Question

JR has recently witnessed his friend Beths success with her real estate investments, and he would like to pursue an investment of his own. JR

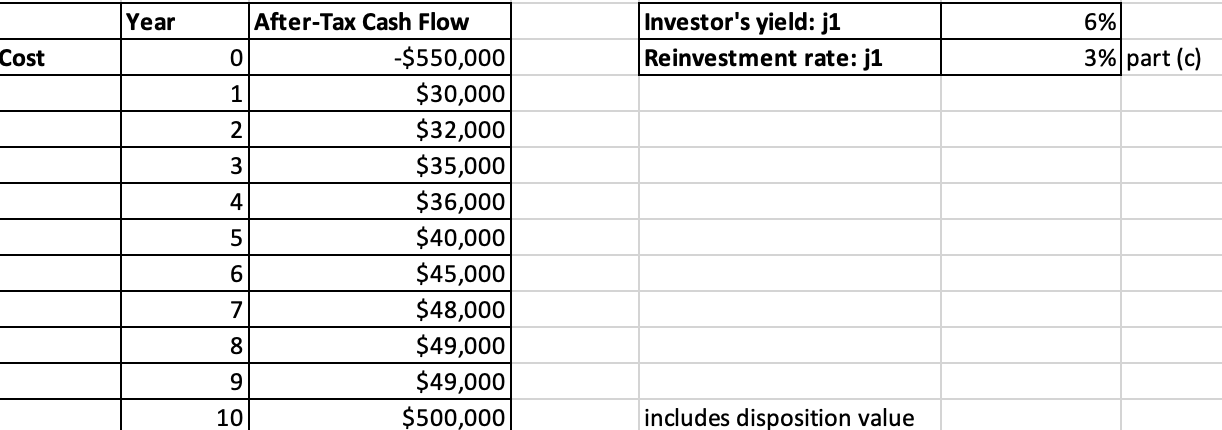

JR has recently witnessed his friend Beths success with her real estate investments, and he would like to pursue an investment of his own. JR has discovered an investment property that will provide him with a series of year-end annual cash flows based on a specific investment today.

(a) Calculate the net present value of this investment. (5 marks)

b) Calculate the internal rate of return (IRR) with no explicit reinvestment considered. (2 marks)

(c) Calculate the IRR and NPV assuming the stated reinvestment rate. Explain why the result is different than part (b). (7 marks)

(d) If the reinvestment rate is higher than the IRR with no explicit reinvestment, what would happen to the IRR and NPV? Explain and support with numerical examples. (7 marks)

(e) Based on all the investment measures calculated, should the investor proceed? Explain with reference to each of the measures calculated. (4 marks)

\begin{tabular}{|l|r|r|} \hline & Year & After-Tax Cash Flow \\ \hline Cost & 0 & $50,000 \\ \hline & 1 & $30,000 \\ \hline & 2 & $32,000 \\ \hline & 3 & $35,000 \\ \hline & 4 & $36,000 \\ \hline & 5 & $40,000 \\ \hline & 6 & $45,000 \\ \hline & 7 & $48,000 \\ \hline & 8 & $49,000 \\ \hline & 9 & $49,000 \\ \hline & 10 & $500,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline Investor's yield: j1 & 6% \\ \hline Reinvestment rate: j1 & 3% \\ \hline \end{tabular} includes disposition value \begin{tabular}{|l|r|r|} \hline & Year & After-Tax Cash Flow \\ \hline Cost & 0 & $50,000 \\ \hline & 1 & $30,000 \\ \hline & 2 & $32,000 \\ \hline & 3 & $35,000 \\ \hline & 4 & $36,000 \\ \hline & 5 & $40,000 \\ \hline & 6 & $45,000 \\ \hline & 7 & $48,000 \\ \hline & 8 & $49,000 \\ \hline & 9 & $49,000 \\ \hline & 10 & $500,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline Investor's yield: j1 & 6% \\ \hline Reinvestment rate: j1 & 3% \\ \hline \end{tabular} includes disposition valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started