Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Journalize the closing entries from the financial statement columns of the worksheet. (Credit account titles are automatically indented when amount is entered. Do not indent

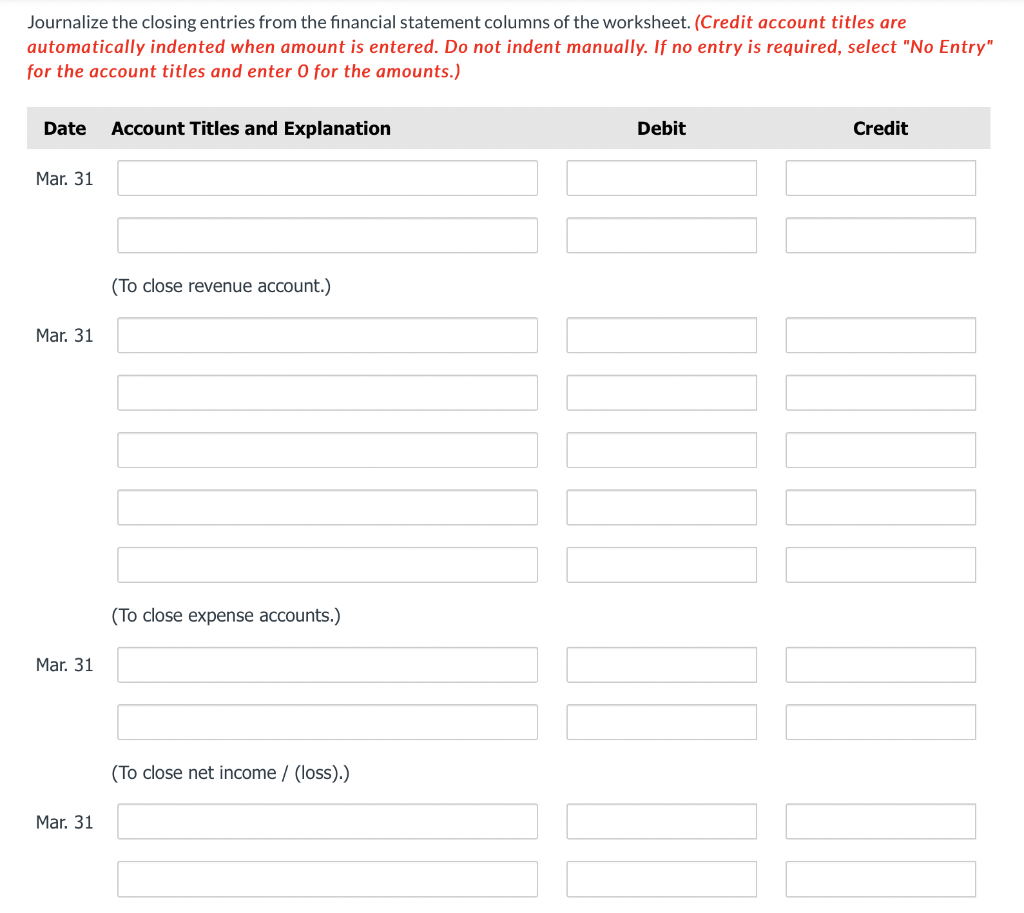

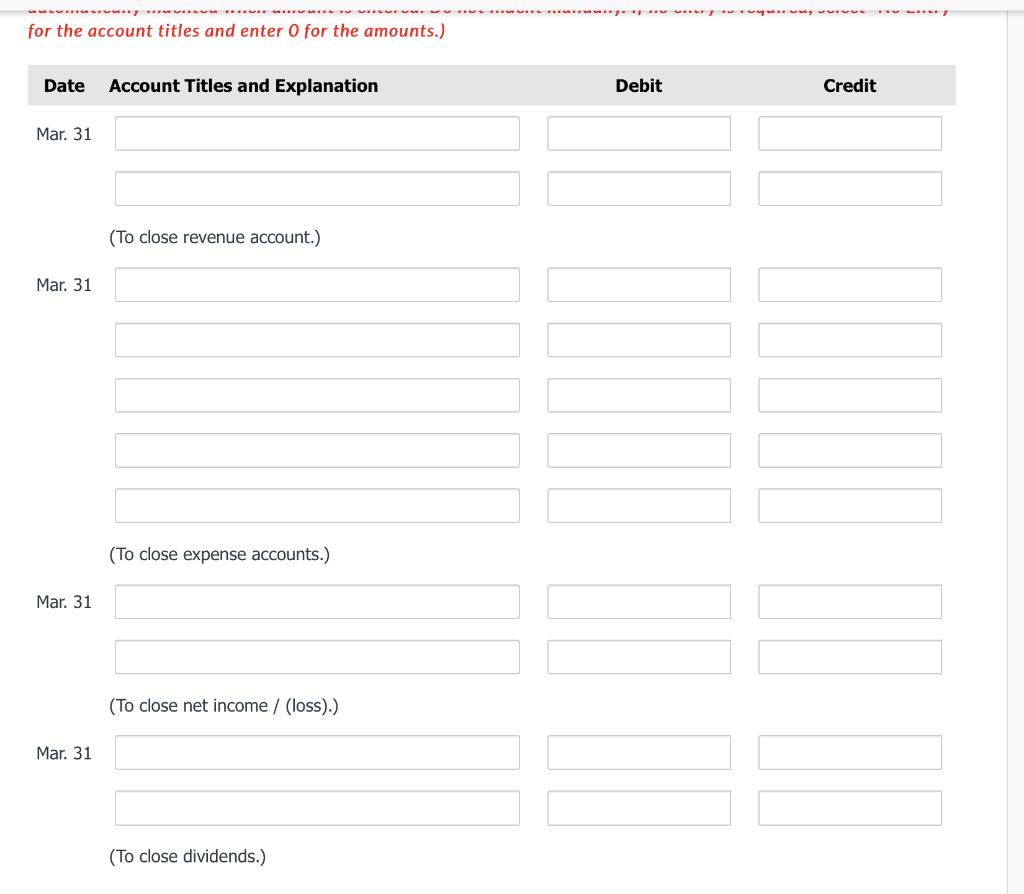

Journalize the closing entries from the financial statement columns of the worksheet. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

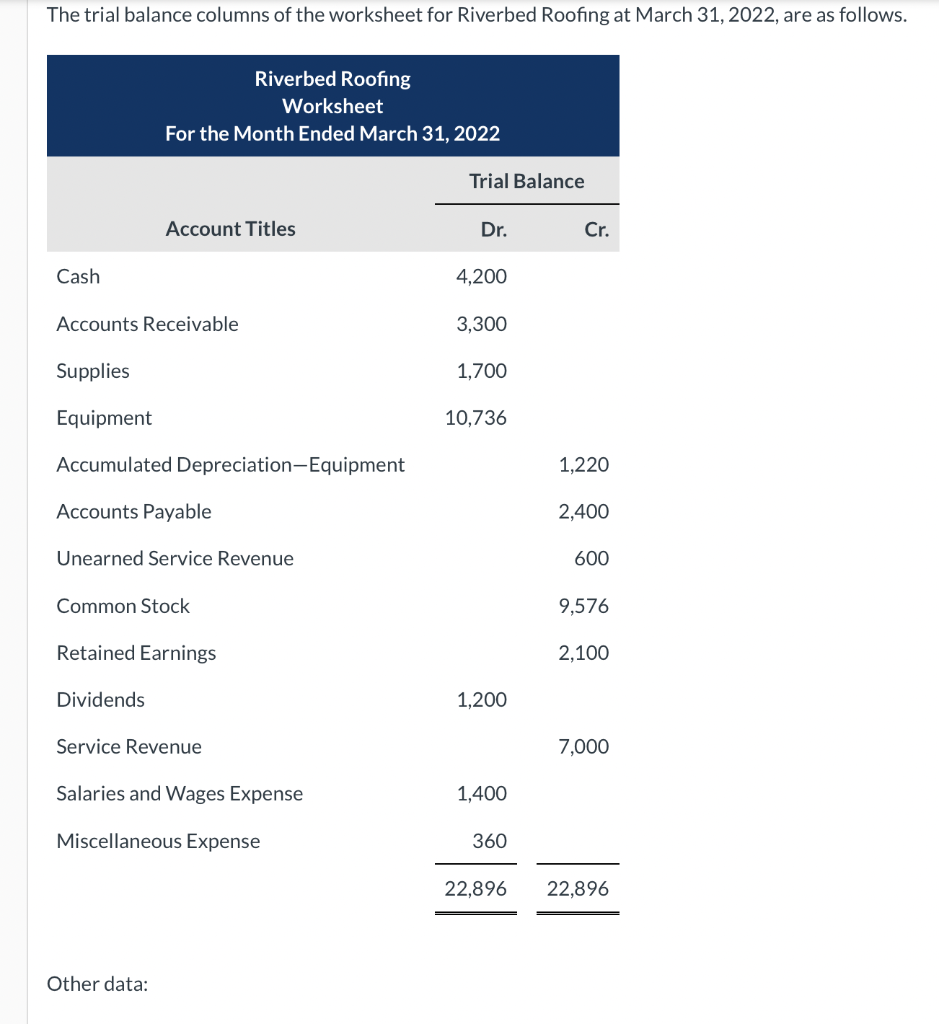

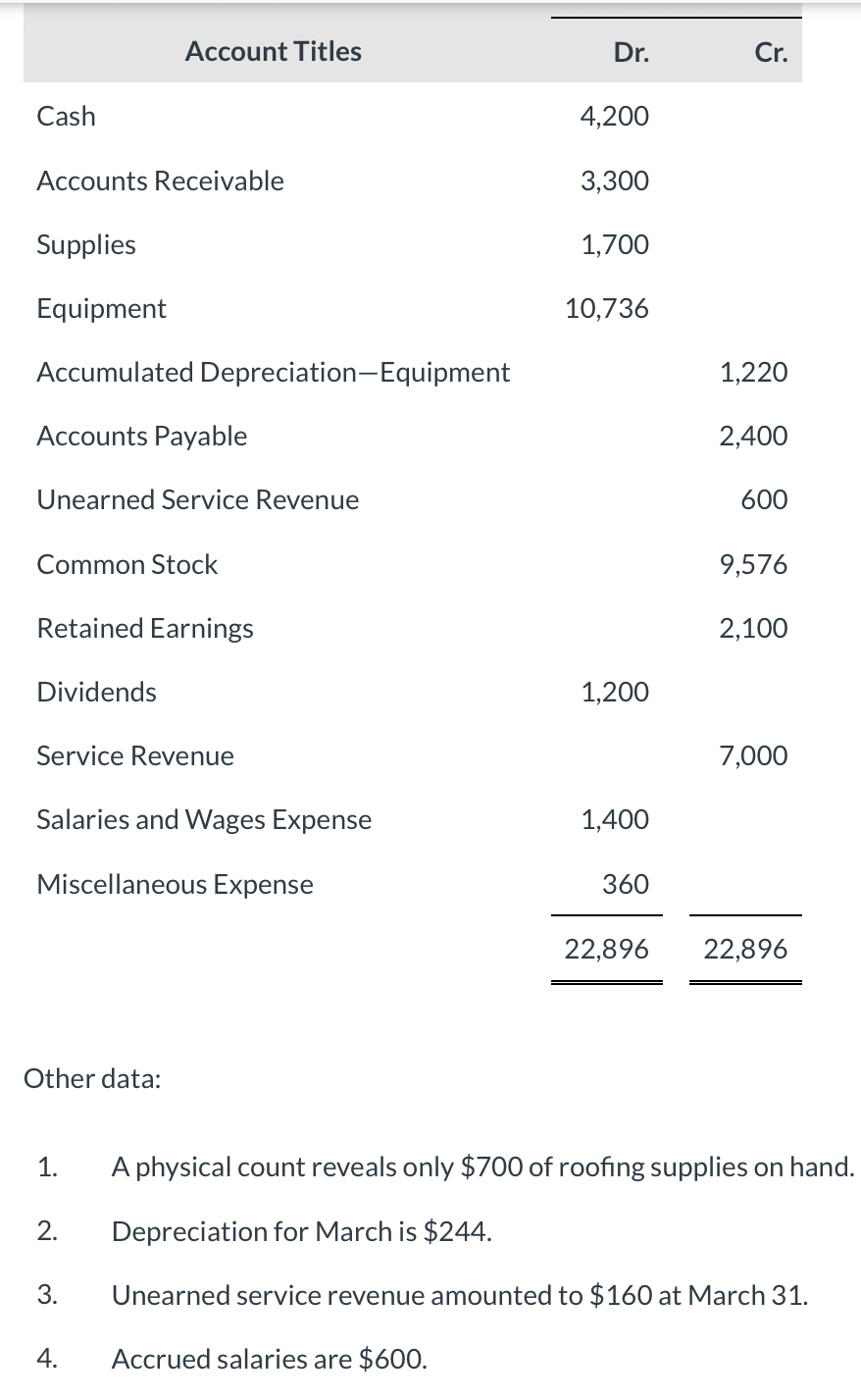

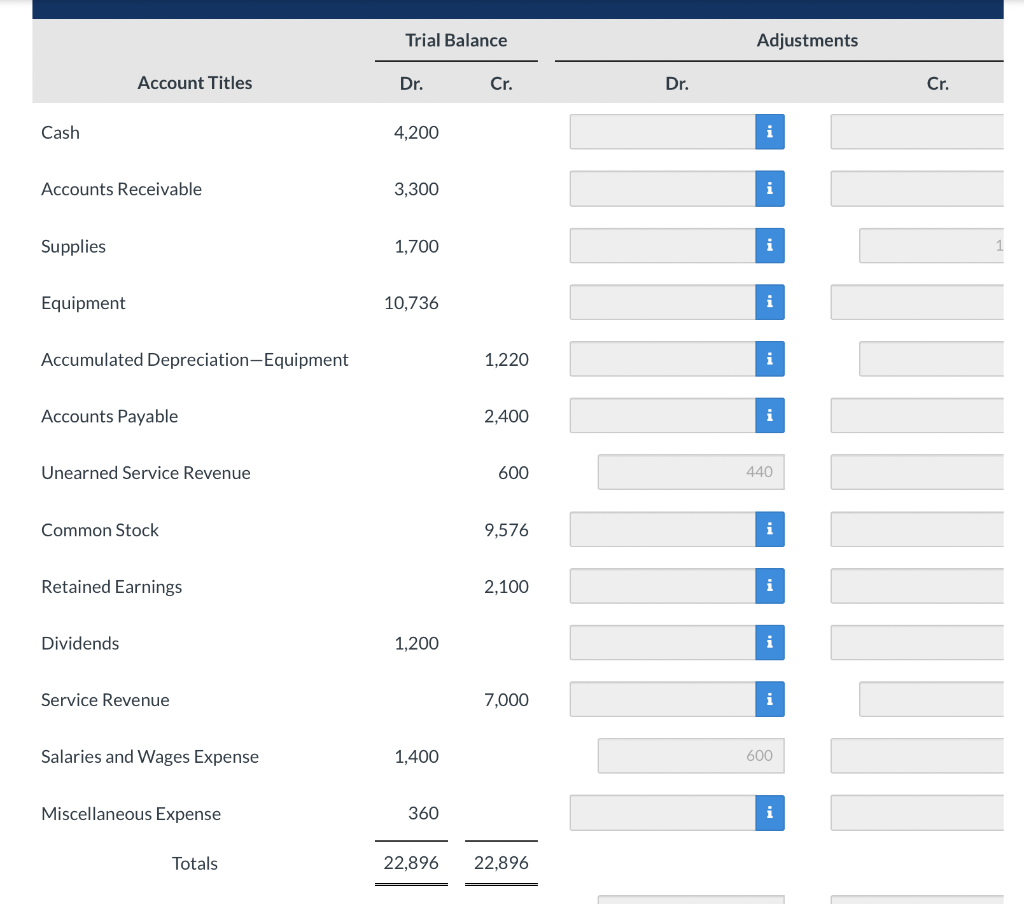

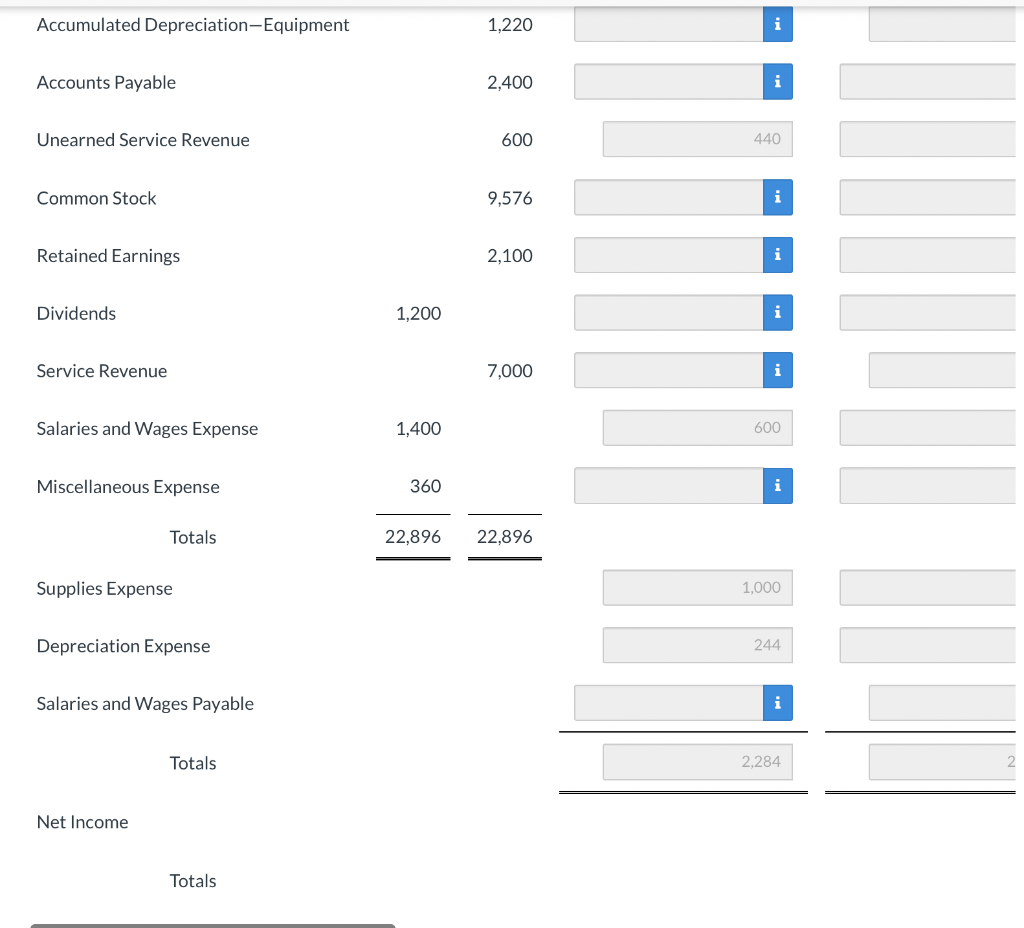

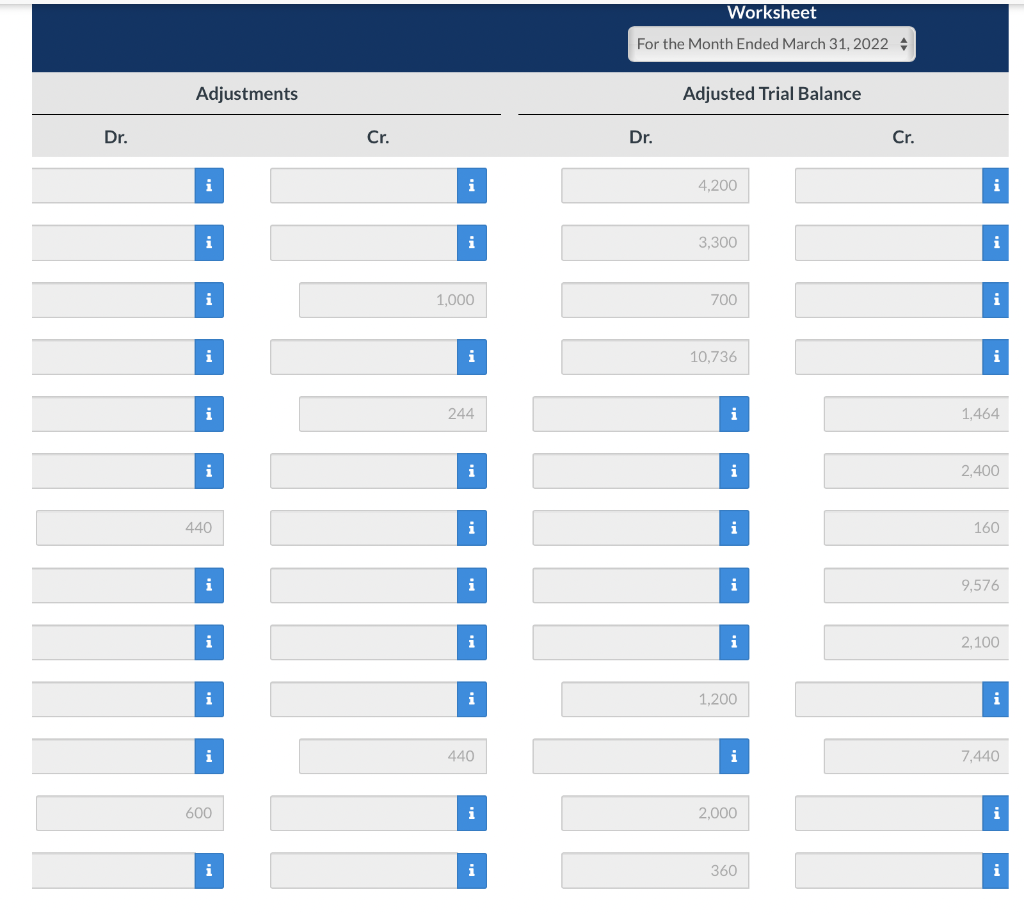

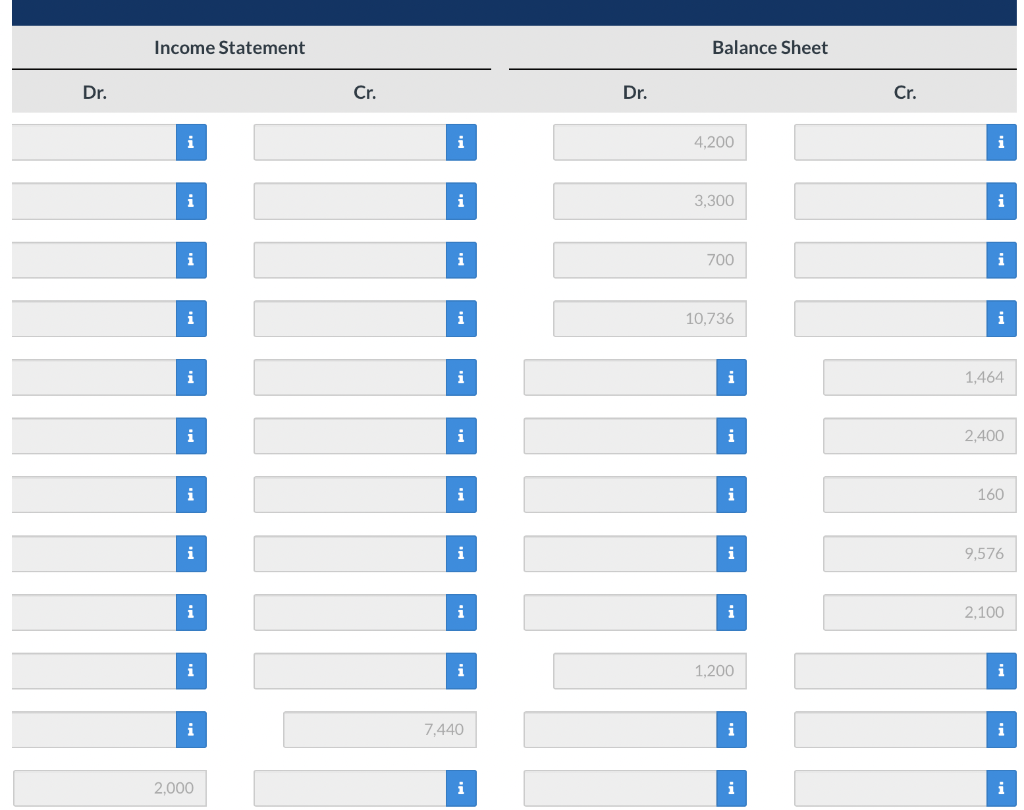

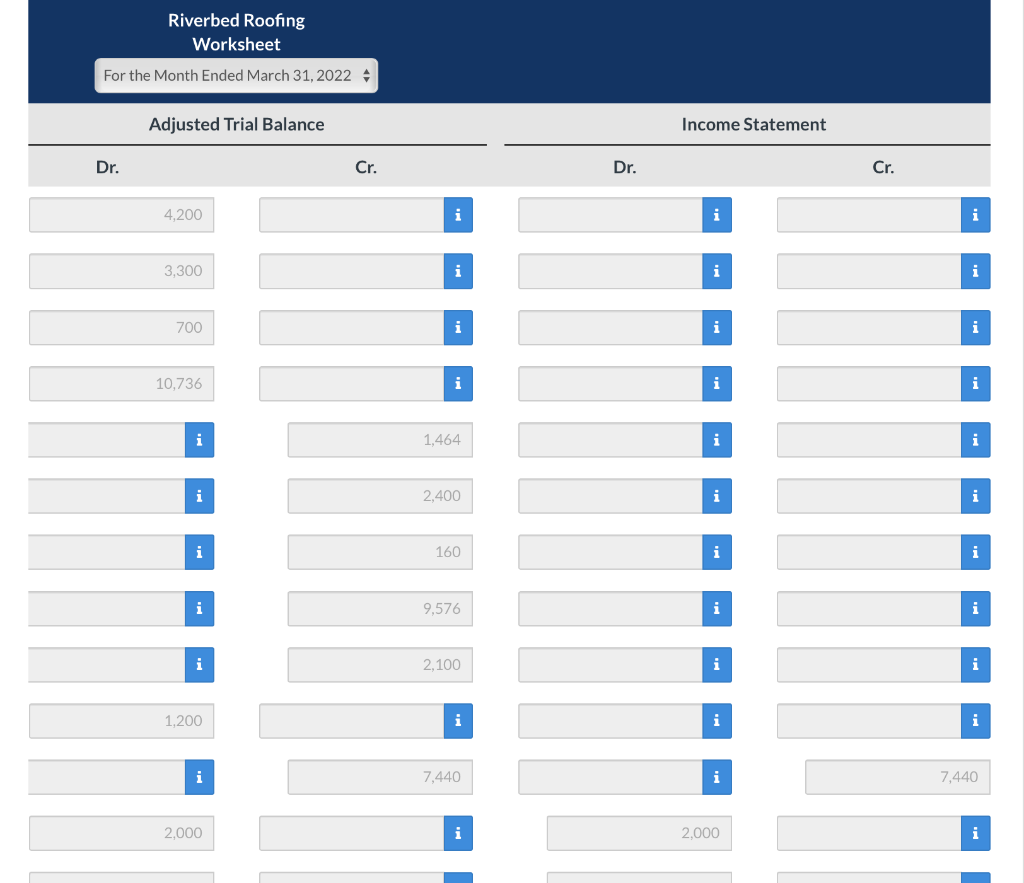

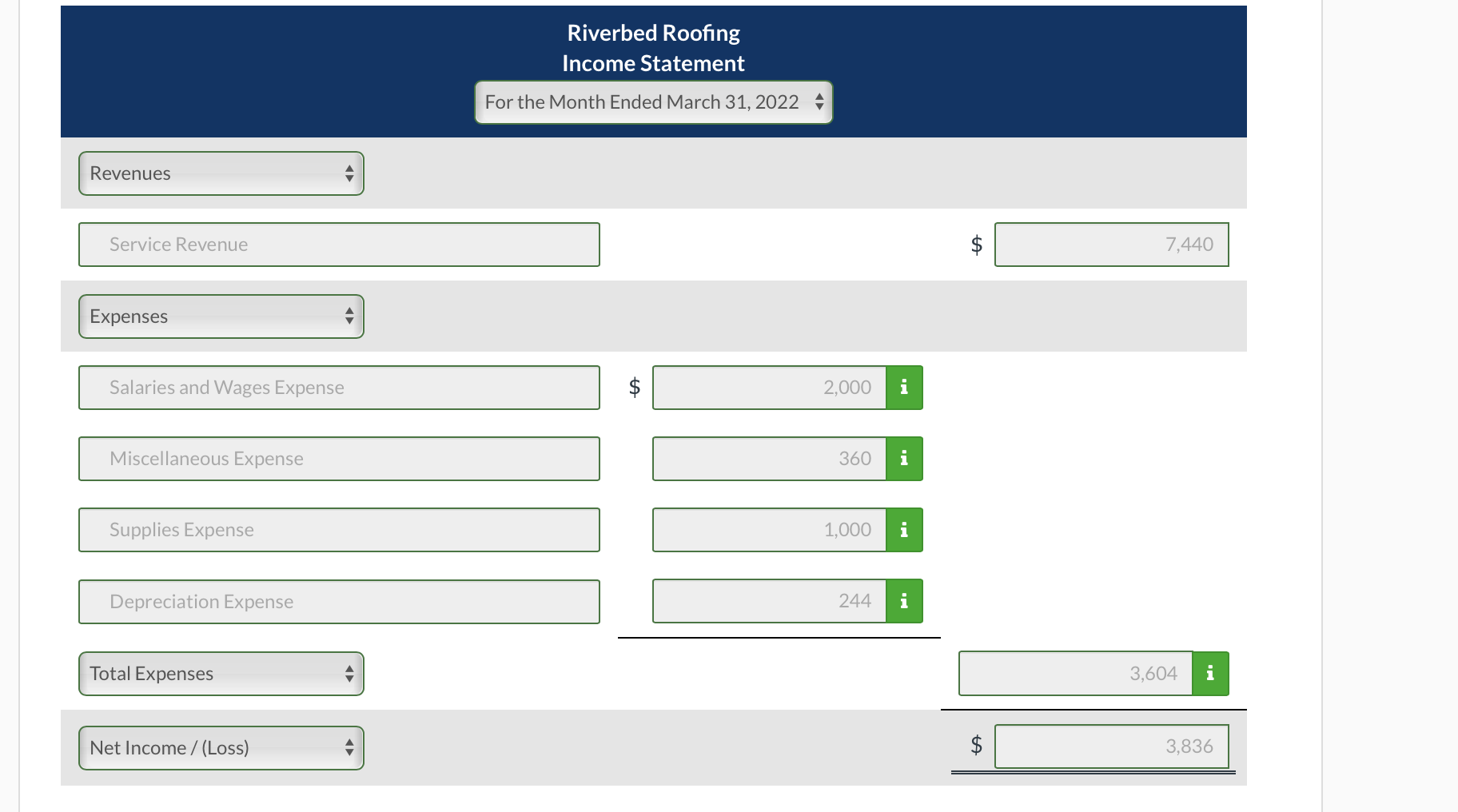

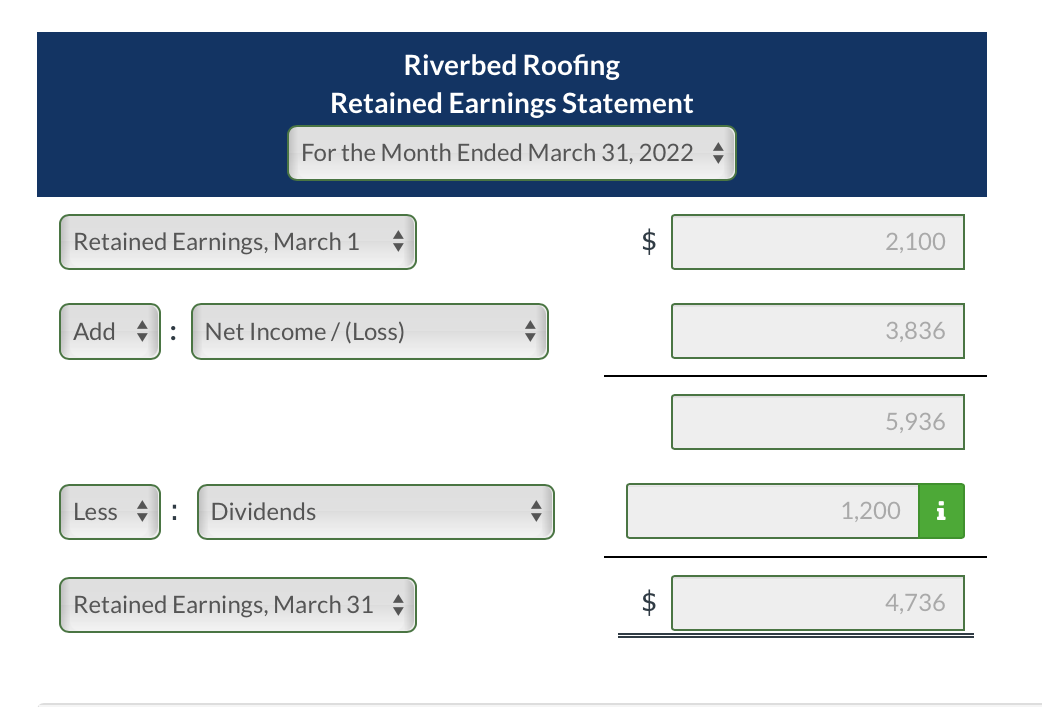

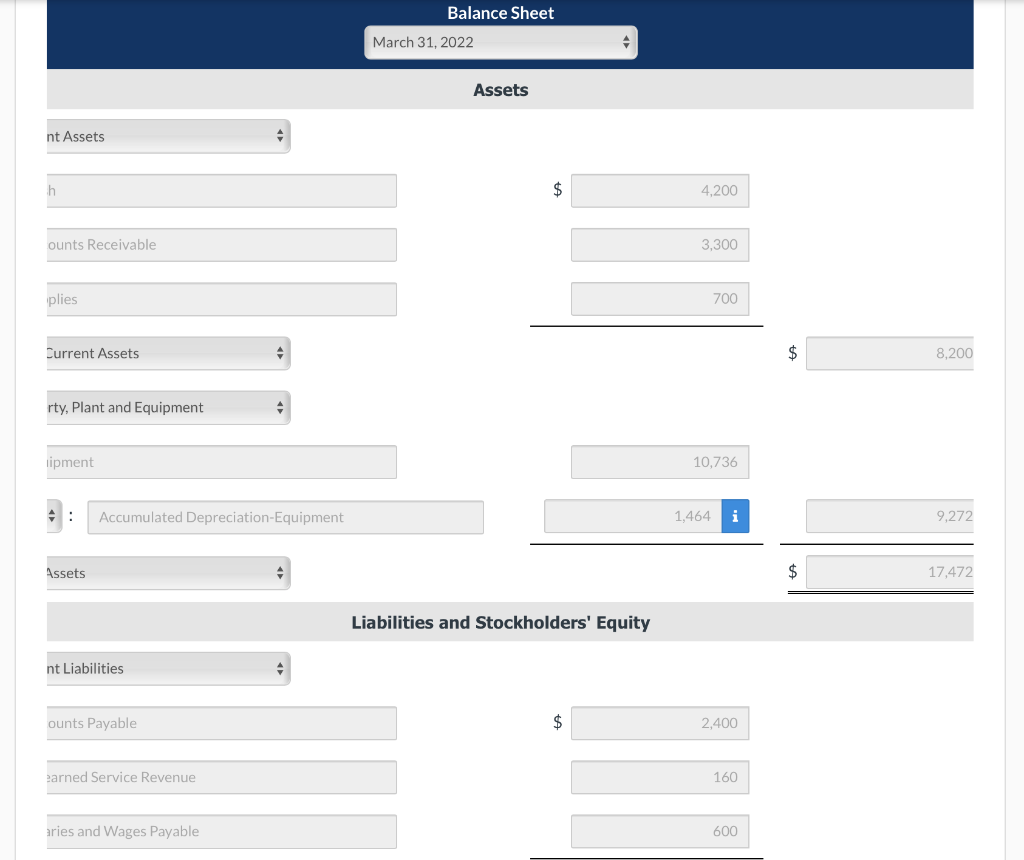

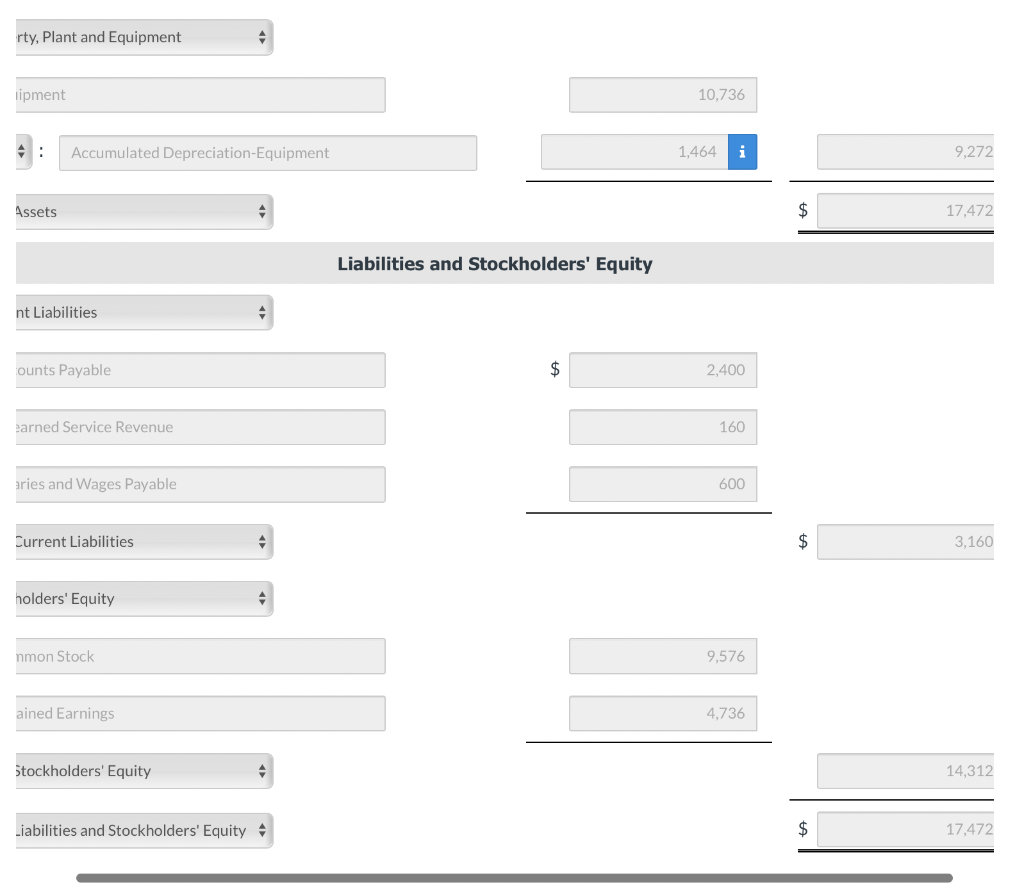

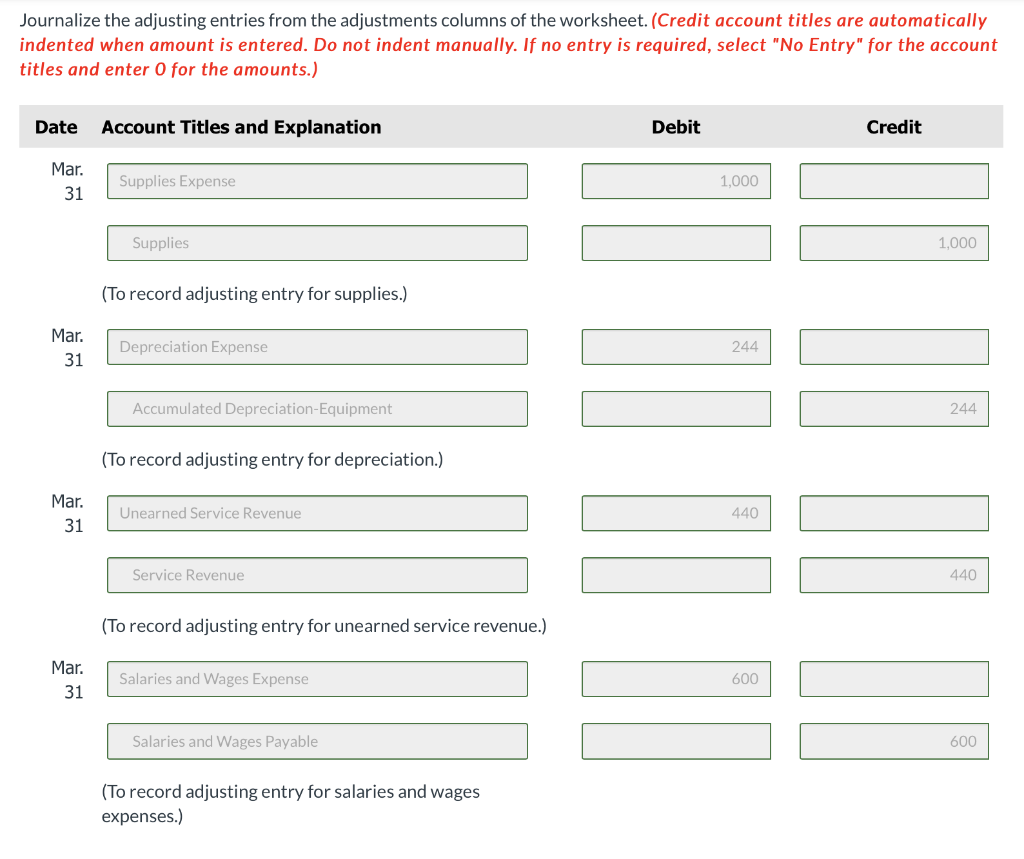

Journalize the closing entries from the financial statement columns of the worksheet. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Mar. 31 (To close revenue account.) Mar. 31 (To close expense accounts.) Mar. 31 (To close net income / (loss).) Mar. 31 for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Mar. 31 (To close revenue account.) Mar. 31 (To close expense accounts.) Mar. 31 (To close net income / (loss).) Mar. 31 (To close dividends.) The trial balance columns of the worksheet for Riverbed Roofing at March 31, 2022, are as follows. Riverbed Roofing Worksheet For the Month Ended March 31, 2022 Trial Balance Account Titles Dr. Cr. Cash 4,200 Accounts Receivable 3,300 Supplies 1,700 Equipment 10,736 Accumulated Depreciation Equipment 1,220 Accounts Payable 2,400 Unearned Service Revenue 600 Common Stock 9,576 Retained Earnings 2,100 Dividends 1,200 Service Revenue 7,000 Salaries and Wages Expense 1,400 Miscellaneous Expense 360 22,896 22,896 Other data: Account Titles Dr. Cr. Cash 4,200 Accounts Receivable 3,300 Supplies 1,700 Equipment 10,736 Accumulated Depreciation Equipment 1,220 Accounts Payable 2,400 Unearned Service Revenue 600 Common Stock 9,576 Retained Earnings 2,100 Dividends 1,200 Service Revenue 7,000 Salaries and Wages Expense 1,400 Miscellaneous Expense 360 22,896 22,896 Other data: 1. A physical count reveals only $700 of roofing supplies on hand. 2. Depreciation for March is $244. 3. Unearned service revenue amounted to $160 at March 31. 4. Accrued salaries are $600. Trial Balance Adjustments Account Titles Dr. Cr. Dr. Cr. Cash 4,200 i Accounts Receivable 3,300 i Supplies 1,700 i 1 Equipment 10,736 i Accumulated Depreciation-Equipment 1,220 i Accounts Payable 2,400 i Unearned Service Revenue 600 440 Common Stock 9,576 i Retained Earnings 2,100 i Dividends 1,200 i Service Revenue 7,000 i Salaries and Wages Expense 1,400 600 Miscellaneous Expense 360 i Totals 22,896 22,896 Accumulated Depreciation-Equipment 1,220 i Accounts Payable 2,400 i Unearned Service Revenue 600 440 Common Stock 9,576 i Retained Earnings 2.100 i Dividends 1,200 i Service Revenue 7,000 i Salaries and Wages Expense 1,400 600 Miscellaneous Expense 360 i Totals 22,896 22,896 Supplies Expense 1,000 Depreciation Expense 244 Salaries and Wages Payable Totals 2,284 Net Income Totals Worksheet For the Month Ended March 31, 2022 Adjustments Adjusted Trial Balance Dr. Cr. Dr. Cr. i 4,200 i i i 3,300 i i 1,000 700 i i i 10,736 i i 244 i 1,464 i i 2,400 440 i i 160 i i i 9,576 i i i 2,100 i i 1,200 i i 440 i 7,440 600 i 2,000 i i i 360 i Income Statement Balance Sheet Dr. Cr. Dr. Cr. i i 4.200 i i 3,300 i i 700 i i 10,736 i i i i 1,464 i i i 2,400 i i i 160 i i i 9,576 i i i 2,100 i i 1,200 i i 7,440 i 2,000 i i i i 1,464 i i i 2,400 i i i 160 i i i 9,576 i i 2,100 i i 1.200 i i 7,440 i i 2,000 i i 360 i i i 1,000 i i 244 i i i i i i 600 3,604 7,440 20,136 16,300 3,836 i i 3.836 7,440 7,440 20,136 20,136 Riverbed Roofing Worksheet For the Month Ended March 31, 2022 Adjusted Trial Balance Income Statement Dr. Cr. Dr. Cr. 4,200 i i i 3,300 i i i 700 i i i 10,736 i i i i 1,464 i i i 2,400 i i i 160 i i i 9,576 i i i 2,100 i i 1,200 i i i i 7,440 i 7,440 2,000 i 2,000 i Riverbed Roofing Income Statement For the Month Ended March 31, 2022 Revenues Service Revenue 7,440 Expenses Salaries and Wages Expense $ 2,000 i Miscellaneous Expense 360 Supplies Expense 1,000 i Depreciation Expense 244 i Total Expenses 3,604 i Net Income / (Loss) ta 3,836 Riverbed Roofing Retained Earnings Statement For the Month Ended March 31, 2022 A Retained Earnings, March 1 2,100 Add A : Net Income / (Loss) 3,836 5,936 Less : Dividends 1,200 i Retained Earnings, March 31 A $ 4,736 Balance Sheet March 31, 2022 Assets nt Assets h $ 4,200 ounts Receivable 3,300 plies 700 Current Assets $ 8,200 rty, Plant and Equipment ipment 10,736 : Accumulated Depreciation Equipment 1,464 i 9,272 Assets $ 17,472 Liabilities and Stockholders' Equity nt Liabilities ounts Payable $ 2,400 earned Service Revenue 160 aries and Wages Payable 600 rty, Plant and Equipment 4 Lipment 10,736 : Accumulated Depreciation-Equipment 1,464 i 9,272 Assets $ 17,472 Liabilities and Stockholders' Equity nt Liabilities ounts Payable $ 2,400 earned Service Revenue 160 aries and Wages Payable 600 Current Liabilities $ 3.160 holders' Equity nmon Stock 9,576 ained Earnings 4,736 Stockholders' Equity 14,312 Liabilities and Stockholders' Equity $ 17,472 Journalize the adjusting entries from the adjustments columns of the worksheet. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Mar. Supplies Expense 1,000 31 Supplies 1,000 (To record adjusting entry for supplies.) Mar. 31 Depreciation Expense 244 Accumulated Depreciation-Equipment 244 (To record adjusting entry for depreciation.) Mar. 31 Unearned Service Revenue 440 UUDIO UT DA Service Revenue 440 (To record adjusting entry for unearned service revenue.) Mar. 31 Salaries and Wages Expense 600 Salaries and Wages Payable 600 (To record adjusting entry for salaries and wages expenses.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started