Answered step by step

Verified Expert Solution

Question

1 Approved Answer

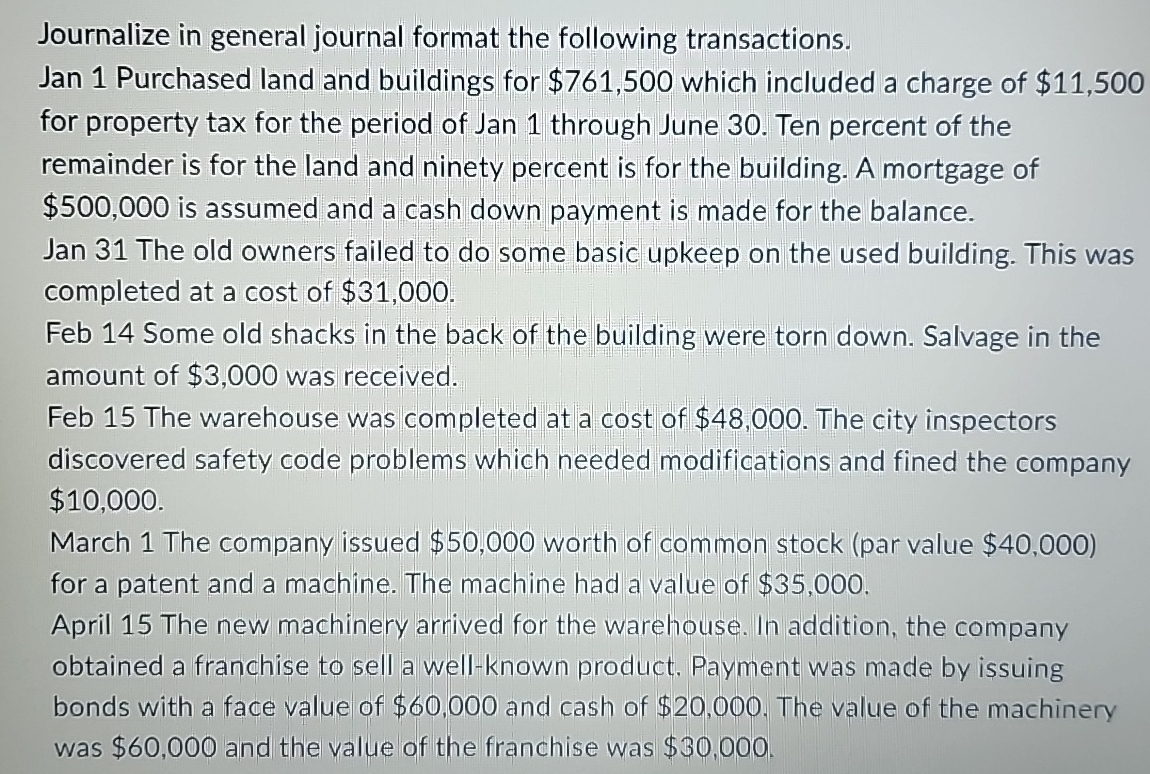

Journalize in general journal format the following transactions. Jan 1 Purchased land and buildings for $ 7 6 1 , 5 0 0 which included

Journalize in general journal format the following transactions. Jan Purchased land and buildings for $ which included a charge of $ for property tax for the period of Jan through June Ten percent of the remainder is for the land and ninety percent is for the building. A mortgage of $ is assumed and a cash down payment is made for the balance. Jan The old owners failed to do some basic upkeep on the used building. This was completed at a cost of $

Feb Some old shacks in the back of the building were torn down. Salvage in the amount of $ was received.

Feb The warehouse was completed at a cost of $ The city inspectors discovered safety code problems which needed modifications and fined the company $

March The company issued $ worth of common stock par value $ for a patent and a machine. The machine had a value of $

April The new machinery arrived for the warehouse. In addition, the company obtained a franchise to sell a wellknown product. Payment was made by issuing bonds with a face value of $ and cash of $ The value of the machinery was $ and the value of the franchise was $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started