Question

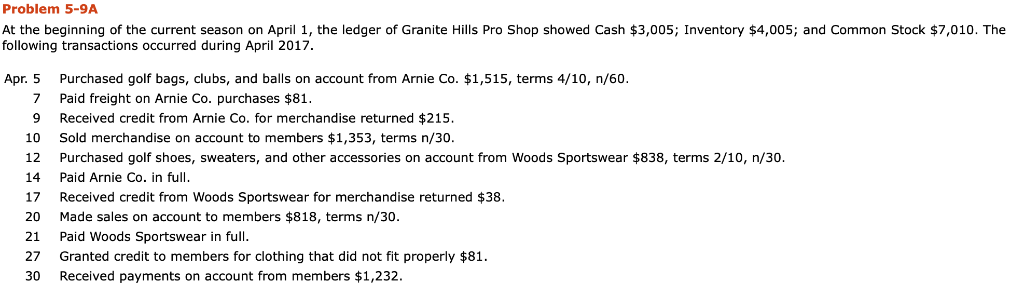

Journalize the April transactions using a periodic inventory system. (If no entry is required, select No Entry for the account titles and enter 0 for

Journalize the April transactions using a periodic inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to 0 decimal places, e.g. 5,275.)

Journalize the April transactions using a periodic inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to 0 decimal places, e.g. 5,275.)

Using T accounts, enter the beginning balances in the ledger accounts and post the April transactions. (Post entries in the order of journal entries posted in part a. Round answers to 0 decimal places, e.g. 5,275. For accounts that have a zero balance select "4/30 Bal." from the list and enter 0 for the amount.)

Prepare a trial balance on April 30, 2017. (Do not list those accounts that have zero ending balance.)

Prepare an income statement through gross profit, assuming inventory on hand at April 30 is $4,306.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started