Answered step by step

Verified Expert Solution

Question

1 Approved Answer

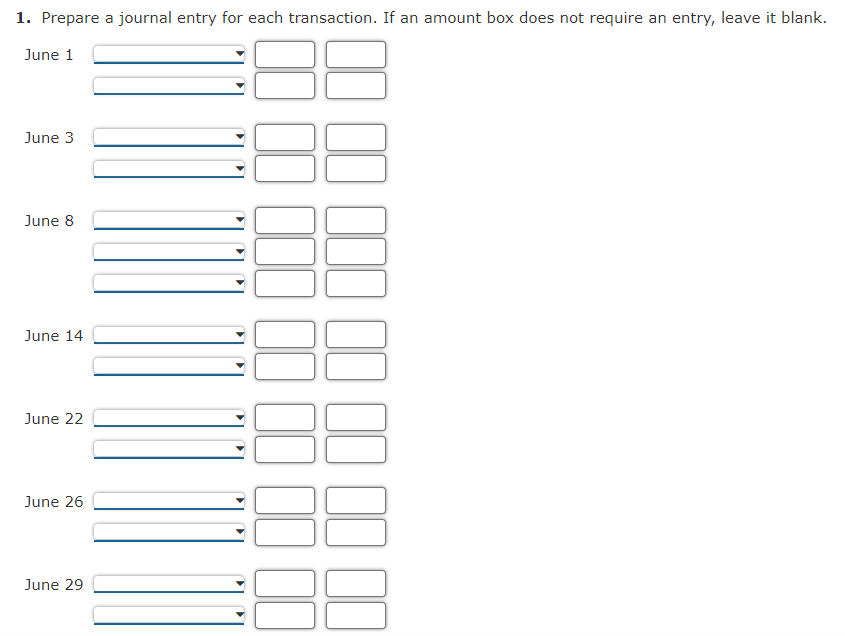

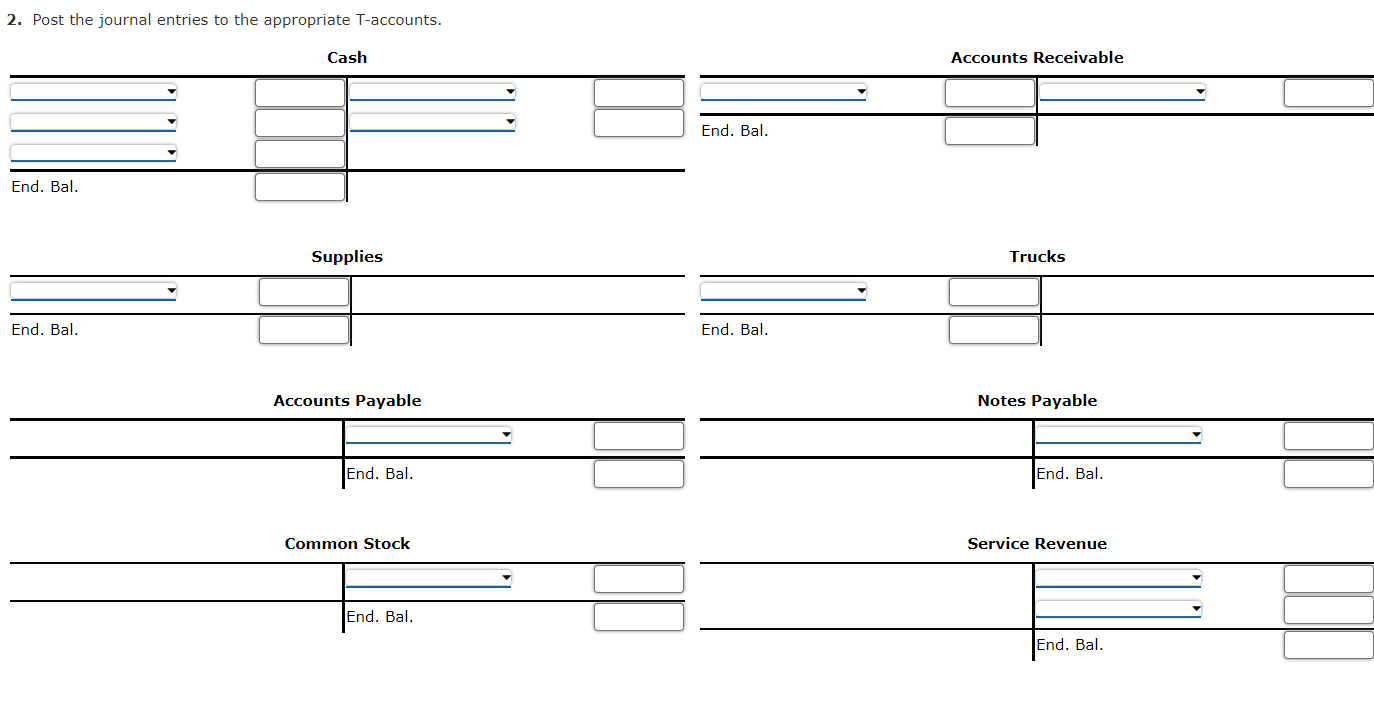

Journalizing and Posting Transactions Cincinnati Painting Service Inc. specializes in painting houses. During June, its first month of operations, Cincinnati Painting engaged in the following

Journalizing and Posting Transactions

Cincinnati Painting Service Inc. specializes in painting houses. During June, its first month of operations, Cincinnati Painting engaged in the following transactions:

| June. 1 | Issued common stock for $25,000. | |

| 3 | Purchased painting supplies from River City Supply for $1,675 on credit. | |

| 8 | Purchased a used truck from Hamilton Used Car Sales for $13,700, paying $1,500 down and agreeing to pay the balance in 6 months. | |

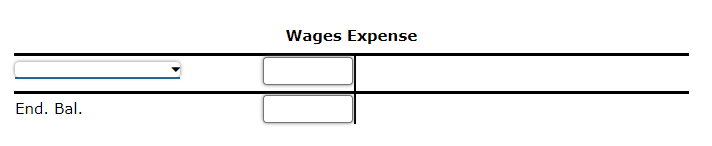

| 14 | Paid $4,230 to hourly employees for work performed in June. | |

| 22 | Billed various customers a total of $10,340 for June painting jobs. | |

| 26 | Received $6,100 cash from James Eaton for a house painting job completed and previously billed. | |

| 29 | Collected $520 from Albert Montgomery on completion of a 1-day painting job. This amount is not included in the June 22 bills. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started