Bank Reconciliation and Related Journal Entries Required: 1. Prepare a bank reconciliation as of October 31, 20-, If required, round your answers to the

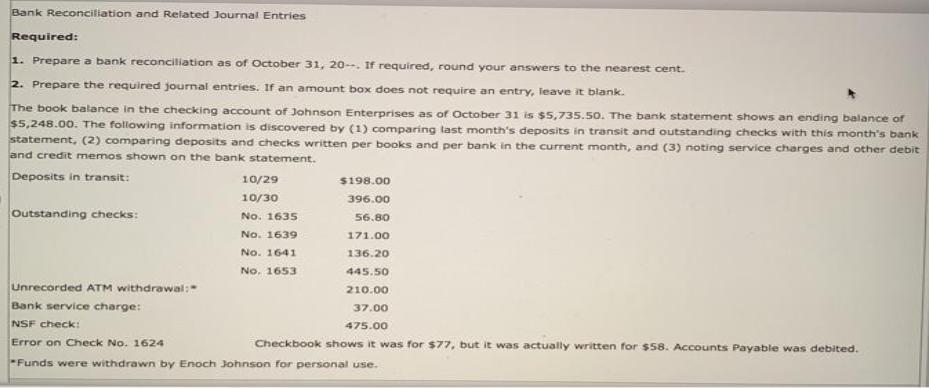

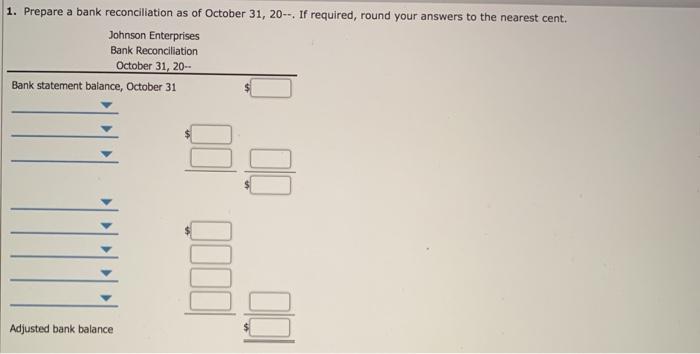

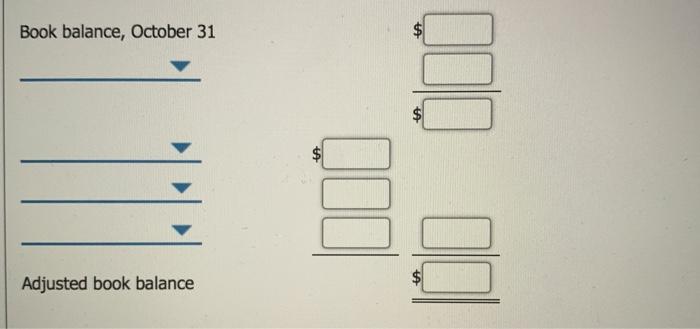

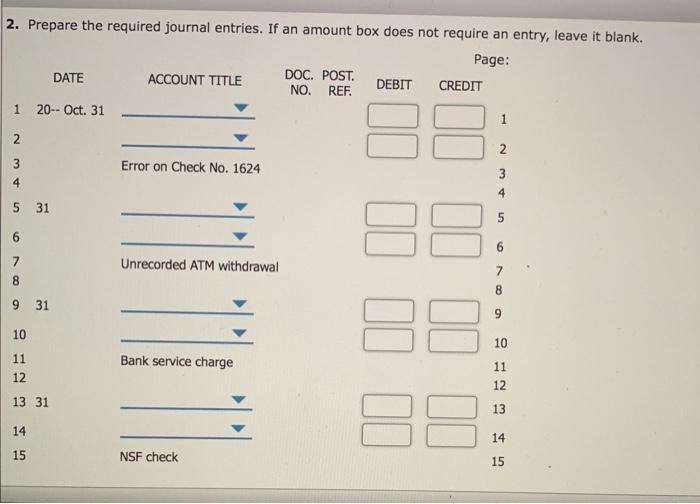

Bank Reconciliation and Related Journal Entries Required: 1. Prepare a bank reconciliation as of October 31, 20-, If required, round your answers to the nearest cent. 2. Prepare the required journal entries. If an amount box does not require an entry, leave it blank. The book balance in the checking account of Johnson Enterprises as of October 31 is $5,735.50. The bank statement shows an ending balance of $5,248.00. The following information is discovered by (1) comparing last month's deposits in transit and outstanding checks with this month's bank statement, (2) comparing deposits and checks written per books and per bank in the current month, and (3) noting service charges and other debit and credit memos shown on the bank statement. Deposits in transit: 10/29 $198.00 10/30 396.00 Outstanding checks: No. 1635 56.80 No. 1639 171.00 No. 1641 136.20 No. 1653 445.50 Unrecorded ATM withdrawal: Bank service charge: 210.00 37.00 NSF check: 475.00 Error on Check No. 1624 Checkbook shows it was for $77, but it was actually written for $58. Accounts Payable was debited. Funds were withdrawn by Enoch Johnson for personal use. 1. Prepare a bank reconciliation as of October 31, 20--. If required, round your answers to the nearest cent. Johnson Enterprises Bank Reconciliation October 31, 20- Bank statement baiance, October 31 Adjusted bank balance Book balance, October 31 Adjusted book balance %24 2. Prepare the required journal entries. If an amount box does not require an entry, leave it blank. Page: DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20-- Oct. 31 2 3 Error on Check No. 1624 3 4. 4 5 31 6 7 Unrecorded ATM withdrawal 8. 9 31 38 10 10 11 Bank service charge 11 12 12 88 13 31 13 14 14 15 NSF check 15 2. Bank Reconciliation and Related Journal Entries Required: 1. Prepare a bank reconciliation as of October 31, 20-, If required, round your answers to the nearest cent. 2. Prepare the required journal entries. If an amount box does not require an entry, leave it blank. The book balance in the checking account of Johnson Enterprises as of October 31 is $5,735.50. The bank statement shows an ending balance of $5,248.00. The following information is discovered by (1) comparing last month's deposits in transit and outstanding checks with this month's bank statement, (2) comparing deposits and checks written per books and per bank in the current month, and (3) noting service charges and other debit and credit memos shown on the bank statement. Deposits in transit: 10/29 $198.00 10/30 396.00 Outstanding checks: No. 1635 56.80 No. 1639 171.00 No. 1641 136.20 No. 1653 445.50 Unrecorded ATM withdrawal: Bank service charge: 210.00 37.00 NSF check: 475.00 Error on Check No. 1624 Checkbook shows it was for $77, but it was actually written for $58. Accounts Payable was debited. Funds were withdrawn by Enoch Johnson for personal use. 1. Prepare a bank reconciliation as of October 31, 20--. If required, round your answers to the nearest cent. Johnson Enterprises Bank Reconciliation October 31, 20- Bank statement baiance, October 31 Adjusted bank balance Book balance, October 31 Adjusted book balance %24 2. Prepare the required journal entries. If an amount box does not require an entry, leave it blank. Page: DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20-- Oct. 31 2 3 Error on Check No. 1624 3 4. 4 5 31 6 7 Unrecorded ATM withdrawal 8. 9 31 38 10 10 11 Bank service charge 11 12 12 88 13 31 13 14 14 15 NSF check 15 2. Bank Reconciliation and Related Journal Entries Required: 1. Prepare a bank reconciliation as of October 31, 20-, If required, round your answers to the nearest cent. 2. Prepare the required journal entries. If an amount box does not require an entry, leave it blank. The book balance in the checking account of Johnson Enterprises as of October 31 is $5,735.50. The bank statement shows an ending balance of $5,248.00. The following information is discovered by (1) comparing last month's deposits in transit and outstanding checks with this month's bank statement, (2) comparing deposits and checks written per books and per bank in the current month, and (3) noting service charges and other debit and credit memos shown on the bank statement. Deposits in transit: 10/29 $198.00 10/30 396.00 Outstanding checks: No. 1635 56.80 No. 1639 171.00 No. 1641 136.20 No. 1653 445.50 Unrecorded ATM withdrawal: Bank service charge: 210.00 37.00 NSF check: 475.00 Error on Check No. 1624 Checkbook shows it was for $77, but it was actually written for $58. Accounts Payable was debited. Funds were withdrawn by Enoch Johnson for personal use. 1. Prepare a bank reconciliation as of October 31, 20--. If required, round your answers to the nearest cent. Johnson Enterprises Bank Reconciliation October 31, 20- Bank statement baiance, October 31 Adjusted bank balance Book balance, October 31 Adjusted book balance %24 2. Prepare the required journal entries. If an amount box does not require an entry, leave it blank. Page: DOC. POST. NO. REF. DATE ACCOUNT TITLE DEBIT CREDIT 20-- Oct. 31 2 3 Error on Check No. 1624 3 4. 4 5 31 6 7 Unrecorded ATM withdrawal 8. 9 31 38 10 10 11 Bank service charge 11 12 12 88 13 31 13 14 14 15 NSF check 15 2.

Step by Step Solution

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The Bank Reconciliation along with required adjusting ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started