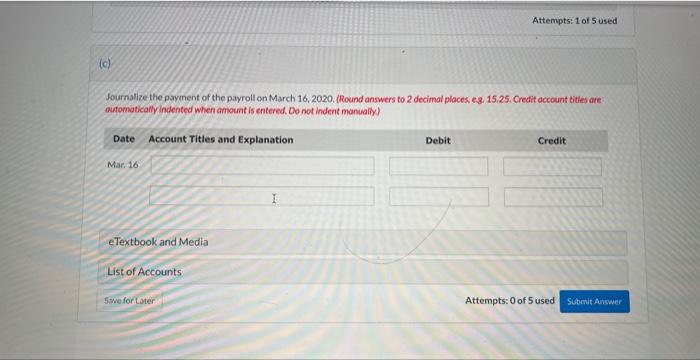

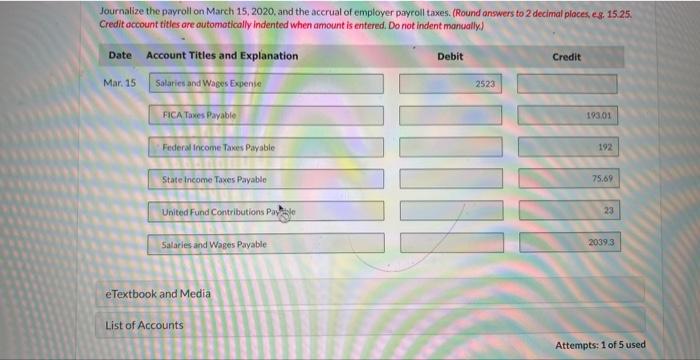

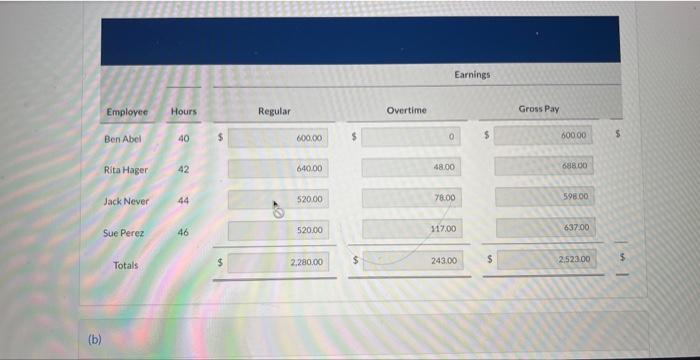

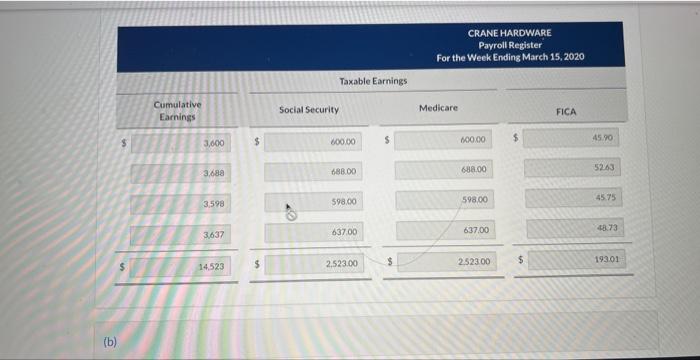

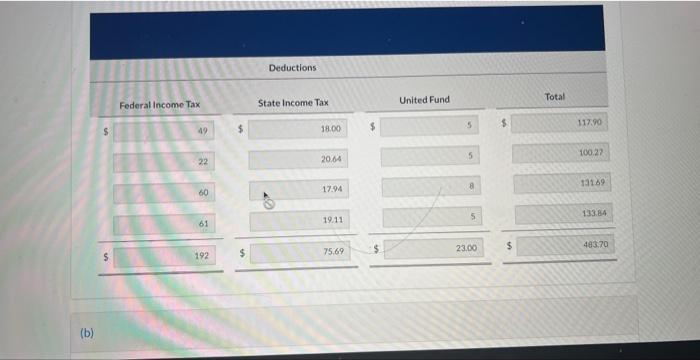

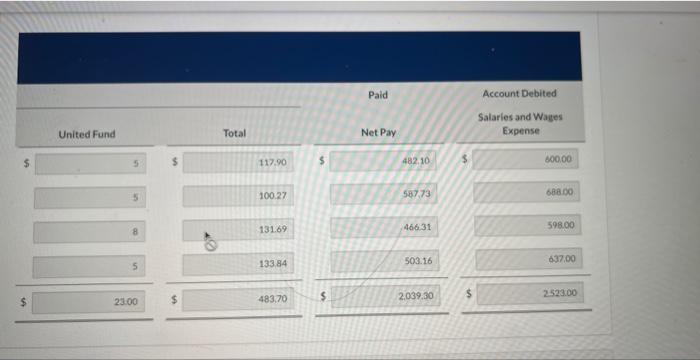

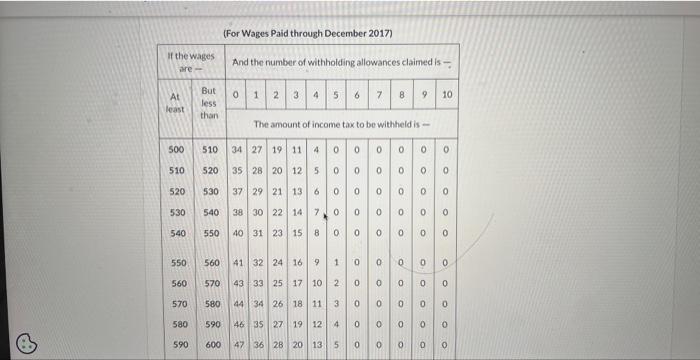

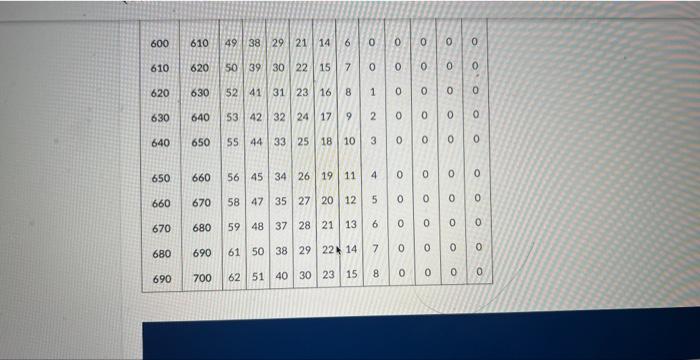

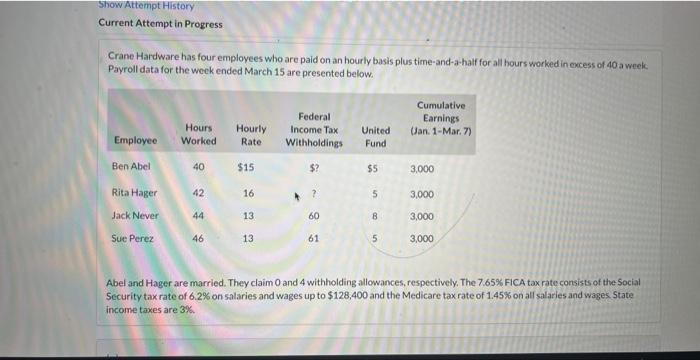

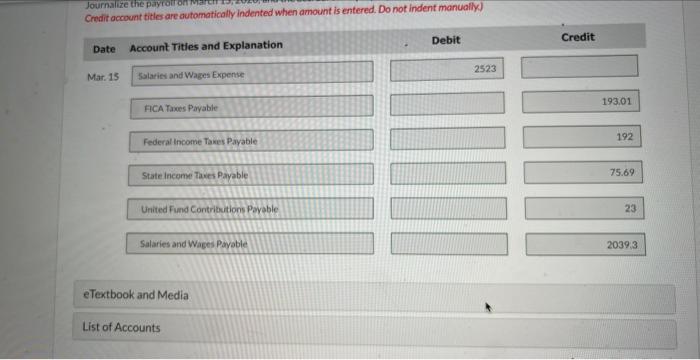

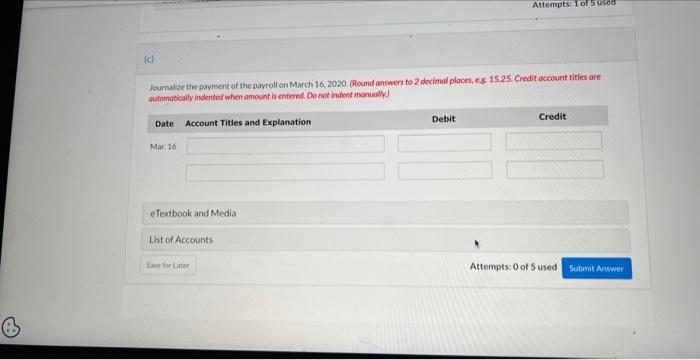

Journalize the payment of the payroll on March 16, 2020. (Round answers to 2 decimal places, es. 15.25, Credit account titles are oufomatically indented when amount is entered. Do not indent manualiy) Journalize the payroll on March 15, 2020, and the accrual of employer payeoll taxes. (Round answers to 2 decimal ploces, eg. 1525. Credit dccount titles are outomotically indented when amount is entered, Do not indent manually. Earnings (b) CRANE HARDWARE Payroll Register For the Week Ending March 15, 2020 Taxable Earnings (b) Deductions- (b) Paid Account Debited Salaries and Wages IEne Mafaman Daid theavah Raramber 3 nd 71 \begin{tabular}{|l|l|l|l|l|l|l|l|l|l|l|l|l|l|} \hline 600 & 610 & 49 & 38 & 29 & 21 & 14 & 6 & 0 & 0 & 0 & 0 & 0 \\ 610 & 620 & 50 & 39 & 30 & 22 & 15 & 7 & 0 & 0 & 0 & 0 & 0 \\ \hline 620 & 630 & 52 & 41 & 31 & 23 & 16 & 8 & 1 & 0 & 0 & 0 & 0 \\ 630 & 640 & 53 & 42 & 32 & 24 & 17 & 9 & 2 & 0 & 0 & 0 & 0 \\ \hline 640 & 650 & 55 & 44 & 33 & 25 & 18 & 10 & 3 & 0 & 0 & 0 & 0 \\ 650 & 660 & 56 & 45 & 34 & 26 & 19 & 11 & 4 & 0 & 0 & 0 & 0 \\ 660 & 670 & 58 & 47 & 35 & 27 & 20 & 12 & 5 & 0 & 0 & 0 & 0 \\ 670 & 680 & 59 & 48 & 37 & 28 & 21 & 13 & 6 & 0 & 0 & 0 & 0 \\ 680 & 690 & 61 & 50 & 38 & 29 & 22 & 14 & 7 & 0 & 0 & 0 & 0 \\ 690 & 700 & 62 & 51 & 40 & 30 & 23 & 15 & 8 & 0 & 0 & 0 & 0 \\ \hline \end{tabular} Current Attempt in Progress Crane Hardware has four employees who are paid on an hourly basis plus time-and-a half for all hours worked in excess of 40 a week Payroll data for the week ended March 15 are presented below. Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128,400 and the Medicare tax rate of 1.45% on all salaries and wages. State income taxes are 3%. redit account titles are automatically indented when amount is entered. Do not indent manually) lournalize the payment of the payroll on March 16, 2020. (Round answers to 2 decinal places, es. 15.25. Credit occount titles are automatically indented when amount is entered. Do not indent manually