Answered step by step

Verified Expert Solution

Question

1 Approved Answer

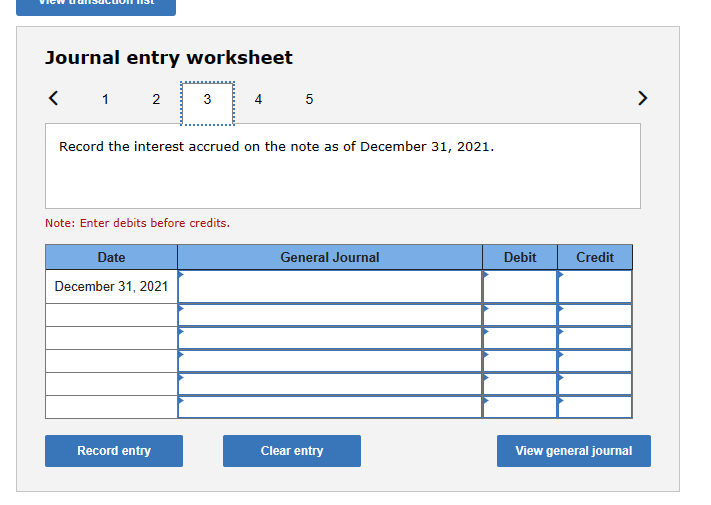

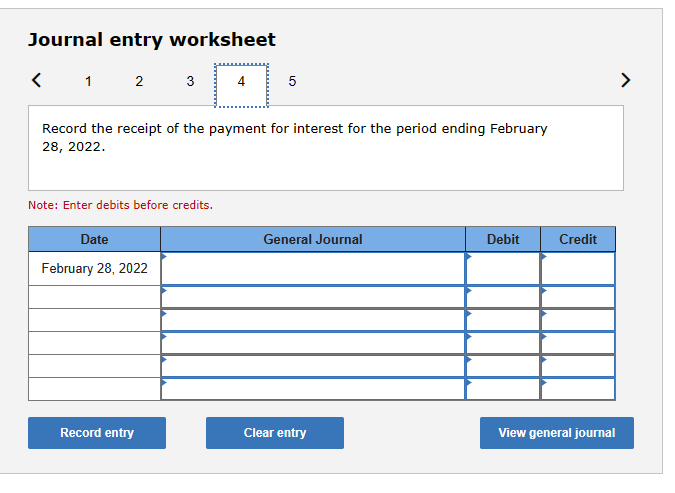

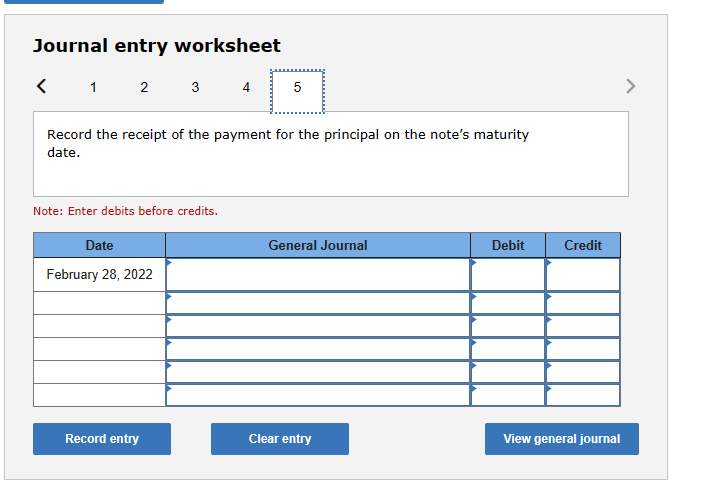

Journal entry worksheet Record the interest accrued on the note as of December 31, 2021. Note: Enter debits before credits. Record the receipt of a

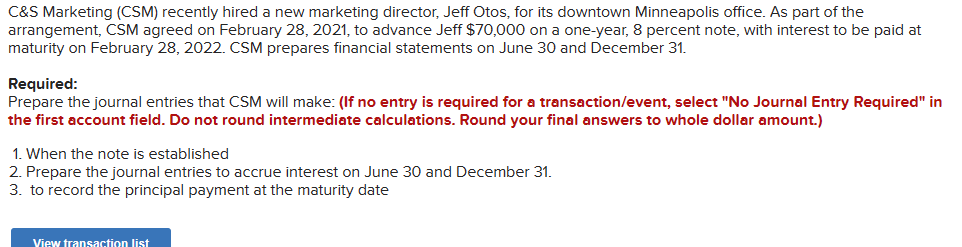

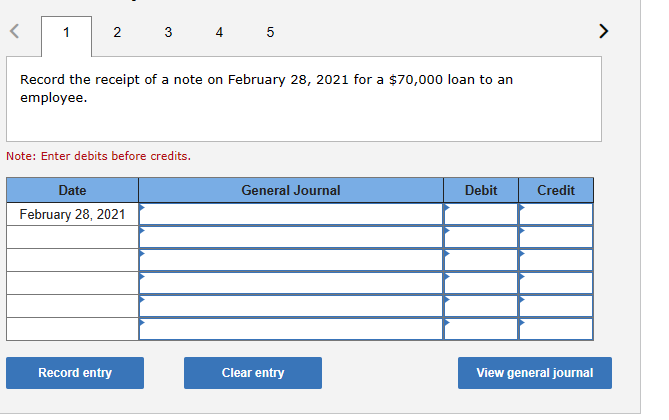

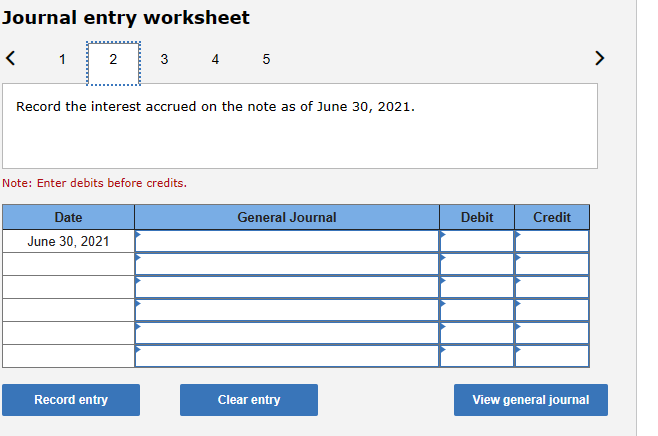

Journal entry worksheet Record the interest accrued on the note as of December 31, 2021. Note: Enter debits before credits. Record the receipt of a note on February 28, 2021 for a $70,000 loan to an employee. Note: Enter debits before credits. C\&S Marketing (CSM) recently hired a new marketing director, Jeff Otos, for its downtown Minneapolis office. As part of the arrangement, CSM agreed on February 28,2021 , to advance Jeff $70,000 on a one-year, 8 percent note, with interest to be paid at maturity on February 28, 2022. CSM prepares financial statements on June 30 and December 31. Required: Prepare the journal entries that CSM will make: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to whole dollar amount.) 1. When the note is established 2. Prepare the journal entries to accrue interest on June 30 and December 31. 3. to record the principal payment at the maturity date Journal entry worksheet Record the receipt of the payment for interest for the period ending February 28,2022. Note: Enter debits before credits. Journal entry worksheet Record the receipt of the payment for the principal on the note's maturity date. Note: Enter debits before credits. Journal entry worksheet

Journal entry worksheet Record the interest accrued on the note as of December 31, 2021. Note: Enter debits before credits. Record the receipt of a note on February 28, 2021 for a $70,000 loan to an employee. Note: Enter debits before credits. C\&S Marketing (CSM) recently hired a new marketing director, Jeff Otos, for its downtown Minneapolis office. As part of the arrangement, CSM agreed on February 28,2021 , to advance Jeff $70,000 on a one-year, 8 percent note, with interest to be paid at maturity on February 28, 2022. CSM prepares financial statements on June 30 and December 31. Required: Prepare the journal entries that CSM will make: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to whole dollar amount.) 1. When the note is established 2. Prepare the journal entries to accrue interest on June 30 and December 31. 3. to record the principal payment at the maturity date Journal entry worksheet Record the receipt of the payment for interest for the period ending February 28,2022. Note: Enter debits before credits. Journal entry worksheet Record the receipt of the payment for the principal on the note's maturity date. Note: Enter debits before credits. Journal entry worksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started