Question

Joyce Murphy runs a courier service in downtown Seattle. She charges clients $0.62 per mile driven. Joyce has determined that if she drives 2,900 miles

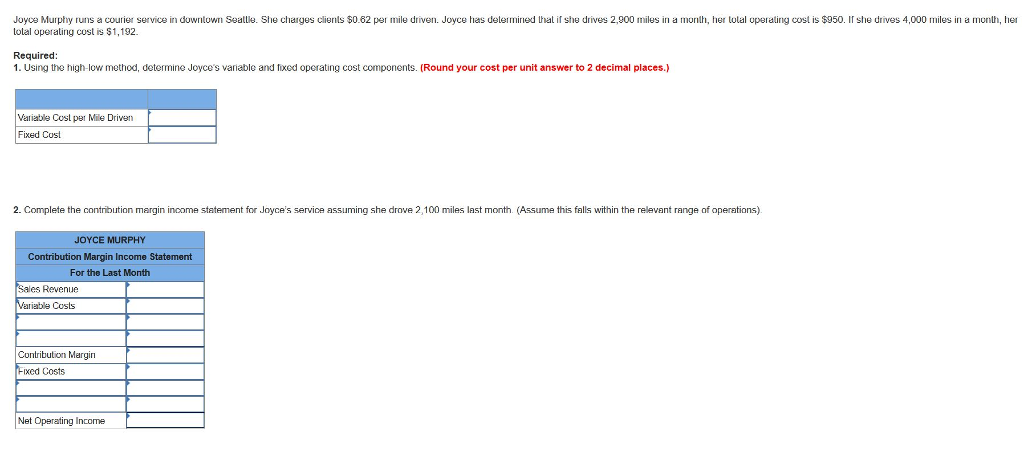

Joyce Murphy runs a courier service in downtown Seattle. She charges clients $0.62 per mile driven. Joyce has determined that if she drives 2,900 miles in a month, her total operating cost is $950. If she drives 4,000 miles in a month, her total operating cost is $1,192. Required: 1. Using the high-low method, determine Joyces variable and fixed operating cost components. (Round your cost per unit answer to 2 decimal places.)

Joyce Murphy runs a courier service in downtown Seattle. She charges clients $0.62 per mile driven. Joyce has determined that if she drives 2,900 miles in a month, her total operating cost is $950. If she drives 4,000 miles in a month, her total operating cost is $1,192. Required: 1. Using the high-low method, determine Joyces variable and fixed operating cost components. (Round your cost per unit answer to 2 decimal places.)

2. Complete the contribution margin income statement for Joyces service assuming she drove 2,100 miles last month. (Assume this falls within the relevant range of operations).

eallle. She charges clients $0.62 pe' "ile driven. Joyce has dele mined lhalif she di 2,000miles in a mon h her tol ost s S 50. Isle d es 40 0 es in a month, he Joy e Murphy runs a courier service in duwntown tolal operating cost is $1,192. e op 1 ng Required 1. Using the high-low method, determine Joyce's variable and fixed operating cost components. (Round your cost per unit answer to 2 decimal places.) Variable Cost per Mile Driven Fixed Cost 2. Complete the contribution margin inoome statement for Joyce's service assuming she drove 2,100 miles last month. (Assume this falls within the relevant range of operations) JOYCE MURPHY Contribution Margin Income Statement For the Last Month Revenue iable Costs Contribution Margin xed Costs Net Operating IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started