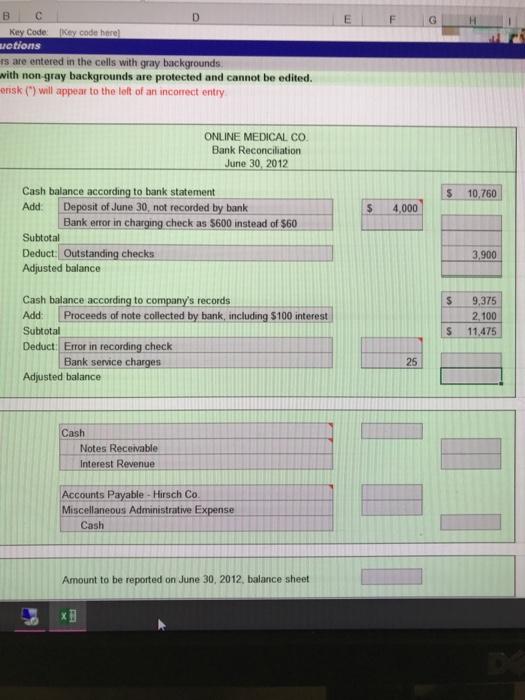

Journalize the transactions. ed 1,400 PR 8-3A Bank reconciliation and entries The cash account for Online Medical Co. at June 30, 2012, indicated a balance of $9,375. The bank statement indicated a balance of $10,760 on June 30, 2012. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: a. Checks outstanding totaled $3,900. b. A deposit of $4,000, representing receipts of June 30, had been made too late to ap- pear on the bank statement. c. The bank had collected $2,100 on a note left for collection. The face of the note was $2,000 d. A check for $550 returned with the statement had been incorrectly recorded by Online Medical Co. as $500. The check was for the payment of an obligation to Hirsch Co. for the purchase on account. e. A check drawn for $60 had been erroneously charged by the bank as $600. f. Bank service charges for June amounted to $25. Instructions 1. Prepare a bank reconciliation. 2. Journalize the necessary entries. The accounts have not been closed. 3. If a balance sheet were prepared for Online Medical Co. on June 30, 2012, what amount should be reported as cash? PR 8-4A Bank reconciliation and entries The cash account for Brayn Bike coat Mu1 2012 edicated ho 1095 B E F C Key Code: keycode here setions s are entered in the cells with gray backgrounds. with non-gray backgrounds are protected and cannot be edited. onsk (") will appear to the left of an incorrect entry $ 10,760 ONLINE MEDICAL CO Bank Reconciliation June 30, 2012 Cash balance according to bank statement Add Deposit of June 30, not recorded by bank Bank errot in charging check as 5600 instead of $60 Subtotal Deduct: Outstanding checks Adjusted balance 4,000 3,900 $ 9,375 2,100 11.475 $ Cash balance according to company's records Add Proceeds of note collected by bank, including S100 interest Subtotal Deduct: Error in recording check Bank service charges Adjusted balance 25 Cash Notes Receivable Interest Revenue Accounts Payable - Hirsch Co. Miscellaneous Administrative Expense Cash Amount to be reported on June 30, 2012, balance sheet