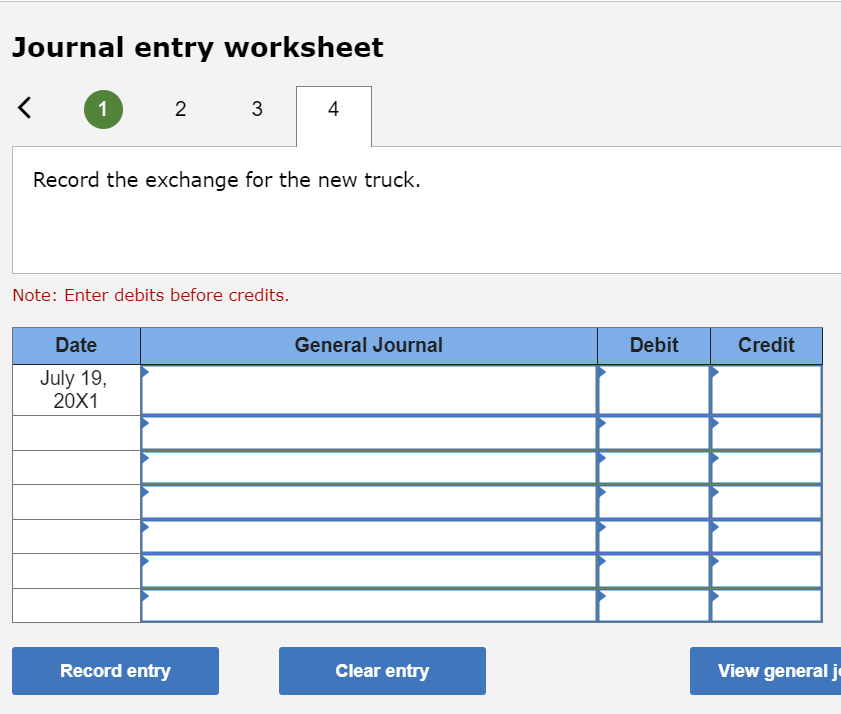

Journal entry worksheet Record depreciation on the truck. Note: Enter debits before credits. Journal entry worksheet 4 Record depreciation on the printer. Note: Enter debits

Journal entry worksheet Record depreciation on the truck. Note: Enter debits before credits. Journal entry worksheet 4 Record depreciation on the printer. Note: Enter debits before credits. Journal entry worksheet Record the exchange for the new printer. Note: Enter debits before credits. The transactions listed below occurred at Jarred Company during 20X1: DATE TRANSACTIONS March 25 Exchanged a printer (Office Equipment) that had an original cost of $7,970 when purchased on January 3rd, two years ago. The useful life of the old asset was originally estimated at six years and the salvage value at $290. The new printer had a price and market value of $11,040. Jarred Company gave up the old machine and paid $5,520 cash. The new printer is estimated to have a useful life of five years and a salvage value of $690. July 19 Exchanged a truck (Vehicles) for a new one that had a sales price, and fair value, of $44,600. Received a trade-in allowance of $11,400 on the old truck and paid cash of $33,200. The old truck had been purchased for $37,420 on May 27 th, three years earlier. The life of the old truck was originally estimated at four years and the salvage value at $6,700. The life of the new truck is estimated to be five years, and it is estimated to have a salvage value of $9,700. August 18 Sold a truck that was purchased on January 4th, two years ago, for an original purchase price of $45,340. It had an estimated life of four years and an estimated salvage value of $7,900. Sales price is as indicated in Instructions, below. Required: Note: In following these instructions, assume that straight-line depreciation is used and that depreciation was last recorded on December 31, 200. Note: The presentation in the text related to the exchanges of assets has been superseded by FAS 153. Under FAS 153, gains and losses on the exchange of assets that have commercial substance are recognized in full. The deferral of gains (by reducing the basis in the new asset) only pertains to assets that lack commercial substance. 1. Prepare the journal entries to record the two exchange transactions. 2. Record the journal entries for the truck sold on August 18, 201. a. The sales price was $21,500. b. The sales price was $16,900. Analyze: What was the book value of the truck sold on August 18? Journal entry worksheet Record the exchange for the new truck. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started