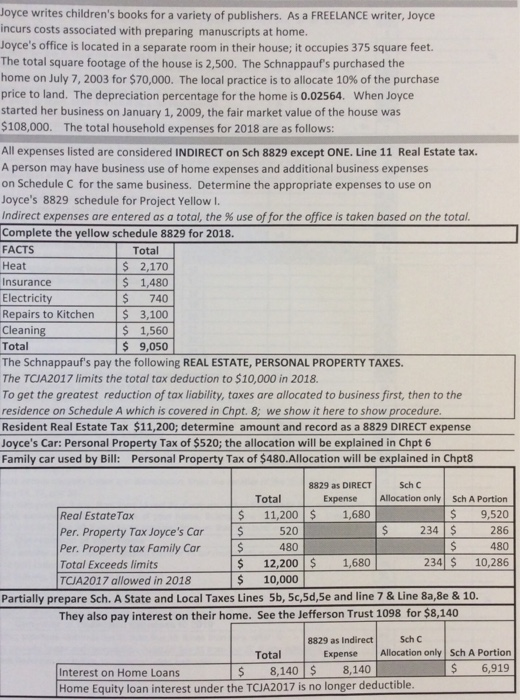

Joyce writes children's books for a variety of publishers. As a FREELANCE writer, Joyce incurs costs associated with preparing manuscripts at home Joyce's office is located in a separate room in their house; it occupies 375 square feet. The total square footage of the house is 2,500. The Schnappauf's purchased the home on July 7, 2003 for $70,000. The local practice is to allocate 10% of the purchas price to land. The depreciation percentage for the home is 0.02564. When Joyce started her business on January 1, 2009, the fair market value of the house was 108,000. The total household expenses for 2018 are as follows All expenses listed are considered INDIRECT on Sch 8829 except ONE. Line 11 Real Estate tax. A person may have business use of home expenses and additional business expenses on Schedule C for the same business. Determine the appropriate expenses to use on Joyce's 8829 schedule for Project Yellow I ect expenses are entered as a total, the % use of for the office is taken based on the total Complete the yellow schedule 8829 for 2018 FACTS Heat Insurance Electricity Repairs to Kitchen 3,100 Cleanin Total The Schnappauf's pay the following REAL ESTATE, PERSONAL PROPERTY TAXES The TCJA2017 limits the total tax deduction to $10,000 in 2018 To get the greatest reduction of tax liability, taxes are allocated to business first, then to the residence on Schedule A which is covered in Chpt. 8; we show it here to show procedure Resident Real Estate Tax $11,200; determine amount and record as a 8829 DIRECT expense Joyce's Car: Personal Property Tax of $520; the allocation will be explained in Chpt 6 Family car used by Bill: Personal Property Tax of $480.Allocation will be explained in Chpt8 S 2,170 $ 1,480 $ 740 $ 1,560 $ 9,050 8829 as DIRECT Sch C Total 11,200 1,680 Real EstateTax Per. Property Tax Joyce's Car Per. Property tax Family Car Total Exceeds limits TCJA2017 allowed in 2018 Expense Allocation only Sch A Portion $ 9,520 286 480 234 $ 10,286 $234 $ 520 480 S $ 12,200 s 1,680 10,000 Partially prepare Sch. A State and Local Taxes Lines 5b, 5c,5d,Se and line 7 & Line 8a,8e & 10 They also pay interest on their home. See the Jefferson Trust 1098 for $8,140 8829 as Indirect Sch C Expense Allocation only Sch A Portion $6,919 Total 8,140S 8,140 Interest on Home Loans Home Equity loan interest under the TCIA2017 is no longer deductibl Joyce writes children's books for a variety of publishers. As a FREELANCE writer, Joyce incurs costs associated with preparing manuscripts at home Joyce's office is located in a separate room in their house; it occupies 375 square feet. The total square footage of the house is 2,500. The Schnappauf's purchased the home on July 7, 2003 for $70,000. The local practice is to allocate 10% of the purchas price to land. The depreciation percentage for the home is 0.02564. When Joyce started her business on January 1, 2009, the fair market value of the house was 108,000. The total household expenses for 2018 are as follows All expenses listed are considered INDIRECT on Sch 8829 except ONE. Line 11 Real Estate tax. A person may have business use of home expenses and additional business expenses on Schedule C for the same business. Determine the appropriate expenses to use on Joyce's 8829 schedule for Project Yellow I ect expenses are entered as a total, the % use of for the office is taken based on the total Complete the yellow schedule 8829 for 2018 FACTS Heat Insurance Electricity Repairs to Kitchen 3,100 Cleanin Total The Schnappauf's pay the following REAL ESTATE, PERSONAL PROPERTY TAXES The TCJA2017 limits the total tax deduction to $10,000 in 2018 To get the greatest reduction of tax liability, taxes are allocated to business first, then to the residence on Schedule A which is covered in Chpt. 8; we show it here to show procedure Resident Real Estate Tax $11,200; determine amount and record as a 8829 DIRECT expense Joyce's Car: Personal Property Tax of $520; the allocation will be explained in Chpt 6 Family car used by Bill: Personal Property Tax of $480.Allocation will be explained in Chpt8 S 2,170 $ 1,480 $ 740 $ 1,560 $ 9,050 8829 as DIRECT Sch C Total 11,200 1,680 Real EstateTax Per. Property Tax Joyce's Car Per. Property tax Family Car Total Exceeds limits TCJA2017 allowed in 2018 Expense Allocation only Sch A Portion $ 9,520 286 480 234 $ 10,286 $234 $ 520 480 S $ 12,200 s 1,680 10,000 Partially prepare Sch. A State and Local Taxes Lines 5b, 5c,5d,Se and line 7 & Line 8a,8e & 10 They also pay interest on their home. See the Jefferson Trust 1098 for $8,140 8829 as Indirect Sch C Expense Allocation only Sch A Portion $6,919 Total 8,140S 8,140 Interest on Home Loans Home Equity loan interest under the TCIA2017 is no longer deductibl