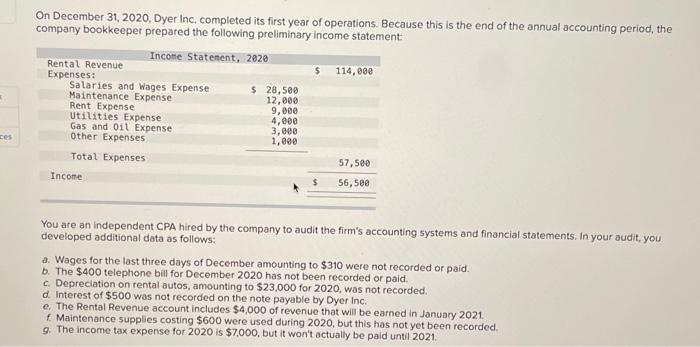

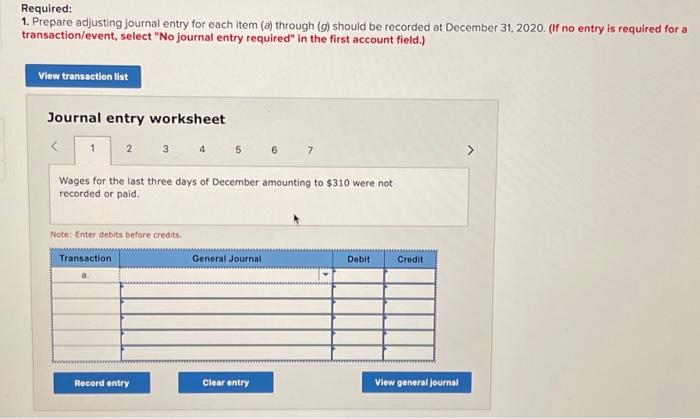

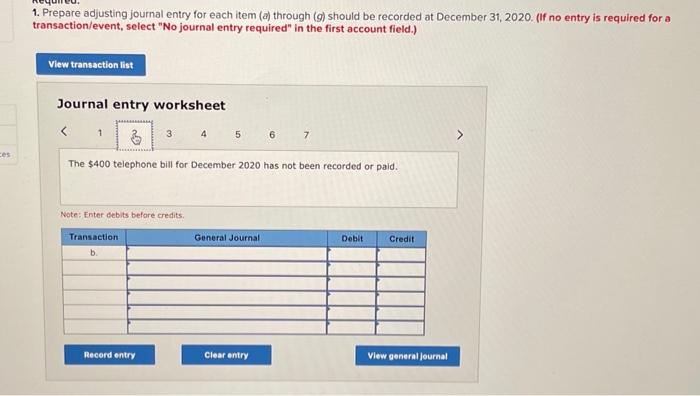

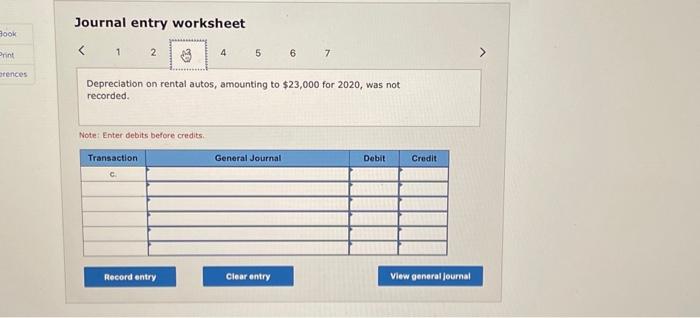

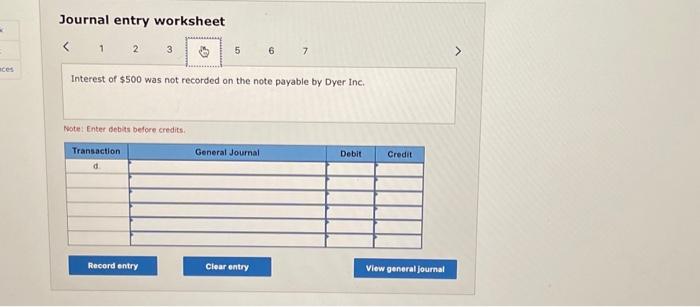

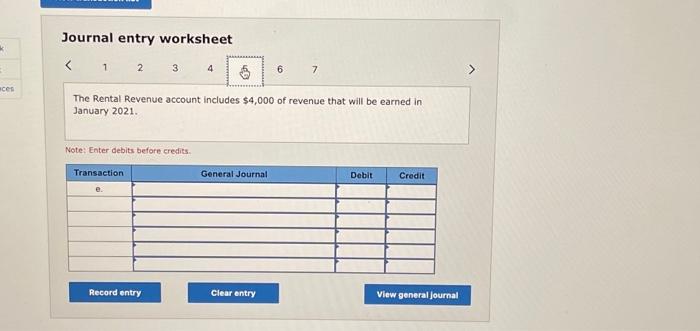

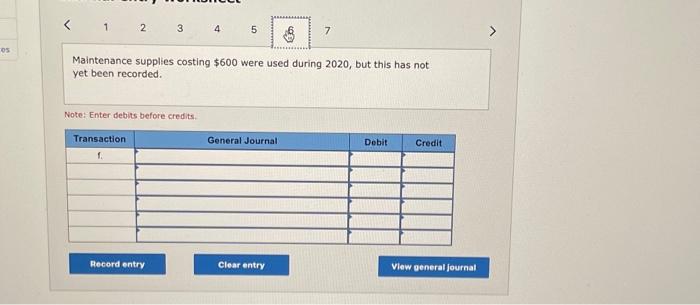

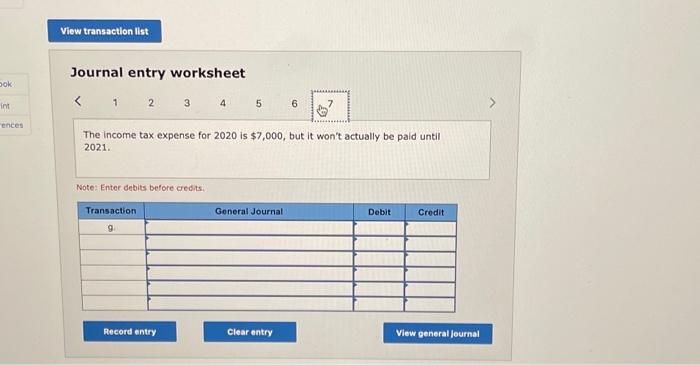

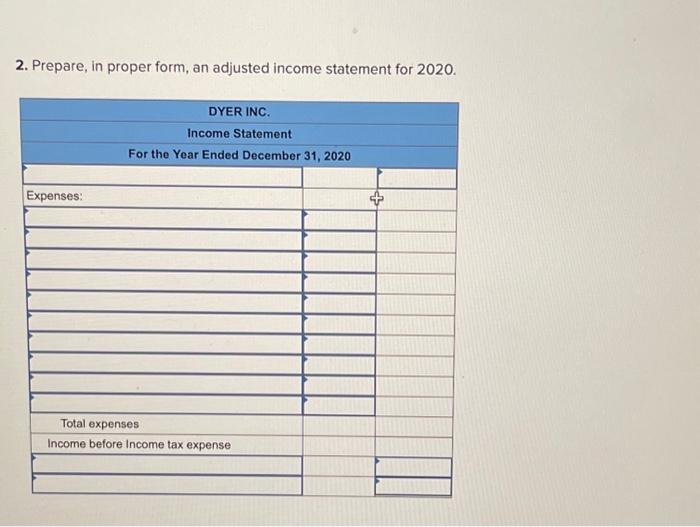

Journal entry worksheet The income tax expense for 2020 is $7,000, but it won't actually be paid until 2021. Note: Enter debits before credits. Maintenance supplies costing $600 were used during 2020 , but this has not yet been recorded. Note: Enter debits before credits. 1. Prepare adjusting journal entry for each item (a) through (g) should be recorded at December 31,2020 . (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 4567 The $400 telephone bill for December 2020 has not been recorded or paid. Note: Enter debits before credits. Journal entry worksheet 67 Depreciation on rental autos, amounting to $23,000 for 2020 , was not recorded. Note: Enter debits before credits. Journal entry worksheet \begin{tabular}{l|l} \hline \\ Interest of $500 was not recorded on the note payable by Dyer Inc. \end{tabular} Note: Enter sebits before credits. On December 31,2020 , Dyer Inc, completed its first year of operations. Because this is the end of the annual accounting period, the company bookkeeper prepared the following preliminary income statement: You are an independent CPA hired by the company to audit the firm's accounting systems and financial statements, In your audit, you developed additional data as follows: a. Wages for the last three days of December amounting to $310 were not recorded or paid. b. The $400 telephone bill for December 2020 has not been recorded or paid. c. Depreciation on rental autos, amounting to $23,000 for 2020 , was not recorded. d. Interest of $500 was not recorded on the note payable by Dyer inc: c. The Rental Revenue account includes $4,000 of revenue that will be earned in January 2021. f. Maintenance supplies costing $600 were used during 2020 , but this has not yet been recorded. 9. The income tax expense for 2020 is $7,000, but it won't actually be paid until 2021 2. Prepare, in proper form, an adjusted income statement for 2020. Required: 1. Prepare adjusting journal entry for each item (a) through ( g ) should be recorded at December 31, 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 4567 Wages for the last three days of December amounting to $310 were not recorded or paid. Note: Enter debits before credits