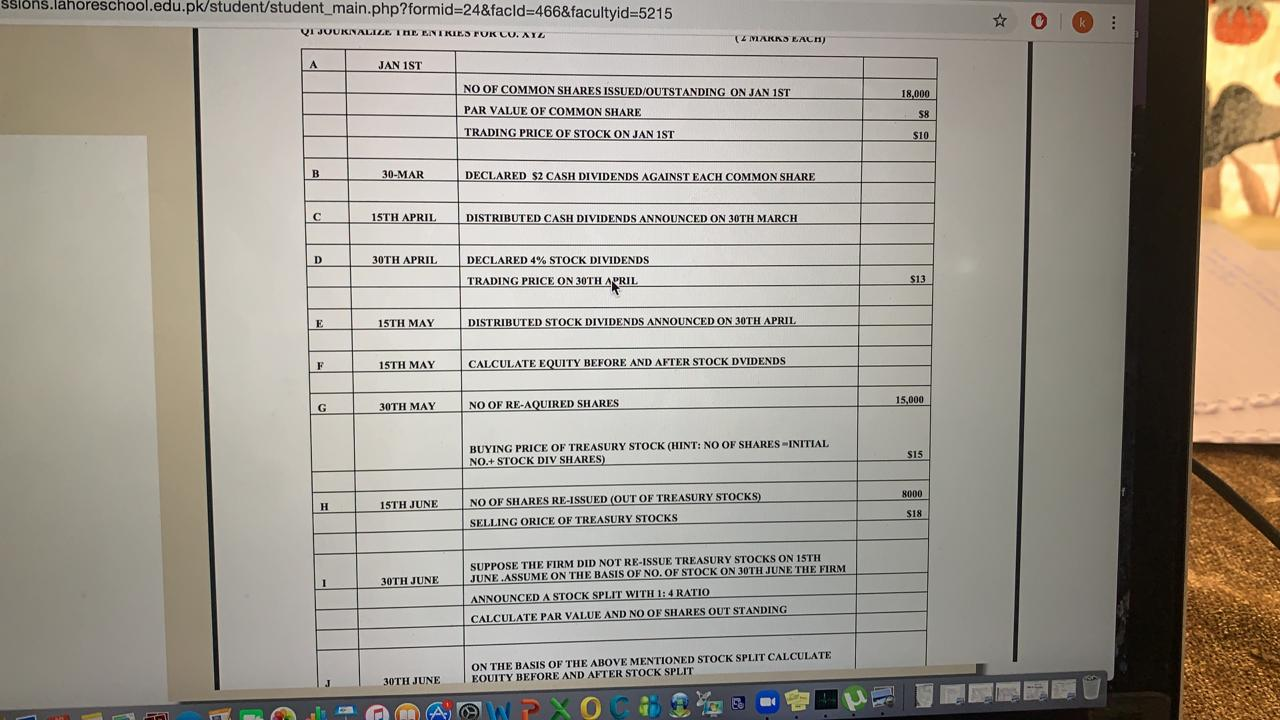

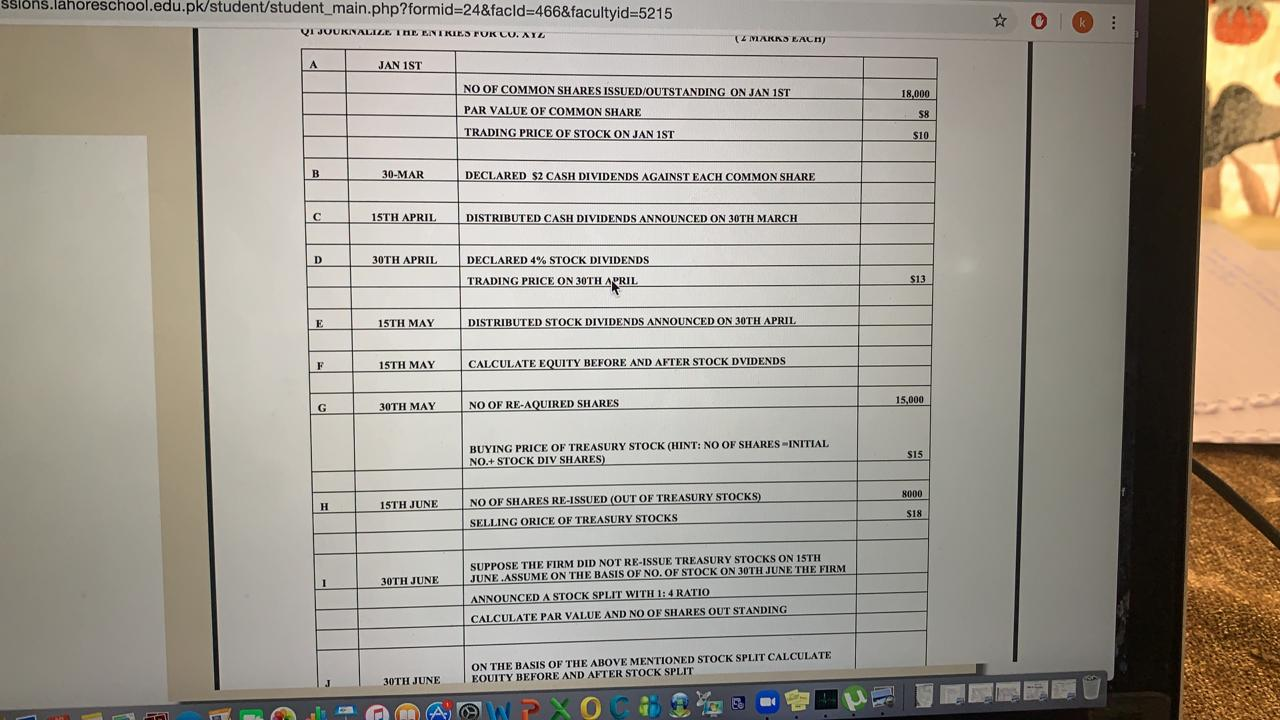

Journalize the following entries

ssions.lahoreschool.edu.pk/student/student_main.php?formid=24&facid=466&facultyid=5215 0 ... VI JOURNALIZE IN ENTRIES TUK LO. AYL (2 MARNS EACH) A JAN 1ST NO OF COMMON SHARES ISSUED/OUTSTANDING ON JAN 1ST 18,000 PAR VALUE OF COMMON SHARE S8 TRADING PRICE OF STOCK ON JAN 1ST $10 30-MAR DECLARED $2 CASH DIVIDENDS AGAINST EACH COMMON SHARE 15TH APRIL DISTRIBUTED CASH DIVIDENDS ANNOUNCED ON 30TH MARCH D 30TH APRIL DECLARED 4% STOCK DIVIDENDS TRADING PRICE ON 30TH APRIL $13 E 15TH MAY DISTRIBUTED STOCK DIVIDENDS ANNOUNCED ON 30TH APRIL F 15TH MAY CALCULATE EQUITY BEFORE AND AFTER STOCK DVIDENDS 15,000 G 30TH MAY NO OF RE-AQUIRED SHARES BUYING PRICE OF TREASURY STOCK (HINT: NO OF SHARES INITIAL NO.+ STOCK DIV SHARES) $15 8000 H 15TH JUNE NO OF SHARES RE-ISSUED OUT OF TREASURY STOCKS) SELLING ORICE OF TREASURY STOCKS S18 SUPPOSE THE FIRM DID NOT RE-ISSUE TREASURY STOCKS ON 15TH JUNE ASSUME ON THE BASIS OF NO. OF STOCK ON 30TH JUNE THE FIRM I 30TH JUNE ANNOUNCED A STOCK SPLIT WITH 1:4 RATIO CALCULATE PAR VALUE AND NO OF SHARES OUTSTANDING ON THE BASIS OF THE ABOVE MENTIONED STOCK SPLIT CALCULATE EQUITY BEFORE AND AFTER STOCK SPLIT 30TH JUNE XO GO ssions.lahoreschool.edu.pk/student/student_main.php?formid=24&facid=466&facultyid=5215 0 ... VI JOURNALIZE IN ENTRIES TUK LO. AYL (2 MARNS EACH) A JAN 1ST NO OF COMMON SHARES ISSUED/OUTSTANDING ON JAN 1ST 18,000 PAR VALUE OF COMMON SHARE S8 TRADING PRICE OF STOCK ON JAN 1ST $10 30-MAR DECLARED $2 CASH DIVIDENDS AGAINST EACH COMMON SHARE 15TH APRIL DISTRIBUTED CASH DIVIDENDS ANNOUNCED ON 30TH MARCH D 30TH APRIL DECLARED 4% STOCK DIVIDENDS TRADING PRICE ON 30TH APRIL $13 E 15TH MAY DISTRIBUTED STOCK DIVIDENDS ANNOUNCED ON 30TH APRIL F 15TH MAY CALCULATE EQUITY BEFORE AND AFTER STOCK DVIDENDS 15,000 G 30TH MAY NO OF RE-AQUIRED SHARES BUYING PRICE OF TREASURY STOCK (HINT: NO OF SHARES INITIAL NO.+ STOCK DIV SHARES) $15 8000 H 15TH JUNE NO OF SHARES RE-ISSUED OUT OF TREASURY STOCKS) SELLING ORICE OF TREASURY STOCKS S18 SUPPOSE THE FIRM DID NOT RE-ISSUE TREASURY STOCKS ON 15TH JUNE ASSUME ON THE BASIS OF NO. OF STOCK ON 30TH JUNE THE FIRM I 30TH JUNE ANNOUNCED A STOCK SPLIT WITH 1:4 RATIO CALCULATE PAR VALUE AND NO OF SHARES OUTSTANDING ON THE BASIS OF THE ABOVE MENTIONED STOCK SPLIT CALCULATE EQUITY BEFORE AND AFTER STOCK SPLIT 30TH JUNE XO GO