Question

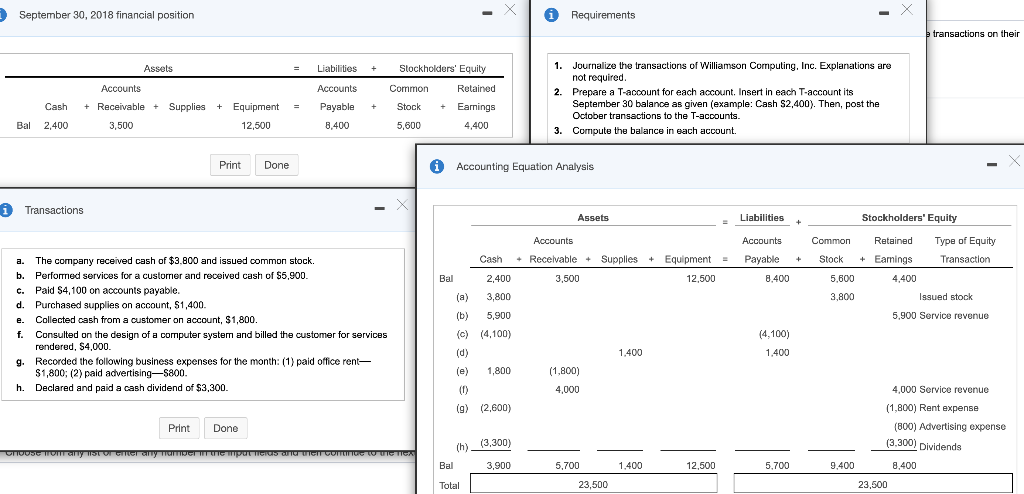

Journalize the transactions above and Prepare T-Accounts for each account. Insert in each T-account its SeptemberSeptember 3030 balance as given (example: Cash $ 2 comma

Journalize the transactions above and

Prepare T-Accounts for each account. Insert in each T-account its

SeptemberSeptember

3030

balance as given (example: Cash

$ 2 comma 400$2,400).

Then, post the

OctoberOctober

transactions to the T-accounts. Compute the balance in each account.

Begin by entering the appropriate beginning balances and posting transactions (a) through (h). Label each balance and transaction with the appropriate posting reference. Finally, label and calculate each ending balance. (For accounts with a zero beginning balance, do not enter a "0" or select the "Bal" reference.)

September 30, 2018 financial position Requirements transactions on their Slockholders' Equity not reauise ansactions of Williamson Computing, Inc. Explanations are Assets Liabilities + Retained Accounts Accounts Common 2. Prepare a T-account for each account. Insert each T-account its September 30 balance as given (example: Cash S2,400). Then, post the Receivable Cash Supplies + Equipment Payable Stock Eanings + + October transactions to the T-accounts. Bal 2,400 12.500 8.400 4,400 3.500 5,600 each account 3. Compute the balance i Print Done Accounting Equation Analysis i Transactions Stockholders' Equity Assets Liabilities Retained Accounts Common Type of Equity Accounts $3.800 and issued common stock. Equipment Cash Recelvable Supplies + Payable Stock +Eaminas Transaction The company received cash + a. Performed services for a customer and received cash of $5.900. h 3,500 12.500 8.400 Ba 2.400 5,600 4.400 Paid $4,100 on accounts payable C. (a 3.800 3,800 Issued stock 1 400 account, 5.900 Service revenue account. $1,800 (b) 5,900 Collected (c (4,100) (4.100) Consulted on the design of a computer system and billed the customer for services rendered, $4,000. 1.400 1.400 (d) Recorded the following business expenses for the month: (1) paid office rent- $1,800; (2) paid advertising-S800. 9 (1,800) (e) 1,800 h. Declared and paid a cash dividend of $3,300. 4.000 4,000 Service revenue ) .800) Rent expense (g) (2,600) (800) Advertising expense ,300) pividends Print Done (3,300) (h hoos mom eny ist oi Gmer any mamGNmNiG mpat Meidis and iehomina 12.500 5.700 8.400 Bal 3.900 5.700 1.400 400 23,500 23,500 TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started