Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Journalize transaction and FIFO method Q2: March transactions for Tribeca Company as follows; March 3: Purchased 500 units of inventory for $12,500, on credit terms

Journalize transaction and FIFO method

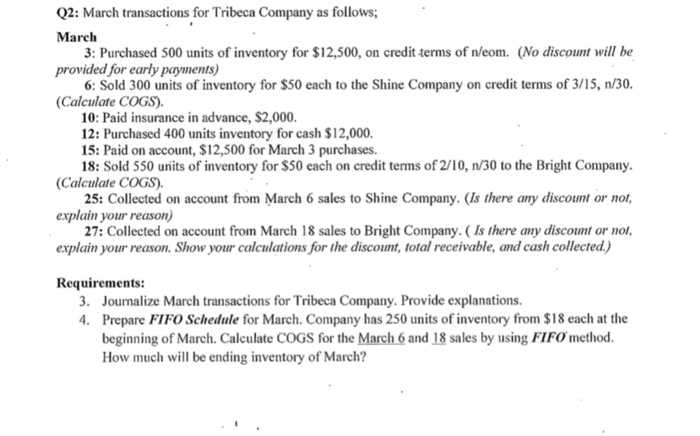

Q2: March transactions for Tribeca Company as follows; March 3: Purchased 500 units of inventory for $12,500, on credit terms of n/eom. (No discount will be provided for early payments) 6: Sold 300 units of inventory for $50 each to the Shine Company on credit terms of 3/15, n/30. (Calculate COGS). 10: Paid insurance in advance, $2,000. 12: Purchased 400 units inventory for cash $12,000. 15: Paid on account, $12,500 for March 3 purchases. 18: Sold 550 units of inventory for $50 each on credit terms of 2/10, n/30 to the Bright Company. (Calculate COGS). 25: Collected on account from March 6 sales to Shine Company. (Is there any discount or not, explain your reason) 27: Collected on account from March 18 sales to Bright Company. Is there any discount or not, explain your reason. Show your calculations for the discount, total receivable, and cash collected.) Requirements: 3. Journalize March transactions for Tribeca Company. Provide explanations. 4. Prepare FIFO Schedule for March. Company has 250 units of inventory from $18 each at the beginning of March. Calculate COGS for the March 6 and 18 sales by using FIFO method. How much will be ending inventory of March Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started