Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Journal transactions into General journal EX. Debits and credits [Your name] Merchandising Company buys and sells a product called Zoom. The company is subject to

Journal transactions into General journal

EX.

Debits and credits

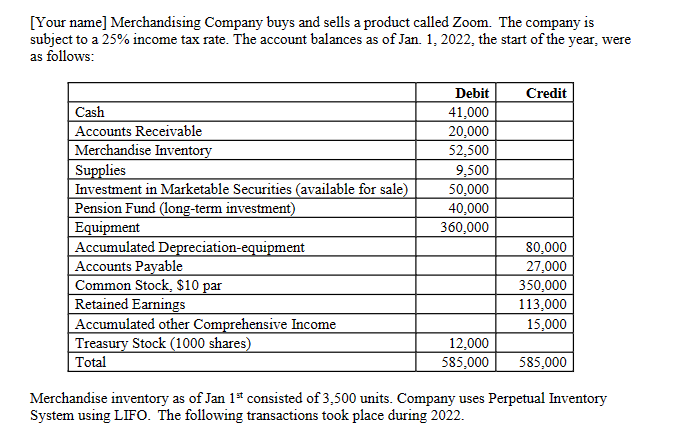

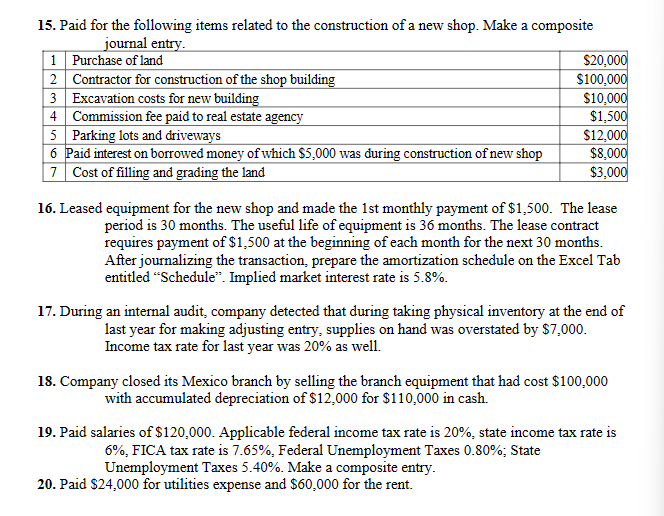

[Your name] Merchandising Company buys and sells a product called Zoom. The company is subject to a 25% income tax rate. The account balances as of Jan. 1,2022, the start of the year, were as follows: Merchandise inventory as of Jan 1st consisted of 3,500 units. Company uses Perpetual Inventory System using LIFO. The following transactions took place during 2022 . 15. Paid for the following items related to the construction of a new shop. Make a composite 16. Leased equipment for the new shop and made the 1 st monthly payment of $1,500. The lease period is 30 months. The useful life of equipment is 36 months. The lease contract requires payment of $1,500 at the beginning of each month for the next 30 months. After journalizing the transaction, prepare the amortization schedule on the Excel Tab entitled "Schedule". Implied market interest rate is 5.8%. 17. During an internal audit, company detected that during taking physical inventory at the end of last year for making adjusting entry, supplies on hand was overstated by $7,000. Income tax rate for last year was 20% as well. 18. Company closed its Mexico branch by selling the branch equipment that had cost $100,000 with accumulated depreciation of $12,000 for $110,000 in cash. 19. Paid salaries of $120,000. Applicable federal income tax rate is 20%, state income tax rate is 6%, FICA tax rate is 7.65%, Federal Unemployment Taxes 0.80%; State Unemployment Taxes 5.40%. Make a composite entry. [Your name] Merchandising Company buys and sells a product called Zoom. The company is subject to a 25% income tax rate. The account balances as of Jan. 1,2022, the start of the year, were as follows: Merchandise inventory as of Jan 1st consisted of 3,500 units. Company uses Perpetual Inventory System using LIFO. The following transactions took place during 2022 . 15. Paid for the following items related to the construction of a new shop. Make a composite 16. Leased equipment for the new shop and made the 1 st monthly payment of $1,500. The lease period is 30 months. The useful life of equipment is 36 months. The lease contract requires payment of $1,500 at the beginning of each month for the next 30 months. After journalizing the transaction, prepare the amortization schedule on the Excel Tab entitled "Schedule". Implied market interest rate is 5.8%. 17. During an internal audit, company detected that during taking physical inventory at the end of last year for making adjusting entry, supplies on hand was overstated by $7,000. Income tax rate for last year was 20% as well. 18. Company closed its Mexico branch by selling the branch equipment that had cost $100,000 with accumulated depreciation of $12,000 for $110,000 in cash. 19. Paid salaries of $120,000. Applicable federal income tax rate is 20%, state income tax rate is 6%, FICA tax rate is 7.65%, Federal Unemployment Taxes 0.80%; State Unemployment Taxes 5.40%. Make a composite entryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started