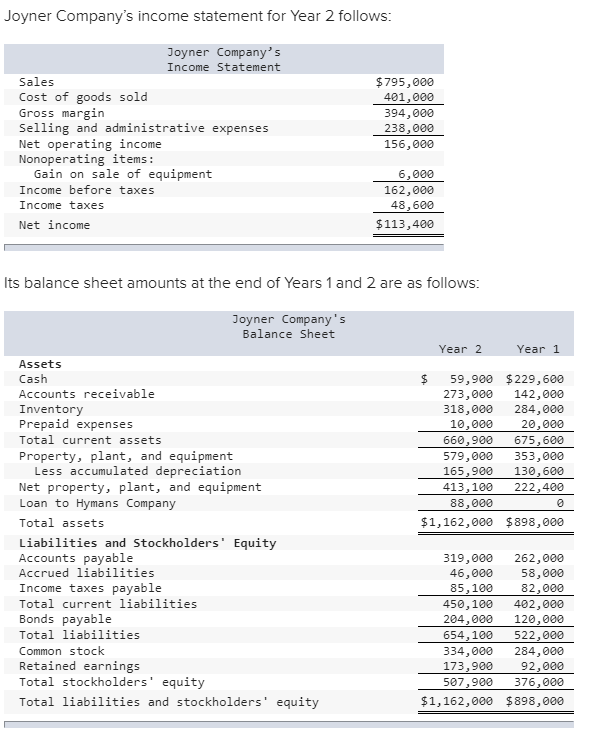

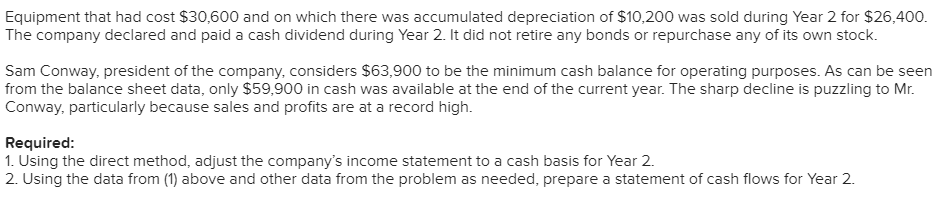

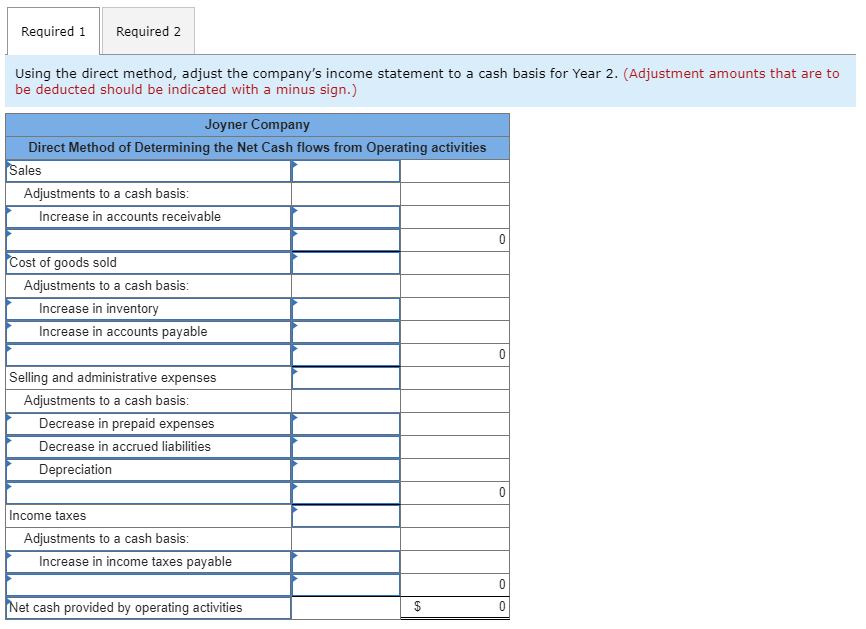

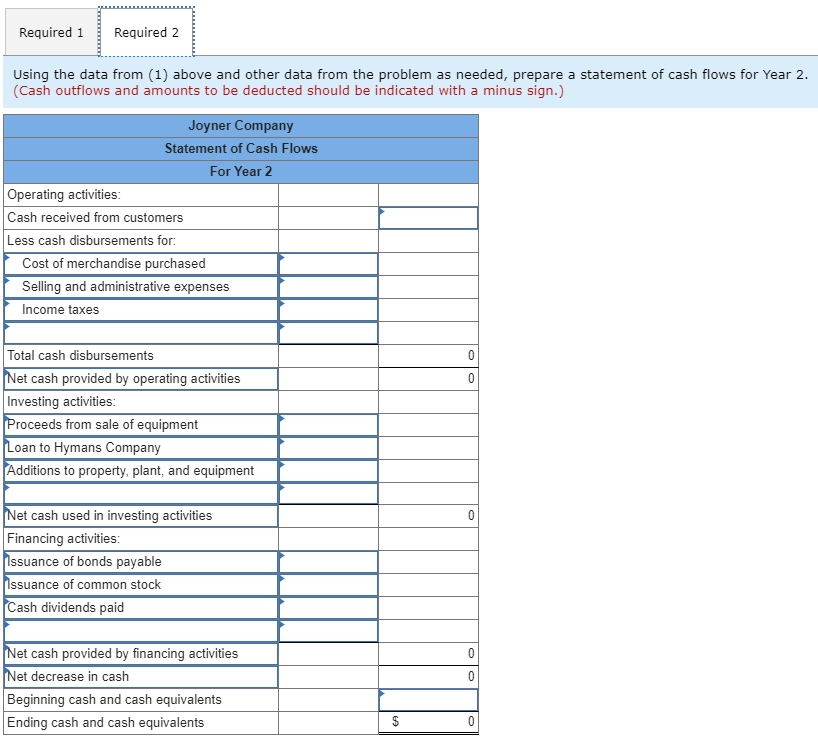

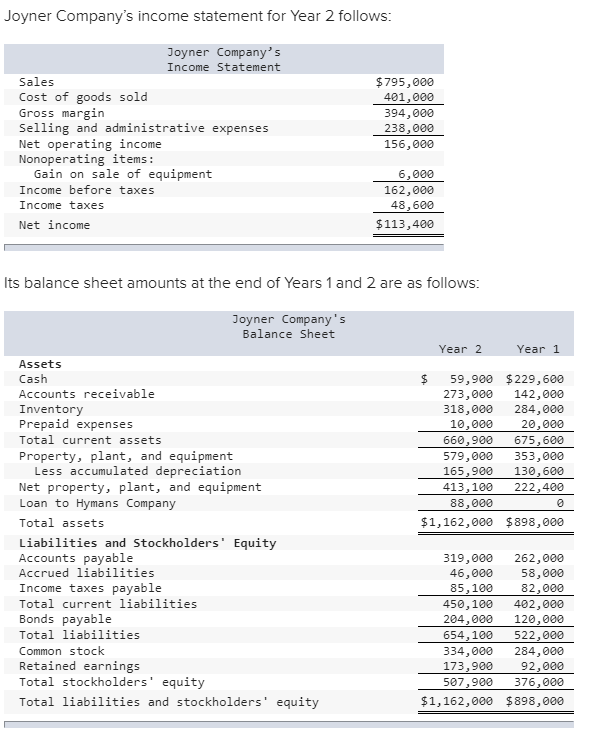

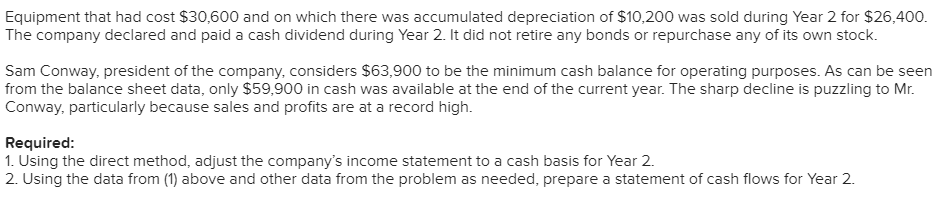

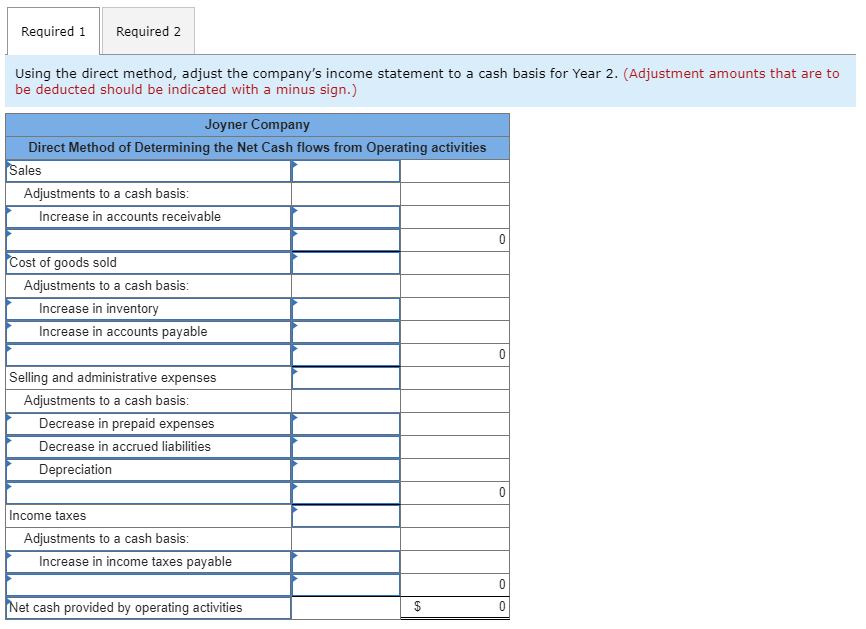

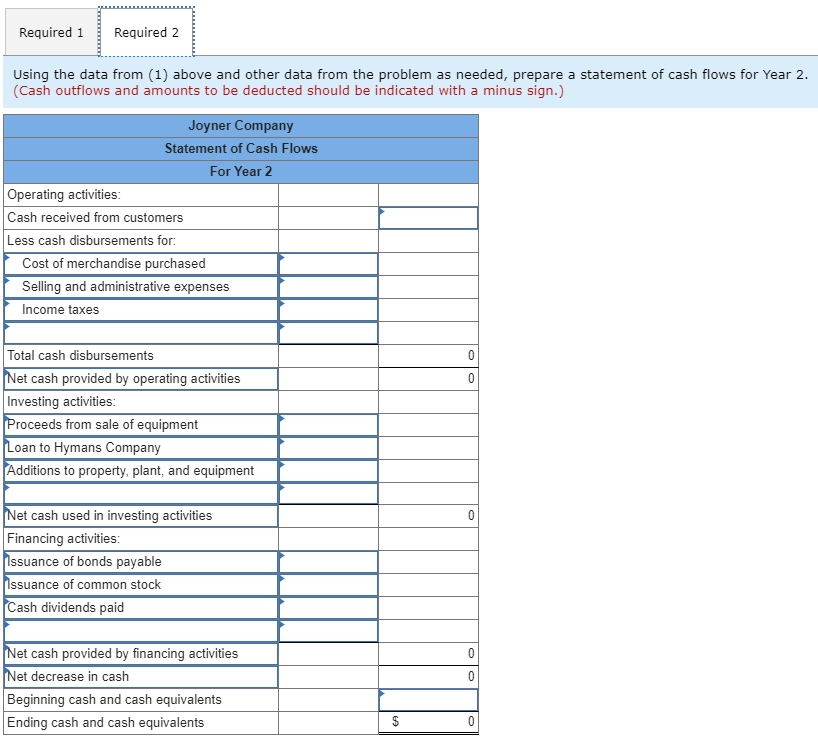

Joyner Company's income statement for Year 2 follows: Joyner Company's Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Gain on sale of equipment Income before taxes Income taxes Net income $ 795,000 401,000 394,000 238,000 156,000 6,000 162,000 48,600 $113,400 Its balance sheet amounts at the end of Years 1 and 2 are as follows: Joyner Company's Balance Sheet Year 2 Year 1 $ 59,900 $229,600 273,000 142,000 318,000 284,000 10,000 20,000 660,900 675,600 579,000 353,000 165,900 130, 600 413,100 222,400 88,000 $1,162,000 $898,000 Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Loan to Hymans Company Total assets Liabilities and Stockholders' Equity Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 319,000 262,000 46,000 58,000 85,100 82,000 450,100 402,000 204,000 120,000 654,100 522,000 334,000 284,000 173,900 92,000 507,900 376,000 $1,162,000 $898,000 Equipment that had cost $30,600 and on which there was accumulated depreciation of $10,200 was sold during Year 2 for $26,400. The company declared and paid a cash dividend during Year 2. It did not retire any bonds or repurchase any of its own stock. Sam Conway, president of the company, considers $63,900 to be the minimum cash balance for operating purposes. As can be seen from the balance sheet data, only $59,900 in cash was available at the end of the current year. The sharp decline is puzzling to Mr. Conway, particularly because sales and profits are at a record high. Required: 1. Using the direct method, adjust the company's income statement to a cash basis for Year 2. 2. Using the data from (1) above and other data from the problem as needed, prepare a statement of cash flows for Year 2. Required 1 Required 2 Using the direct method, adjust the company's income statement to a cash basis for Year 2. (Adjustment amounts that are to be deducted should be indicated with a minus sign.) Joyner Company Direct Method of Determining the Net Cash flows from Operating activities Sales Adjustments to a cash basis: Increase in accounts receivable 0 Cost of goods sold Adjustments to a cash basis: Increase in inventory Increase in accounts payable 0 Selling and administrative expenses Adjustments to a cash basis: Decrease in prepaid expenses Decrease in accrued liabilities Depreciation 0 Income taxes Adjustments to a cash basis: Increase in income taxes payable 0 Net cash provided by operating activities $ 0 Required 1 Required 2 Using the data from (1) above and other data from the problem as needed, prepare a statement of cash flows for Year 2. (Cash outflows and amounts to be deducted should be indicated with a minus sign.) Joyner Company Statement of Cash Flows For Year 2 Operating activities: Cash received from customers Less cash disbursements for Cost of merchandise purchased Selling and administrative expenses Income taxes 0 0 Total cash disbursements Net cash provided by operating activities Investing activities: Proceeds from sale of equipment Loan to Hymans Company Additions to property, plant, and equipment 0 Net cash used in investing activities Financing activities: Issuance of bonds payable Issuance of common stock Cash dividends paid 0 Net cash provided by financing activities Net decrease in cash Beginning cash and cash equivalents Ending cash and cash equivalents $ 0