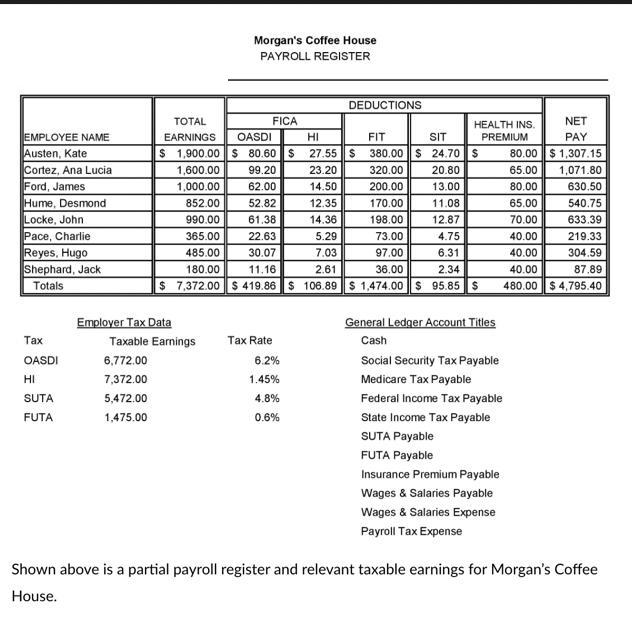

Journalize the employer's payroll tax expense for the pay period ending EMPLOYEE NAME Austen, Kate Cortez, Ana Lucia Ford, James Hume, Desmond Locke, John Pace,

Journalize the employer's payroll tax expense for the pay period ending

Journalize the employer's payroll tax expense for the pay period ending

EMPLOYEE NAME Austen, Kate Cortez, Ana Lucia Ford, James Hume, Desmond Locke, John Pace, Charlie Reyes, Hugo Shephard, Jack Totals Tax OASDI HI SUTA FUTA TOTAL EARNINGS Morgan's Coffee House PAYROLL REGISTER Employer Tax Data FICA HI 27.55 23.20 14.50 12.35 14.36 Taxable Earnings Tax Rate 6,772.00 6.2% 7,372.00 1.45% 5,472.00 4.8% 1,475.00 0.6% DEDUCTIONS OASDI FIT SIT $ 1,900.00 $ 80.60 $ 380.00 $ 24.70 $ 1,600.00 99.20 320.00 20.80 1,000.00 62.00 200.00 13.00 852.00 52.82 170.00 11.08 990.00 61.38 198.00 12.87 365.00 22.63 5.29 73.00 4.75 485.00 30.07 7.03 97.00 6.31 180.00 11.16 2.61 36.00 2.34 $ 7,372.00 $ 419.86 $ 106.89 $ 1,474.00 $ 95.85 $ HEALTH INS. PREMIUM $ General Ledger Account Titles Cash Social Security Tax Payable Medicare Tax Payable Federal Income Tax Payable State Income Tax Payable SUTA Payable FUTA Payable Insurance Premium Payable Wages & Salaries Payable Wages & Salaries Expense Payroll Tax Expense 80.00 65.00 80.00 65.00 70.00 NET PAY $1,307.15 1,071.80 630.50 540.75 633.39 219.33 304.59 87.89 40.00 40.00 40.00 480.00 $4,795.40 Shown above is a partial payroll register and relevant taxable earnings for Morgan's Coffee House.

Step by Step Solution

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Debit Credit Payroll Tax Ex...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started