Answered step by step

Verified Expert Solution

Question

1 Approved Answer

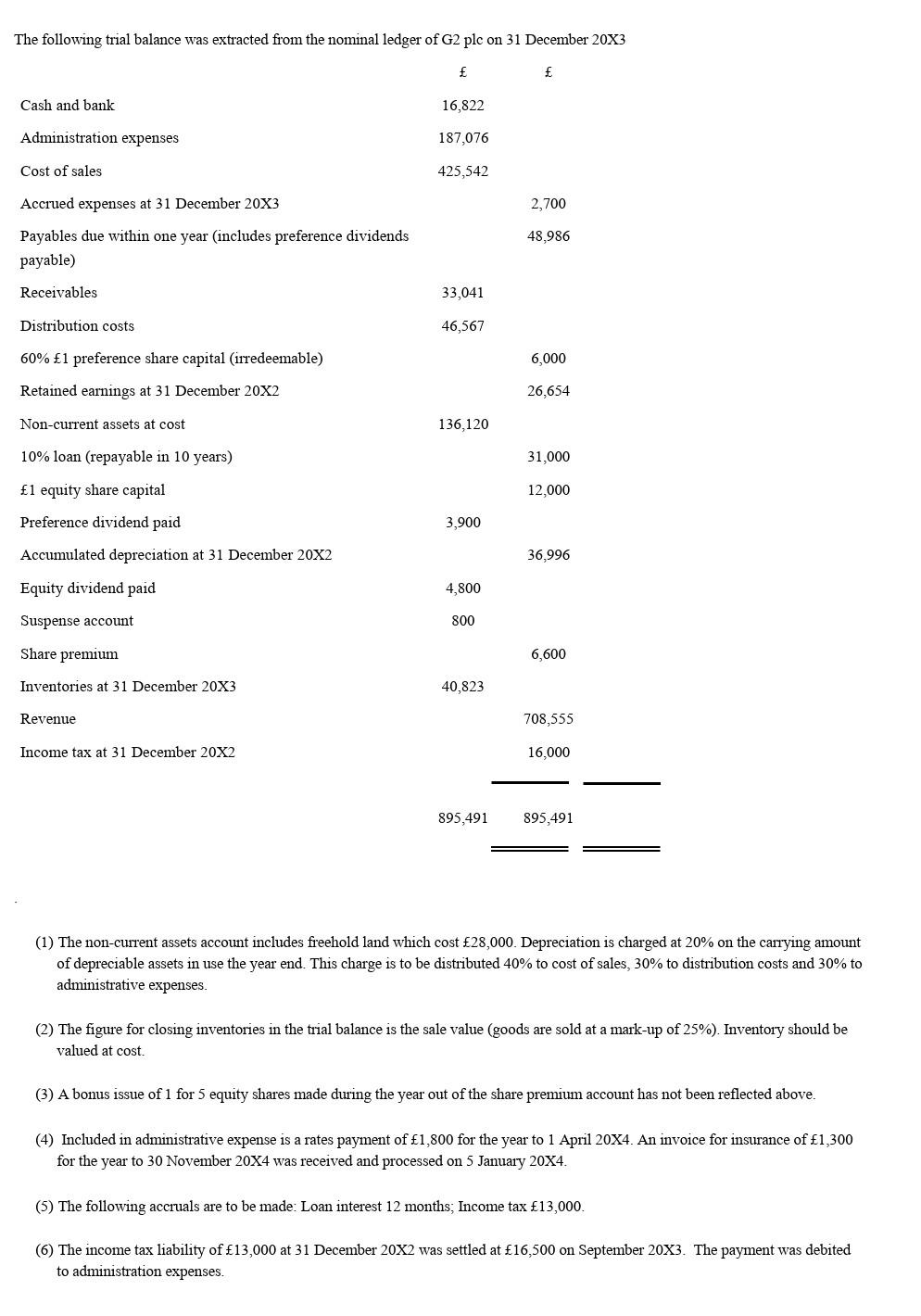

Journalize the transactions and make the profit or loss statement The following trial balance was extracted from the nominal ledger of G2 plc on 31

Journalize the transactions and make the profit or loss statement

The following trial balance was extracted from the nominal ledger of G2 plc on 31 December 20X3 (1) The non-current assets account includes freehold land which cost 28,000. Depreciation is charged at 20% on the carrying amount of depreciable assets in use the year end. This charge is to be distributed 40% to cost of sales, 30% to distribution costs and 30% to administrative expenses. (2) The figure for closing inventories in the trial balance is the sale value (goods are sold at a mark-up of 25\%). Inventory should be valued at cost. (3) A bonus issue of 1 for 5 equity shares made during the year out of the share premium account has not been reflected above. (4) Included in administrative expense is a rates payment of 1,800 for the year to 1 April 20X4. An invoice for insurance of 1,300 for the year to 30 November 20X4 was received and processed on 5 January 20X4. (5) The following accruals are to be made: Loan interest 12 months; Income tax 13,000. (6) The income tax liability of 13,000 at 31 December 20X2 was settled at 16,500 on September 20X3. The payment was debited to administration expensesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started