Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- JOURNALIZE THE ABOVE TRANSACTIONS - PREPARE AND ADJUSTED TRIAL BALANCE AS OF DECEMBER 31. - PREPARE AND INCOME STATEMENT, RETANED EARNINGS STATEMENT AND CLASSIFIED

- JOURNALIZE THE ABOVE TRANSACTIONS

- PREPARE AND ADJUSTED TRIAL BALANCE AS OF DECEMBER 31.

- PREPARE AND INCOME STATEMENT, RETANED EARNINGS STATEMENT AND CLASSIFIED BALANCE SHEET AS DECEMBER 31.

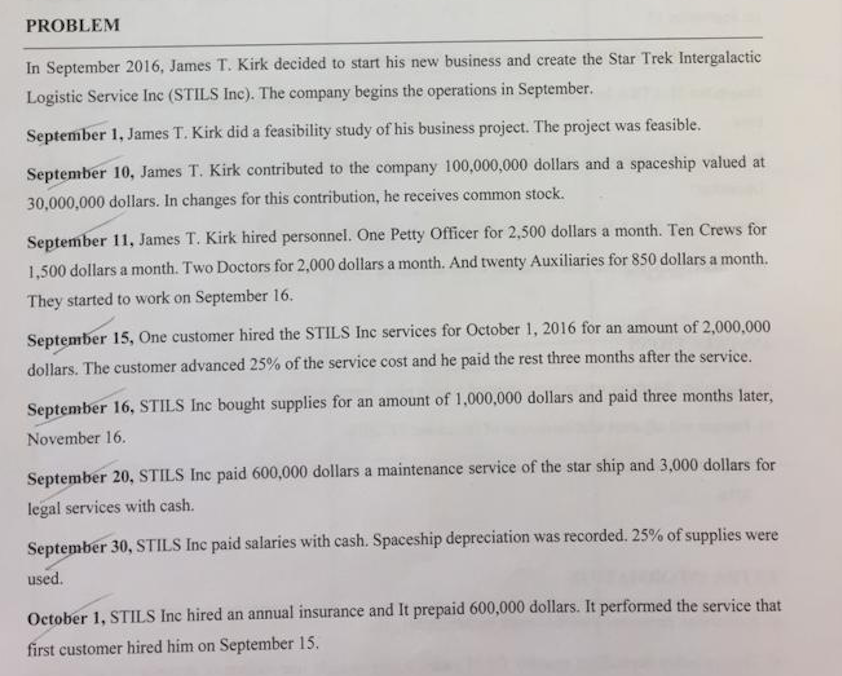

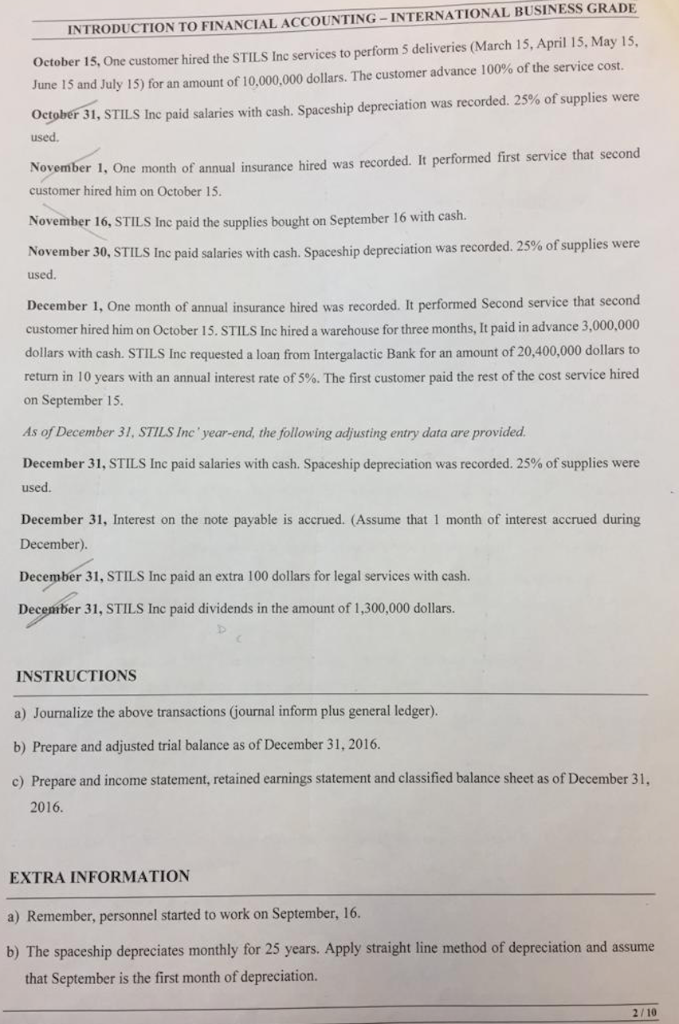

PROBLEM In September 2016, James T. Kirk decided to start his new business and create the Star Trek Intergalactic Logistic Service Inc (STILS Inc). The company begins the operations in September. September 1, James T. Kirk did a feasibility study of his business project. The project was feasible. September 10, James T. Kirk contributed to the company 100,000,000 dollars and a spaceship valued at 30,000,000 dollars. In changes for this contribution, he receives common stock. September 11, James T. Kirk hired personnel. One Petty Officer for 2,5 1,500 dollars a month. Two Doctors for 2,000 dollars a month. And twenty Auxiliaries for 850 dollars a month. They started to work on September 16. September 15, One customer hired the STILS Ine services for October 1, 2016 for an amount of 2,000,000 dollars. The customer advanced 25% of the service cost and he paid the rest three months after the service. 00 dollars a month. Ten Crews for September 16, STILS Inc bought supplies for an amount of 1,000,000 dollars and paid three months later November 16 Septem legal services with cash. September 30, STILS used. October 1, STILS Inc hired an annual insurance and It prepaid 600,000 dollars. It performed the service that first customer hired him on September 15. ber 20, STILS Inc paid 600,000 dollars a maintenance service of the star ship and 3,000 dollars for Inc paid salaries with cash. Spaceship depreciation was recorded 25% of supplies were INTRODUCTION TO FINANCIAL ACCOUNTING-INTERNATIONAL BUSINESS GRADE October 15, One customer hired the STILS Inc services to perform 5 deliveries (March 15, April 15, May 15, June 15 and July 15) for an amount of 10,000,000 dollars. The customer advance 100% of the service cost. Octobe used. Novemb customer hired him on October 15 r 31, STILS Inc paid salaries with cash. Spaceship depreciation was recorded, 25% of supplies were er 1, One month of annual insurance hired was recorded. It performed first service that second November 16, STILS Inc paid the supplies bought on September 16 with cash. November 30, STILS Inc paid salaries with cash. Spaceship depreciation was recorded 25% of supplies were used. December 1, One month of annual insurance hired was recorded. It performed Second service that second customer hired him on October 15. STILS Inc hired a warehouse for three months, It paid in advance 3,000,000 dollars with cash. STILS Inc requested a loan from Intergalactic Bank for an amount of 20,400,000 dollars to return in 10 years with an annual interest rate of 5%. The first customer paid the rest of the cost service hired on September 15. As of December 31, STILS Inc' year-end, the following adjusting entry data are provided December 31, STILS Inc paid salaries with cash. Spaceship depreciation was recorded, 25% of supplies were used December 31, Interest on the note payable is accrued. (Assume that 1 month of interest accrued during December). December 31, STILS Inc paid an extra 100 dollars for legal services with cash. Decemiber 31, STILS Inc paid dividends in the amount of 1,300,000 dollars. INSTRUCTIONS a) Journalize the above transactions (journal inform plus general ledger). b) Prepare and adjusted trial balance as of December 31, 2016 c) Prepare and income statement, retained earnings statement and classified balance sheet as of December 31, 2016. EXTRA INFORMATION a) Remember, personnel started to work on September, 16. b) The spaceship depreciates monthly for 25 years. Apply straight line method of depreciation and assume that September is the first month of depreciation. 2/10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started