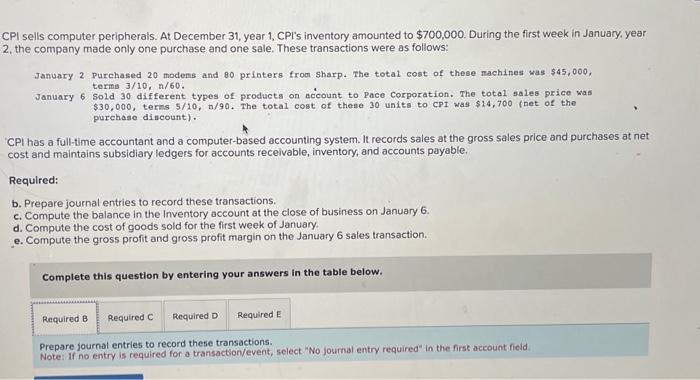

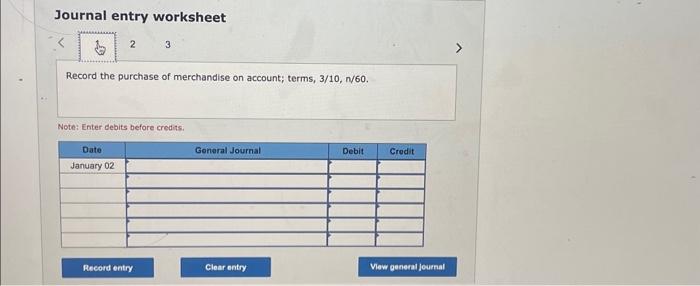

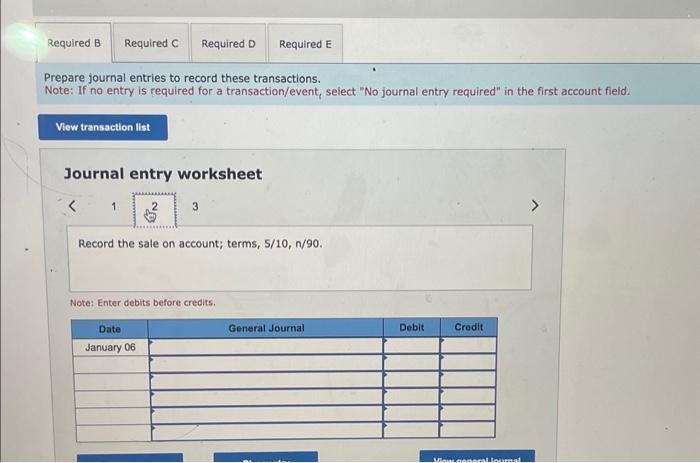

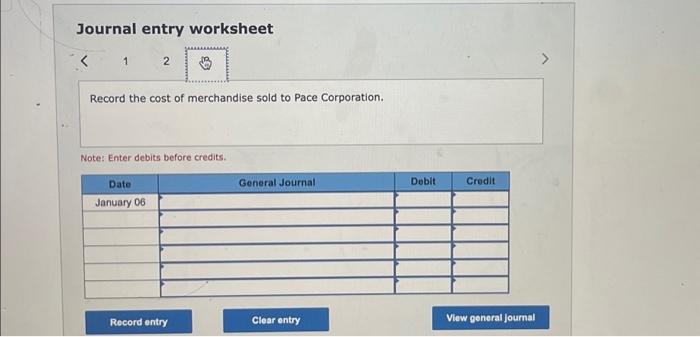

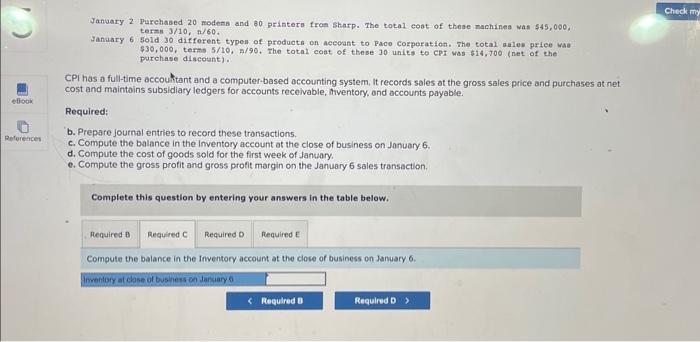

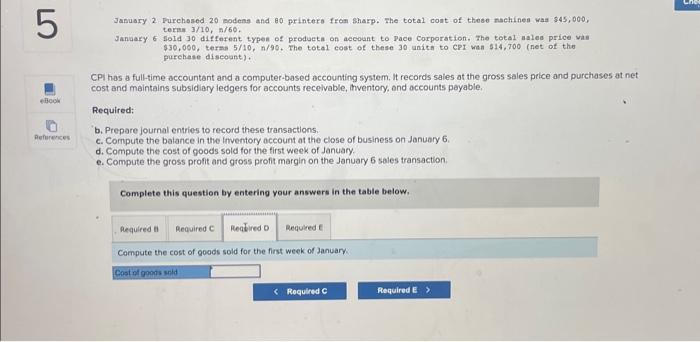

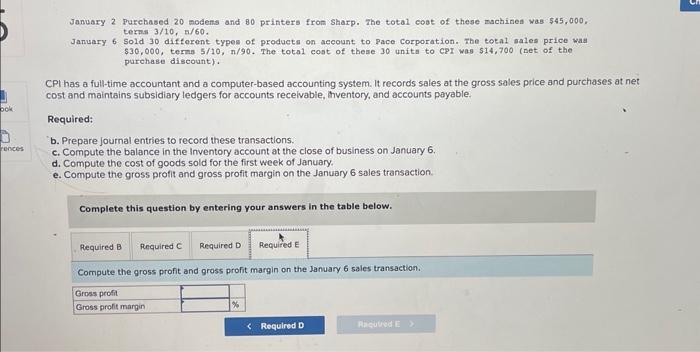

Journal entry worksheet Record the cost of merchandise sold to Pace Corporation. Note: Enter debits before credits. Janvary 2 purchased 20 modens and 60 printers fron Sharp. The total cost of these nachines was $45, 000 , termin 3/10,+1/60. January 6 sold 30 different typen of products on accoant to Paco corporation. The total sales priee vae $30,000, terms 5/10,A/90. The total coat of these 30 units to cPI was $14,700 (net of the purchase discount). CPI has a full-time accouttant and a computer-based accounting system, it records sales at the gross sales price and purchases at net cost and maintains subsidiary ledgers for accounts receivable, hiventory, and accounts payable. Required: b. Prepare journal entries to record these transactions. c. Compute the balance in the Inventory account at the close of business on January 6 . d. Compute the cost of goods sold for the first week of January. e. Compute the gross profit and gross profit margin on the January 6 sales transaction. Complete this question by entering your answers in the table below. Compute the balance in the Inventory account at the close of business on January 6 . Jasuary 2 Purchosed 20 modens and 80 printers f ron sharp. The total cont of these nachines was $45,000, teras 3/10,n/60. Janaary 6 SoId 30 different typen of produeta on account to pace Corporation, The total alalea price vas $30,000, terna 5/10,n/90. The total cost of these 30 units to CPI wan $14,700 (net of the purchase discoant). El has a full-time accountant and a computer-based accounting system, It records sales at the gross sales price and purchases at net cost and maintains subsidiary ledgers for accounts recelvable, inventory, ond occounts payable. Required: b. Prepare journal entries to record these transactions. c. Compute the balance in the Inventory account at the close of business on January 6. d. Compute the cost of goods sold for the first week of January. e. Compute the gross profit and gross profit margin on the January 6 sales transaction. Complete this question by entering your answers in the table below. Compute the cost of goods sold for the first week of January. Journal entry worksheet Record the purchase of merchandise on account; terms, 3/10, n/60. Note: Enter debits before credits. CPI sells computer peripherals. At December 31 , year 1, CPI's inventory amounted to $700,000. During the first week in January. year 2 , the company made only one purchase and one sale. These transactions were as follows: January 2 purchased 20 modens and 80 printers froc Sharp. The total cost of these machines was $45,000, terms 3/10,n/60. January 6 sold 30 different types of products on account to pace Corporation. The total sales price was $30,000, terms 5/10,n/90. The total cost of these 30 units to CPI was $14,700 (net of the purchase discount). CPI has a full-time accountant and a computer-based accounting system. It records sales at the gross sales price and purchases at net cost and maintains subsidiary ledgers for accounts recelvable, inventory, and accounts payable. Required: b. Prepare journal entries to record these transactions. c. Compute the balance in the Inventory account at the close of business on January 6 . d. Compute the cost of goods sold for the first week of January. e. Compute the gross profit and gross profit margin on the January 6 sales transaction. Complete this question by entering your answers in the table below. Prepare journal entries to record these transactions. Note: If no entry is required for a transaction/event, select "No joumal entry required" in the first account field January 2 purchased 20 modens and 80 printers fron sharp. The total coat of these machinea was 545,000 , termis 3/10,B/60. January 6 Sold 30 difterent types of producta on account to Pace Corporation. The total sales price wall $30,000, terms 5/10,n/90. The total cost of these 30 unita to CPI was $14,700 (net of the purchase discount). CPI has a full-time accountant and a computer-based accounting system. It records sales at the gross sales price and purchases at net cost and maintains subsidiary ledgers for accounts recelvable, thventory, and accounts payable. Required: b. Prepare journal entries to record these transactions. c. Compute the balance in the Inventory account at the close of business on January 6 . d. Compute the cost of goods sold for the first week of January. e. Compute the gross profit and gross profit margin on the January 6 sales transaction. Complete this question by entering your answers in the table below. Compute the gross profit and gross profit margin on the January 6 sales transaction. repare journal entries to record these transactions. ote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the sale on account; terms, 5/10,n/90. Note: Enter debits before credits