Answered step by step

Verified Expert Solution

Question

1 Approved Answer

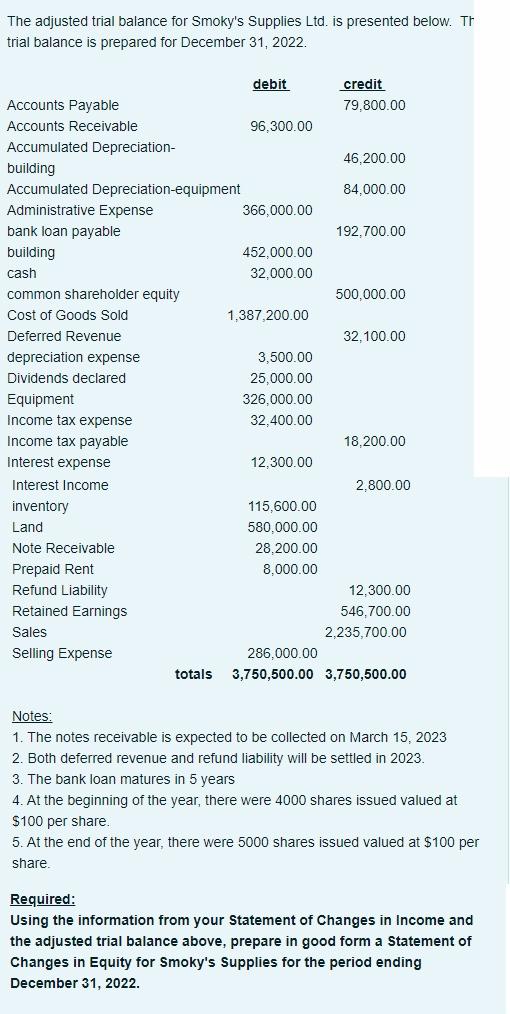

The adjusted trial balance for Smoky's Supplies Ltd. is presented below. Th trial balance is prepared for December 31, 2022. Accounts Payable Accounts Receivable

The adjusted trial balance for Smoky's Supplies Ltd. is presented below. Th trial balance is prepared for December 31, 2022. Accounts Payable Accounts Receivable Accumulated Depreciation- building Accumulated Depreciation-equipment Administrative Expense bank loan payable building cash common shareholder equity Cost of Goods Sold Deferred Revenue depreciation expense Dividends declared Equipment Income tax expense Income tax payable Interest expense Interest Income inventory Land Note Receivable Prepaid Rent Refund Liability Retained Earnings Sales Selling Expense debit 96,300.00 366,000.00 452,000.00 32.000.00 1,387,200.00 3,500.00 25,000.00 326,000.00 32,400.00 12,300.00 115,600.00 580,000.00 28,200.00 8,000.00 credit 79,800.00 46,200.00 84,000.00 192,700.00 500,000.00 32,100.00 18,200.00 2,800.00 12,300.00 546.700.00 2,235,700.00 286.000.00 totals 3,750,500.00 3,750,500.00 Notes: 1. The notes receivable is expected to be collected on March 15, 2023 2. Both deferred revenue and refund liability will be settled in 2023. 3. The bank loan matures in 5 years 4. At the beginning of the year, there were 4000 shares issued valued at $100 per share. 5. At the end of the year, there were 5000 shares issued valued at $100 per share. Required: Using the information from your Statement of Changes in Income and the adjusted trial balance above, prepare in good form a Statement of Changes in Equity for Smoky's Supplies for the period ending December 31, 2022.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started