Answered step by step

Verified Expert Solution

Question

1 Approved Answer

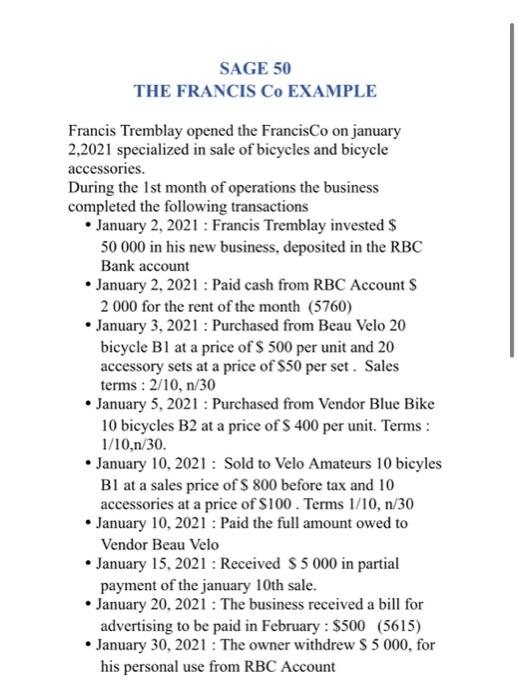

journal the following transaction SAGE 50 THE FRANCIS Co EXAMPLE Francis Tremblay opened the FrancisCo on january 2,2021 specialized in sale of bicycles and bicycle

journal the following transaction

SAGE 50 THE FRANCIS Co EXAMPLE Francis Tremblay opened the FrancisCo on january 2,2021 specialized in sale of bicycles and bicycle accessories. During the 1st month of operations the business completed the following transactions - January 2, 2021 : Francis Tremblay invested \$ 50000 in his new business, deposited in the RBC Bank account - January 2, 2021 : Paid cash from RBC Account \$ 2000 for the rent of the month (5760) - January 3, 2021 : Purchased from Beau Velo 20 bicycle B1 at a price of $500 per unit and 20 accessory sets at a price of $50 per set. Sales terms : 2/10,n/30 - January 5, 2021 : Purchased from Vendor Blue Bike 10 bicycles B2 at a price of $400 per unit. Terms : 1/10,n/30. - January 10, 2021 : Sold to Velo Amateurs 10 bicyles B1 at a sales price of $800 before tax and 10 accessories at a price of $100. Terms 1/10,n/30 - January 10, 2021 : Paid the full amount owed to Vendor Beau Velo - January 15, 2021 : Received \$5 000 in partial payment of the january 10 th sale. - January 20, 2021 : The business received a bill for advertising to be paid in February : $500 (5615) - January 30, 2021 : The owner withdrew \$ 5000 , for his personal use from RBC Account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started