Journalizing Sales, Sales Returns and Allowances, and Cash Receipts Aug. 4 Sold merchandise on account to...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

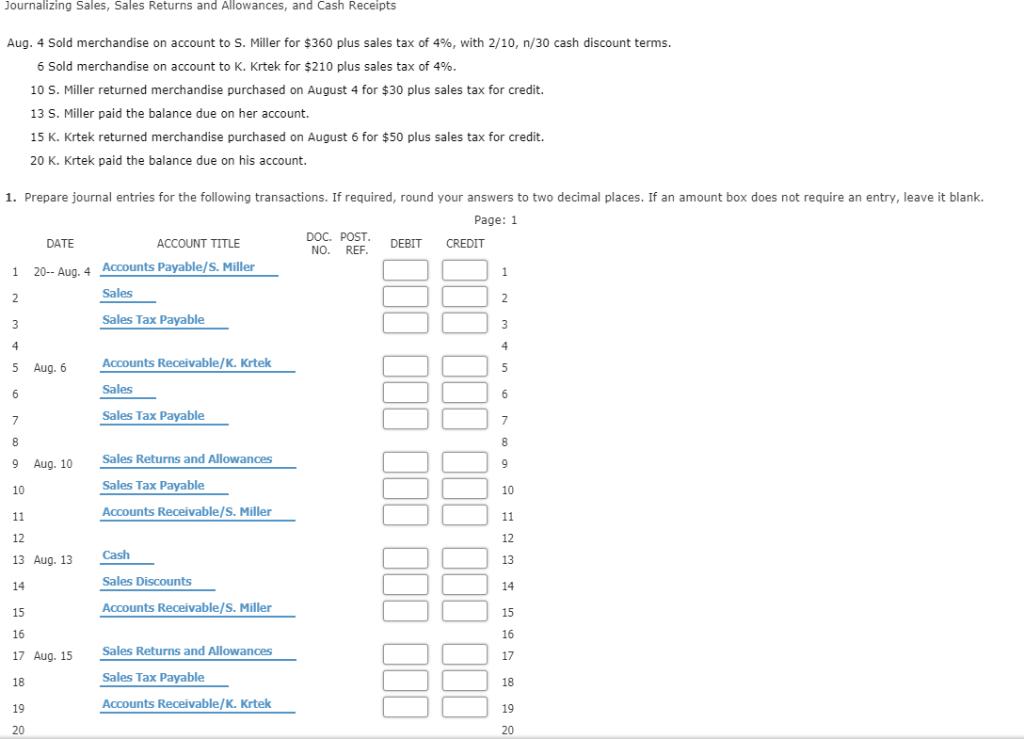

Journalizing Sales, Sales Returns and Allowances, and Cash Receipts Aug. 4 Sold merchandise on account to S. Miller for $360 plus sales tax of 4%, with 2/10, n/30 cash discount terms. 6 Sold merchandise on account to K. Krtek for $210 plus sales tax of 4%. 10 S. Miller returned merchandise purchased on August 4 for $30 plus sales tax for credit. 13 S. Miller paid the balance due on her account. 15 K. Krtek returned merchandise purchased on August 6 for $50 plus sales tax for credit. 20 K. Krtek paid the balance due on his account. 1. Prepare journal entries for the following transactions. If required, round your answers to two decimal places. If an amount box does not require an entry, leave it blank. Page: 1 DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 1 20-- Aug. 4 Accounts Payable/S. Miller Sales 2 2. Sales Tax Payable 3 3 4 4 5 Aug. 6 Accounts Receivable/K. Krtek 5 6. Sales 6 Sales Tax Payable 8. Sales Returns and Allowances 9 Aug. 10 9 Sales Tax Payable Accounts Receivable/S. Miller 10 10 11 11 12 12 Cash 13 Aug. 13 13 Sales Discounts Accounts Receivable/S. Miller 14 14 15 15 16 16 Sales Returns and Allowances 17 Aug. 15 17 Sales Tax Payable 18 18 Accounts Receivable/K. Krtek 19 19 20 20 10I 1II III III II Journalizing Sales, Sales Returns and Allowances, and Cash Receipts Aug. 4 Sold merchandise on account to S. Miller for $360 plus sales tax of 4%, with 2/10, n/30 cash discount terms. 6 Sold merchandise on account to K. Krtek for $210 plus sales tax of 4%. 10 S. Miller returned merchandise purchased on August 4 for $30 plus sales tax for credit. 13 S. Miller paid the balance due on her account. 15 K. Krtek returned merchandise purchased on August 6 for $50 plus sales tax for credit. 20 K. Krtek paid the balance due on his account. 1. Prepare journal entries for the following transactions. If required, round your answers to two decimal places. If an amount box does not require an entry, leave it blank. Page: 1 DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 1 20-- Aug. 4 Accounts Payable/S. Miller Sales 2 2. Sales Tax Payable 3 3 4 4 5 Aug. 6 Accounts Receivable/K. Krtek 5 6. Sales 6 Sales Tax Payable 8. Sales Returns and Allowances 9 Aug. 10 9 Sales Tax Payable Accounts Receivable/S. Miller 10 10 11 11 12 12 Cash 13 Aug. 13 13 Sales Discounts Accounts Receivable/S. Miller 14 14 15 15 16 16 Sales Returns and Allowances 17 Aug. 15 17 Sales Tax Payable 18 18 Accounts Receivable/K. Krtek 19 19 20 20 10I 1II III III II

Expert Answer:

Answer rating: 100% (QA)

Date Account title and Explanation Debit Credit Aug 4 Accounts ReceivableSMiller 416 Sales 400 Sale... View the full answer

Related Book For

Posted Date:

Students also viewed these accounting questions

-

Bank Reconciliation and Related Journal Entries Required: 1. Prepare a bank reconciliation as of October 31, 20-, If required, round your answers to the nearest cent. 2. Prepare the required journal...

-

Prepare the journal entries for the following transactions for Batson Co. Batson Co. purchased 1,200 shares of the total of 100,000 outstanding shares of Michael Corp. stock for $20.75 per share plus...

-

Prepare journal entries for the following transactions. Oct. 5 Sold merchandise on account to B. Farnsby for $280 plus sales tax of 4%. 8 Sold merchandise on account to F. Preetee for $240 plus sales...

-

Your friend recently attended a local mail fraud trial. In your conversation about the case, she described the cross-examination of the expert witness as follows: After his counsels questioning was...

-

During the 201112 winter seasons, a homeowner received four deliveries of heating oil, as shown in the following table. Gallons Purchased Price per Gallon ($) 209................... 2.60...

-

Define competitive advantage and identify the key conceptual frameworks that guide decision makers in the strategic planning process.

-

Nurmi Company accumulates the following data concerning raw materials in making one gallon of finished product: (1) Price net purchase price \($3.50\), freight-in \($0.20\), and receiving and...

-

Feherty, Inc., purchased the following investments during December 2013: 1. 50 of Donald Company's $1,000 bonds. The bonds pay semiannual interest payments and return principal in eight years....

-

Find all of the eigenvalues of the matrix A. 34 A = 70

-

A new English -Language Arts (ELA) teacher is so excited to take all of the ideas she learned during her training and use them in the classroom. After a PLC (Professional Learning Committee) meeting,...

-

Calculate the tax payable for a single resident earning $250,000, who does not have private hospital insurance in place. Include Medicare Levy and Surcharge if relevant. Australian tax laws

-

What are the primary phases of operation of a system, product, or service? Can there be other phases of operation?

-

Find a machine translation service online. Have it translate a piece of text in a language with which you are not familiar into English. What errors does the translator introduce? Can you determine...

-

What is a system life cycle?

-

Identify three quality management methods from the literature and discuss how you will apply them in a project environment.

-

How is mission task analysis is performed?

-

According to IIA guidance, which of the following is the most appropriate criterion to use during an evaluation of the quality assurance and improvement program? a. The internal audit activity...

-

How has the globalization of firms affected the diversity of their employees? Why has increased diversity put an additional burden on accounting systems?

-

Assuming that all entries have been posted, prepare correcting entries for each of the following errors. 1. The following entry was made to record the purchase of $700 in supplies on account: 2. The...

-

Journalize the following transactions in a general journal: May 3 Purchased merchandise from Reed, $6,100. Invoice No. 321, dated May 1, terms n/30. 9 Purchased merchandise from Omana, $2,500....

-

Analyze each situation and indicate the correct dollar amount for the adjusting entry. 1. Amount of insurance expired $970. 2. Amount of unexpired insurance $565. (Balance Sheet) Prepaid Insurance...

-

Brandon Company produces and sells a product that has variable costs of $9 per unit and fixed costs of $110,000 per year. 1. Compute the unit cost at a production and sales level of 10,000 units per...

-

Evaluating performance, decision by decision, is costly. Aggregate measures, like the income statement, are frequently used. How might the wide use of income statements affect managers decisions...

-

An administrator at Riverview Hospital is considering how to use some space made available when the outpatient clinic moved to a new building. She has narrowed her choices as follows: a. Use the...

Study smarter with the SolutionInn App