Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Journal transactions into General journal EX. Debits and credits [Your name] Merchandising Company buys and sells a product called Zoom. The company is subject to

Journal transactions into General journal

EX.

Debits and credits

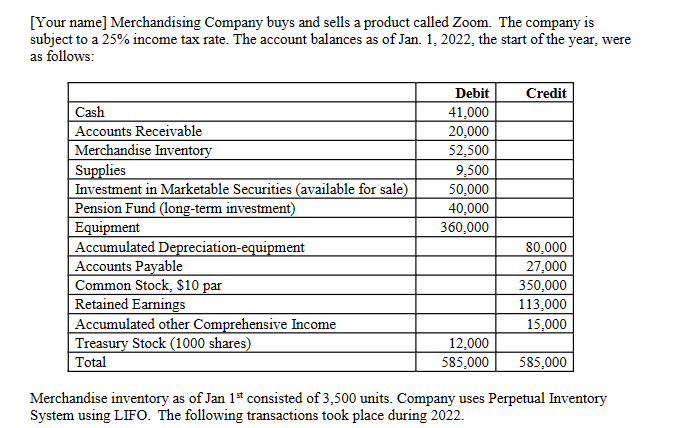

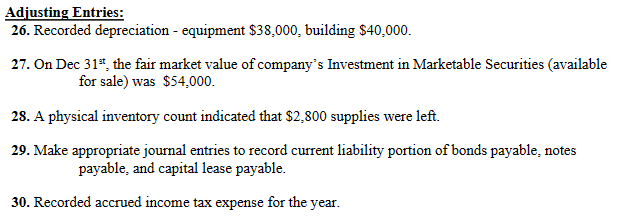

[Your name] Merchandising Company buys and sells a product called Zoom. The company is subject to a 25% income tax rate. The account balances as of Jan. 1,2022, the start of the year, were as follows: Merchandise inventory as of Jan 1st consisted of 3,500 units. Company uses Perpetual Inventory System using LIFO. The following transactions took place during 2022 . Adjusting Entries: 26. Recorded depreciation - equipment $38,000, building $40,000. 27. On Dec 31st, the fair market value of company's Investment in Marketable Securities (available for sale) was $54,000. 28. A physical inventory count indicated that $2,800 supplies were left. 29. Make appropriate journal entries to record current liability portion of bonds payable, notes payable, and capital lease payable. 30. Recorded accrued income tax expense for the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started