Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Journalize and post transaction. Amos ask you to issue check #1019 to Joe Slowe for the net amount owed him for time that he worked

Journalize and post transaction.

Amos ask you to issue check #1019 to Joe Slowe for the net amount owed him for time that he worked this past week.

Joe worked 20 hours. Amos is required to withhold the following from Joe’s pay: federal income taxes at a rate of 15%, state income taxes at a rate of 6% and FICA taxes at a rate of 7.65%. (Round to the nearest dollar). You must also record a journal entry for the employer’s payroll taxes. This includes FICA tax of 7.65% and Federal Unemployment Insurance of 6.00%.

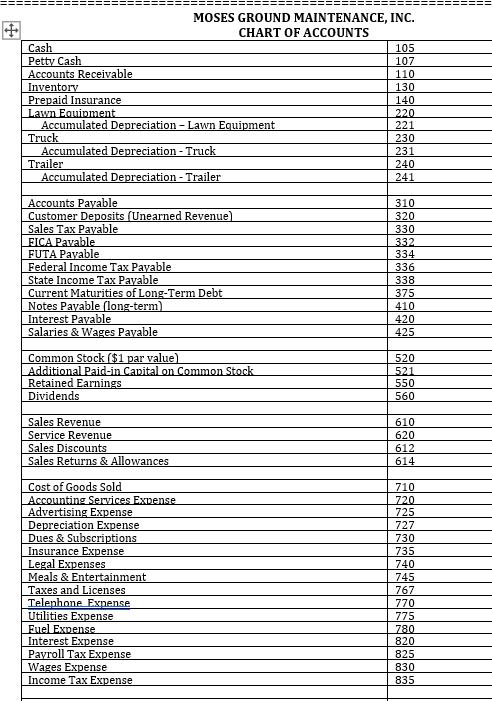

Cash Petty Cash Accounts Receivable Inventory Prepaid Insurance Lawn Equipment Accumulated Depreciation - Lawn Equipment Accumulated Depreciation - Truck Accumulated Depreciation - Trailer Truck Trailer Accounts Payable Customer Deposits (Unearned Revenue) Sales Tax Payable FICA Pavable FUTA Payable Federal Income Tax Payable State Income Tax Payable Current Maturities of Long-Term Debt Notes Payable (long-term) Interest Payable Salaries & Wages Payable Common Stock ($1 par value) Additional Paid-in Capital on Common Stock Retained Earnings Dividends Sales Revenue Service Revenue Sales Discounts Sales Returns & Allowances MOSES GROUND MAINTENANCE, INC. CHART OF ACCOUNTS Cost of Goods Sold Accounting Services Expense Advertising Expense Depreciation Expense Dues & Subscriptions Insurance Expense Legal Expenses Meals & Entertainment Taxes and Licenses Telephone Expense Utilities Expense Fuel Expense Interest Expense Payroll Tax Expense Wages Expense Income Tax Expense 105 107 110 130 140 220 221 230 231 240 241 310 320 330 332 334 336 338 375 410 420 425 520 521 550 560 610 620 612 614 710 720 725 727 730 735 740 745 767 770 775 780 820 825 830 835

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entries To record the employees gross wages Debit Salaries Wages Expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started