Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Juan Dela Cruz presented to you the following income for 2018: Basic salary (net of withholding tax) Withholding tax on basic salary Director's fee

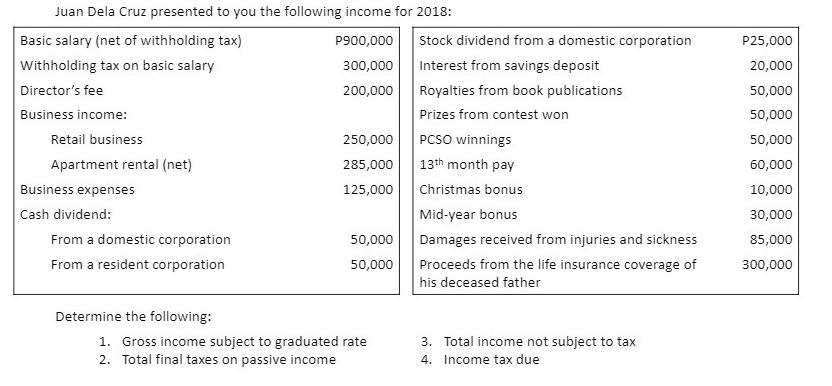

Juan Dela Cruz presented to you the following income for 2018: Basic salary (net of withholding tax) Withholding tax on basic salary Director's fee Business income: Retail business Apartment rental (net) Business expenses Cash dividend: From a domestic corporation From a resident corporation Determine the following: P900,000 300,000 200,000 250,000 285,000 125,000 50,000 50,000 1. Gross income subject to graduated rate 2. Total final taxes on passive income Stock dividend from a domestic corporation Interest from savings deposit Royalties from book publications Prizes from contest won PCSO winnings 13th month pay Christmas bonus Mid-year bonus Damages received from injuries and sickness Proceeds from the life insurance coverage of his deceased father 3. Total income not subject to tax 4. Income tax due P25,000 20,000 50,000 50,000 50,000 60,000 10,000 30,000 85,000 300,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Gross income subject to graduated rate Basic Salary net of withholding tax 900000 Directors fee 5000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started