Answered step by step

Verified Expert Solution

Question

1 Approved Answer

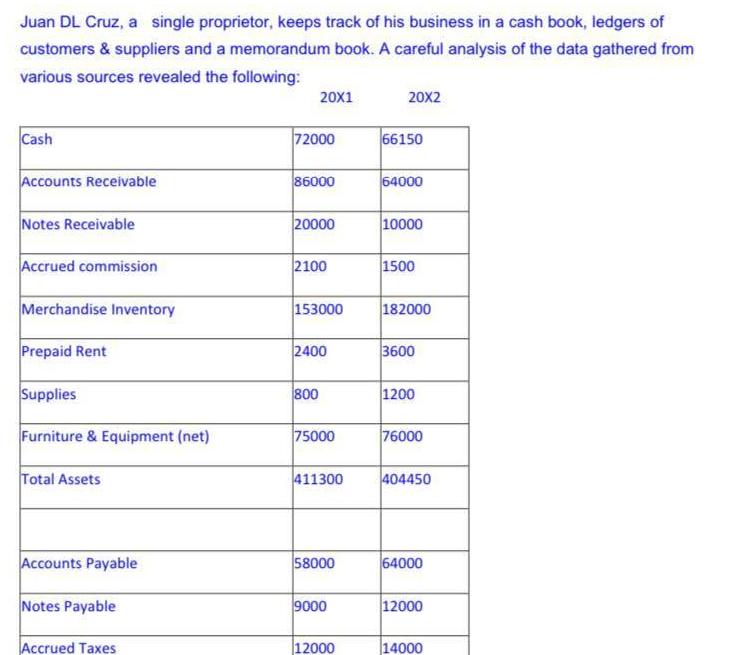

Juan DL Cruz, a single proprietor, keeps track of his business in a cash book, ledgers of customers & suppliers and a memorandum book.

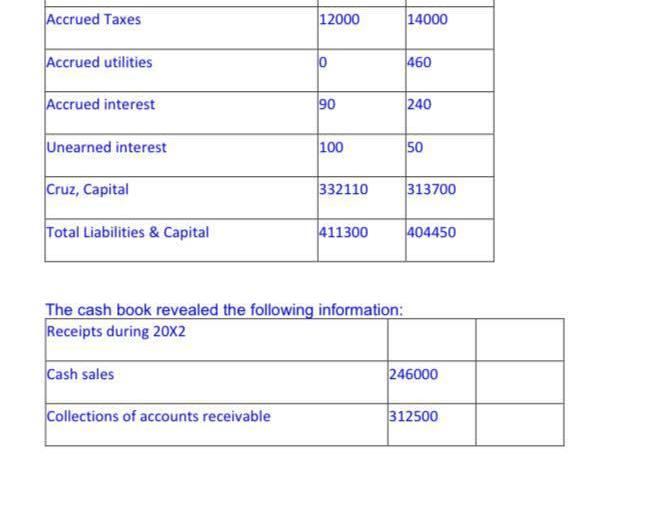

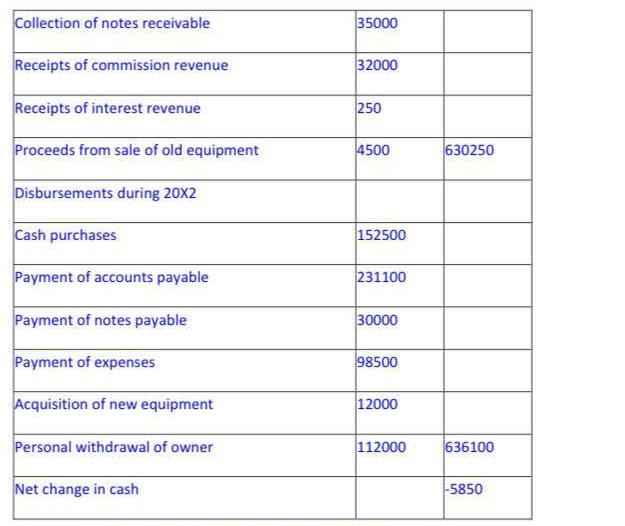

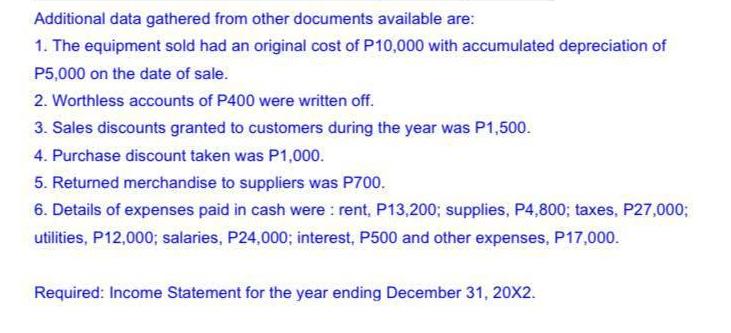

Juan DL Cruz, a single proprietor, keeps track of his business in a cash book, ledgers of customers & suppliers and a memorandum book. A careful analysis of the data gathered from various sources revealed the following: Cash Accounts Receivable Notes Receivable Accrued commission Merchandise Inventory Prepaid Rent Supplies Furniture & Equipment (net) Total Assets Accounts Payable Notes Payable Accrued Taxes 20X1 72000 86000 20000 2100 153000 2400 800 75000 411300 58000 9000 12000 20x2 66150 64000 10000 1500 182000 3600 1200 76000 404450 64000 12000 14000 Accrued Taxes Accrued utilities Accrued interest Unearned interest Cruz, Capital Total Liabilities & Capital Cash sales 12000 Collections of accounts receivable 0 90 100 332110 The cash book revealed the following information: Receipts during 20X2 411300 14000 460 240 50 313700 404450 246000 312500 Collection of notes receivable Receipts of commission revenue Receipts of interest revenue Proceeds from sale of old equipment Disbursements during 20X2 Cash purchases Payment of accounts payable Payment of notes payable Payment of expenses Acquisition of new equipment Personal withdrawal of owner Net change in cash 35000 32000 250 4500 152500 231100 30000 98500 12000 112000 630250 636100 -5850 Additional data gathered from other documents available are: 1. The equipment sold had an original cost of P10,000 with accumulated depreciation of P5,000 on the date of sale. 2. Worthless accounts of P400 were written off. 3. Sales discounts granted to customers during the year was P1,500. 4. Purchase discount taken was P1,000. 5. Returned merchandise to suppliers was P700. 6. Details of expenses paid in cash were rent, P13,200; supplies, P4,800; taxes, P27,000; utilities, P12,000; salaries, P24,000; interest, P500 and other expenses, P17,000. Required: Income Statement for the year ending December 31, 20X2.

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Net Sales Net Sales Cash Sales Collections of Accounts Receivable Colle...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started