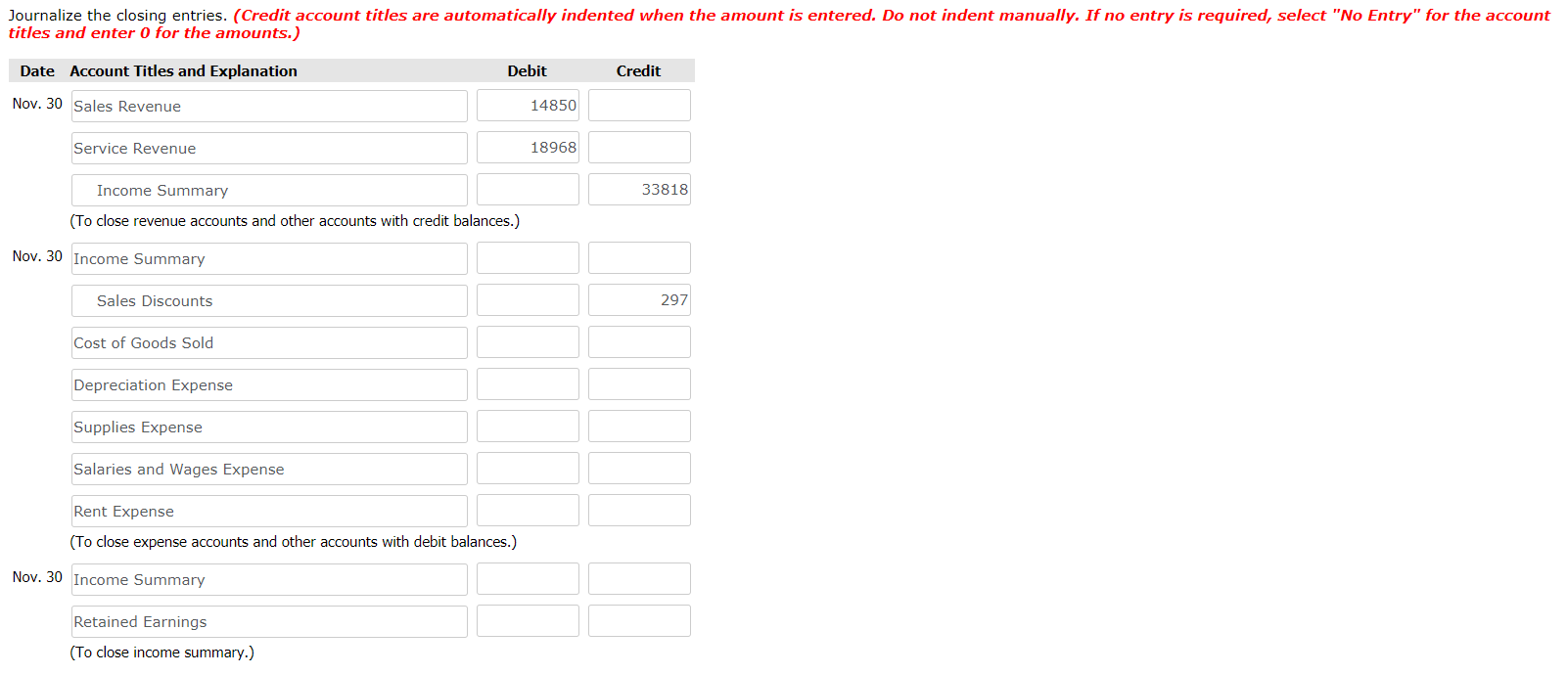

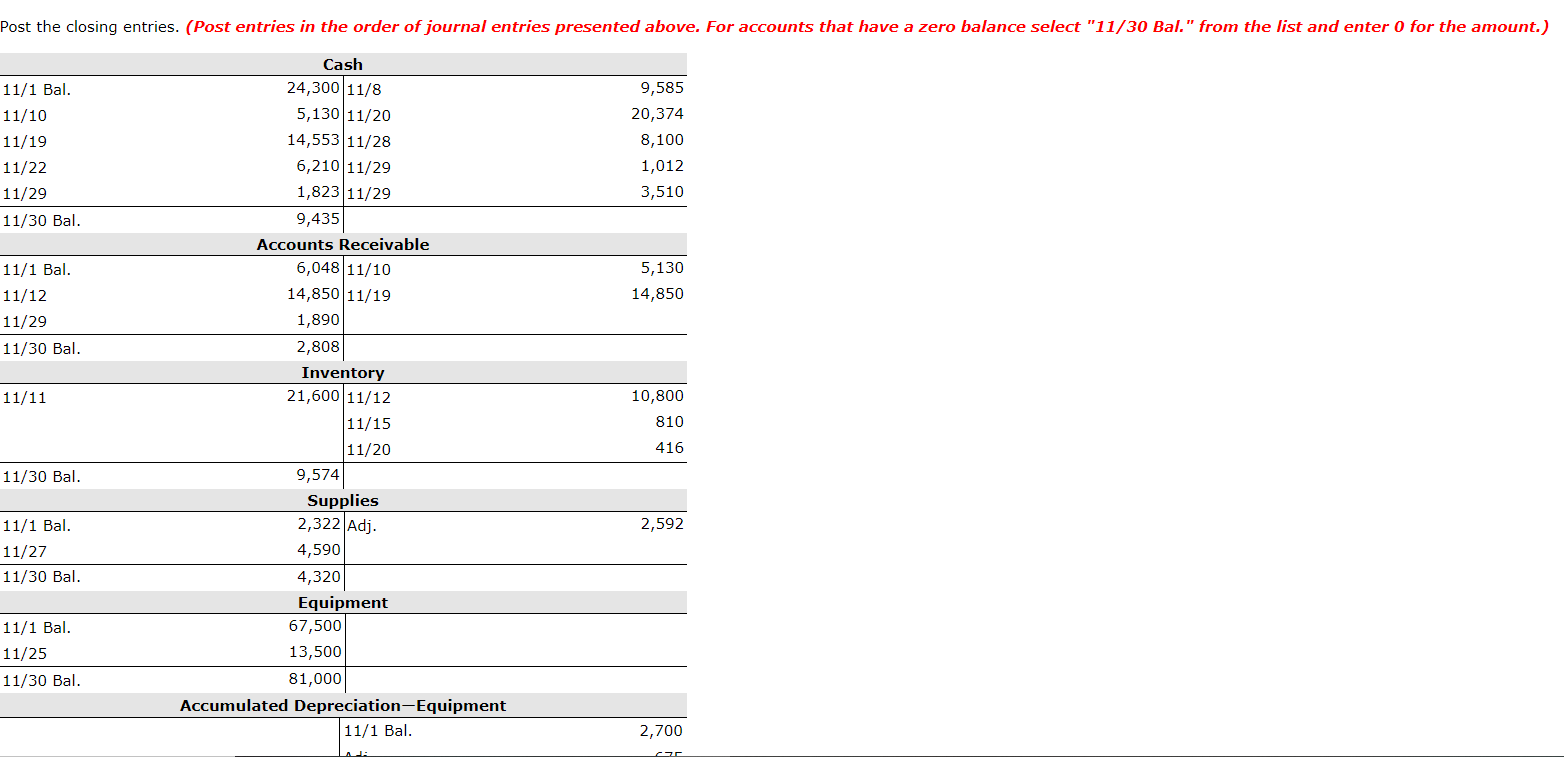

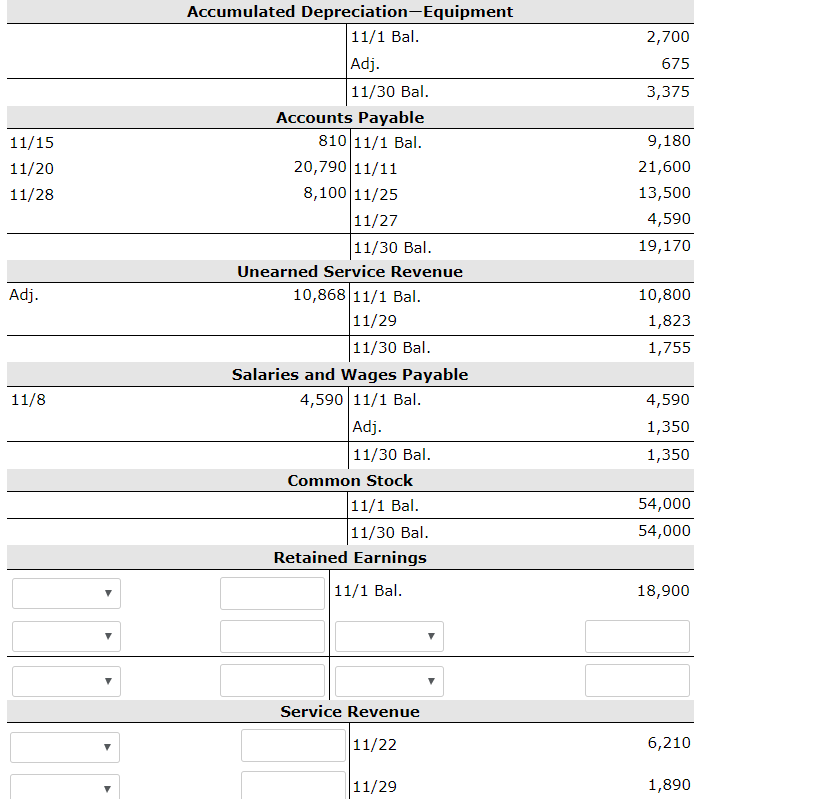

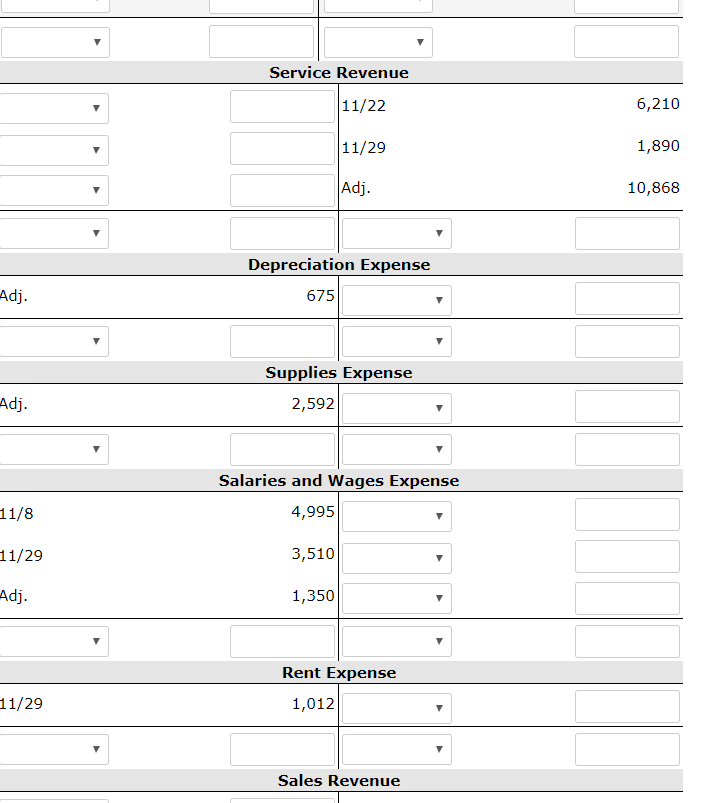

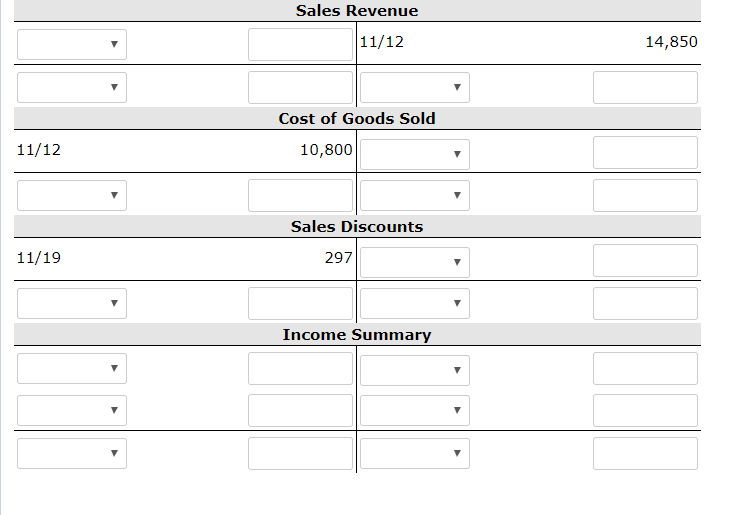

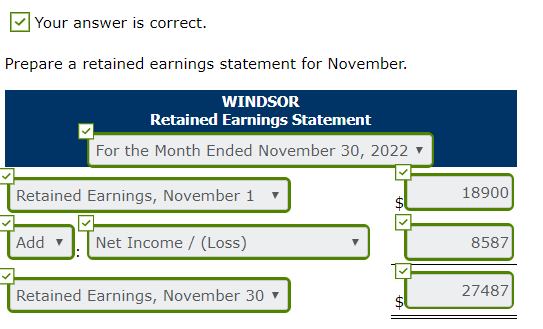

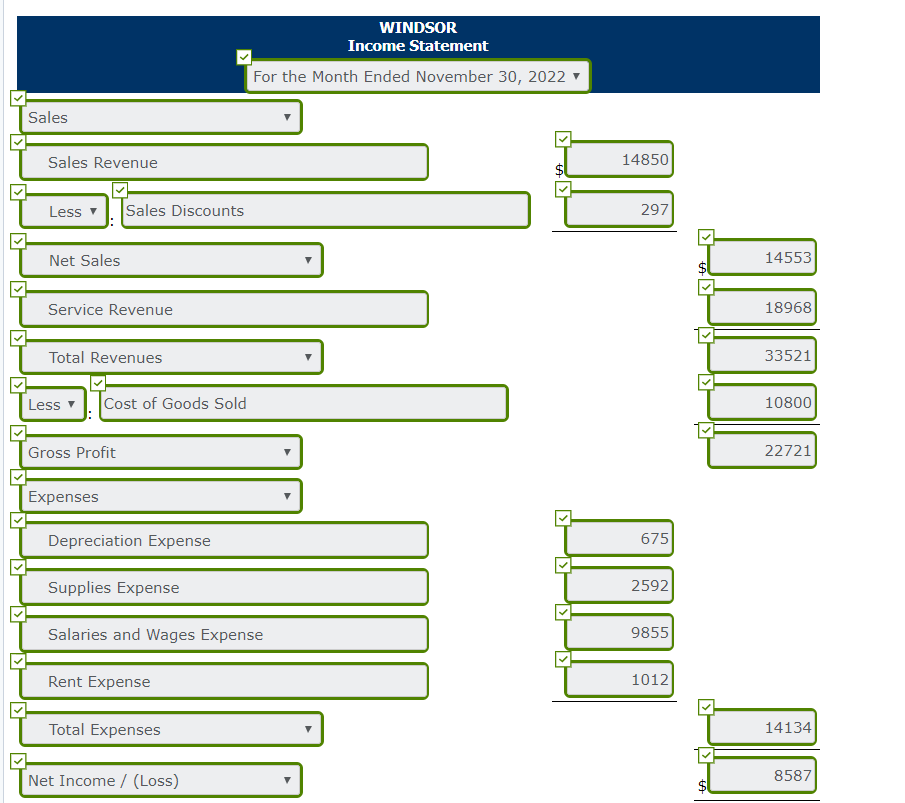

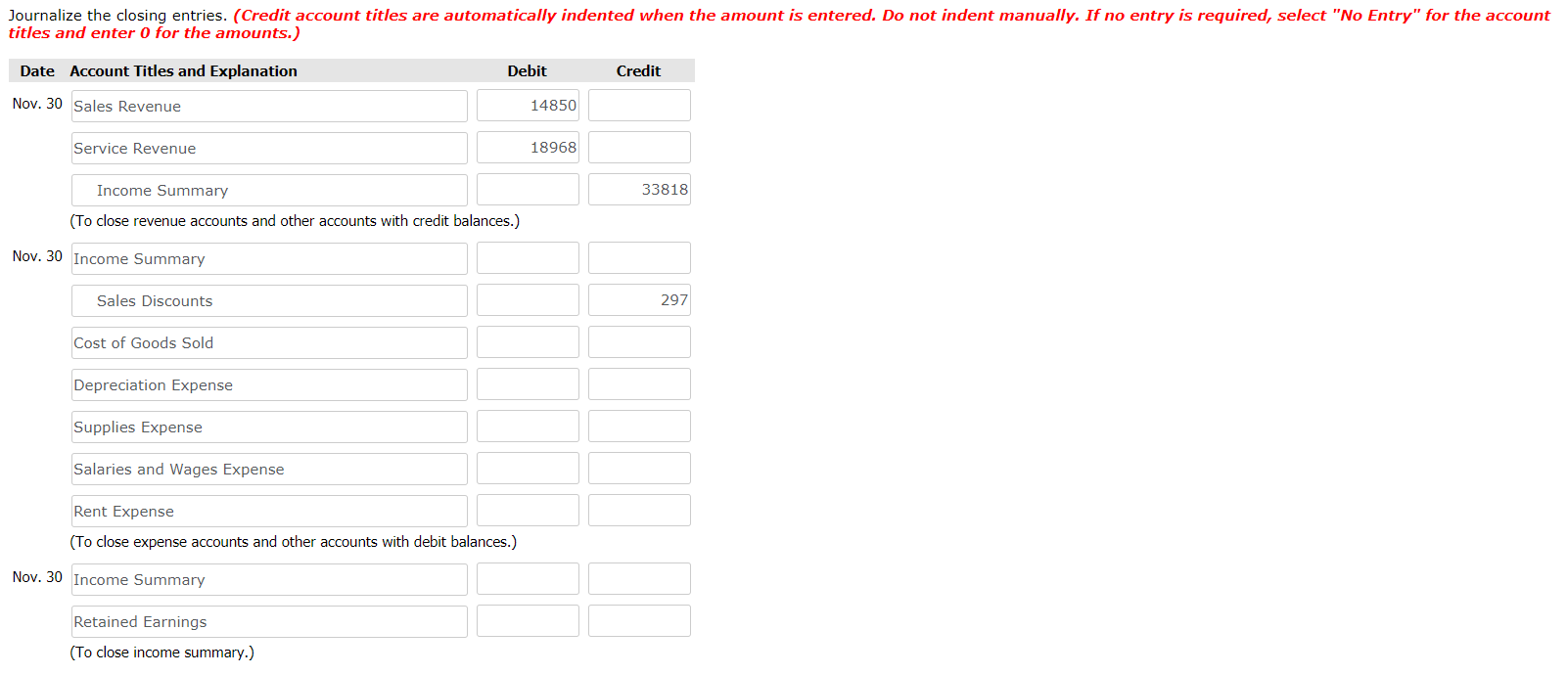

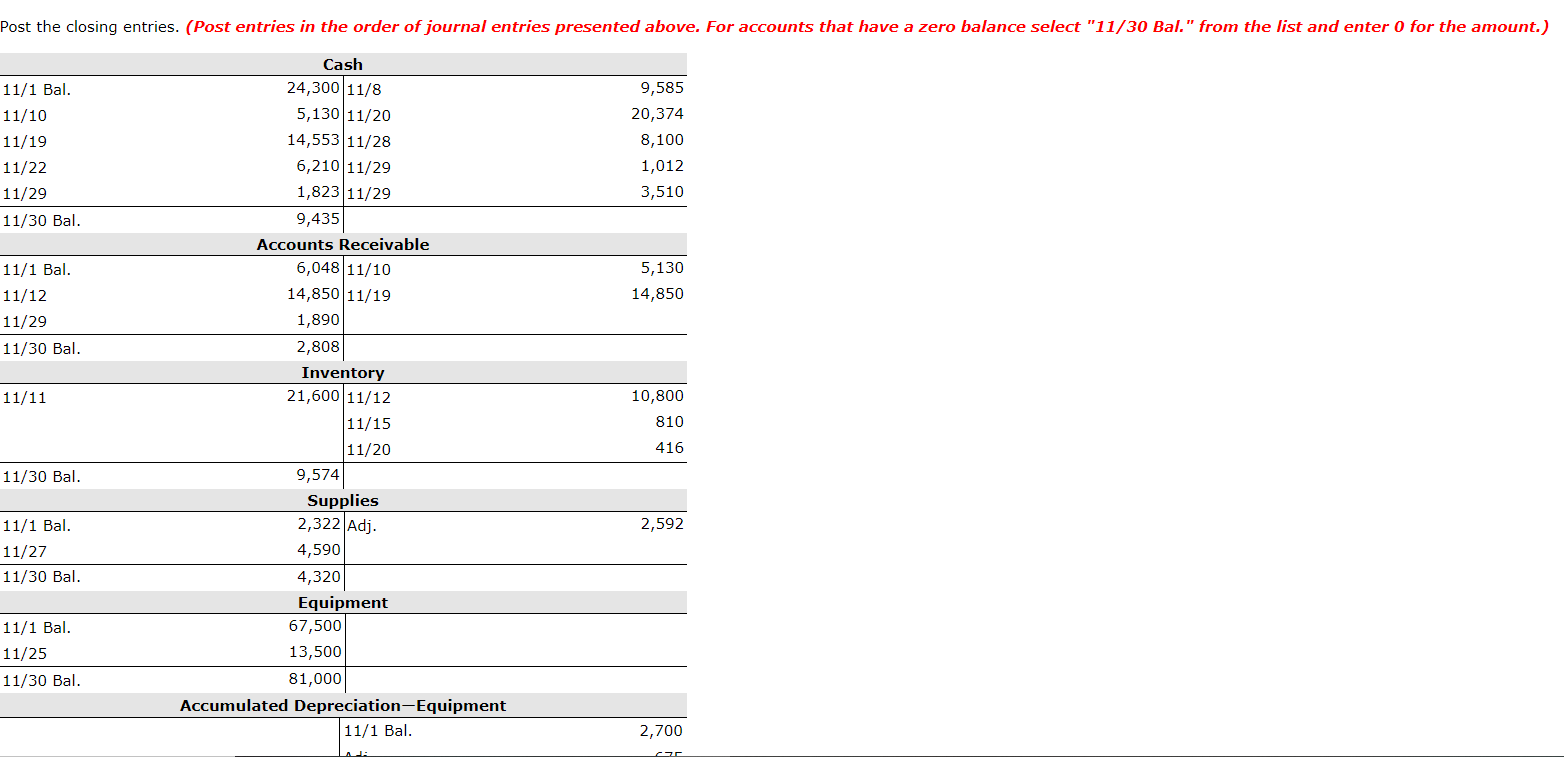

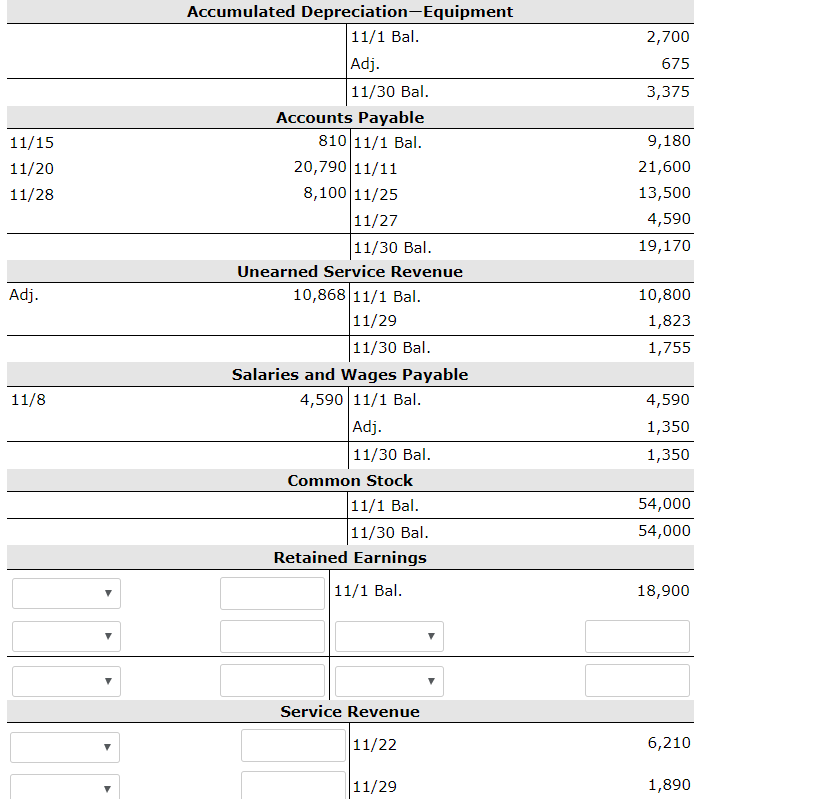

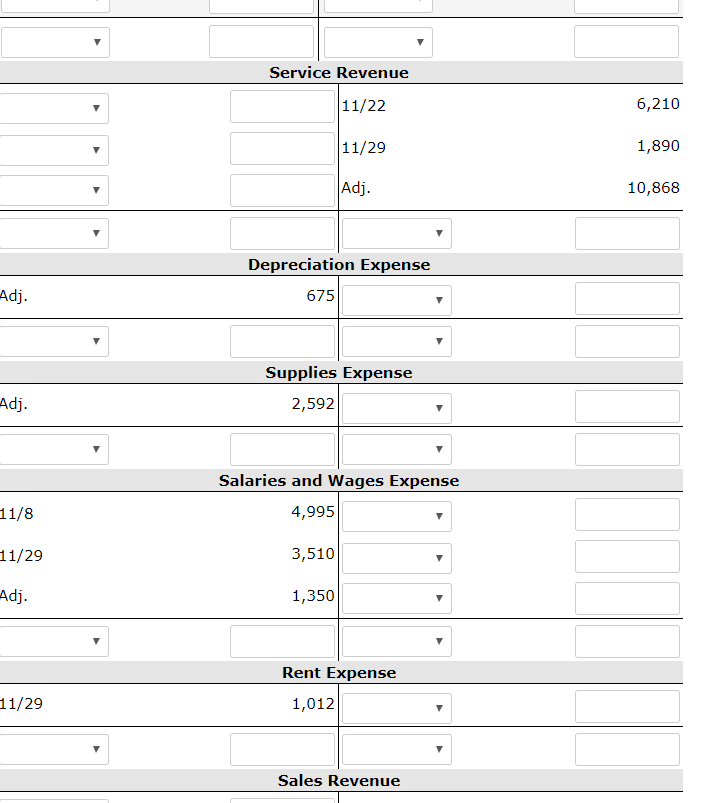

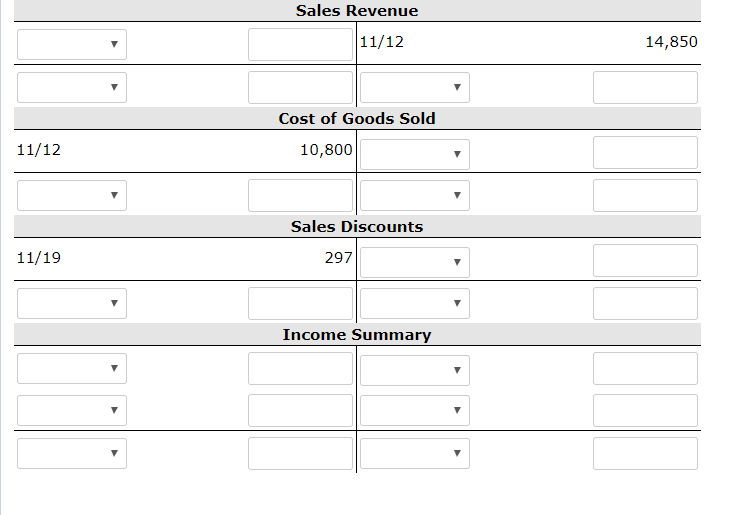

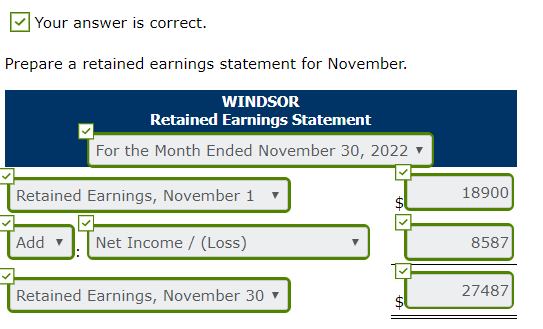

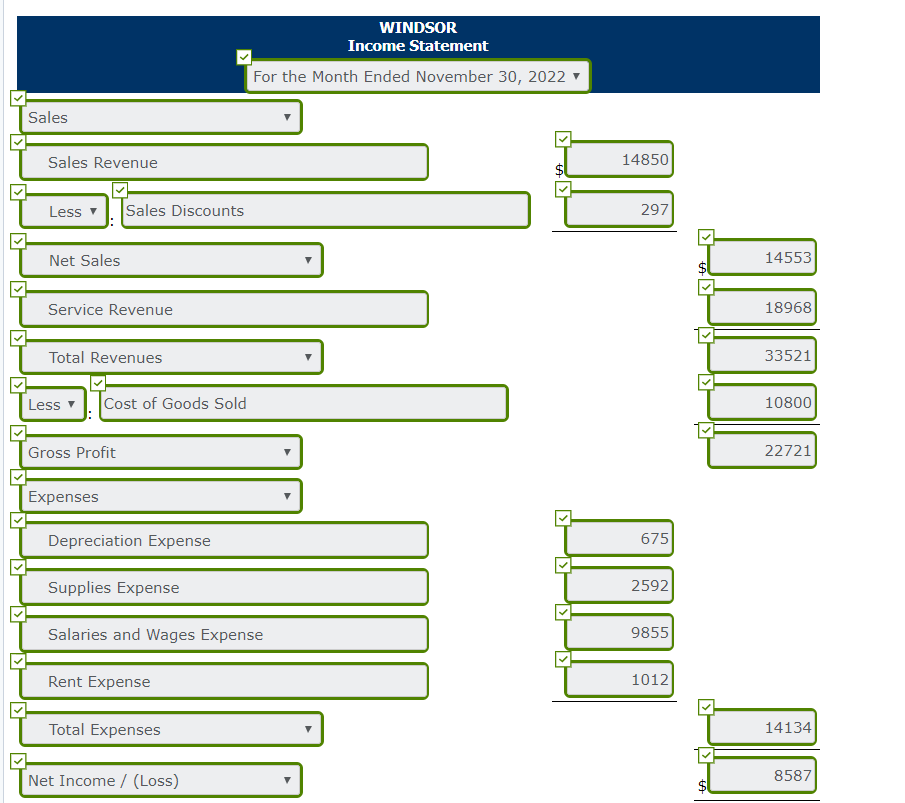

Journalize the closing entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Nov. 30 Sales Revenue 14850 Service Revenue 18968 Income Summary 33818 (To close revenue accounts and other accounts with credit balances.) Nov. 30 Income Summary Sales Discounts 297 Cost of Goods Sold Depreciation Expense Supplies Expense Salaries and Wages Expense Rent Expense (To close expense accounts and other accounts with debit balances.) Nov. 30 Income Summary Retained Earnings (To close income summary.) Post the closing entries. (Post entries in the order of journal entries presented above. For accounts that have a zero balance select "11/30 Bal." from the list and enter 0 for the amount.) 11/1 Bal. 11/10 11/19 11/22 11/29 11/30 Bal. 9,585 20,374 8,100 1,012 3,510 5,130 14,850 11/1 Bal. 11/12 11/29 11/30 Bal. 11/11 Cash 24,300 11/8 5,130 11/20 14,553 11/28 6,210 11/29 1,823 11/29 9,435 Accounts Receivable 6,048 11/10 14,850 11/19 1,890 2,808 Inventory 21,600 11/12 11/15 11/20 9,574 Supplies 2,322 Adj. 4,590 4,320 Equipment 67,500 13,500 81,000 Accumulated Depreciation Equipment 11/1 Bal. 10,800 810 416 11/30 Bal. 2,592 11/1 Bal. 11/27 11/30 Bal. 11/1 Bal. 11/25 11/30 Bal. 2,700 Accumulated Depreciation-Equipment 11/1 Bal. 2,700 Adj. 675 3,375 11/15 11/20 11/28 9,180 21,600 13,500 4,590 19,170 11/30 Bal. Accounts Payable 810 11/1 Bal. 20,790 11/11 8,100 11/25 11/27 11/30 Bal. Unearned Service Revenue 10,868 11/1 Bal. 11/29 11/30 Bal. Salaries and Wages Payable 4,590 11/1 Bal. Adj. 11/30 Bal. Common Stock 11/1 Bal. 11/30 Bal. Retained Earnings 11/1 Bal. 10,800 1,823 1,755 11/8 4,590 1,350 1,350 54,000 54,000 18,900 Service Revenue 11/22 6,210 11/29 1,890 Service Revenue 11/22 6,210 11/29 1,890 Adj. 10,868 Depreciation Expense 675 Adj. Supplies Expense 2,592 Adj. Salaries and Wages Expense 4,995 11/8 11/29 3,510 Adj. 1,350 Rent Expense 1,012 11/29 Sales Revenue Sales Revenue 11/12 14,850 Cost of Goods Sold 10,800 11/12 Sales Discounts 11/19 297 Income Summary Your answer is correct. Prepare a retained earnings statement for November. WINDSOR Retained Earnings Statement For the Month Ended November 30, 2022 Retained Earnings, November 1 $C 18900 TAdd T Net Income / (Loss) 8587 Retained Earnings, November 30 27487 WINDSOR Income Statement For the Month Ended November 30, 2022 Sales i Sales Revenue 14850 Less Sales Discounts 297 Net Sales Net Sales 14553 Service Revenue 18968 Total Revenues 33521 Less Cost of Goods Sold 10800 Gross Profit 22721 Expenses Depreciation Expense 675 Supplies Expense 2592 | Salaries and Wages Expense 9855 Rent Expense 1012 Total Expenses 14134 Net Income / (Loss) 8587