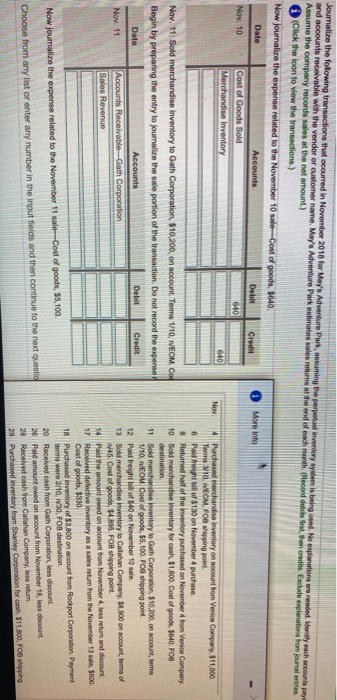

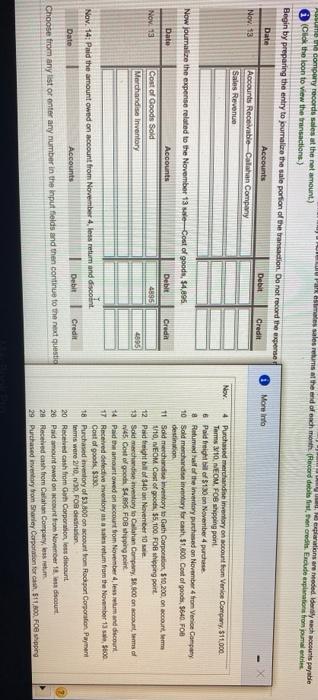

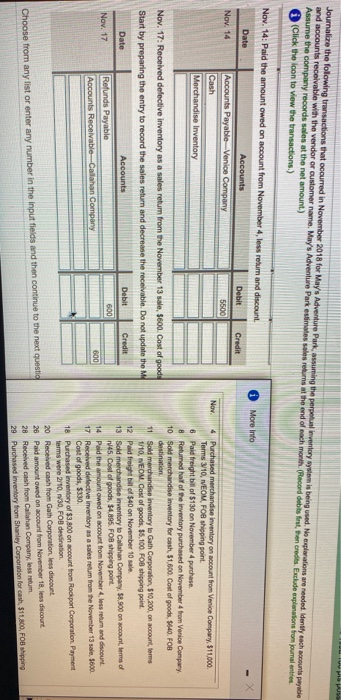

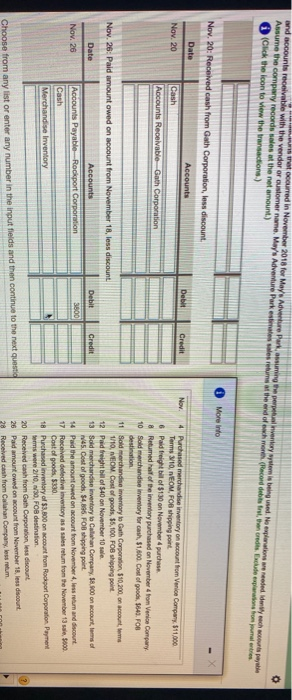

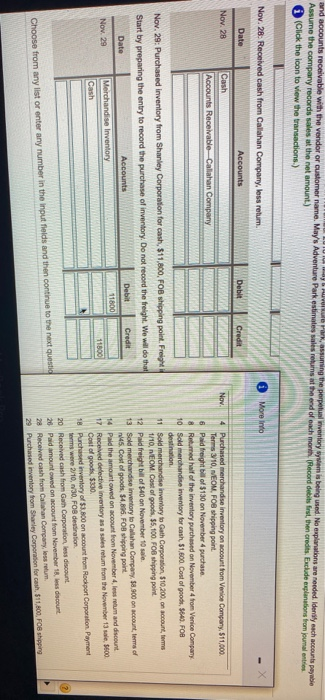

Journalize the following transactions that occurred in November 2016 for May's Adventure Park, suming the perpentory system is being used. No explanations are needed. Identity each accounts paye and accounts receivable with the vendor or customer name. May's Adventure Park estimates sales returns the end of each month (Record debts first, the credits Exclude explanations from Journal entre Assume the company records sales at the net amount) (Click the loon to view the transactions.) Now journalize the expense related to the November 10 sale--Cost of goods. 8640 Date Accounts Debit More Info Credit Nov. 10 Cost of Goods Sold 640 Merchandise Inventory 640 Nov Purchased merchandise inventory on account from Venice Company, $11.000 Terms 10. IEOM, FOB shipping point 6 Pald freight bill of $130 on November 4 purchase 8 Returned half of the inventory purchased on November 4 from Venice Company Nov. 11: Sold merchandise Inventory to Gath Corporation, $10,200, on account. Terms 1/10, NEOM.CO 10 Sold merchandise Inventory for cash $1,600. Cost of goods, 3640 FOB destination Begin by preparing the entry to joumalize the sale portion of the transaction. Do not record the expense 11 Sold merchandise ventory to Gath Corporation, $10,200, on account, terme 1/10, NEOM. Cost of goods, 56,100. FOB shipping point Date Accounts Debit Credit 12 Paid freight of 540 on November 10 sale No. 11 Accounts Receivable Gath Corporation 13 Sold merchandise Inventory to Calahan Company, 58,900 on account, terms of 145. Cost of goods, $4,896. FOB shipping point Sales Revenue 14 Pad the amount owed on account from November 4, loss return and discount 17 Received defective Inventory as a sales retum from the November 13 sale, $800. Cost of goods, $330. 18 Purchased Inventory of 3.800 on account from Rockport Corporation Payment terms were 2/10, W30, FOB destination Now journalize the expense related to the November 11 saler-Cost of goods, $5,100 20 Received cash from Gath Corporation, less discount 26 Paid amount owed on account from November 18, less discount. Choose from any list or enter any number in the input fields and then continue to the next questi 28 Received cash from Calahan Company loss return. 29 Purchased inventory from Shanley Corporation for cash, $11,800, FOB shipping e company records sales at the net amount.) PAR les sales retums at the end of each month Record debil fest the credits Exclude explanations from journals Uplorations are needed. Identity each accounts payable (Click the loon to view the transactions.) Begin by preparing the entry to journaliure the sale portion of the transaction. Do not record the expenser Date Accounts More Info Debit Credit Nev: 13 Accounts Receivable-Calahan Company Sales Revenue Nov. 4 Purchased merchandise inventory on account from Venice Company, $11.000 Terms 10. NEOM, FOB shipping point 6 Paid freight of $130 on November 4 purchase 8 Relumediff the inventory purchased on November 4 from Venice Company Now journaline the expense related to the November 13 saleCost of goods, 54,895 10 Sold merchandise intory for cash $1,600. Cost of goods, 5640 FOB destination Date Accounts Debit Credit 11 Sold merchandise inventory to Gath Corporation, $10,200, on account, Nov. 13 Cost of Goods Sold 1/10, NEOM. Cost of goods, $5,100. FOB shipping point 4895 12 Paid freight bill of $40 on November 10 sale. Merchandise Inventory 4895 13 Sold merchandise inventory to Callahan Company, 58,900 on account, terms of 1/45. Cost of goods. 54,896. FOB shipping point 14 Paid the amount owed on account from November 4, less return and discount 17 Received defective inventory as a sales return from the November 13, 5600 Cost of goods $330 Nov. 14: Paid the amount owed on account from November 4, less return and discot 18 Purchased inventory of $3,800 on account from Rockport Corporation Payment | Debit Credit terms were 2/10, 1/30, FOB destination Accounts Date 20 Received cash from Goh Corporation, loss discount 26 Paid amount owed on account from November 18, loss discount Choose from any list or enter any number in the input fields and then continue to the next questid 28 Received cash from Callahan Company, less retum 29 Purchased Inventory from Shanley Corporation for cash. 511,800, FB shipping Journalize the following transactions that occurred in November 2018 for May's Adventure Park, assuming the perpetual inventory system is being used. No explorations are needed. Identity each accounts payable and accounts receivable with the vendor or customer name. May's Adventure Park estimates sales returns at the end of each month (Record debts first, then credits. Exclude explanations from journal entries Assume the company records sales at the net amount) (Click the icon to view the transactions.) Nov. 14: Paid the amount owed on account from November 4, less return and discount More Info Date Debit Credit Nov. 14 5500 Accounts Accounts Payable Venice Company Cash Merchandise Inventory Nov Nov. 17: Received defective inventory as a sales retum from the November 13 sale $600. Cost of goods Start by preparing the entry to record the sales return and decrease the receivable. Do not update the Date Accounts Debit Credit Nov. 17 Refunds Payable 600 Accounts Receivable--Callahan Company 600 4 Purchased merchandise inventory on account from Venice Company, 511,000 Terms 310, IVEOM, FOB shipping point 6 Paid freight bill of $130 on November 4 purchase. 8 Retumedal of the inventory purchased on November 4 from Venice Company 10 Sold merchandise inventory for cash, S1,600. Cost of goods $540FOB destination 11 Sold merchandise inventory to Gath Corporation, $10.200, on account, torms 1/10, NEOM. Cost of goods, 55,100. FOB shipping point 12 Paid freight of $40 on November 10 sale 13 Sold merchandise inventory to Callahan Company, 58,900 on account terms of 145. Cost of goods, 34.895. FOB shipping point 14 Pald the amount owed on account from November 4, less return and discount 17 Received defective inventory as a sales rebum from the November 13, 5600 Cost of goods, 5330 18 Purchased inventory of $3,800 on account from Rockport Corporation Payment terms were 2/10,30, FOB destination 20 Received cash from Gath Corporation, les discount 26 Paid amount owed on account from November 18, less discount 28 Received cash from Callahan Company loss retum 29 Purchased Inventory from Shanley Corporation for cash. 511,800, FOB shipping Choose from any list or enter any number in the input fields and then continue to the next questid wat occurred in November 2016 for May's Adventure Parking the perpetual inventory system is being used. No explanations we needed yacht and accounts receivable with the vendor or customer name, May's Adventure Park estimates sales retum at the end of where (ecord debts fest, then tres deten fontes Assume the company records soles at the net amount.) Click the icon to view the transactions) More Info Date Nov. 20: Received cash from Gath Corporation, les discount Accounts Nov. 20 Cash Accounts Receivable Gath Corporation Debit Credit Nov. Nov. 26: Paid amount owed on coount from November 18, less discount Date Debit Credit 4 Purchased merchandise inventory on account from Venice Company: $11,000 Terms 10, NEOM, FOB shipping point 6 Pald freight bill of $130 on November purchase & Remed half of the inventory purchased on November 4 from Venice Company 10 Sold merchandise Inventory for $1.800. Cost of goods. 1543. FOB destination 11 Sold merchandise inventory Gath Corporation, $10.200, on account, 1/10, NEOM. Cost of goods, 36,100. FOB shipping point 12 Paid freight bill of $40 on November 10 sale. 13 Sold merchandise inventory to Callahan Company, 58.800 on account of 45. Cost of goods, $4,895. FOB shipping point 14 Pad the amount owed an account from November 4, less return and discount 17 Received defective inventory as a sales return from the November 13 000 Cost of goods, $330. 18 Purchased inventory of $3.300 on account from Rockport Corporation Payment terms were 2/10, FOB destination 20 Received cash from Gath Corporation, less discount 26 Paid amount owed on account from November 18, les discount 28 Received cash from Callahan Company, less retum Nov. 26 Accounts Accounts Payable Rockport Corporation Cash Merchandise Inventory 3800 Choose from any list or enter any number in the input fields and then continue to the next questi GP, assuming the perpetual entory wyem is being used. No explanations are needed. Identity each accounts payable and accounts receivable with the vendor or customer name. May's Adventure Park estimates sales returns at the end of each month Record debits first, the credits. Exclude explanations from journal antes Assume the company records sales at the net amount) (Click the icon to view the transactions.) Nov. 28. Received cash from Callahan Company loss retum More Info Date Accounts Debit Credit Nov. 28 Nov Cash Accounts Receivable Callahan Company Nov. 29: Purchased Inventory from Shanley Corporation for cash, $11,800, FOB shipping point. Freigh Start by preparing the entry to record the purchase of inventory. Do not record the freight. We will do that Date Accounts Debit Credit Nov. 29 Merchandise Inventory 11800 Cash 11800 4 Purchased merchandise inventory on account from Venice Company, $11,000 Terms 310, VEOM, FOB shipping point 6 Paid freight of $130 on November 4 purchase 8 Returned half of the inventory purchased on November 4 from Venice Company 10 Sold merchandise inventory for cash $1,600. Cost of goods, 5840. FOB destination 11 Sold merchandise inventory to Gath Corporation, $10.200, on account forms 1/10, NEOM. Cost of goods. 55,100. FOB shipping point 12 Paid freight bill of $40 on November 10 sale 13 Sold merchandise inventory to Callahan Company, 58,800 on account, terms of 45. Cost of goods, S4,886. FOB shipping point 14 Paid the amount owed on account from November 4, less retum and discount 17 Received deflective Inventory as a sales retum from the November 13,800 Cost of goods $300 18 Purchase inventory of $3.800 on account from Rockport Corporation Payment terms were 2/10, 30, FOB destination 20 Received cash from oth Corporation, les discount 26 Paid amount owed on account from November 18 less discount 28 Received cash from Calhan Company, less retum 29 Purchased inventory from Shanley Corporation for cash. 511,800, FOB shipping Choose from any list or enter any number in the input fields and then continue to the next questid