Answered step by step

Verified Expert Solution

Question

1 Approved Answer

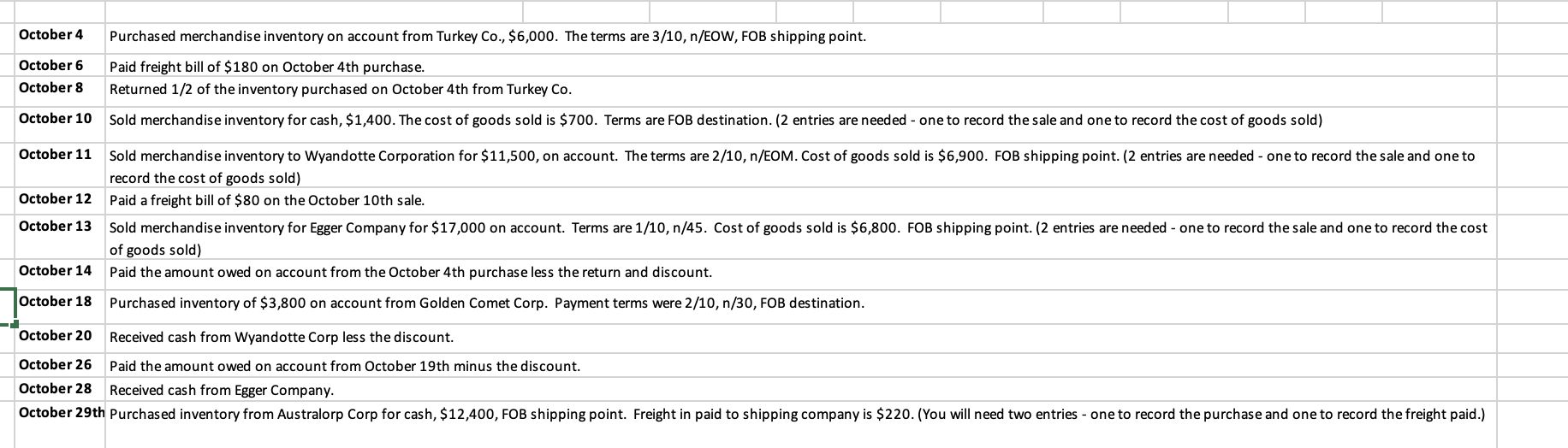

Journalizethe following transactions for Spinning Wheel. You do not need to provide explanations. Use formulas whenever possible to calculate the discount amounts. begin{tabular}{|c|c|c|} hline October

Journalizethe following transactions for Spinning Wheel. You do not need to provide explanations. Use formulas whenever possible to calculate the discount amounts.

\begin{tabular}{|c|c|c|} \hline October 4 & \multicolumn{2}{|l|}{ Purchased merchandise inventory on account from Turkey Co., $6,000. The terms are 3/10, n/EOW, FOB shipping point. } \\ \hline October 6 & \multicolumn{2}{|l|}{ Paid freight bill of $180 on October 4 th purchase. } \\ \hline October 8 & \multicolumn{2}{|l|}{ Returned 1/2 of the inventory purchased on October 4 th from Turkey Co. } \\ \hline October 10 & \multicolumn{2}{|c|}{ Sold merchandise inventory for cash, $1,400. The cost of goods sold is $700. Terms are FOB destination. (2 entries are needed - one to record the sale and one to record the cost of goods sold) } \\ \hline October 11 & \\ \hline October 12 & \multicolumn{2}{|l|}{ Paid a freight bill of $80 on the October 10 th sale. } \\ \hline October 13 & \\ \hline October 14 & \multicolumn{2}{|l|}{ Paid the amount owed on account from the October 4 th purchase less the return and discount. } \\ \hline October 18 & \multicolumn{2}{|l|}{ Purchased inventory of $3,800 on account from Golden Comet Corp. Payment terms were 2/10,n/30, FOB destination. } \\ \hline October 20 & \multicolumn{2}{|l|}{ Received cash from Wyandotte Corp less the discount. } \\ \hline October 26 & \multicolumn{2}{|l|}{ Paid the amount owed on account from October 19th minus the discount. } \\ \hline October 28 & \multicolumn{2}{|l|}{ Received cash from Egger Company. } \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|} \hline October 4 & \multicolumn{2}{|l|}{ Purchased merchandise inventory on account from Turkey Co., $6,000. The terms are 3/10, n/EOW, FOB shipping point. } \\ \hline October 6 & \multicolumn{2}{|l|}{ Paid freight bill of $180 on October 4 th purchase. } \\ \hline October 8 & \multicolumn{2}{|l|}{ Returned 1/2 of the inventory purchased on October 4 th from Turkey Co. } \\ \hline October 10 & \multicolumn{2}{|c|}{ Sold merchandise inventory for cash, $1,400. The cost of goods sold is $700. Terms are FOB destination. (2 entries are needed - one to record the sale and one to record the cost of goods sold) } \\ \hline October 11 & \\ \hline October 12 & \multicolumn{2}{|l|}{ Paid a freight bill of $80 on the October 10 th sale. } \\ \hline October 13 & \\ \hline October 14 & \multicolumn{2}{|l|}{ Paid the amount owed on account from the October 4 th purchase less the return and discount. } \\ \hline October 18 & \multicolumn{2}{|l|}{ Purchased inventory of $3,800 on account from Golden Comet Corp. Payment terms were 2/10,n/30, FOB destination. } \\ \hline October 20 & \multicolumn{2}{|l|}{ Received cash from Wyandotte Corp less the discount. } \\ \hline October 26 & \multicolumn{2}{|l|}{ Paid the amount owed on account from October 19th minus the discount. } \\ \hline October 28 & \multicolumn{2}{|l|}{ Received cash from Egger Company. } \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started